Digital transformation business Made Tech (LON: MTEC) increased interim revenues 27% to £27.7m and the full year will be better than expected. The contacted backlog slipped 8% to £74m, from what was a very strong level. Net cash was £11.9m at the end of November 2025. Full year pre-tax profit is expected to improve from £2.9m to £3.9m. The share price jumped 25.5% to 33.25p.

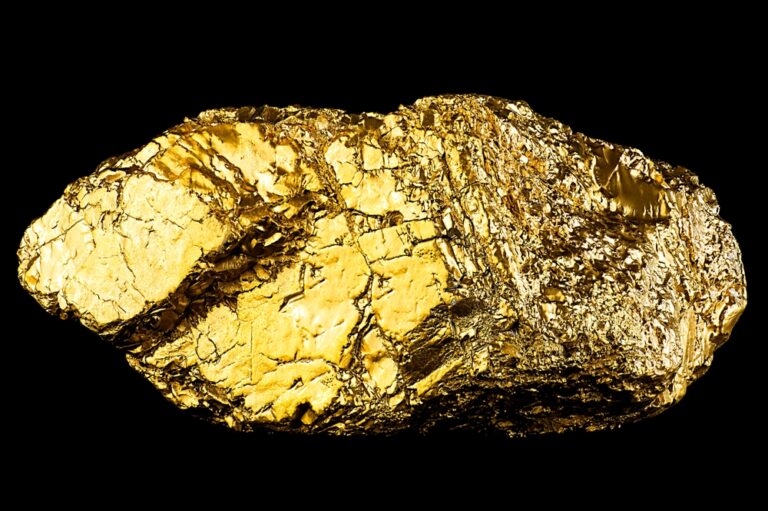

Oracle Power (LON: ORCP) says drilling at the Northern Zone gold project in Western Australia has identified gold mineralisation in the previously undrilled ‘saddle’ between the eastern and northwestern mineralised zones. The share price rebounded 23.5% to 0.04p.

Dekel Agri-Vision (LON: DKL) maintained cashew production at 700 tonnes in November. Higher palm oil prices are offsetting lower oil palm harvests. Dekel Agi-Vision is on course to be profitable in 2026. The share price improved 5.26% to 0.5p.

Customer engagement systems provider Netcall (LON: NET) is acquiring digital experience platform Jadu for an initial £15.2m in cash and shares. This will bring cloud-based technology and 76% of annual revenues of £7.4m are recurring. The deal should be earnings enhancing within one year. Canaccord Genuity has raised its 2025-26 pre-tax profit forecast from £9.4m to £9.7m, while next year’s has been increased from £10.7m to £11.9m. The share price is 4.13% higher at 113.5p.

Following yesterday’s trading statement by digital signage supplier Mediazest (LON: MDZ) showing annual revenues are estimated to be 30% higher at £4m in the year to September 2025, the share price has risen a further 2.78% to 0.0925p. Long-term incentive plans have been announced for directors. The related options have an exercise price of 0.09p. There are a total of 180 million shares under option.

FALLERS

Cinemas operator Everyman Media Group (LON: EMAN) has been hit by disappointing box office for films in the second half of the year. UK admissions have declined in recent months. Forecast revenues have been reduced to £114.5m, while EBITDA has been cut to £16.8m, which is slightly higher than last year. The share price slumped 23.9% to 27p.

Chemotherapy drug delivery technology developer CRISM Therapeutics (LON: CRTX) has raised £1m at 9p/share. The cash will be spent on progressing the MHRA approved phase 2 open label clinical trial of irinotecan-ChemoSeed in patients with surgically resectable glioblastoma. A retail offer is planned. The share price slipped 13.6% to 9.5p.

Blue Star Capital (LON: BLU) investee company SatoshiPay has onboarded its first customers to its fiat-to-crypto infrastructure platform. They include laCrypto in Brazil. Blue Star Capital shares slipped. The share price fell 6.98% to 10p.

Defence equipment and services supplier Cohort (LON: CHRT) reported interim revenues 9% higher at £128.8m, but pre-tax profit dipped from £9.8m to £8.8m. This was due to sales of lower margin products. The order book is worth £604.5m. The share price declined 5.89% to 1039p.