MP Evans dividend growth continues

Oil palm plantations operator MP Evans (LON: MPE) increased its interim dividend by 25% to 12.5p a share, as higher crude palm oil prices boosted profitability. The strong cash generation has moved MP Evans from a net debt to a net cash position.

MP Evans has maintained or grown its regular annual dividends each year for 15 years or more. Others on AIM that have done this include RWS Holdings (LON: RWS), Judges Scientific (LON: JDG) Brooks Macdonald (LON: BRK), NWF (LON: NWF), FW Thorpe (LON: TFW), Renew Holdings (LON: RNWH), Lok’nStore (LON: LOK), James Halstead (LON: JHD), Mattioli Woods (LON: MTW), Concurrent Technologies (LON: CNC), Oxford Metrics (LON: OMG), CareTech Holdings (LON: CTH) and Wynnstay Group (LON: WYN). There were some other companies that had a consistent record up until 2020, but the dividend was passed or reduced in that year.

Growing revenues

Interim revenues were one-third higher at $170.3m. There were some cost pressures, particularly in relation to fertiliser, but the higher revenues still helped to increase pre-tax profit by 53% to $61.2m.

This was achieved despite the changes in export rules and taxation during the period. Lower levels of independent crops were purchased.

The average crude palm oil price achieved was $1,035/tonne, up from $724/tonne in the same period last year. Total cost of production increased from $437/tonne to $598/tonne.

Crude palm oil production was slightly lower at 160,800 tonnes, but production has been increasing since the end of the half year.

Net cash was $13.5m at the end of June 2022. That provides the balance sheet strength to buy additional land, although the high palm oil prices have made it difficult to acquire land at realistic prices.

Although the crude palm oil price has fallen, it is well above the levels of two or three years ago and it is well above the average cost of production.

finnCap still values the company’s plantations at $20,000/hectare. That underpins the 1100p share price target.

Profitability will not be maintained at the level expected in 2022, which is between $110m and $120m. Next year is difficult to predict, but profit is likely to fall back below $100m. The cash pile will continue to grow after the payment of dividends and further capital investment.

Pound falls to lowest level against Euro since 2021

The Pound fell to its lowest level against the Euro since early 2021, after hawkish rhetoric from the European Central Bank strengthened the Euro while the UK’s weaker than expected GDP report failed to boost the flailing Sterling.

UK GDP grew 0.2% in July after a 0.6% fall in June, representing a return to growth. However, the results came in below analyst expectations of 0.3% growth, serving to hamper the Pound’s return to strength.

The Euro was trading at £0.86516 in late afternoon trading on Monday, with the Pound falling to £0.87215 against the currency earlier today.

“July’s rather anaemic growth came in below expectations, a factor which will add to concerns that the UK is slow marching towards recession,” said AJ Bell financial analyst Danni Hewson.

“Despite the package of support for households, which has just been announced by the government, the cost of living crisis hasn’t magically disappeared.”

“Energy costs are just one part of the equation – food prices, fuel prices and pretty much every single service we use has gone up and, even if inflation doesn’t peak at those eyewatering levels we’d been warned of, budgets are still very tight.”

Greatland Gold secures A$340m funding for Haverion project

Greatland Gold shares gained 11.2% to 9.2p in late afternoon trading on Monday, after the mining company secured A$340 million in funding for its gold-copper Haverion deposit in Australia.

The group reported the funding enabled it to fully fund its 30% share of the Haverion development, of which Newcrest holds the additional 70%.

Greatland Gold confirmed the project’s estimated value in excess of $1.2 billion, which is currently in development under a joint-venture with Newcrest Mining, the largest Australian gold producer.

The gold mining group signed a Commitment Letter, including a term sheet, for a A$220 million seven-year term, self arranged debt syndicate with HSBC Bank, Australia and New Zealand Banking Group and ING Bank in advance of its finalised feasibility study later in 2022.

Meanwhile, privately owned metals company Wyloo Metals also contributed an initial strategic equity subscription of A$60 million, with a potential further A$60 million in the future.

Greatland Gold confirmed it also intended to seek secondary dual listing on the Australian Stock Exchange to increase liquidity.

The news follows another set of optimistic drilling results from the Haverion operation.

