Managed IT and networking services provider AdEPT Technology (LON: ADT) achieved a one-fifth increase in interim revenues to £34.3m. The prospects appear to be good as more companies move to cloud telephony, but the share price does not reflect this

Managed services revenues accounted for 87% of total revenues, which could have been higher, but delays meant that £900,000 was not recognised in the period and this should be included in the second half. Fixed line revenues are declining, although they are lower margin. There was a slightly lower overall gross margin because there were more hardwa...

Used car prices soar as inflation hits record highs

The cost of used cars in the UK have soared as inflation also hits record highs.

The average price for a used car in the UK jumped 26.9% to almost £20,000, according to Auto Trader.

Auto Trader’s data and insights director Richard Walker commented: “To see such a huge increase in car prices in such a short period of time is truly remarkable and is indicative of the current perfect storm of exceptionally high levels of consumer demand coupled with very constrained new and used supply channels.”

“Although inflation will always pose a threat to demand, based on the positive consumer metrics we’re tracking across the retail market, as well as broader economic factors such as the record number of job vacancies reported just this week, we don’t anticipate any significant easing beyond normal seasonal trends.”

Commenting on the cost of transport and travel amid the new inflation figures, Laura Suter, head of personal finance at AJ Bell, said:

“Inflation has soared to a 10-year high and everyone is feeling the pinch, whether it’s in their weekly shop, their energy bills or when they’re heading out to buy a new car. But not everything has risen in price and some areas of our lives are getting pricier than others.

“The single biggest price rise of the year will dismay DIY fans or anyone working on a home renovation: MDF (or Medium-density fibreboard). The man-made wood has got 63% more expensive since the start of the year, as supply chain issues and a surge of people doing up their homes has put it in strong demand. And the biggest faller of the year? Computer games, which are a third cheaper than the start of the year, following a boom in demand during the pandemic that has died away now.”

FTSE 100 wobbles as inflation hits decade high

The FTSE 100 gave up ground on Wednesday as the market digested inflation data that makes it near impossible for the Bank of England to avoid hiking rates in December.

UK inflation was 4.2% in October, the highest rate in nearly a decade and a level that will start to seriously impact household spending power if inflation isn’t addressed in the short term.

“Inflation at a 10-year high of 4.2% makes for uncomfortable reading and goes to show the punishing effects of higher energy and food prices on family finances. It almost certainly means the Bank of England will raise interest rates soon, potentially as soon as next month,” says Russ Mould, investment director at AJ Bell.

The Bank of England said they wanted to see further evidence of a healthy UK economy before moving on rates. Today’s inflation data and strong jobs data yesterday does just that.

With investors pricing in the chances of higher rates, the pound gained and hit shares earning significant revenue overseas. Names such as Shell, BHP, Vodafone and Unilever were all weaker.

The FTSE 100 traded at 7,309, down 0.2% as we approaching midday in London.

“The prospect of higher rates has given some support to the pound, but the movement is only mild which suggests that rising inflation is a surprise to no-one. Sterling gained 0.1% against the US dollar at $1.3440,” Russ Mould said.

“What really matters to markets is the scale of any interest rate hikes over the next year, and that will be guided by the longevity and ferocity of inflation. There is a real chance that rates keep going up by small increments and after a while this starts to make life more difficult for consumers and companies as the cost of borrowing becomes more expensive.

Mould also highlighted the strength in UK banks this morning and the benefits associated with higher rates for banking profits.

“NatWest and Lloyds were among the biggest risers on the FTSE as the banking sector should be a beneficiary of rising interest rates. It creates scope for them to increase net interest margins which is the difference between the interest they earn on loans and the interest they pay on savings deposits,” said Mould.

Vodafone, SSE and Inflation with Alan Green

The UK Investor Magazine Podcast is joined by Alan Green to discuss UK shares and leading market themes.

We start by drilling down into the latest inflation data and what it means for shares in the medium term given the Bank of England will have little choice but to hike rates in December.

The Podcast features two FTSE 100 dividend payers that will be of great interest to UK equity income seekers in Vodafone and SSE.

Vodafone now provides not only a very respectable dividend, but after producing a 5% revenue increase in H1, there is a real prospect of capital appreciation. Vodafone rose 5% after the release of their report yesterday and retraced 2% the day after in a weak market.

Is the SSE the best play on renewable energy for UK investors looking for a blue chip company? The company has unveiled a progress report that highlights the focus on their renewables strategy with a £12.5bn strategic capital investment. Their plans have seemingly quelled short term fears of a break up pursued by activist investor Elliot.

