Boanerges is a shell, or special purpose acquisition company, that is seeking to acquire technology companies involved in big data, machine learning, telematics and internet of things. These could be pre-commercialisation or at an early stage of commercialisation.

Although the subscription was at 20p a share, the share price was expected to open at 2p according to the prospectus. That compares with pro forma cash of 1p a share because most of the shares had previously been issued at 0.1p each.

The opening trade was at 26p a share and there were three other trades at 24p a share. There may have...

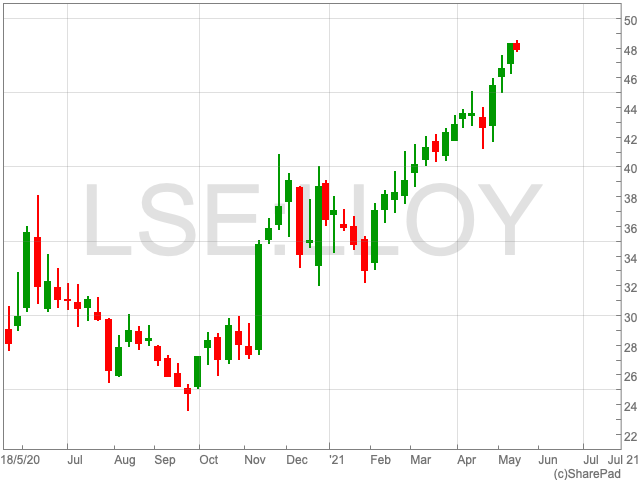

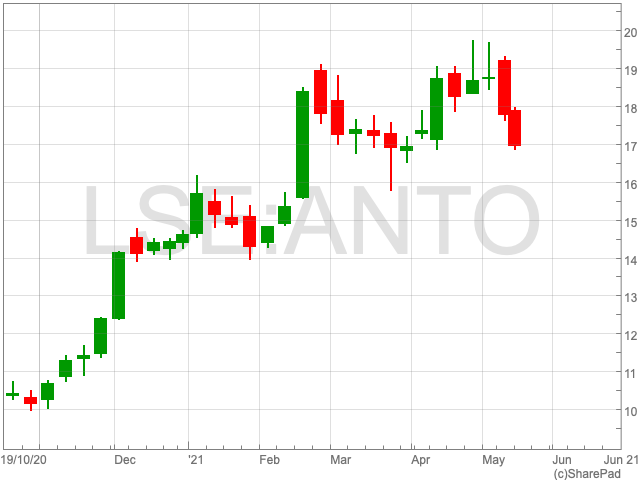

Copper prices and strong emissions performance bodes well for Antofagasta share price

Antofagasta share price

The Antofagasta share price is down by just under 5% on Monday to 1,694.16p per share. It followed on from last week when the FTSE 100 mining giant lost ground. The retreat came after a bull run that started at the end of 2020 as the price of copper soared. Investors are curious as to whether copper can sustain its recent highs, as well as the impact of Antofagasta’s climate pledge on the outlook of its share price.

Copper

The red metal is the most significant contributor to Antofagasta’s revenue and is on a robust run during 2021. At the time of writing, it is valued at just below $10,200 per tonne. Copper hit a record high earlier this month as demand for the commodity soared on the back of a five-day holiday in China. The question now is if copper can keep the momentum that was established in 2020 amid talk of a supercycle.

A note released by Goldman Sachs recently about copper will be of interest to Antofagasta investors. “Copper is the new oil”, the note read. The New York-based investment bank predicted that the red metal will reach $11,000 this year. Looking further ahead, Goldman predicts that copper could reach $15,000 per tonne by 2025.

Antofagasta Emissions Target

Antofagasta confirmed its intention of reducing its carbon emissions by 30% by 2025. The goal comes as the Chilean mining company said it has met prior targets of reducing “Scope 1” and “Scope 2” emissions by 300,000 tonnes of CO2e by 2022. Antofagasta’s mission over the longer-term is to achieve carbon neutrality by 2050.

Iván Arriagada, Chief Executive Officer of Antofagasta said: “Copper will be a key enabler of a modern low carbon economy. It’s essential we work with all our stakeholders to produce it in a sustainable and responsible way.”

The role that copper is set to play in the provision of renewable energy is well documented. What is less clear is the impact of the announcement over emissions targets on the Antofagsta share price. Investors, who are increasingly conscious of ESG factors, may consider it the bare minimum.

Johnson calls for public to be sensible as Indian variant of Covid-19 threatens reopening

The UK has confidence that the vaccine works against the Indian strain of the coronavirus

Boris Johnson is calling for caution among Brits attending pubs and restaurants, especially as they are due to reopen indoors across England, and with cases for the Indian variant of Covid-19 on the rise.

