A price range of between 150p and 170p has been set for Recycling Technologies Group. The PrimaryBid offer is due to close on 2 December and the final pricing will be announced on 9 December with dealings likely to commence on AIM one week later.

Recycling Technologies Group wants to raise up to £40m, so the potential market capitalisation will be between £102m and £111m. The offer could be increased by up to 15% if there is sufficient demand. There could also be existing shares offered.

Recycling Technologies has developed a modular machine called the RT7000, which can process hard to recycle...

A different approach to UK Equity Income portfolios with Octopus Investments

In his role as Lead Fund Manager at Octopus, Chris overseas a team dedicated to building UK equity portfolios designed to provide investors with an attractive yield.

It is immediately apparent that Octopus are doing things differently. The Multi Cap nature of their income fund, the Octopus UK Multi Cap Income Fund, alludes to a strategy producing one of the best performances among their UK Income peers.

The team at Octopus have built an income fund that encompasses a broad range of companies that other managers in the space overlook. These being shares with a market cap of £100m-£1bn, paying a dividend and providing significant opportunity for growth.

The portfolio utilises a core/satellite approach to investing that builds income and growth satellites around a selection of core holdings Octopus believes can grow earnings and dividends ahead of the market.

The strategy has helped Octopus return a 29.3% performance over the past year, alongside a very respectable 4.1% yield.

Learn more about the Octopus UK Multi Cap Income Fund here.

FTSE 100 sinks in ‘Red Friday’ selling

The FTSE 100 was a major casualty on Friday in the wake of the discovery of a new COVID-19 variant in Africa.

In what should have been a day focused on the sales figures of Black Friday, all eyes were on global markets and the severe selling which earned the name ‘Red Friday’.

“Forget Black Friday; today has been renamed Red Friday after the colour of share price screens as stocks slump globally on fears over a new Covid strain,” said Russ Mould, investment director at AJ Bell.

Lower oil prices were a major contributor to the FTSE’s weakness as heavyweights including Shell and BP sank.

Shell and BP were down 4.8% and 5.9% respectively in early trade as oil prices dropped over 6%.

“The drop in the oil price the market’s way of saying it is worried about a reduction in economic activity, something which also explains the slump in metal prices,” Mould highlighted.

“Markets are clearly speculating that a rapid spread of a more brutal Covid strain could once again derail the global economy. Banking stocks were also weak as they are closely tied to economic activity.”

“The flipside of falling commodity prices is that a weaker oil price should provide some relief in terms of inflationary pressures. That may cause central banks to be more cautious towards raising rates in the near-term, however it does depend on whether the new Covid strain causes significant disruption or can be contained as best as possible in a rapid manner.”

Travel shares were heavily hit as the uncertainty about how disruptive the strain could be smashed airlines. London-listed IAG was down as much as 20% before recovering.

“Headlines calling it the ‘worst ever variant’ have caused investors to panic and dump shares in travel-related stocks for fear that we’re going to see tough travel restrictions once again,” said Mould

“Wizz Air and British Airways owner International Consolidated Airlines both fell by approximately 18% in early trading, followed by a 14% drop in EasyJet and a 9% decline in Jet2.

“This is the worst possible news for airline operators as they were just starting to see a pick-up in trading, helped by people becoming more comfortable about travelling on a plane and routes like US/UK reopening.

“These companies have been under significant financial stress and will want to avoid having to go back to shareholders yet again to ask for more money to help see them through bad times, should we get new widespread travel restrictions.”

A bout of extreme turbulence has rocked airlines with the emergence of a new mutant covid strain spooking investors. Shares in British Airways owner IAG were down by 16% in early trade, easyJet down 13% and Ryanair down 10%. FTSE 100 slides 3.3% as the storm engulfs markets.

— Susannah Streeter (@StreeterNews) November 26, 2021

Economic recovery

The timing of the new variant couldn’t have been worse for economic recovery hopes as questions had already started to be asked about the robustness of the rebound as European infections rose.