We finally update on Blencowe Resources, including their latest funding round and an overview of their resources.

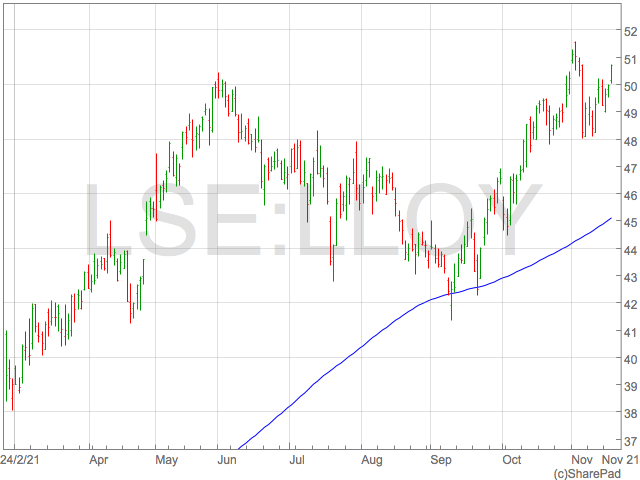

Lloyds share price: why pre-pandemic highs are now in reach

Lloyds share price (LON:LLOY) is now within touching distance of the highest levels since the beginning of the pandemic.

Indeed, at the time of writing, with shares trading at 50.56p, Lloyds shares are less 0.6p away from 51.11p and the highest level closest price of 2021.

The Lloyds share price was up over 1% in early trading on Wednesday as investors began to once more price in the impact of higher interest rates on the profitability of UK banking shares.

We wrote previously how the Bank of England bottling a rate hike at their last meeting would impact the Net Interest Margin of UK banks, including Lloyds.

However, with the latest instalment of inflation data and strong UK employment data, it is now very difficult to see how the Bank of England can’t hike rates at their next meeting in December.

Record Inflation

On Tuesday, we received the latest insights into the health of the UK jobs markets which created just over 160K jobs in October.

One of the main reasons why the Bank of England didn’t hike at their last meeting was to allow time to gain further information on the health of the UK jobs market. This instalment of data showed amazing resilience in the labor market and the market began to immediately price in higher rates with GBP rising against major currencies.

Lloyds share ticked marginally higher on the jobs data but really jumped after the UK released the highest inflation data for 10 years with a CPI read of 4.2% in October.

“Inflation roared ahead in October, hitting its highest rate in a decade, and raising the risk that the Bank of England will step into the inflation fight and show its teeth,” said Sarah Coles, personal finance analyst, Hargreaves Lansdown.

Banks traditional enjoy higher profit margins in times higher rates and UK focused Banks Lloyds, Barclays and Natwest Group were among the FTSE 100’s top risers on Wednesday.

Investors will also be watching the drivers of inflation and the impact on household spending. While higher rates can help banking profits, households facing financial strain can undo much of the upside for banks.

Lloyds share price

Lloyds shares are up 39% in 2021 and one would think if we see the BoE deliver a rate hike, Lloyds shares will move to 2021 highs above 51.11p, if they don’t do that in the run up to the next interest rate decision.

In days prior to the pandemic’s first lockdown, Lloyds had a close of 58.03p on 13th February 2021 and this level will now be eyed by investors looking for the next major technical levels in Lloyds share price.

British Land swings to profits

British Land has posted profits for the second half of the year thanks to improved rent collection.

The firm posted post-tax profits of £8370m, which was up from a £730m loss a year earlier.

Chief executive Simon Carter said: “Demand is firmly focused on the very best (office) space, with an emphasis on sustainability, wellness, shared and flexible space and excellent transport connections.”

Richard Hunter, Head of Markets at interactive investor, said: “As the property landscape evolves and with specific challenges in London, British Land is redesigning its portfolio to reflect the new environment.”

“The first relates to the inexorable rise of online shopping, boosted further during the pandemic, and the scarring this may leave on physical shopping centres and, indeed, the high street in general in future years. In addition, the longer term impact of hybrid working is yet to wash through, with staff at some companies not returning to the office at all and others on a limited basis.”

“These shadows have forced a redefinition of British Land’s strategy and there are some encouraging signs that the group is beginning to move ahead of the curve,” he added.

UK inflation hits 10-year high

UK inflation has jumped to a 10-year high of 4.2%.

Inflation has risen 3.1% in September and is higher than analyst expectations.

The inflation rate was driven higher by the cost of electricity, gas and other fuels. Also driving up inflation was petrol prices. Average petrol prices in October were 138.6 pence per litre, which is an increase from 113.2 pence per litre a year earlier.

