The FTSE 250 was up 0.8% to 19,477.4 and the AIM was up 0.1% to 947.6 in midday trading on Tuesday, after the market clawed back some ground from its miserable drop on Monday.

The small and mid cap market were led higher by strong corporate results as investors shifted their attention to companies reporting shored-up revenues and positive outlooks for the year ahead.

“Stocks in general have struggled this year, with investors worrying about inflation, rising interest rates, a slowdown in the world economy, war in Ukraine, new Covid flare-ups in China, weakness in consumer spending and concerns that business investment might take a back seat,” said investment director Russ Mould.

“The narrative has gone from ‘how can I make money?’ to ‘how can I protect my money?”

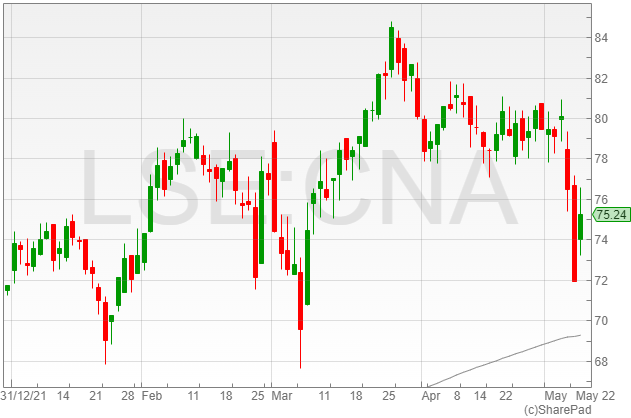

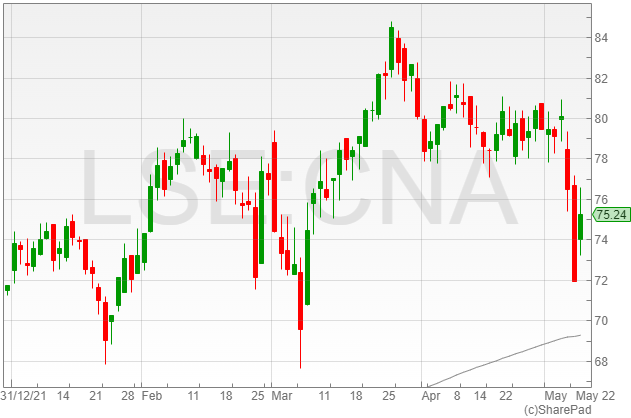

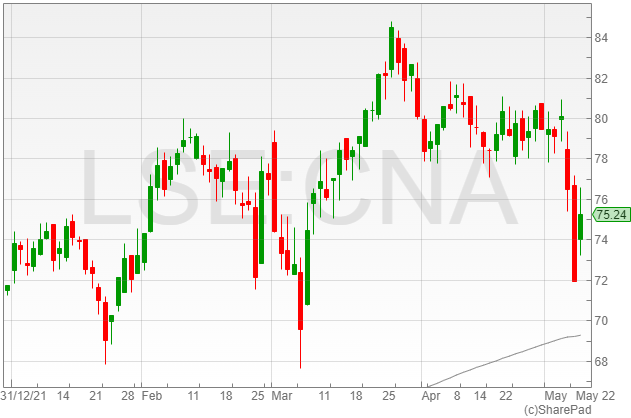

Centrica shares were up 4.8% to 75.4p following an estimated annual earnings at the top end of analyst expectations, despite supply chain and inflationary challenges.

