FTSE-listed engineering firm Smiths Group (LON:SMIN) saw its share price bounce on Tuesday, as the company booked robust trading during the COVID pandemic.

For its continuing operations, Smiths Group said that underlying revenue for the ten months to 31 May 2020 was up 2% year-on-year. Meanwhile, reported year-to-date revenue jumped 6%, which included a 3% rise provided by the acquisition of United Flexible.

The company said that its performance over the last four months was driven by its strong order books at the start of the pandemic, and the overall momentum of first half trading. It did note, however, that there had been some slowing down, with its customers and operations impacted by COVID. It said that it was currently operating at all 75 of its plants but was not immune to higher consequential costs.

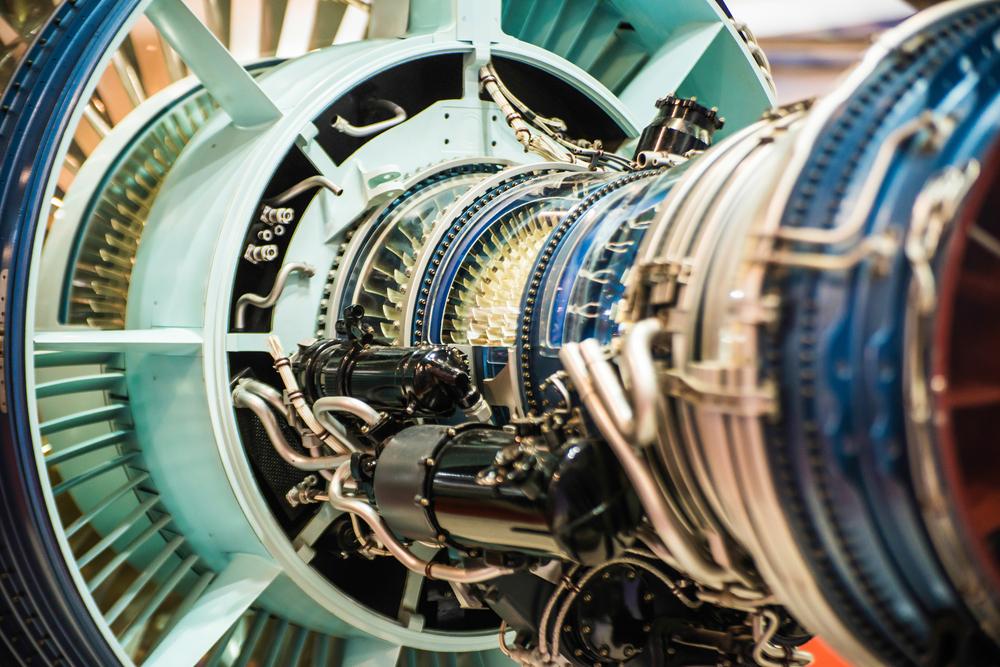

Throughout its divisions, Smiths Group stated that; John Crane still booked year-to-date revenue growth, Smiths Detection performed strongly due to delivery of original equipment programmes, Flex-Tek performs well though its aerospace and Smiths Interconnect has had its revenues impacted, though orders and revenues have both recently improved.

In addition, the company noted that Smiths Medical saw underlying revenue growth of 2% in the second half, alongside year-to-date revenue growth of 1%. While the division’s non-COVID procedures suffered, demand for critical care restocking was strong.

Further to its trading update, the company also announced that it would be undertaking a restructuring plan to maintain its strong performance after the virus, and help it to deliver its operating margin goal of 18-20%. The programme will be group-wide, with a £65 million operating cost split between FY2020 and FY2021. Smiths Group said the restructuring would substantially offset costs in FY2021 and deliver the full annualised benefit of £70 million in FY2022.

Smiths Group response

Company Chief Executive Andy Reynolds Smith commented on the results:

“ Market-leading positions and a flexible business model have enabled the Group to continue to perform through crisis disruption.”

“Our immediate focus is the safety of our people and business continuity for our customers. We will continue to take the actions necessary to safeguard our long-term competitiveness. I very much regret that this will result in some job losses. My sincere personal thanks go to the amazing Smiths employees around the world for their dedication and commitment.”

“The Group has a resilient business model; market-leading positions, a culture of innovation at its heart, combined with relentless execution. We are confident that we will meet the challenges of the current crisis – and emerge stronger, better able to outperform long-term.”

Investor insights

Following the update, Smiths Group shares rallied significantly by 7.74% or 100.50p to 1,398.50p per share 30/06/20 11:59 BST. The company is still rated as a ‘Strong Buy’ or ‘Buy’ in most analysts’ eyes.

The median price target is 1,450.00p a share, while its share price at the start of trading on Tuesday, was down 11.09% year-on-year. Th company has a p/e ratio of 18.98 and a dividend yield of 3.30%.