“This is a tremendous announcement for Greatland to have a pathway to being fully funded for its share of the development costs of Havieron,” said Greatland Gold managing director Shaun Day.

“This outcome has been achieved through a combination of equity market support, including today’s execution of strategic investment agreements with Wyloo and in combination with the support from a syndicate of high-quality banks providing a commitment letter in respect of A$220m of debt funding.”

“The significant size of each bank’s commitment together with the strategic support from Wyloo highlights the long-term confidence in the Havieron gold-copper project and the strength of this world class asset.”

AIM movers: UK Oil & Gas cash call and Greatland secures Havieron funding share

UK Oil & Gas (LON: UKOG) took advantage of the positive outlook for UK oil and gas explorers to raise £3m at 0.0875p a share. The share price has fallen by one-fifth to 0.0875p. Two weeks ago, the share price was 0.08625p and it ended last week at 0.1098p. The cash, though, will be invested in a seismic programme and the drilling of an appraisal well in the Basur oil discovery in Turkey. This could, if successful, go into production in the first half of 2023.

Phoenix Global Resources (LON: PGR) continues its decline ahead of the ending of the AIM quotation on 15 September. The shares fell a further 36.4% to 3.5p.

Sustainable wood producer Accsys Technologies (LON: AXS) has strong demand for its Accoya wood, but a shutdown at its plant in Arnhem meant that it had less to sell in the first half. Capacity is constrained ahead of the beginning of production from the new reactor, which increases capacity by one-third. Even more disappointingly, there are further delays to the new Tricoya plant in Hull and management is assessing its options. More cash will be required for the project. Construction on the US Accoya plant has commenced. The shares declined by 12.3% to 78.1p. The fundraising in May was at 123p a share.

Full year revenues from IT and digital services provider Made Tech (LON: MTEC) were in line with forecasts but pre-tax profit was slightly lower than consensus forecasts of £2.43m. The trading outlook was positive, but the market reception was not with the shares 11.6% down at 26.95p.

Insig AI (LON: INSG) has secured a convertible loan facility of £750,000, repayable on 30 June 2023, from Richard Bernstein, who has already provided £1m. The conversion price is 35p. That was a premium to the market price even before the 7.6% fall to 30.5p.

Stripping out discontinued activities at Omega Diagnostics (LON: ODX) shows the progress of the health and nutrition business. There was still a loss in the year to March 2022 and a larger one is expected this year. Net cash fell to £1.4m at the end of March 2022, by next March disposal proceeds should help to improve the net cash position to £6m. The share price fell 2.7% to 2.675p.

Greatland Gold (LON: GGP) has secured its share of the finance to develop the Havieron project in Australia. Wyloo Metals has subscribed for 430 million shares at 8.2p each and agreed to invest a similar amount in the future. The share price jumped 12.1% to 9.3p. There is also a commitment letter for a seven-year A$220m debt facility provided by a syndicate of banks. The total funding comes to £200m. Greatland Gold owns 30% of Havieron.

Pipehawk (LON: PIP) has won a £1m contract to supply a floor jointing system to RCR Flooring Products. This will take 12 months with one-third of the amount paid upfront. The share price rose 11.5% to 14.5p.

Kape Technologies (LON: KAPE) got a big boost from the acquisition of ExpressVPN in the first half of the year but the ongoing digital security businesses grew by 19% and retention rates improved to 82%. Interim revenues were 217% ahead at $302.4m. What was most impressive was the cash generation with $90.1m of underlying operating cash flow, which helped to cut net debt from $457.5m to $391.9m during the period. There are more cost savings to come from the ExpressVPN acquisition. The share price has increased by 11.5% to 290p.

FTSE 100 helped higher by UK consumer stocks

Consumer stocks helped the FTSE 100 gain on Monday as the Uk economy returned to growth in July and falling natural gas prices increased hopes inflation may soon start to slow.

The FTSE 100 pressed ahead, rising 1.3% in late morning trading as a collection of consumer-focused stocks pulled the blue chip index higher.

Analysts commented the 0.6% growth in consumer-facing services output over July served to breathe fresh life into the FTSE 100’s top performers, following a rise in consumer spending due to the hot weather and a wave of entertainment events, including the country’s hosting of the Women’s Euros and the Commonwealth Games.

“Given all the talk of recession, businesses will be reassured to hear that the economy grew in July, at around its long-term trend rate. Consumer spending was reasonably strong, as hot weather, a strong sporting schedule and holiday bookings boosted retail and recreation activities,” said Institute of Directors chief economist Kitty Ussher.

PwC economist Jake Finney added: “The UK economy grew by a modest 0.2pc on a month-on-month basis in July, following its 0.6pc contraction in June 2022.”

“Consumer-facing services grew by 0.6pc in July, following a flat month in June. The sector was helped by record-high temperatures and one-off events, such as the UK’s hosting of the Women’s Euros and the Commonwealth games.”

Consumer stocks gain

Grocery shares gained, with Sainsbury’s rising 4.3% to 211.4p and Tesco climbing 4% to 249.5p, while B&M increased 3.3% to 362.5p and Associated British Foods rose 2.7% to 1,392.5p.

Fashion companies also climbed higher, with JD Sports Fashion rising 3.6% to 130.7p and Next gaining 2.8% to 6,050p.

Mining companies rise

Mining companies rose on the back of supply risks in China and a weakening dollar ahead of US inflation data on Tuesday, with Anglo American shares increasing 4.1% to 3,047p, Glencore climbing 3.2% to 504.1p, Antofagasta gaining 2.6% to 1,226.7p and Rio Tinto rising 2.5% to 4,985.5p.

Oil prices

Meanwhile, oil prices rose thanks to a weaker dollar and supply uncertainty, with the price of benchmark Brent crude increasing 1% to $93 per barrel.

Shell shares gained 1% to 2,323p and BP shares climbed 1.7% to 458.6p.

Natural gas prices sank as investors looked forward to potential intervention by the EU.

PIP – An outstanding long-term track record

Helen Steers, Pantheon Partner and lead manager of Pantheon International Plc (ticker code: PIN), discusses the recent annual results of one of the longest established private equity investment companies.

Pantheon International Plc (“PIP”) is a FTSE 250 private equity investment company managed by Pantheon, a leading global private markets investor, and overseen by an independent Board of Directors. PIP provides investors with exposure to many of the best private equity managers in the world that may otherwise be difficult to access for many types of investors. These managers are backing high growth, exciting companies many of which are in niche sectors.

Consistent outperformance over 35 years

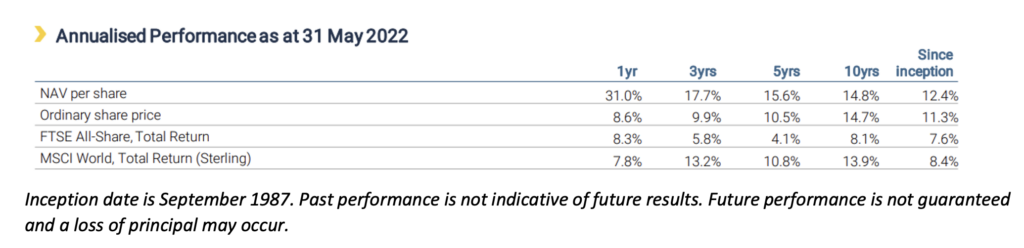

As shown in its recent annual results, PIP had an outstanding year, reporting record growth in the value of its net assets (“NAV”) as well as record net cash flow and investment activity for the 12 months to 31st May 2022. PIP’s NAV grew by 31.0% during the financial year and in the 35 years since PIP’s inception, it has grown by an average of 12.4% each year. This performance is stated net of all fees.

PIP has had an excellent year in terms of both new commitments and exits from existing companies held in the portfolio. PIP’s portfolio is being managed to provide ample cash that can be recycled into new investments. During the year, PIP received cash of £419m from its investments relative to £187m of calls from existing commitments to private equity funds, resulting in net cash flow of £232m. PIP made 70 new investments worth a combined £496m in the year and we expect its strong pipeline to continue to drive deal flow over the coming months.

We have continued to increase the number of direct company holdings in the portfolio and nearly 45% of the portfolio is now invested directly in companies. The increased concentration provides shareholders with greater exposure to the potential for individual companies to provide a boost to performance while, importantly, the benefits of diversification are not lost as PIP continues to invest in a well balanced portfolio of private equity funds and direct investments in companies.

