BHP Group reported its submission of a non-binding indicative proposal to the Board of OZL to acquire 100% of the issued capital in the group via a scheme of arrangement on Monday.

The firm announced its proposal to acquire all of OZL’s shares for cash consideration at AUS $25 per share, amounting to a total of approximately $5.8 billion.

The offer price represents a premium of 32.1% to OZL’s closing price of AUS $18.92 per share on 5 August 2022 and 41.4% to OZL’s 30-day VWAP of AUS $17.67 per share on 5 August 2022.

BHP Group commented the offer would deliver immediate value to OZL shareholders and de-risk any value which may eventually end up reflected in the group’s share price.

The company added the proposal would be subject to the completion of certain conditions, including confirmatory due diligence, entry into a scheme implementation, and a unanimous recommendations from the OZL board that its shareholders vote in favour of the proposal, in the absence of a more attractive agreement.

However, BHP Group said OZL had so far indicated a lack of interest in the proposed agreement.

“Our proposal represents compelling value and certainty for OZ Minerals shareholders in the face of a deteriorating external environment and increased OZL operational and growth related funding challenges,” said BHP Group CEO Mike Henry.

“We are disappointed that the Board of OZL has indicated that it is not willing to entertain our compelling offer or provide us with access to due diligence in relation to our proposal.”

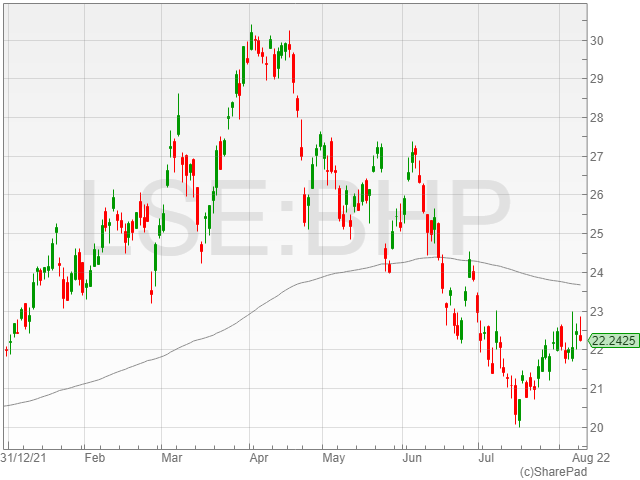

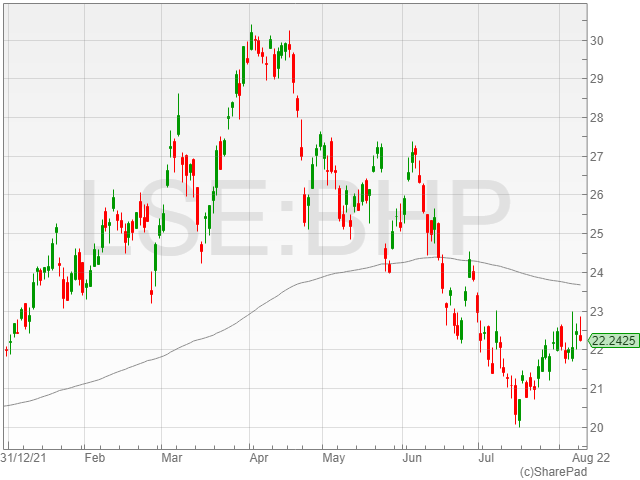

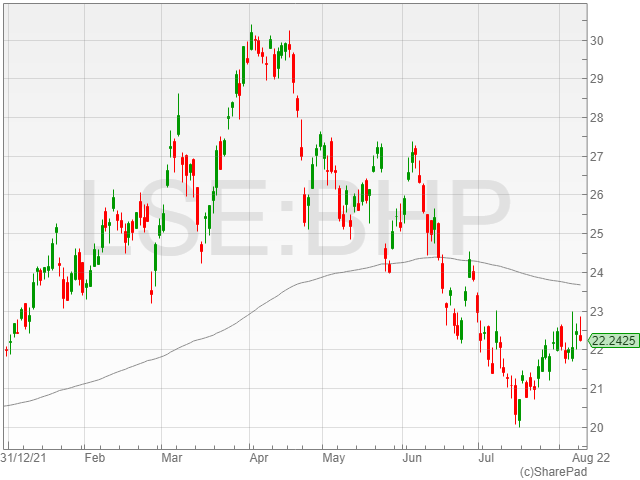

BHP Group shares fell 1% to 2,224p in early morning trading on Monday.