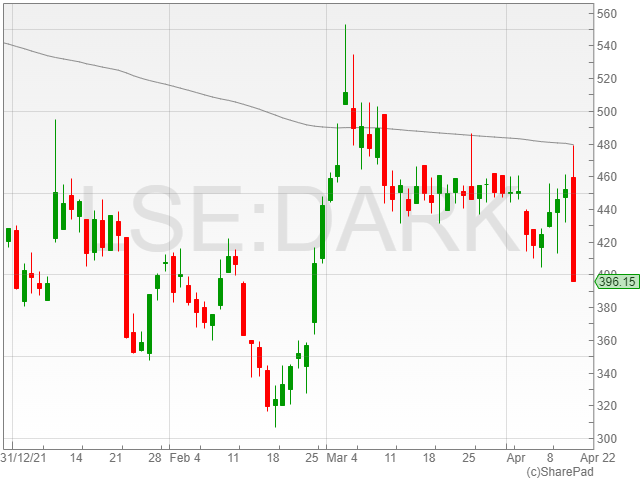

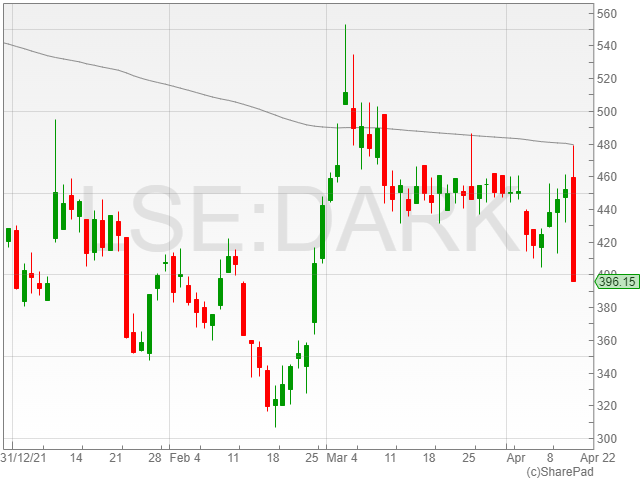

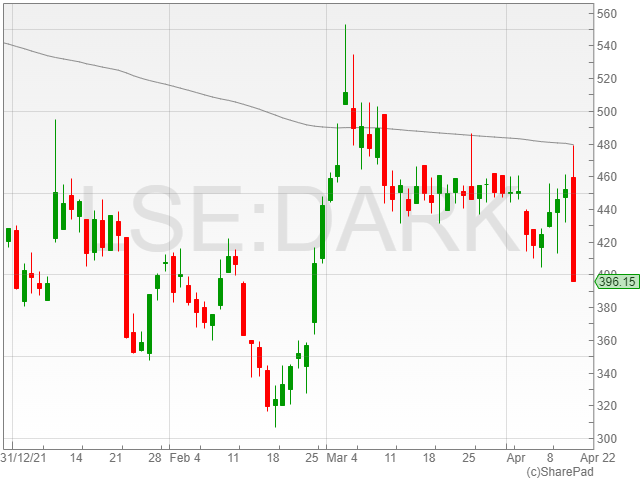

Darktrace shares plummeted 11.3% to 401.3p in late afternoon trading on Wednesday, despite a reported revenue of $109.8 million in the company’s latest trading update for Q3 2022.

The cybersecurity firm confirmed a year-on-year growth of 50.1%, with its current year-to-date revenue climbing to $302 million.

Darktrace brought in 359 new customers to its client base, with its its total number amounting to 6,890 and representing a year-on-year increase of more than 37%.

The technology group also highlighted its acquisition of surface attack management technology company Cybersprint for €47.5 million in March, contributing to the firm’s ambition to develop a continuous AI loop for addressing international cyber challenges.

“In March, we took a step closer to [our] goal when we completed our acquisition of Cybersprint and welcomed their outstanding attack surface management technology and talented team to Darktrace,” said Darktrace CEO Cathy Graham.

“Together, we are driven by innovation and committed to developing the world-class technologies, underpinned by our powerful Self-Learning AI, that are so critical to our customers remaining protected in a rapidly evolving threat landscape.”

The cybersecurity group said that its strong results had persuaded Darktrace to increase its FY 2022 guidance, with an estimated year-on-year growth of between 40% to 41.5% compared to the company’s previous guidance of 38.5% to 40%.

The firm added that it expected a FY 2022 year-on-year revenue growth between 45.5% to 47% against its previously anticipated 44.5% to 46.5% growth.

“In our third quarter, we sustained strong growth trends across our customer base, ARR and revenue, as well as maintaining the gains in churn and net ARR retention rates we made in the first half of the financial year,” said Graham.

“Year-to-date results and a continuing positive operating outlook have led us to again increase our FY 2022 expectations across all financial and customer measures.”