The BHP Group announced an update to its merger with Australian gas company Woodside on Friday, which included an explanatory memorandum and notice of a meeting for the Woodside shareholder vote on 19 May 2022.

Woodside also released the independent expert’s Report, which had drawn the conclusion that the merger was in the best interests of Woodside shareholders, short of a superior proposal.

The BHP Group confirmed that the merger’s completion was on track for 1 June 2022, pending approval by Woodside shareholders.

The company added that BHP would receive 914.8 million newly issued Woodside shares upon the transaction’s completion, and decide a fully franked in specie dividend of Woodside shares to BHP shareholders.

BHP said that company shareholders would be entitled to one Woodside share for each 5.5 BHP shares held on the Record Date.

According to the energy firm, Woodside’s current share price of 25,550c and BHP’s implied value of $23.4 billion would bring an in specie dividend of $4.62, with $1.98 in franking credits set for distribution per BHP share and a total of $10 billion in franking credits.

Woodside is reportedly set to retain its primary listing on the ASX, and is aiming for a standard listing on the LSE, alongside a sponsored Level 3 ADR program on the NYSE once the merger has been closed.

The disclosure release also said that a share sale facility would be in place for eligible BHP shareholders who decide to participate and for shareholders who are also not eligible to receive Woodside shares.

Woodside’s explanatory memorandum for shareholders advocated for the beneficial outcomes of the pending merger with BHP, including an anticipated $400 million in pre-tax synergies per year upon completion of the deal.

“Woodside Shareholders are being asked to consider this transformative opportunity and approve the Merger and the associated issue of New Woodside Shares,” said Woodside chairman Richard Goyder.

“After carefully considering all aspects, benefits and risks of the Merger and the Independent Expert Report, the Woodside Board unanimously recommends that Woodside Shareholders vote in favour of the Merger Resolution at the Meeting.”

“This is a significant decision for Woodside’s long-term future. The case for the proposed Merger is compelling, bringing together the best of both organisations to create a global independent energy company with the scale, diversity and resilience to create value for shareholders and increased ability to navigate the energy transition.”

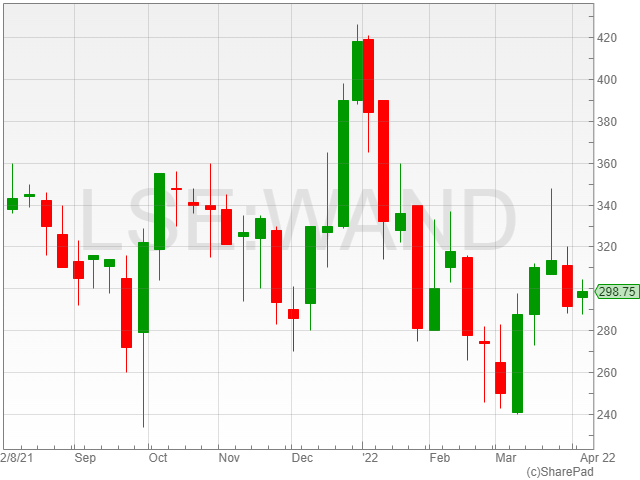

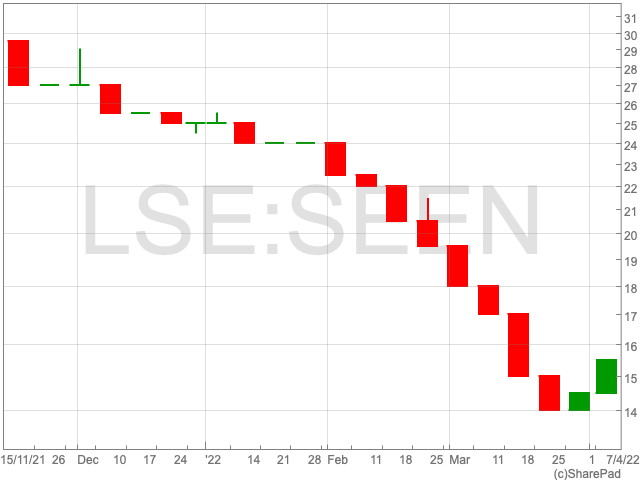

Woodside shares were down 1.5% to 32.4 AUD and BHP shares were up 1.7% to 51.9 AUD in early morning trading on Friday, following the announcement.