“With Europe still battling with the surge of a fourth wave of the virus, there are now fears that the highly mutated Covid strain discovered in states in Southern Africa will prompt fresh shutdowns around the world in an attempt to stop its spread, leading to another drag on recovery,” said Susannah Streeter, senior investment and markets analyst, Hargreaves Lansdown.

The FTSE 100 was trading down 2.7% at 7,104 just after 10am in London.

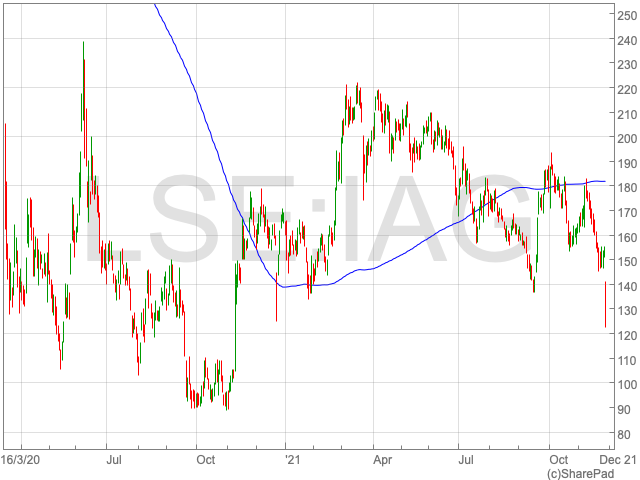

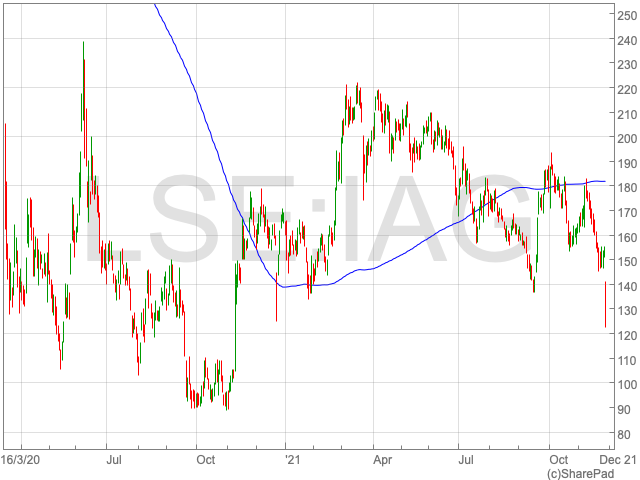

IAG shares destroyed by discovery of new variant in Africa

IAG shares were heavily hit on Friday after African counties confirmed the discovery of a new variant of coronavirus that was called the ‘most significant’ yet.

The new variant is said to have over 50 mutations which are yet to be fully understood and presents a huge challenge to the global travel industry that was only just starting to get back on its feet with higher passenger number and the reopening of routes including the Transatlantic route.

The UK government moved quickly to restrict travel and impose measures on those travelling from certain African countries.

The IAG share price was down as much as 20% in early trade on Friday, before recovering to be down 11%.

The selling was evident across the travel industry and those companies associated with travel, for example Rolls Royce traded at the lowest level since September.

“The decision by the UK government to impose stringent quarantine rules on six southern African countries within hours has severely rattled the travel and tourism industry. It’s set off a fresh bout of extreme turbulence for the travel sector,” said Susannah Streeter, senior investment and markets analyst, Hargreaves Lansdown.

“British Airways owner IAG nosedived 16% in early trade with investors deeply disturbed that demand for long haul transatlantic flights could be badly affected. Rolls Royce followed the descent, plunging by 11%, as the development could prove another major upset for its core business of making and servicing engines for long-haul aircraft. easyJet, Ryanair, TUI and Wizz Air also plummeted in early trading, registering much sharper falls than earlier drops of Quantas on Australia’s ASX which fell 5.5%, and Hong Kong listed Cathay Pacific which was 4.1% lower.”

IAG shares

Investors in IAG shares have been devastated by the drop today as the IAG share price now trades at the lowest levels of 2021, having given up most the gains made during the recovery from initial selling last February.

