Spain accounted for fewer than 2% of Deliveroo’s overall sales in H1 2021

Deliveroo (LON:ROO) is weighing up the possibility of ceasing its services in Spain because of the high costs involved in operating in the country.

The food delivery company added on Friday that it may seek to focus its resources on other markets by expanding into new locations.

“The company has determined that achieving and sustaining a top-tier market position in Spain would require a disproportionate level of investment with highly uncertain long-term potential returns,” Deliveroo said in a statement.

A spokesperson for Deliveroo specifically said that Spain’s employment rights law was not the reason, although it was confirmed that it did contribute to the earlier than initially expected withdrawal.

Back in March the Spanish government revealed its intention to give employment rights to workers food delivery companies and similar platforms in what was a landmark ruling.

According to Deliveroo, Spain accounted for fewer than 2% of its overall sales in H1 2021.

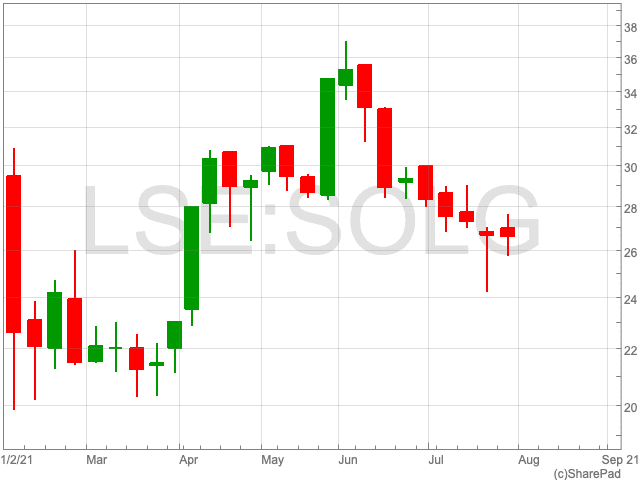

The Deliveroo share price is up by 2.77% on Friday following the announcement.

The London-listed food delivery company operates in 12 markets across Europe, as well as Hong Kong, with around 50% of its revenue coming from the UK and Ireland.

The Deliveroo share price surged towards the end of June as a UK court ruled that the people who deliver the food on bikes are self-employed. The ruling was passed by three judges who came to a unanimous agreement.

“Concern about the company’s reliance on the gig economy model was one of the factors which contributed to its disastrous IPO in March,” said Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown.