As the third lockdown comes to an end, hopefully for the last time, the UK’s leisure industry is all set for a substantial recovery. This is on the assumption that the the government eases out of lockdown restrictions in a proper way. According to research conducted by Edison Group, the confidence is driven by lessons learned during the pandemic, from pent-up demand on 2020 reopening and the benefits of technology. Another driver has been the prospect of a new post-Covid structural environment, in addition to a positive change consumer behaviour patterns, which has followed delivery uptake as a growth channel for hospitality. While the continuation of curbs on international travel is bad for the airline industry, it will be a positive for the domestic’s leisure sector.

The pandemic’s silver lining

There is a grim irony that COVID-19’s exacerbation of longstanding structural difficulties in UK hospitality has thrown up undeniable growth opportunity for well-funded businesses. There has been an increasing availability of prime sites at ever cheaper prices, in addition to being on more flexible terms. This has come about as businesses have been forced to close down which has led to an increase in the supply of high-quality staff. The outlook is starkly contrasted to chronic capacity before the pandemic, which caused intense cost pressures and narrow margins, compounded by Brexit-led economic uncertainty.

To this end, surviving companies have strengthened finances and accelerated implementation of initiatives, such as the use of technology in managing labour costs and driving customer loyalty. Delivery has predictably excelled, offering scope for operators with the right scale and brands.

Pushing at an open door

In addition to the boost to domestic leisure from persisting uncertainty about foreign holidays in 2021, there is welcome industry consensus ahead of reopening about pent-up consumer demand. Since the start of the pandemic, household savings have increased and household debt remains mostly unchanged, largely owing to a fall in spending on non-essential items over lockdown (the Q220 household savings ratio was the highest ever).

For those who have suffered financially, low-ticket domestic leisure may well be an attractive option. Potential beneficiaries cover a mix of activities from family entertainment centres and escape rooms to gyms and hospitality.

The value of vaccination

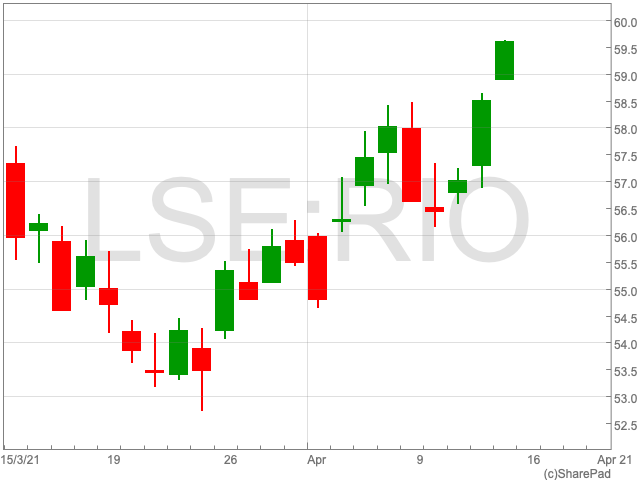

The UK has pushed ahead with a world-leading vaccination programme and looks set to emerge at the head of the pack from the pandemic. As social distancing and lockdowns give way to social spending, the leisure entertainment and travel sectors may be set for an earnings-based recovery. Valuations may have recovered but this relative earnings momentum may point to further outperformance in the months ahead.

While the negative impact of the pandemic are well documented, there are reasons for optimism for Brits looking ahead. The UK leisure industry is primed for recovery with huge opportunities for the fittest businesses.