Domino’s Pizza (LON: DOM) has tough comparatives for this year’s trading and the delivery market is slowing. The pizza company’s interims are due on 2 August. This should provide some indication of how trading is faring.

Domino’s Pizza has been withdrawing from its overseas businesses so that it can concentrate on its core UK business. It is estimated that like-for-like UK sales could be up to 9% lower in the second quarter

Peel Hunt trimmed its 2022 pre-tax profit forecast to £109.7m, down from £113.9m in 2021. This reflects higher costs and the potential slowing of volumes.

By early May, nin...

FTSE 100 closes higher despite retail sales fall

The FTSE 100 closed 0.2% higher on Friday trading after a 0.1% retail sales fall in June cast a gloomy outlook on consumer-focused groups, while oil and commodities stocks rebounded on higher prices at the week’s close.

“The FTSE 100 eked out some gains on Friday to provide hope it may finish in positive territory for the week,” said AJ Bell investment director Russ Mould.

“A drop in the pound as retail sales disappointed probably helped since it boosted the relative value of the overseas earnings that dominate the stock index.”

The price of benchmark Brent Crude oil rose to $104 per barrel on demand fears after Russia announced it would not supply crude oil to countries that place a price cap on their oil.

Shell shares gained 0.6% to 2,042p, however BP shares dipped 0.2% to 383.1p.

BT Group shares fell 1.8% to 177.6p, despite the Competition and Markets Authority (CMA) granting the green light to the company’s sport joint-venture with Warner Bros’ Eurosport UK.

“It’s great news that the CMA has approved the new JV that we are forming with Warner Bros. Discovery, combining the very best of BT Sport and Eurosport UK, to create an exciting new offer for live sport programming in the UK,” said BT Consumer Division CEO Marc Allera.

“Today is a huge milestone, as we now look toward day one of the new business, which we hope to be in the coming weeks.”

Mining groups picked up after supply fears saw a 0.3% rise in three-month copper on the London Metal Exchange at $7,343.50 per tonne.

Anglo American shares gained 1.4% to 2,665.5p, Antofagasta increased 2.7% to 1,076p, Endeavor rose 1.3% to 1,619p, Glencore saw an uptick of 0.5% to 422.2p and Rio Tinto climbed 1.6% to 4,772p.

Meanwhile, JD Sports defied the gloomy retail sales results after it reported it was on track to reach £1 billion in profits for FY 2022, with sales rising 5% year-on-year.

The company is currently still searching for a new CEO after the departure of Peter Cowgill earlier this month.

Yellow Cake capitalises on higher uranium demand as company awaits nuclear power transition

Yellow Cake shares gained 2% to 357.4p in late afternoon trading on Friday after the group announced continued market improvement for U3O8, with the spot price increasing 89% from $30.65 per pound on 31 March 2021 to $57.90 per pound on 31 March 2022.

The uranium-specialised company reported a 203% rise in the value of its holding in U3O8 across the financial year to $916.7 million at 31 March 2022 on the back of the increased price of uranium.

Yellow Cake also highlighted the net growth in the volume of uranium held from 9.8 million pounds of U3O8 to 15.8 million pounds.

The firm mentioned a post-tax profit of $417.3 million for FY 2022 from $29.9 million in FY 2021.

Yellow Cake confirmed $236.6 million raised over the period through share placings in June and October 2021, after it raised $138.5 million in March 2021.

The company said it applied the proceeds of the three placings to acquire 8.3 million pounds of U3O8 in FY 2022, along with an additional 0.9 million pounds post-year end.

It noted a NAV of $1 billion, representing 442p per share on 31 March 2022, against a NAV of $421.4 million at 238p per share the last year.

Yellow Cake further reported a completed $3 million share buyback after year-end of 566,833 shares between 4 April and 6 May 2022.

The group also confirmed a 47% increase in the value of its 18.8 million pound holding of U3O8 at 15 July 2022 to $860.4 million, relative to the acquisition cost of $585.1 million.

“I am very pleased to report on another year of considerable progress. We have remained focused on our strategy to buy and hold uranium, providing investors with the opportunity to directly participate in the continued rise in the price of the commodity, which in turn has generated consistent returns for our shareholders,” said Yellow Cake CEO Andre Liebenberg.

