Battery technology developer Ilika (LON: IKA) has commissioned its manufacturing plant for Stereax batteries and there is significant interest from medical technology companies, but it will be another year until sales start to ramp up so investors will have to be patient.

Process optimisation and product qualification continues at the facility and then initial products can be sold for pre-clinical studies for medical technology products. Management has decided to focus on this sector rather than the sensors market. Sales will be slower building up, but the medical markets could be much bigger.

It could take five years to go from pre-clinical studies to mass production. The potential products include implanted medical devices, smart orthodontics and cardiac sensors. The potential pipeline is much larger than the capacity of the manufacturing facility. Licensing the technology could become a possibility in three years. A US supplier would be useful given the potential customer base.

Liberum is expecting a rise in Stereax revenues from £31,000 to £200,000 this year before a jump to £6m in 2023-24. That is slower than previously expected.

Meanwhile, the development of the larger Goliath battery for luxury electric cars continues. Ilika would be one of the few European producers of solid state batteries. Goliath batteries could achieve a level of performance in excess of existing technology by 2024. A pilot plant could be started next year with a larger scale plant likely at the UK Battery Industrialisation Centre later.

Cash

There is plenty of cash in the bank to undertake the investment required in both Stereax and Goliath battery technologies thanks to the £24.7m raised at 140p a share last July. Net cash is £22.6m and that could fall to £12.2m by April 2023 after which the cash outflows from operations and investment should start to reduce.

This year the loss is expected to fall slightly from £8.15m to £7.79m on revenues improving from £496,000 £1m – mainly due to greater grant income.

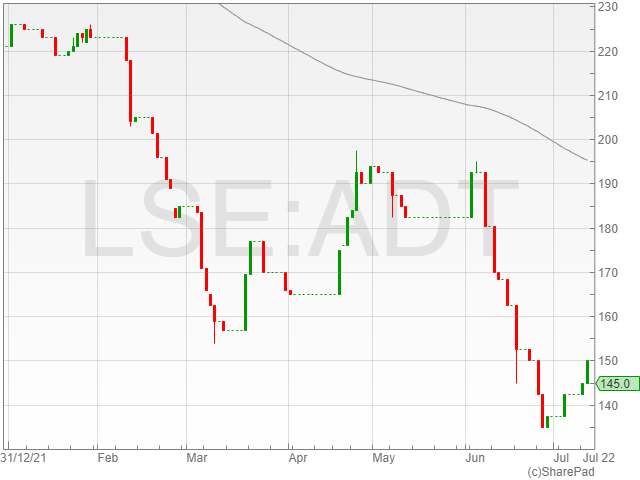

At 45.5p, down 10.8%, the share price is not much more than one-third of the placing and open offer price last year, which itself was a significant discount to the then market price.

The focus for Stereax on medical technology has slowed initial sales growth, but there are still enormous prospects for Stereax and Goliath. Investors got overexcited a few years ago and pushed up the share price but there appears an opposite overreaction in the current share price.