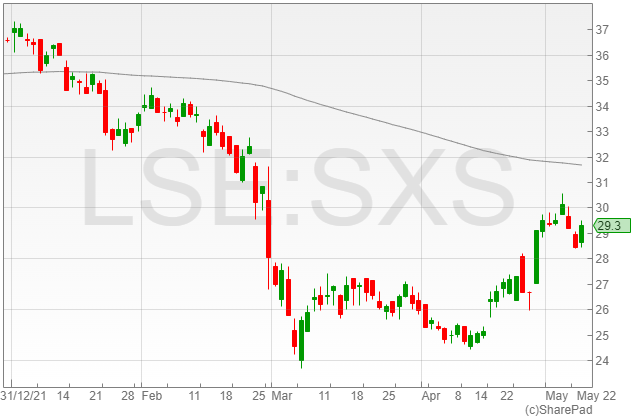

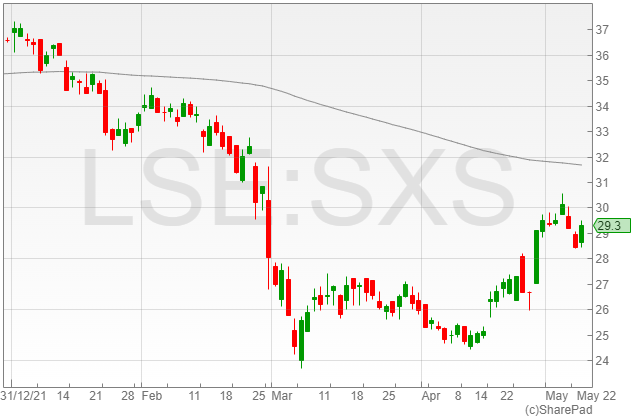

Spectris shares were up 3.7% to 2,949p following the company’s acquisition of California accelerometers maker Dytran Instruments for £66 million.

“Dytran will be integrated into Hottinger Breel & Kjaer, which has a long-established brand in accelerometers and where it will benefit from leveraging HBK’s global sales and service network,” said Spectris.

“The acquisition strengthens HBK’s piezo-electric offering, adds new Microelectromechanical systems capability and expands sales into North America.”

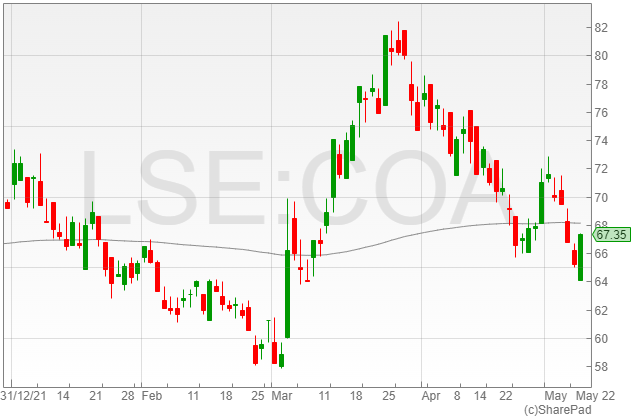

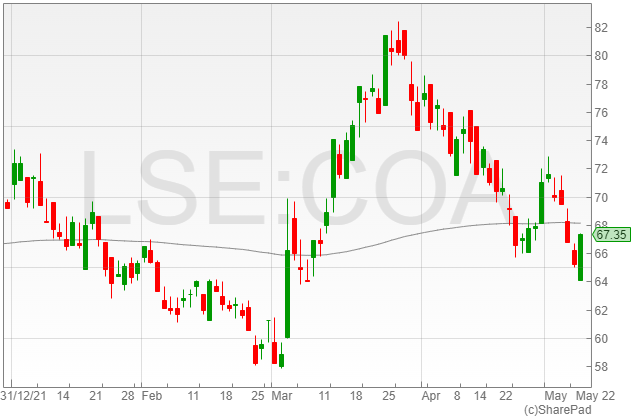

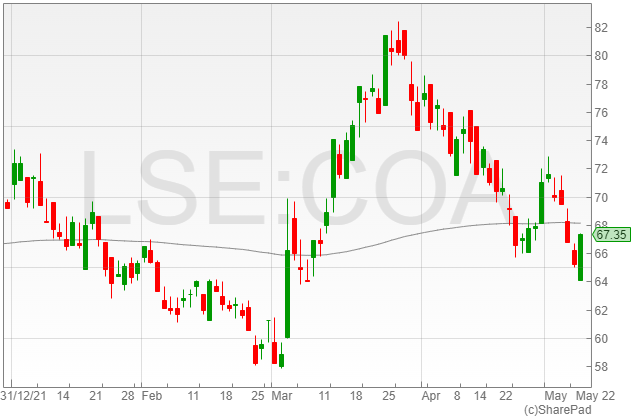

Coats shares were up 3.2% to 67.3p in light of the group’s update that its profit margin would receive a boost from its Brazil and Argentina business sales.

