The FTSE 100 shrank below 6,700 on early Tuesday morning as it fell 0.6%. This was despite cable also shedding 0.4% as it ducked under $1.381.

The fall came on the back of employment news which “broadly disappointed” according to Connor Campbell, financial analyst at Spreadex. “Though the unemployment rate covering the 3 months to January unexpectedly fell from 5.1% to 5.0%, the more recent data paints a less rosy picture, with February’s claimant count change number hitting 86,600 against the 9,000 forecast,” Campbell said.

Extending Germany’s partial lockdown over the Easter period, Merkel stated that the country was in a ‘very serious’ situation, going as far to say that it is ‘basically in a new pandemic’ thanks to the new found dominance of the British variant.

“Britain should perhaps prepare itself for similar news. After all, yesterday Boris Johnson warned that we would feel the effects of the European third wave ‘in due course’,” said Campbell.

FTSE 100 Top Movers

At the top of the FSTE 100, Imperial Brands (1.97%), Reckitt Benckiser (1.88%) and Severn Trent (1.70%) are the day’s biggest risers so far.

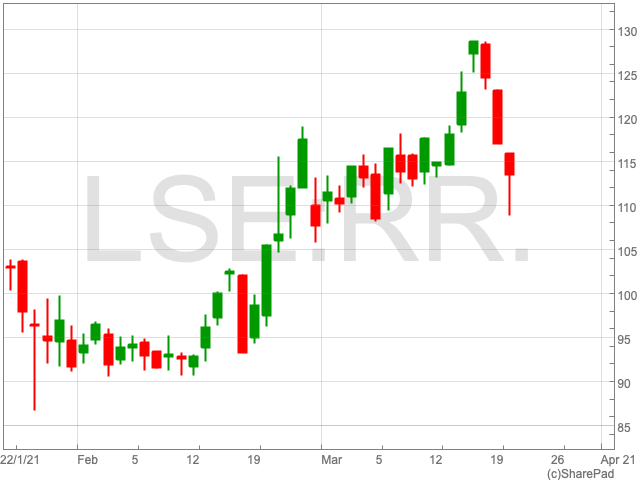

Air travel companies IAG (-4.33%) and Rolls-Royce (-4.24%) are the day’s top fallers so far, closely followed by JD Sports (-3.08%).

£5,000 for Going on Holiday

Fines of £5,000 are set to be introduced for people from England who travel abroad before the end of June as the country is taking measures to control its borders.

While the government is still reviewing the possibility of international travel in April, ahead of a possible return in May, health minister Matt Hancock said travel fines were a part of legislation in the event that a resumption of travel is not possible.