“In 2021, we raised approximately USD375 million to acquire 8.35 million lb of uranium during the financial year, which with an additional purchase after year-end, means we now own 18.81 million lb, doubling the amount since the end of the 2021 financial year.”

Yellow Cake commented it was optimistic in its outlook, on the back of strong demand for uranium and an expected price increase as nuclear power potentially grows in popularity.

“The confidence we have in our longer term outlook remains very strong and this is driven by the same supply demand fundamentals that have supported the performance to date,” said Liebenberg.

“We expect to see a sustained increase in uranium demand and price increases in years to come as the global demand for clean energy highlights the need for nuclear energy. We have seen very positive policy developments in the US, the EU and in China as nuclear is increasingly recognised as a core way to urgently address climate change.”

“Yet despite a clear growing demand picture and recent prise rises, supply remains severely constrained, and looks set to get even tighter as utility companies around the world start to address their future uncovered fuel requirements. Yellow Cake is very well placed to capitalise on these market characteristics.”

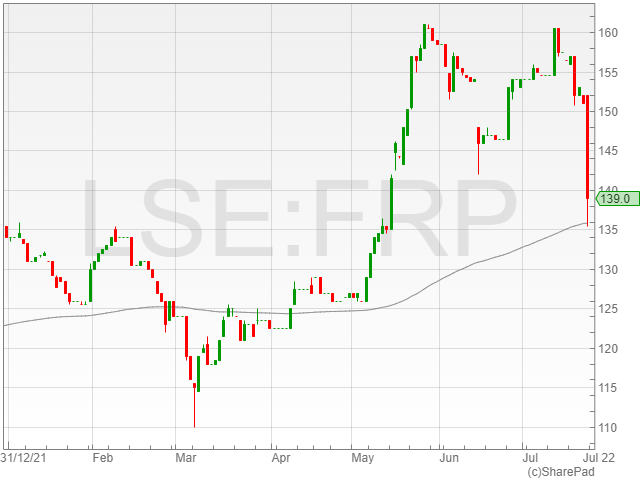

FRP Advisory Group pre-tax profits slide to £15.1m, revenues grow to £95.2m in FY 2022

FRP Advisory Group shares dropped 7.6% to 139.4p in late afternoon trading on Friday following a pre-tax profit slide to £15.1 million in FY 2022 against £16.6 million in FY 2021.

However, the company announced a revenue growth to £95.2 million compared to £79 million in the previous year, with 11% driven by organic increases underpinned by the support offered on several larger projects, and 10% stemming from acquisitions.

FRP Advisory Group also reported an adjusted underling EBITDA of £25.7 million from £23 million.

Meanwhile, the business advisory firm mentioned a basic EPS of 5.3p compared to 6p and an adjusted EPS of 7.5p against 7.1p year-on-year.

FRP Advisory Group noted net cash of £18.1 million at the end of FY 2022 from £16.4 million the last year, along with an undrawn revolving credit facility of £10 million.

“I am pleased to report another year of profitable growth. FRP is a resilient business, with a track record of growth regardless of the economic conditions. The UK M&A mid-market remains active, our Corporate Finance team have an excellent pipeline to help clients realise their strategic ambitions,” said FRP Advisory Group CEO Geoff Rowley.

“Uncertainties still remain over how long troubled businesses can continue in their current form or how proactive key creditors like HMRC and institutional lenders will be on addressing over-due debts. Following the removal of government support, inflationary pressures and other disruptive forces, the Group has seen an increase in the level of enquiries for restructuring services in recent months.”

“The Group has a strong balance sheet and the Board believes the medium-term outlook for all the Group’s markets is positive. Trading since 1 May 2022 is in line with the Board’s expectations.”

FRP Advisory Group announced a total dividend of 4.3p per share against 4.1p the year before.

Mirriad Advertising shares tumble as HY1 revenue halves on disappointing China performance

Mirriad Advertising shares tumbled 41.6% to 8.6p in late afternoon trading on Friday after its HY1 revenue was almost halved to £577,000 from £1.1 million year-on-year.