The company reported an expected 0.5% increase to its annual adjusted operating margins due to the agreement.

“An exit from the Brazil and Argentina business is in line with Coats’ strategic initiatives, announced in March, to accelerate profitable sales growth and transform the company,” said Coats.

Renishaw shares dropped 1.3% to 4,132p after the group announced a lowered profit guidance for FY 2022 to £155-£170 million from £157-£181 million on the back of uncertainty in its operations due to Covid-19 lockdowns in China.

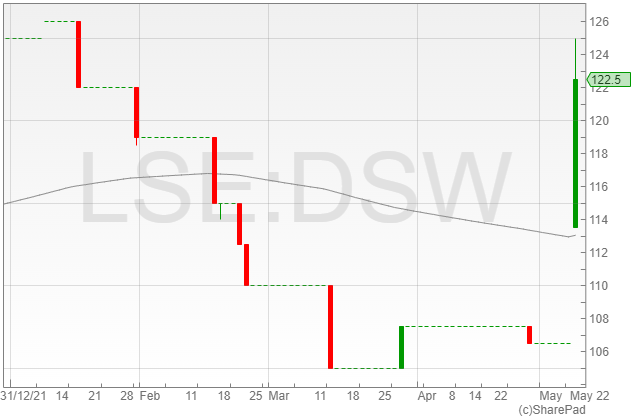

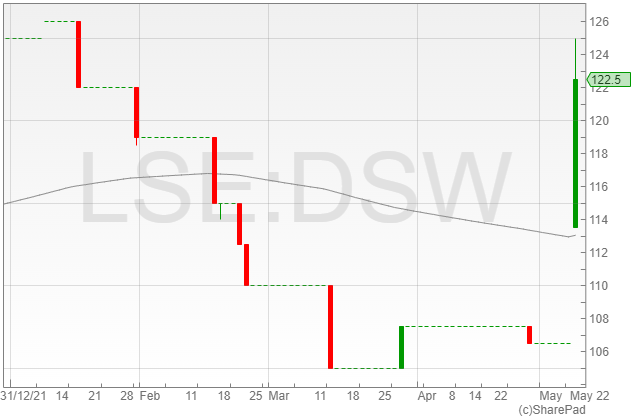

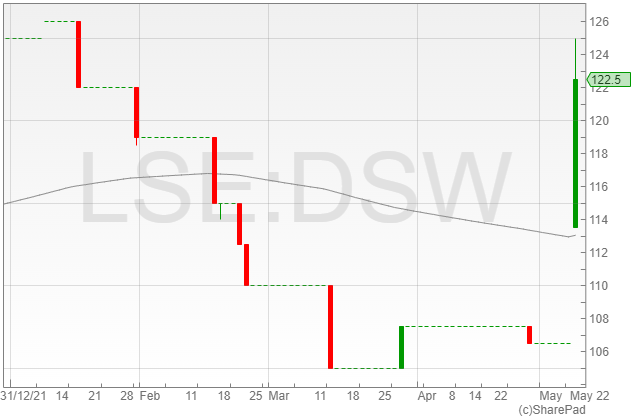

DSW Capital shares increased 15% to 122.5p following confirmation that its annual results were projected to come “significantly ahead” of market expectations, with expected network revenues of £18.3 million against £15.3 million in 2021, representing a 19.6% rise year-on-year.

“I am delighted to announce a strong performance for FY22 with the Group expected to report results ahead of expectations both in terms of revenue and adjusted profits,” said DSW CEO James Dow.

