Thomas Cook shares fall despite a “good start” to the year

Ashmore Group report 18pc growth in assets under management, but profits fall

Compass shares jump 5pc on strong organic revenues

On The Beach report 23pc revenue jump

Beach holiday retailer On The Beach saw revenue rise 23 percent in the three months to the end of January, boosted by both core business and its sunshine.co.uk acquisition.

The group said it had continued to “perform well” over the period, despite price increases in the market year-on-year for winter departures due to the failure of Monarch Airlines.

However, the group said summer 2018 seat prices would remain broadly flat, with other carriers adding incremental capacity from Easter 2018 onwards.

“These pricing factors, together with a return of customer demand for destinations in the Eastern Mediterranean, are helping to drive strong bookings growth for summer 2018 departures,” the group said.

Simon Cooper, Chief Executive of On the Beach Group plc, commented:

“The first four months of the new financial year has delivered another solid period of growth for the On the Beach, Sunshine and ebeach brands. Our strategy of investing in our brands, talent and technology to drive growth has delivered performance in line with the Board’s expectations, with consumers attracted to our wide range of value for money beach holidays. The Board remains confident in the Group’s outlook and will continue to evaluate opportunities to enhance its market share position.”

On The Beach (LON:OTB) shares are currently trading up 0.40 percent at 503.00 (0818GMT).

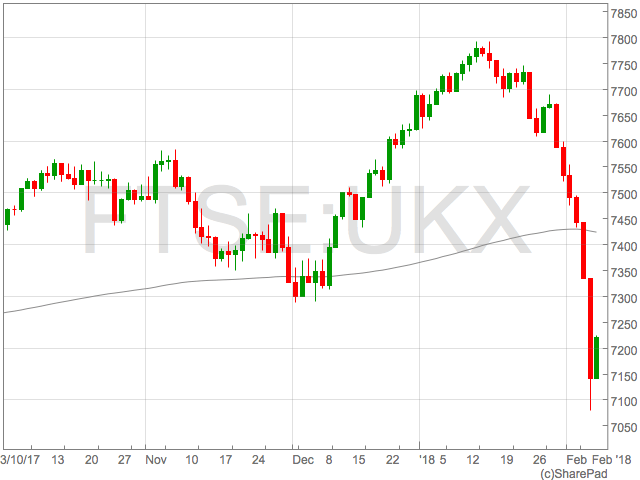

FTSE 100 bounces back after market rout

Despite today’s relief rally, some market participants were still questioning whether the reversal was sustainable.

“Certainly there is a risk that yesterday’s rally is a fake out before another selloff”, said Neil Wilson, senior market analysts at ETX Capital to Reuters.

Despite today’s relief rally, some market participants were still questioning whether the reversal was sustainable.

“Certainly there is a risk that yesterday’s rally is a fake out before another selloff”, said Neil Wilson, senior market analysts at ETX Capital to Reuters.

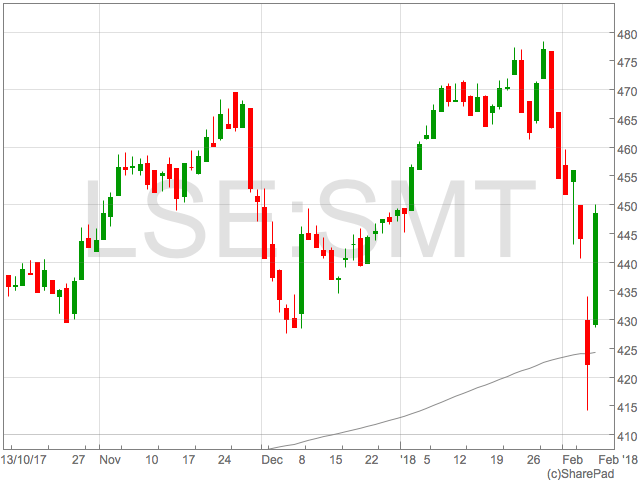

Scottish Mortgage Investment Trust (SMT:LON) was the biggest riser in London on Wednesday as it reversed strong losses from yesterday.

Precious metals miners Fresnillo and Randgold Resources were the weakest shares in London’s leading index as gold declined following risk-aversion price jumps earlier in the week.

Scottish Mortgage Investment Trust (SMT:LON) was the biggest riser in London on Wednesday as it reversed strong losses from yesterday.

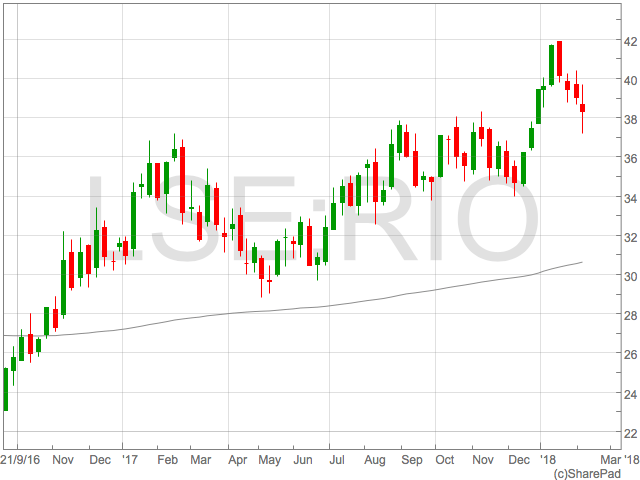

Precious metals miners Fresnillo and Randgold Resources were the weakest shares in London’s leading index as gold declined following risk-aversion price jumps earlier in the week. Rio Tinto posts record margins alongside share buy-back

“Today we have announced a strong set of results with operating cash flow of $13.9 billion, a record full year dividend of $5.2 billion and an additional $1 billion share buy-back. This brings total cash returns to shareholders to $9.7 billion declared for 2017.

“The strength of our cash flow is a result of resilient prices during the year coupled with a robust operational performance and a focus on mine to market productivity.

“Our strong balance sheet, world-class assets and disciplined allocation of capital puts us in the unique position of being able to invest in high-value growth through the cycle, and consistently deliver superior cash returns to shareholders.”

“Today we have announced a strong set of results with operating cash flow of $13.9 billion, a record full year dividend of $5.2 billion and an additional $1 billion share buy-back. This brings total cash returns to shareholders to $9.7 billion declared for 2017.

“The strength of our cash flow is a result of resilient prices during the year coupled with a robust operational performance and a focus on mine to market productivity.

“Our strong balance sheet, world-class assets and disciplined allocation of capital puts us in the unique position of being able to invest in high-value growth through the cycle, and consistently deliver superior cash returns to shareholders.” Hargreaves Lansdown report strong figures and client growth in 2017

Global stock sell-off sees FTSE plunge at market open

BP profits soar after boost in oil prices

Ocado shares sink as profit plunges 11pc

“Profitability in the period was adversely impacted by the wage increases partly impacted by increased national living wage, higher costs associated with the opening of Andover customer fulfilment centre, our continued investment in a number of strategic initiatives to aid future growth, and additional depreciation,” the company said.

The group also announced a share placement of around 5 percent of the company’s existing capital, in order to raise funds for expansion.

Ocado shares are currently trading down 6.46 percent on the news at 460.80 (0820GMT).