The prime minister’s message comes following UK health secretary Matt Hancock’s advice that plans to remove lockdown restrictions in England on 21 June could be in doubt.

While the prime mister has allowed the continued reopening of the hospitality sector, he has called on the public to act with responsibility.

“We are keeping the spread of the variant first identified in India under close observation and taking swift action where infection rates are rising,” Johnson said.

As of Monday, people will be able to meet outside in groups of up to 30, while six people or two households are able to meet indoors.

While the increasing reach of vaccines are proving to combat the Indian strain, those who are unvaccinated could catch Covid-19 and spread it rapidly.

Mr Hancock said that it was “quite likely” that the variant would become the dominant strain in the UK.

He said: “What that reinforces is the importance of people coming forward for testing and being careful because this isn’t over yet.

“But the good news is because we have increasing confidence that the vaccine works against the variant, the strategy is on track – it’s just the virus has gained a bit of pace and we’ve therefore all got to be that bit more careful and cautious.”

According to numbers released by the government, more than 20m people have now had two doses of the coronavirus vaccine.

From the market’s perspective, Russ Mould, investment director at AJ Bell, said UK consumers are eager to spend their cash, although the Indian variant could change some people’s minds.

“A lot of consumers are in a strong position to spend big, having saved a lot of money during the pandemic, and many will be eager to splash the cash as they reclaim leisure experiences. Therefore, takings could be strong for at least the next few weeks, assuming consumers aren’t put off from the threat of the Indian variant spreading fast, particularly among those not yet vaccinated,”

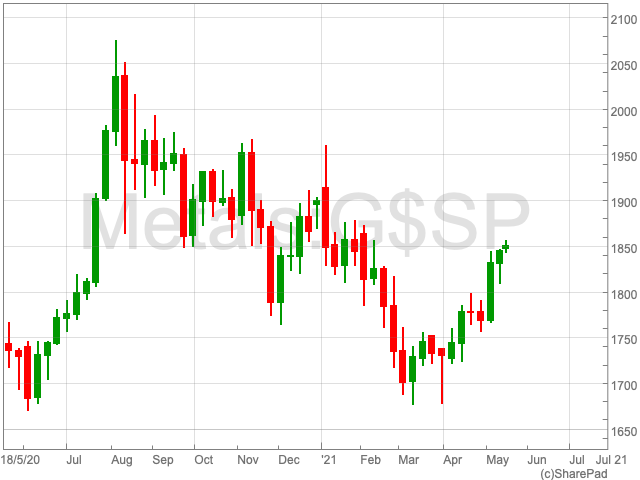

Gold surges as investors spooked by inflation fears

Gold composite up by 0.7% to $1,850.02

The price of gold rallied to its highest level in over 12 weeks on Monday as investors were spooked by fears over inflation in America.

The price of gold, having risen to $2000 last summer, before retreating as announcements around vaccines emerged, is up to its highest point since early February. An increase of 0.7% to $1,850.02.

The precious metal historically performs during periods of inflation or expected inflation.

Last week it was confirmed that US consumer prices surpassed economists’ expectations, rising by 4.2% in April, above their level 12 months ago.

It is the highest level of inflation since 2008 and well above March’s figure of 2.6%.

“What we are seeing is a perfect storm of supply and demand side factors, from monetary and fiscal stimulus boosting consumer spending, to supply bottlenecks related to the pandemic which are increasing costs,” said Kevin Lester, CEO of Validus.

As a result, global stocks endured their worst performing week since February.

Greatland Gold

Greatland Gold saw its share price rise on Wednesday as it confirmed the commencement of the underground decline at the Havieron Gold-Copper Project in the Paterson province of Western Australia.

This news, according to a statement released by the company, sets Havieron on course to become a large, multi-commodity, bulk tonnage, underground mining operation.

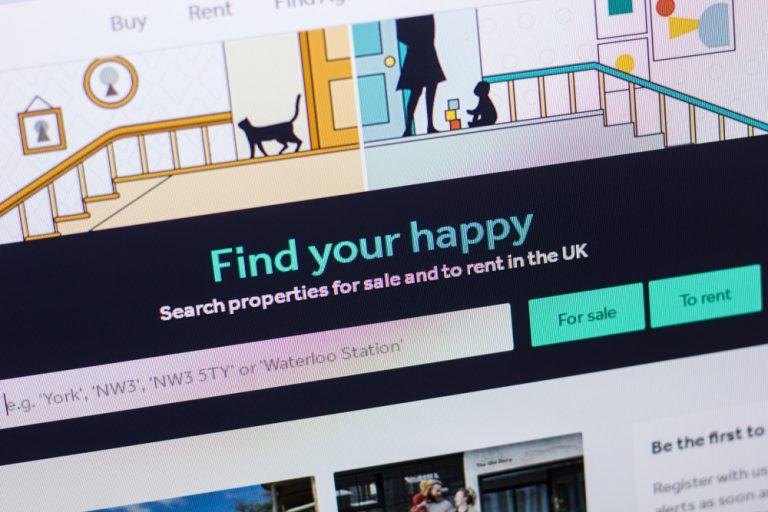

Average house prices set new record in May as surge continues

Average property price increased by 1.8% during May to £333,564

The recent rise in house prices across the UK has continued its trajectory, as the market set a new record for May.