PIP had its largest ever single company exit in its history during the financial year. PIP co-invested in EUSA Pharma, a pharmaceutical company focused on oncology and rare diseases, in 2015 alongside EW Healthcare which is one of the longest established private equity managers in the healthcare sector. EUSA Pharma was sold to a strategic buyer, Recordati, in December 2021, providing PIP with proceeds of £49.5m which equates to c.5.0x invested cost.

PIP has a strong balance sheet with good liquidity. We recently agreed a new, enlarged £500m five-year multi-currency, revolving loan facility to replace the previous lending agreement and there is an option to extend the facility by one year at a time beyond its expiration in July 2027. This facility, combined with £178m of cash at 31 July 2022, gives PIP even greater flexibility to meet its outstanding investment commitments and to continue to invest in compelling deal opportunities over the coming years.

Investing in exciting companies in growth sectors

PIP’s portfolio has been actively managed to be resilient in a variety of market conditions including in times of economic stress. The portfolio is tilted towards Information Technology and Healthcare, both of which are sectors that are benefitting from long-term secular trends that are not dependent on the macroeconomic environment.

The IT businesses that we invest in are typically mission-critical software and IT infrastructure businesses and those that are supporting the move towards automation and digitalisation across many sectors. These are high quality, cash generative companies with strong recurring revenues. For example, during the year PIP invested in TriMech, which is a provider of 3D design, engineering and manufacturing solutions in North America. We believe that this business is particularly interesting as TriMech is one of the few businesses operating at scale in an attractive 3D printing and design market which is set to continue to grow as companies utilise 3D software as part of their product development. TriMech has already made numerous acquisitions and they are likely to be a key component of its growth story.

We like Healthcare as a sector due to the positive tailwinds from ageing demographics and increased demand for high quality healthcare products and services from the growing middle classes in emerging economies. PIP has invested in Seqens which is a pharmaceutical ingredients manufacturer, headquartered in France, and is a leading supplier of pain relief ingredients for both the Paracetamol and Aspirin supply chains. Seqens is a great example of a company that is strongly positioned to benefit from western reshoring initiatives, which de-risk supply chains, and the growth in outsourcing of pharmaceutical supply chains.

We have continued to invest PIP’s capital in a thoughtful, responsible manner. Pantheon was an early signatory to the UN PRI in 2007 and we continue to enhance our ESG strategy. Sustainable investment can also create opportunities and we have invested in companies that have positive ESG angles. One such example is Satlink, a global leader in the development of technological solutions for the maritime sector with a focus on sustainable fishing. They recently won a United Nations Global Compact award in February 2022 for their contribution to a more sustainable fishing industry and the preservation of marine life.

Download PIP’s latest newsletter

Outlook

The impact of substantially lower economic growth globally, coupled with supply chain issues, higher energy, food and input costs, and the lingering effects of the COVID-19 crisis, is creating an unenviable mix of challenges which are being faced by both individuals and businesses. While we are cautious in these difficult times, we believe that our industry will continue to experience significant growth in the coming years. Private equity managers have a long-term investment horizon and they offer access to subsectors that are generally under-represented in the public markets and that continue to innovate and offer compelling investment opportunities.

PIP’s portfolio is orientated towards small and medium-sized businesses and those in the growth phase of their development. Within those businesses, there are a number of levers that our private equity managers can pull to create value and there are also several routes for them to sell the businesses on. The majority of the exits in PIP’s portfolio are to corporate buyers, executing their M&A strategies, or to other private equity managers who have a different set of skills to take the business to the next stage of its growth. The managers we are backing are not dependent on the IPO market being open. In fact, just 7% of the exits in PIP’s portfolio during the financial year were due to companies being taken public. Furthermore, PIP’s portfolio is tilted towards asset-light companies, which typically have no debt (in the case of companies in the growth capital stage), or lower levels of debt (in the case of small and mid-sized businesses), compared with large and mega sized firms.

For the past 35 years, Pantheon has managed PIP through numerous economic cycles to deliver long-term outperformance over its public market benchmarks. Investors must assess carefully what is suitable for them and their investment objectives and tolerance/appetite for risk but PIP’s access, through Pantheon, to many of the best private equity managers globally provides us with confidence that PIP can continue to provide attractive returns to shareholders over the long term.