“In April 2020, the energy price cap had been reduced causing electricity, gas and other fuels’ contribution to the CPIH headline rate to fall to negative 0.20 percentage points. But this fall was reversed in April 2021 with rises in gas and electricity prices,” said the ONS.

“The further price rises in October 2021 have compounded the April 2021 increases, resulting in 12-month inflation rates of 18.8% for electricity and 28.1% for gas. These are the highest annual rates for these classes since early 2009.”

Commenting on the rise in inflation, ONS chief economist said: “Inflation rose steeply in October to its highest rate in nearly a decade. This was driven by increased household energy bills due to the price cap hike, a rise in the cost of second-hand cars and fuel as well as higher prices in restaurants and hotels.”

“Costs of goods produced by factories and the price of raw materials have also risen substantially and are now at their highest rates for at least 10 years.”

Danni Hewson, AJ Bell financial analyst, commented on the latest figures: “Anybody responsible for paying the household bills won’t be surprised by today’s inflation number. 4.2% might be slightly above where it had been predicted to fall for October but just look at the prices motorists are paying at the petrol pumps, the demand for used cars sky-rocketing and of course the wholesale cost of gas which continues to put small suppliers out of business.”

“The energy cap which protects consumers from those price hikes was itself a contributor to this month’s inflation figures as it rose substantially just as the temperatures began to fall and nights closed in.”

Investing in social housing with AHH

Sponsored by AHH

AHH is a leading social impact investor co-investing with individuals and institutions to deliver affordable housing in vibrant communities that help people live well for less. Our unique approach is proven to reduce pressure on local health and social care whilst making profitable and sustainable returns – everybody wins.

Shared Ownership is a key growth area which can help tackle the longstanding housing crisis in the UK whilst still meeting the aspirations of much of the population, and government, for home ownership.

Whilst it is currently a small part of the housing market, it has grown substantially over the last decade and has the potential to become the next mainstream tenure, particularly in London and the South East, where affordability is most constrained.

AHH Group creates not just affordable housing but also affordable lives through the delivery of a range of not-for-profit services and support alongside deeply discounted rent.

This provides a means for homeowners to buy as little or as much of their home as they can afford, meaning that our customers can live well for less.

Affordable communities are crucial for society, there is unquenchable market demand in all economic climates which further strengthens this low-volatility asset class.

Limited Supply of Stock

AHH Group is expanding to create thousands more affordable homes – meaning that the AHH investment platform is now opening up to a non-institutional investor audience.

Funds are only raised to match the strategic delivery of affordable communities. A limited pipeline of development means there is a limited supply of investment opportunities.

Prospective investors are invited to visit AHH communities to explore and learn how capital is invested in the regeneration of boroughs, how we work in partnership with the NHS and Local Authorities and how affordable communities help to improve the lives of homeowners.

Come visit, see what we do and help us to deliver real social impact whilst enjoying great returns.

AHH Investment Management

AHH Investment Management is only able to promote AHH Secured Lending in investment opportunities to High Net Worth, Sophisticated and Institutional Investors – an easy and quick process qualifies all potential investors who wish to understand more.

This can be done over the phone, on line, or better still, when we meet at one of our wonderful communities where you can see the difference we make and meet the teams making the difference.

Invest alongside highly experienced investors:

“The pandemic has highlighted how much we all rely on other people and society during difficult times. Now is the time for us to do things differently and help those who need it the most. AHH’s investment solutions create real social impact. Building happy and healthy communities is at the heart of everything they do, and that customer focus is something that resonates with me.”

- Nick Wheeler, Founder/Owner of Charles Tyrwhitt

“I’m excited to be a part of a fast growing and continuously evolving venture, such as AHH. They recognise that social investing is a long-term process, and their revolutionary offering and experienced service provision allows people the opportunity to live affordable lives.”

- Robin Phillips, Formerly Global Head of Global Banking HSBC

“I’m passionate about investing in people

and supporting the development of local communities. AHH is a credible solution which allows me to do both. With an excellent team of trusted experts, I know that it’s an investment which delivers substantial social impact, whilst still creating a long-term, low-risk return for its investors.”

- Loretta Leberknight, Formerly Director at Russell Investments

“Many investors, such as myself, like to support businesses contributing to society, by creating new jobs or enhancing communities. AHH’s entrepreneurial spirit and strategic foresight allows them to do exactly that.”

- Ira Rapp, Executive Chairman at Westcity Properties