Rightmove’s House Price Index has revealed that the cost of the average property increased by 1.8% during May to £333,564.

The biggest increases came from the north-west, Yorkshire and Wales, which each saw the price of homes climb by more than 10%.

Notably, prices in the capital were more subdued, with a 0.2% rise in prices in London.

In line with Rightmove’s latest House Price Index, Sundeep Patel, Director of Sales at specialist lender Together, commented: “The continued rush to buy property in today’s market is undeniable. With house prices increasing by 1.8% in May, to £333,564 (up from £327,797 in April), it’s clear sellers are very optimistic about the months ahead, as the race is still on to make the most of the Stamp Duty holiday extension.”

“That said, while the Stamp Duty holiday has certainly stimulated the rush of activity we’ve been seeing recently, there will still be a large proportion of the market who continue to be underserved when approaching highstreet lenders. It’s here where specialist lenders are invaluable when supporting home-buyers’ property plans. It’s tricky to predict what the market will look like post-pandemic, so while the economy continues to recover, we’re anticipating flexibility will be crucial for borrowers and their evolving needs from the latter half of this year onwards.”

Tim Bannister, Rightmove’s director of property data comments: “Last year’s unexpected mini-boom is rolling on into 2021, with new price and market activity records again defying many predictions.

“Buyer affordability is increasingly stretched, but there’s obviously some elasticity left to stretch a bit more as many buyers are squeezing their way into higher price bands.”

“This high demand, with both willingness and ability to pay more, has pushed the average price of property coming to market to a new all-time high of a third of a million pounds.”

Rightmove confirmed last month that the average asking price for a property rose by 2.1% in April to £327,797, a new all-time high, and an increase of £6,733 from the previous month.

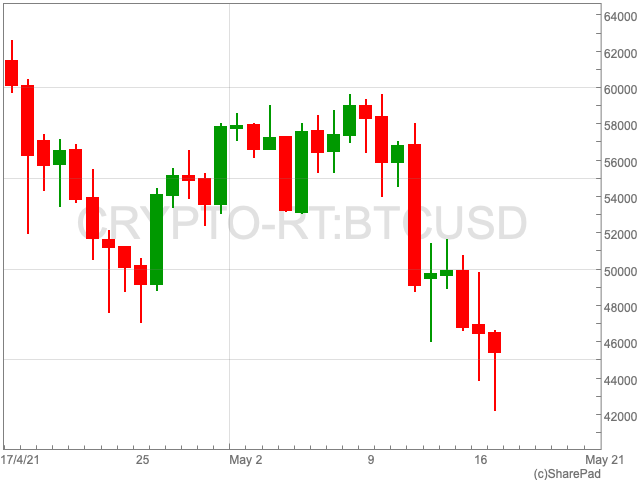

Bitcoin suffers as Elon Musk ramps up criticism on Twitter

Tesla chief also confirmed that company has not recently sold its bitcoin holding

The price of bitcoin plummeted over the weekend as Elon Musk ramped up his criticism of the cryptocurrency, before confirming Tesla has not recently sold any of its holding.

This followed his announcement last week that the electric vehicle manufacturer would no longer be accepting bitcoin.

Bitcoin made it below $43,000 on Monday, having been above $60,000 within the last 30 days, representing a fall of over 25%.

Neil Wilson of Markets.com told The Guardian that crytpocurrency’s latest price volatility proves that it is a bubble.

“A nice pop, but this is small versus the Musk-induced selling that has been taking place lately. In addition to Tesla saying it would stop accepting Bitcoin as payment, Musk indicated in a reply to a tweet that the company was dumping or had already dumped all its Bitcoin. Prices fell sharply over the weekend and at $44k the crypto asset is still down by around a third from the all-time high near $66k set in April,” said Wilson.

“There is nothing new I can say about Bitcoin – volatile, highly speculative, easy to manipulate; a bubble.”

The recent volatility in the price of bitcoin caused by Musk’s tweeting has raised concerns among a number of institutional fund managers, according to the Financial Times.

The FT reported that Pimco, UBS Wealth Management and Glenmede have each expressed concerns over the credibility of cryptocurrency investments.

Despite rumours circulating over Twitter as the social media site turned into a frenzy, Musk confirmed that Tesla has not recently sold any bitcoin.