The selling today adds to pressure earlier in the week caused by rising infections in Europe that was leading to lockdowns and ultimately reduced travel over the festive period.

IAG shares were trading at 137p, shortly before 10.00am in London.

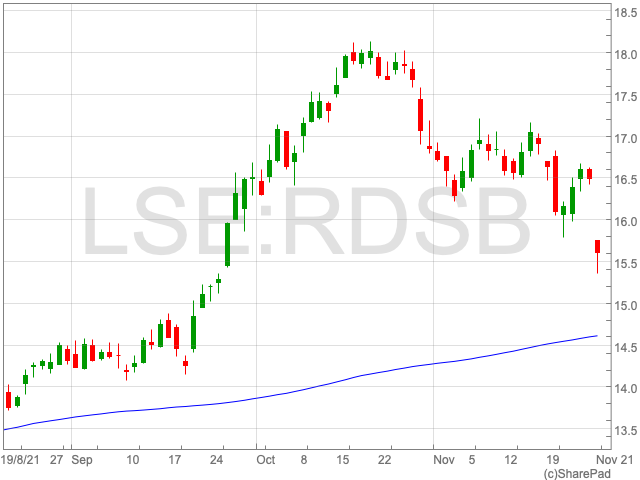

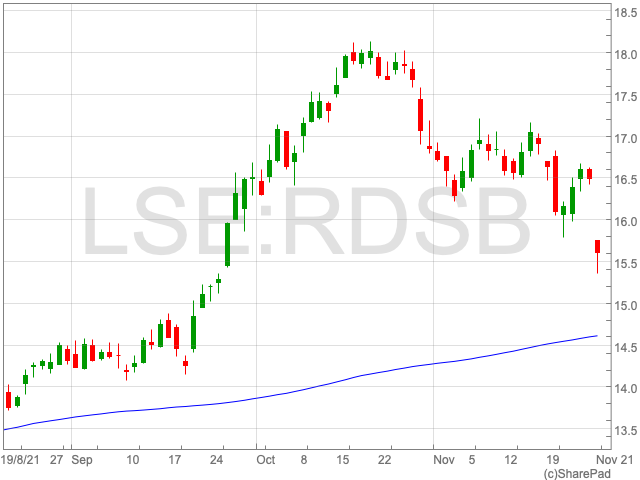

Shell share price: does COVID-19 variant crash present an opportunity?

The Shell share price sank on Friday after the announcement of a new COVID-19 variant in Africa. Shell shares were heavily hit in a significant risk-off move that weighed on oil prices and oil shares.

Shell share were down 5.3% to 1,561p in the first hour of trade in London on Friday as global equites and commodities crashed.

With the prospect of a new variant comes the all too familiar scenario of lockdowns and reduction in demand that saw oil prices trade negatively last year. Indeed, the new variant has been called the ‘most significant yet’.

Negative oil prices are of course unlikely, but the risk to the downside in oil prices have been dramatically increased with the discovery of the new variant.

Front month Brent Crude Oil Futures for delivery in January were down 4.6% to $78.43 a barrel and approaching levels not seen since September. NYMEX Light Sweet Crude, also known as WTI Oil, was down over 5%.

Rising oil prices had been central to the recovery of the Shell share price through 2021 and a fresh bout of selling in energy commodities will be negative for Shell shares in the short term.

Shell share price value

The Shell share price had recovered inline with rising oil prices driven by the opening up of economies in 2021, although analysts felt Shell didn’t take full advantage of higher oil prices in the last quarter.

“Normally one shouldn’t get too hung up over a mere three months’ trading, but this was meant to be Shell’s big quarter, given the surge in oil and gas prices in the past few months. Sadly, it has missed earnings forecasts and left investors feeling frustrated,” said Russ Mould, investment director at AJ Bell after the release of Shell’s Q3 results in October.

However, investors may look at today’s drop in Shell shares as an opportunity to add the oil major to their portfolios.

We recently wrote about the value Shell share price offered, and today’s drop will only strengthen that argument, over a long term horizon.

Recent analyst forecasts of Shell earnings had valued the stock at 8.8x forward earnings, offering significant value compared to historical averages.