The company attributed its lower revenues to the “seasonal nature of key advertising markets” and its present sales pipeline, with higher revenues projected for HY2.

Mirriad Advertising reported an 85% drop in its China revenues to £123,000 against £820,000, linked to Covid-19 lockdowns and contractual changes removing guaranteed income from the region.

The marketing firm said it aimed to wind down its Chinese operations by the end of its Tencent contract in March 2023, targeting annual cost savings of £1 million after the board decided it was not prudent to budget for the awaited rebound in the country’s market.

However, its US revenues climbed 57% to £418,000 compared to £266,000 in HY1 2021, currently accounting for 72% of total revenue.

Mirriad Advertising confirmed cash of £17.7 million at the end of June 2022 from £29.8 million year-on-year, with year-end cash expected to exceed market expectations on the back of cost savings and lower than expected budgeted bonus provisions.

The company highlighted improvements recorded across all KPIs on supply and demand sides, and its cost control programme, which is set to deliver £2.5 million of total annualised costs savings, with the majority to be achieved in FY 2023.

It added the firm would be leaning into digital advertising in the EU and APAC to reflect initial progress made on the digital front in North America.

“Our positive US momentum is diluted by the disappointing results of our operations in China, stemming from the unexpected length of stringent lockdowns and a challenging macro environment overall,” said Mirriad Advertising CEO Stephan Beringer.

“The decision to make an orderly wind down of our operations at the end of the Tencent contract does not impact our overall route to scale, which is rooted in standardisation and integration with the wider advertising ecosystem and enhancing our advanced programmatic capabilities.”

Mirriad Advertising commented it expected far stronger revenue in HY2 2022 on the assumption of a significantly backloaded revenue profile.

“In our priority markets we are seeing a clear in-content interest surge – moving it from novel consideration to must-have and we expect our revenue-generating activity to be backloaded towards the end of the year, as per industry norms,” said Beringer.

“We are also within the Company’s expectations of cash consumption and cash balance as the whole Mirriad team works to convert our high-quality and varied pipeline at pace.”

Titon Holdings shares fall as cost inflation and ERP System complications eat into revenues

Titon Holdings shares were down 8% to 75.8p in late afternoon trading on Friday on the back of continued margin erosion due to cost inflation, alongside shortages in raw materials and components in FY 2021/2022.

The firm said it would instigate price increases for its products in a move to mitigate the effects of the volatile macro-economic environment and lower the impact on its margins for the FY financial period.

Titon Holdings also noted unforeseen operational impacts linked to the implementation of the new internal ERP system for its UK and Europe operations.

The ERP system is reportedly a critical component for the group’s business improvement and is a necessary part of its growth strategy.

However, its introduction led to short-term production despatch delays, resulting in lower than expected revenues for the last three months of trading.

Additionally, ERP delays brought further costs for system development, rising labour expenses to ramp up production, and costs for staff retention.

Titon Holdings commented its issues were being resolved and sales had returned to normal levels, but the cost disruption resulted in a sales fall unlikely to be recovered over FY 2021/2022.

The company said it consequently expected its results for the FY term to come beneath management expectations.

The firm added its revenues in the rest of the world had remained unsatisfactory, with South Korea revenues disappointing as a result of delays to construction projects and a shift in market demand to ventilation products from natural ventilation.

Titon Holdings confirmed it expected a better than expected small profit from its Korea and 49%-owned associate company Browntech Sales, despite its problems over the period.

It also mentioned expected revenues from sales of mechanical products bought-in by Browntech Sales to start accruing in FY 2022/2023.

The company currently has a positive balance sheet, with cash balances of approximately £3 million at 30 June 2022 and no debt.

“We are obviously disappointed that the Group’s trading performance for the FY21/22 full year will be lower than previously indicated due to the margin pressures we have experienced and the production and despatch issues we have suffered from in the last three months as we implemented our new ERP system,” said Titon Holdings executive chairman Keith Ritchie.

“We will continue to actively manage the market-wide supply chain and inflationary challenges and seek to increase our factory output for the remainder of the financial year.”