Important Information

This article and the information contained herein may not be reproduced, amended, or used for any other purpose, without the prior written permission of PIP. This article is distributed by Pantheon Ventures (UK) LLP (“Pantheon”), PIP’s manager and a firm that is authorised and regulated by the Financial Conduct Authority (“FCA”) in the United Kingdom, FCA Reference Number 520240.

The information and any views contained in this article are provided for general information only. Nothing in this article constitutes an offer, recommendation, invitation, inducement or solicitation to invest in PIP. Nothing in this article is intended to constitute legal, tax, securities or investment advice. You should seek individual advice from an appropriate independent financial and/or other professional adviser before making any investment or financial decision. Investors should always consider the risks and remember that past performance does not indicate future results. PIP’s share price can go down as well as up, loss of principal invested may occur and the price at which PIP’s shares trade may not reflect its prevailing net asset value per share.

This article is intended only for persons in the UK. This article is not directed at and is not for use by any other person. Pantheon has taken reasonable care to ensure that the information contained in this article is accurate at the date of publication. However, no warranty or guarantee (express or implied) is given by Pantheon as to the accuracy of the information in this article, and to the extent permitted by applicable law, Pantheon specifically disclaims any liability for errors, inaccuracies or omissions in this article and for any loss or damage resulting from its use. All rights reserved.

HgCapital Trust NAV climbs 1.8%, net assets exceed £2bn

HgCapital Trust shares rose 4% to 383.5p in late morning trading on Monday, after the firm announced a total return NAV climb of 1.8% to a NAV per share of £4.43 and net assets of over £2 billion.

The Trust linked its results to strong portfolio trading and value creation, which reportedly offset a decline in valuation multiples of listed comparable companies.

HgCapital Trust invested £71 million alongside its other institutional clients, with an estimated additional £355 million invested post-period.

Meanwhile, HgCapital noted £29 million of returns realised on behalf of the Trust, with an anticipated additional £465 million returned post-period at an uplift of 29% to December book value.

The Trust highlighted an investment of £1,000 made 20 years prior in HgCapital would currently be worth £18,370 at a total return of 1,737%, with an equivalent investment in the FTSE All-Share Index worth £3,521.

“Despite the obvious challenges and uncertainty presented by the current macro-economic and geo-political environment, the Board remains optimistic about the future prospects for HGT,” said HgCapital Trust chairman Jim Strang.

“The businesses within the portfolio are resilient, and in such an environment as today’s continue to provide critical solutions to their clients and reduce the costs and complexity of doing business.”

“The long-term value creation prospects from owning such a portfolio remains attractive.”

HgCapital Trust declared a HY1 dividend of 2.5p per share against 2p the last year, which is scheduled for October 2022 payment.

Pound climbs against dollar ahead of US inflation report

The Sterling rose to 1.1682 against the dollar in Monday trading after analysts noted maintained hawkish sentiment from the US Federal Reserve ahead of US inflation data, which is scheduled for release on Tuesday.

Disappointing UK GDP growth of 0.2% in July did little to dent the Pound’s rise versus the dollar, with Prime Minister Liz Truss’ financial support package announced on Thursday lending some buoyancy to the Sterling after its spiral to 37-year lows earlier last week.

“In their last chance to provide guidance before the 20-21 September meeting, there was no push-back from any Fed official on the market view that is almost fully priced for a 75bp hike. Fed rhetoric remains hawkish with officials resolute in their commitment to bring inflation down,” said ANZ senior economist Tom Kenny.

The US last saw inflation drop to 8.5% from its multi-decade record high of 9.1%, sparking some hope the US Fed would ease off aggressive interest rate hikes.

However, Fed chair Jerome Powell quickly shut down such hopes at the Jackson Hole convention in late August, during which he confirmed continued hawkish rate decisions until inflation was tackled back down to the 2% target.

Cleveland Fed president Loretta Mester said she didn’t expect inflation to return to 2% until 2024, and advocated potentially more aggressive rate hikes than the Fed already had in sight if inflation hits another peak.

“My current view is that it will be necessary to move the nominal fed funds rate up to somewhat above 4 percent by early next year and hold it there; I do not anticipate the Fed cutting the fed funds rate target next year. But let me emphasize that this is based on my current reading of the economy and outlook,” said Mester to MNI News.