It must be noted that these forecasts were made before the discovery of the new variant and may be revised leading to changes in the forward earnings multiple.

Nonetheless, the selling in the Shell share price today has been exacerbated by low volumes due to Thanks Giving in the US and governments’ response to the new strain has been swift and decisive. Long term holders of Shell shares will watch with interest.

Shoppers face price rises ahead of Christmas

A new survey from the CBI has found that shoppers might face the biggest price rises in over 30 years amid widespread shortages.

“Christmas seems to have come early for retailers, with clothing and department stores in particular seeing a big upward swing in sales volumes in November,” said Ben Jones, CBI economist.

“Overall, retailers are becoming more optimistic, with both employment growth and investment intentions picking up strongly. Cost pressures remain a very real concern, however,” he added.

Businesses are also increasing prices as the cost of production is also rising.

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, commented: “Looking ahead, higher CPI inflation, coupled with the withdrawal of government support at the end of the third quarter, will weigh on real disposable incomes.”

Priti Patel uninvited to ministers’ meeting by France

The French government has uninvited Priti Patel to a meeting with European interior ministers.

The move was made after Boris Johnson reportedly asked France to “take back” the people who have crossed the Channel.

The news is following the death of 27 people whose boat was capsized when crossing from France to the UK.

A French interior ministry source told POLITICO: “We find the open letter from the British prime minister unacceptable … Thus, Priti Patel is not invited anymore to the ministers’ meeting.”

The French interior ministry said in a statement: “We consider Boris Johnson’s public letter unacceptable and in opposition with discussions between counterparts.”

The meeting will go ahead without Priti Patel. France, Belgium, The Netherlands, Germany and the EU commission will continue without the UK.

Was the Kiskstart scheme worth it?

A report has found that Rishi Sunkak’s Kickstart scheme is not delivering value for money.

The scheme, which gets young people who are on universal credit into placements for 16- to 24-year-olds, has found to be flawed by the National Audit Office (NAO).

“At the start of the pandemic, DWP acted quickly to set up Kickstart to help young people into work when youth unemployment was predicted to rise significantly,” said Gareth Davies, the head of the NAO.

“However, DWP has limited assurance that Kickstart is having the positive impact intended. It does not know whether the jobs created are of high quality or whether they would have existed without the scheme.”

“It could also do more to ensure the scheme is targeted at those who need it the most.”

Frances O’Grady, general secretary of the TUC, commented and said that the scheme still had an important part to play. She said: “The government should now work more closely with unions on the next phase so that we can give young workers a voice in improving the scheme.”

Vivo Energy shares soar on Vitol takeover

Vivo Energy shares jumped some 20% on Thursday as the group confirmed a cash offer from Vitol has been accepted.

Vivo Energy distributes fuel for Shell and Engen across Africa but has had a far from fruitful time since being listed on the London Stock Exchange.

At the time of it’s IPO, Vivo was the largest African company IPO in London for a decade but failed to live up to the hype with shares spending most of the time since below the flotation price.

Their largest shareholder Vitol has quite clearly had enough and decided its time to take the business private through BidCo, and company indirectly owned by Vitol.

The of price of 139p per Vivo Share represented a 24.6% premium to the 111p closing price 24th November.

“The three and a half-year history of African service station operator Vivo Energy on the London market seems to have come and gone without anyone really noticing,” said Russ Mould, investment director at AJ Bell.

“It is probably in everyone’s best interest that its top shareholder, oil trader Vitol, has emerged with a premium-priced bid.

“While the offer is pitched materially above the current share price, the valuation is substantially below where Vivo was valued when it first listed.

“The Vivo story, running the distribution and marketing of Shell and Engen petroleum products across Africa, just never really gained traction.

“Perhaps it was the focus on Africa which had investors on their guard, as there have been relatively few success stories on the UK stock market to emerge from the continent to date, or maybe Vivo’s patchy profit performance itself was to blame.

“Net income was lower in the first half of this year than it was in the first half of 2018 suggesting that, for all the roll-out of new facilities, the company was struggling to get anywhere fast.”