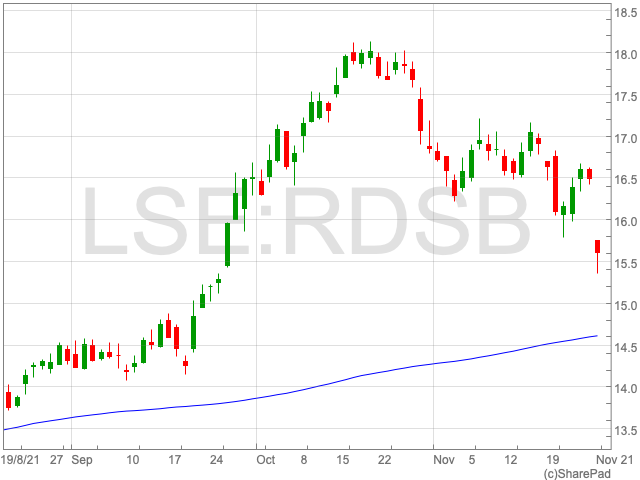

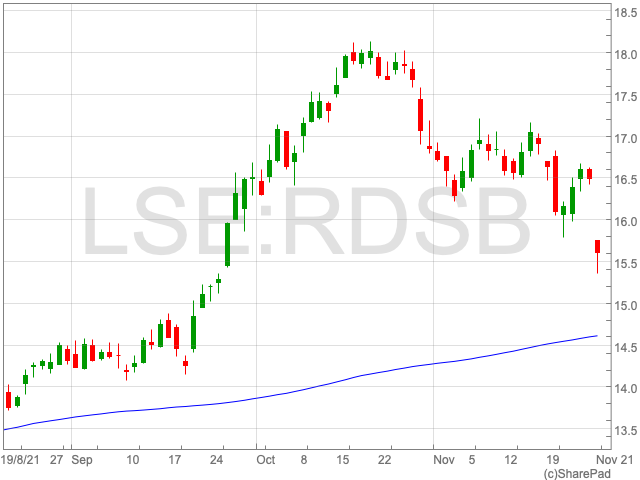

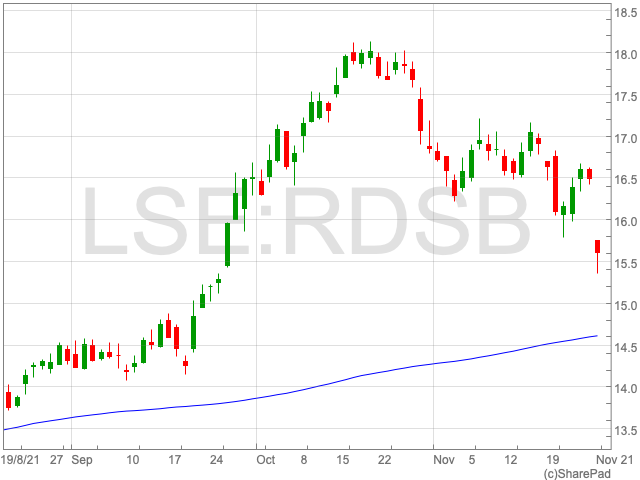

The Shell share price sank on Friday after the announcement of a new COVID-19 variant in Africa. Shell shares were heavily hit in a significant risk-off move that weighed on oil prices and oil shares.

Shell share were down 5.3% to 1,561p in the first hour of trade in London on Friday as global equites and commodities crashed.

With the prospect of a new variant comes the all too familiar scenario of lockdowns and reduction in demand that saw oil prices trade negatively last year. Indeed, the new variant has been called the ‘most significant yet’.

Negative oil prices are of course unlikely, but the risk to the downside in oil prices have been dramatically increased with the discovery of the new variant.

Front month Brent Crude Oil Futures for delivery in January were down 4.6% to $78.43 a barrel and approaching levels not seen since September. NYMEX Light Sweet Crude, also known as WTI Oil, was down over 5%.

Rising oil prices had been central to the recovery of the Shell share price through 2021 and a fresh bout of selling in energy commodities will be negative for Shell shares in the short term.

Shell share price value

The Shell share price had recovered inline with rising oil prices driven by the opening up of economies in 2021, although analysts felt Shell didn’t take full advantage of higher oil prices in the last quarter.

“Normally one shouldn’t get too hung up over a mere three months’ trading, but this was meant to be Shell’s big quarter, given the surge in oil and gas prices in the past few months. Sadly, it has missed earnings forecasts and left investors feeling frustrated,” said Russ Mould, investment director at AJ Bell after the release of Shell’s Q3 results in October.

However, investors may look at today’s drop in Shell shares as an opportunity to add the oil major to their portfolios.

We recently wrote about the value Shell share price offered, and today’s drop will only strengthen that argument, over a long term horizon.

Recent analyst forecasts of Shell earnings had valued the stock at 8.8x forward earnings, offering significant value compared to historical averages.

It must be noted that these forecasts were made before the discovery of the new variant and may be revised leading to changes in the forward earnings multiple.

Nonetheless, the selling in the Shell share price today has been exacerbated by low volumes due to Thanks Giving in the US and governments’ response to the new strain has been swift and decisive. Long term holders of Shell shares will watch with interest.