“We thank all of our customers for their patience as we work to fulfil their orders and our employees for their continued hard work. Despite these difficulties we remain confident in our medium-term future, supported by our strong financial position.”

Retail sales fall 0.1% in June as fuel and clothing sales decline

Retail sales across the UK fell 0.1% in June, according to the latest figures from the Office of National Statistics (ONS).

The organisation also downgraded its retail figures in May to a 0.8% drop from its initial estimate of 0.5%.

“The bottom lines is people are buying less. Big ticket items are being put on hold until life becomes more affordable,” said AJ Bell investment analyst Danni Hewson.

“Day to day spending requirements are being carefully weighed and costed, and when the price tag gets too high there’s no choice but to cut back.”

Jubilee boosts food sales

Food sales grew 3.1% as people across the UK celebrated the Platinum Jubilee, with snacks, alcohol and sweet treats driving grocery figures as consumers indulged in parties thrown to commemorate the special occasion.

“People did splurge on their street parties, house parties and bank holiday breaks. The nation raided supermarket shelves for party snacks, filled trollies with cases of beer and wine, and in some cases even bought all the bits needed to whip up a Jubilee pudding,” said Hewson.

“It was a moment to lose themselves, to push problems aside and enjoy the festivities with friends and families. But June’s 0.1% fall in retail sales won’t fool anybody – the sector is under siege and the Jubilee celebrations papered over the cracks at best.”

Fuel sales fall on spiking prices

A cold reminder of the cost of living crisis hit in the spectre of fuel sales, which slid 4.3% as crushing petrol prices forced motorists to cut back on filling up their vehicles.

“With prices at the pumps hitting record levels motorists had to think carefully about every journey,” said Hewson.

“If it was manageable people were swapping four wheels for two, or pulling on their trainers to avoid using what is beginning to feel like the liquid gold needed to power our motors.”

Retail sales decline

Non-food store sales fell 0.7% as a result of a 4.7% drop in clothing store volumes and a 3.7% decline in furniture stores.

Customers pared back on clothing and big retail investments as the enthusiasm to stock post-lockdown wardrobes died down, and soaring 9.4% inflation tamped down consideration of pricy purchases such as new household items.

“The rush to refresh wardrobes is over. Clothing sales have plummeted, perhaps partly because shoppers have bought their holiday attire and celebratory outfits, but mostly because prices have been creeping up and retailers know affordability is an issue,” said Hewson.

Online shopping

Non-store retailing, such as online shopping, fell by 3.7% year-on-year. However, sales volumes were 20.8% above February 2020 levels.

The proportion of online retail sales fell to 25.3% over the month, reaching its lowest proportion since March 2020 and continuing a downward trend since its peak in February 2021.

“It’s no co-incidence that designer sofa maker Made.com has issued its third profit warning in the last week. Online retail has taken a big hit and virtual household goods stores have watched sales tumble almost twenty percent in the last year,” said Hewson.

“It’s not a pretty picture and, with inflation expected to heat up further just as that all important golden period begins, the sector will be nervous.”

“Savings are dwindling and simply covering day to day living costs is becoming harder.”

JTC revenue grows 8-10%, M&A pipeline remains active on new business acquisitions

JTC shares increased 4.7% to 744p in late morning trading on Friday after the professional services group announced an 8% to 10% revenue growth in HY1 2022, in line with management guidance.

The company highlighted an underlying EBITDA margin of 33% to 38%, with margin progression compared to HY1 2021 as JTC mitigated the impact of cost inflation.

JTC confirmed cash conversion within the guidance range of 85% to 90%, resulting in a leverage reduction of 0.7 times in the financial term and bringing it within guidance of 1.5 to 2 times underlying EBITDA.

In addition, organic growth was driven by record new business wins of £12.6 million, representing a 22% climb against £10.3 million year-on-year.

The group also noted a new business pipeline of £52.2 million at the close of HY1 2022, with an especially strong performance in June giving the company good momentum going forward in HY2.

“In the first half of 2022 we have built upon the strong performance delivered in 2021,” said JTC CEO Nigel Le Quesne.

