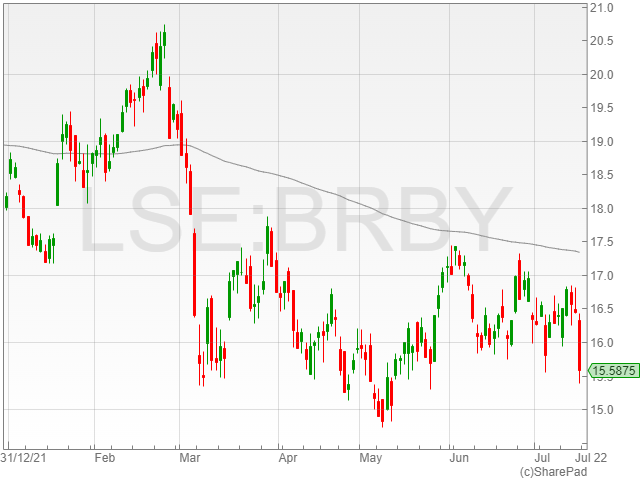

Direct Line Insurance Group shares tumbled 12.3% in early morning trading following volatile market conditions, leading to severe claims inflation above priced-in levels for the company at overall motor claims severity inflation of approximately 10% in the year-to-date.

The insurance firm commented its HY1 2022 current year motor loss ratio was expected to be in the region of 86%.

However, Direct Line said it expected its HY1 releases to remain in line with expectations as a result of its conservative reserving over 2021.

The company added its additional business units were performing in line with management expectations, with an overall expected combined operating ratio of 96.5% for the financial period, normalised for weather and gross written premium of approximately £1.5 billion.

The group said it had worked to restore margins in Q2 through increased prices to reflect higher than anticipated claims inflation.

It further mentioned its recently launched updated motor risk pricing model, which the company believes will improve risk selection.

Direct Line confirmed an expected FY 2022 operating ratio between 96% to 98%, normalised for weather.

The company added a projected operating costs reduction to £690 and £700 million, with a FY 2023 operating expenses target of around £670 million, representing an estimated reduction of £76 million from 2021 to 2023.

The firm also noted its continued target of a 20% expense ratio, however it confirmed the goal was currently unlikely to be reached due to a reduction in motor market average premiums as a result of structurally lower claims frequency.

Direct Line said it expected a combined operating ratio of 95% for FY 2023 and a return to target range of 93% to 95% over the medium term.

The insurance group reported an intention to pay out its dividend based on satisfactory its satisfactory balance sheet.

However, the company announced the cancellation of its second £50 million tranche of its £100 million share buyback programme launched earlier this year.

“Today’s trading update follows a period of heightened volatility across the UK motor insurance market, in which we have seen claims inflation in motor in the first half of 2022 spike above the levels assumed in our pricing. As a result, we are revising our combined operating ratio target range for 2022 to 96-98%,” said Direct Line CEO Penny James.

“We have already taken actions including increasing prices and deploying new pricing capability to restore margins, which mean we expect our 2023 combined operating ratio will improve to around 95% and we reiterate our medium-term target range of 93-95%.”

“This, combined with our diversified business model, our strong balance sheet and our continuing actions to further improve resilience, gives us confidence in the sustainability of our regular dividends for this year and as we look ahead.”