Back in February Tesla announced that the company had purchased $1.5bn worth of bitcoin, in addition to pledging to accept payments in the digital currency, causing a surge in the price of the digital currency to a record high of $44,100.

In an SEC filing, also in February, Tesla said it has made a net gain of $101m from sales of bitcoin during the quarter, allowing the company to post a record profit.

Year-to-date the digital currency remains up by 55.8%.

FTSE 100 stays above 7,000 despite falling into the red

Following the rollercoaster ride of last week, the markets got off to a more subdued start on Monday.

“Contributing to the quiet open was the overnight figures out of China, numbers that are indicative of a slowing recovery in the country,” said Connor Campbell, financial analyst at Spreadex.

Fixed asset investment fell from 25.6% to 19.9% month-on-month, while industrial production dropped from 14.1% to 9.8%. Retail sales almost halved, from 34.2% to 17.7%, far worse than the 25.0% forecast.

This news helped nudge the FTSE 100 into the red, but not by enough to threaten its status above 7,000. At least for now. Instead, the UK index dipped by 0.3%, leaving it at 7,030.

“Sterling eked out a 0.1% increase against both the dollar and the euro, sitting at $1.4107 and €1.162 respectively,” said Campbell.

Things were just as flat in the Eurozone, where the CAC started the week unchanged, and the DAX at most moved 0.1% higher.

FTSE 100 Top Movers

Leading up the FTSE 100 early on Monday morning is B&M European Value Retail (2.39%), BT Group (2.29%) and Sainsbury (1.66%).

Rolls-Royce (-2.66%), Ocado (-2.45%) and Antofagasta (-2%) are the day’s biggest fallers so far.

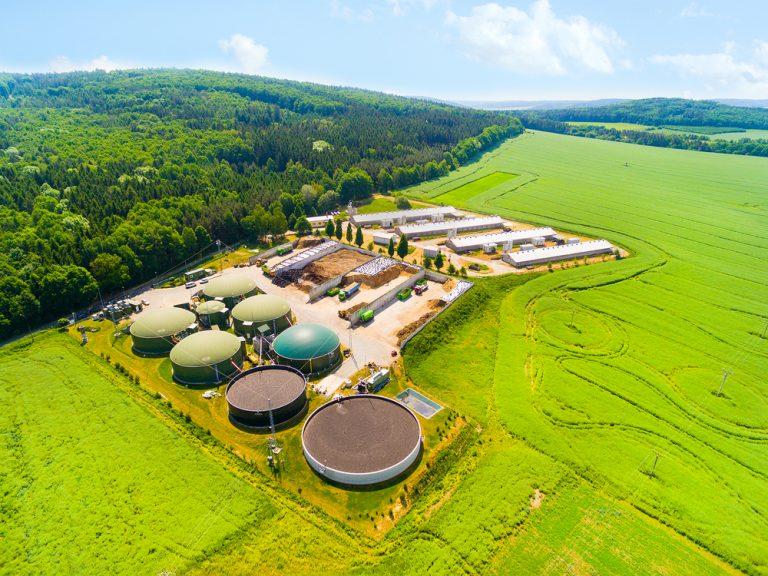

EQTEC set to recommission waste-to-energy plant in Italy

The plant is built around EQTEC’s propriety and patented Advanced Gasification Technology

EQTEC (AIM:EQT), the gasification technology company, confirmed on Monday that it is planning to recommission its waste-to-energy plant in Italy.

First commissioned in 2015, the plant is built around EQTEC’s propriety and patented Advanced Gasification Technology.

The AIM-listed company has purchased, and will head up a consortium to own and operate the biomass-to-energy plant in Castiglione d’Orcia, Tuscany, Italy.

Once operational, “the plant will transform straw and forestry wood waste from local farms and forests into green electricity and heat for use in the local community”, read a statement by the company.

EQTEC said its intention is for the plant to become the first of its ‘Market Development Centres

(“MDCs”), showcasing its technology in an operational and commercial setting.

David Palumbo, CEO of EQTEC, commented on the announcement:

“I am very pleased that EQTEC will lead the effort with our partners to re-commission and revive this

biomass-to-energy plant in Italy, providing power and heat to the area and demonstrating sustainable, commercial success with EQTEC advanced gasification. Additionally, I am delighted to see us secure this with a well-balanced consortium of experienced partners and this is an approach we hope can be

achieved for other projects in our pipeline,” said Palumbo.

“Finally, I am pleased about the local nature of this plant and our future role there as co-owner/operators. EQTEC is committed to ensuring our projects have a positive local impact, from sourcing, treating and converting local waste through to the generation of clean energy in the local area, all powered by EQTEC technology. We will continue to support local businesses, employing local people and sustainably delivering value for local communities in all the markets we operate.”