“The business continues to demonstrate its resilience and agility during a period of macro uncertainty and our record new business wins reflect our ability to attract new clients and provide additional services to existing clients as they navigate both the threats and opportunities presented by the wider markets.”

The firm’s inorganic growth highlights included the smooth integration of its seven businesses acquired in FY 2021 into the JTC Global Platform, with its M&A pipeline remaining active with a selection of small-to-medium size opportunities currently in progress.

JTC commented its targets spanned the Institutional Clients Services Division, alongside the Private Client Services Division, with a special focus on the high-growth US market.

The company said it was confident in delivering FY 2022 results in line with market expectations, and reiterated its medium-term guidance.

“All integration programmes for the businesses we acquired in 2021 are on track and we maintain a healthy pipeline of targets in a consolidating sector,” said Le Quesne.

“We look forward to capitalising on our momentum in the second half of the year and, as always, my thanks go to the outstanding global team of JTC employee-owners, who continue to deliver service excellence for our clients and drive the Group forwards.”

Homeserve trading in line with expectations, £4bn Bidco acquisition on track

Homeserve shares were flat in late morning trading on Friday following a report of trading in line with management expectations in the group’s latest trading statement.

The home insurance firm highlighted good business progress in North America and EMEA, along with high policy retention rates and strong maintenance in customer service levels.

Homeserve confirmed the continued execution of its HVAC buy and build strategy across its established territories, with Q1 achieving acquisitions across North America, France, Spain and the UK.

The company said its Home Experts business saw its number of trades exceed 47,000 despite a moderation in customer demand, on the back of Checkatrade’s tiered subscription packages as trade retention continued to improve.

The firm also highlighted its Court Meeting and General Meeting scheduled for later today to seek shareholder approval for the recommended cash offer by Bidco to acquire the entire issued and to be issued share capital of Homeserve for approximately £4 billion.

The transaction is expected to close in Q4 of calendar FY 2022, with Brookfield and Homeserve reportedly making progress on the submission of all regulatory and competition notifications and pre-notifications to complete the agreement.

Beazley announces best HY ratio since 2015 despite falling profits

Beazley shares gained 8.2% to 516.5p in early morning trading on Friday after the company reported its best HY ratio combined since 2015 of 87% as a result of high underwriting performance.

However, Beazley announced a pre-tax profit decrease to $22.3 million for HY1 2022, compared to $167.3 million in HY1 2021, on the back of investment losses of $193 million across the financial term.

The insurance firm highlighted a 1% return on equity against 15% year-on-year, alongside a 26% gross premiums written increase to $2.5 million from $2 million supported by a buoyant rating environment, with a premium rate change of 18% seen on average across the company.

Beazley confirmed a rate increase on renewal portfolio of 18% against 20% in the previous year.

The group also noted prior year reserve releases of $92.6 million compared to $95.7 million, along with a reserve surplus at 5.9% above actuarial estimates from 6.6%.

“We have maintained the momentum of the second half of 2021 with gross premiums increasing by 26% alongside better than expected claims experience,” said Beazley CEO Adrian Cox.

“A challenging investment environment has impacted profit; however I’m delighted that we have achieved our best combined ratio at a half year since 2015.”

Underwriting team structure

Beazley reported several changes to its underwriting team structure, with four new underwriting divisions created.

The new sectors include cyber risks, led by Paul Bantick, MAP risks, headed by Tim Turner, property risks under the guidance of Richard Montminy, and specialty risks under the management of Bethany Greenwood.

Beazley commented the divisions would be interconnected to operate at scale with the goal of delivering innovation and generating efficiencies to benefit the firm’s clients and brokers.

The group also set up a new digital division under the leadership of Ian Fantozzi, consolidating all the digital business written across Beazley into one segment.

FY 2022 guidance

Beazley commented it would continued to deliver in line with its goals for the remainder of 2022 and beyond, with an expected FY combined ratio in the high 80s, assuming an average claims experience for HY2.

“We continue to manage actively for inflation and recession and our estimate for the war in Ukraine remains unchanged,” said Cox.

“Given the positive experience in the first half of this year we are in a position to update our combined ratio guidance to high 80s for 2022 assuming average claims experience for the second half of the year.”