“These results are underpinned by the significant market demand for DSW’s expert service lines and our performance illustrates the considerable benefits of our platform model.”

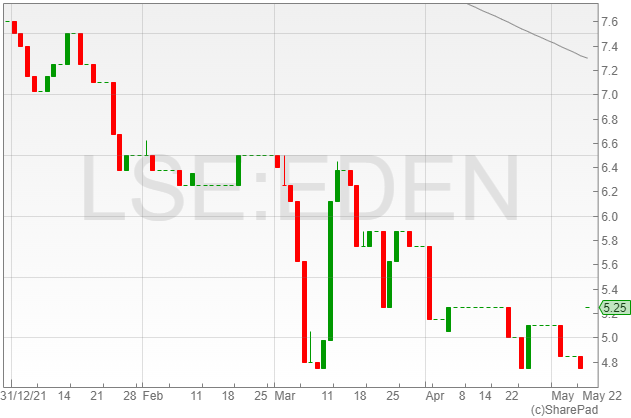

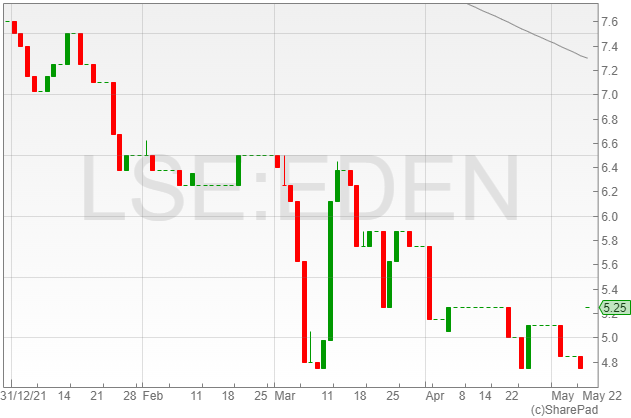

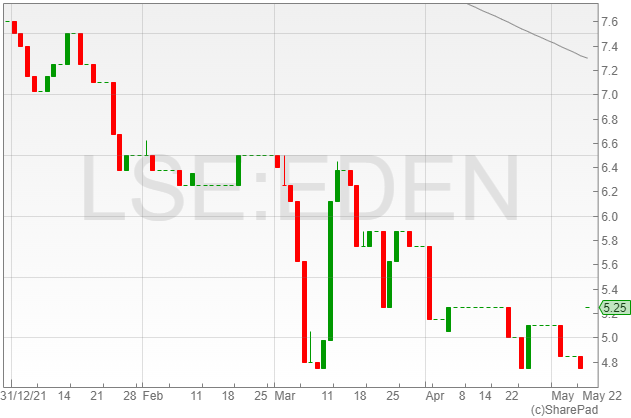

Eden Research shares were up 10.5% to 5.2p after the group passed a regulatory milestone in the US for the use of its Mevalone biofungicide and CedrozÔ products.

The firm also announced the approved rollout of Mevalone for use on crops in Italy to control the Botrytis Cinerea destructive fungal pathogen, which damages a wide selection of plant species, alongside the approval of its use against fungal pathogens Powdery Mildew and Sclerotinia.

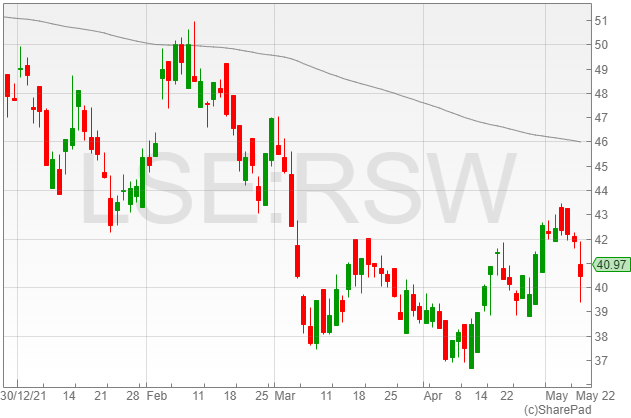

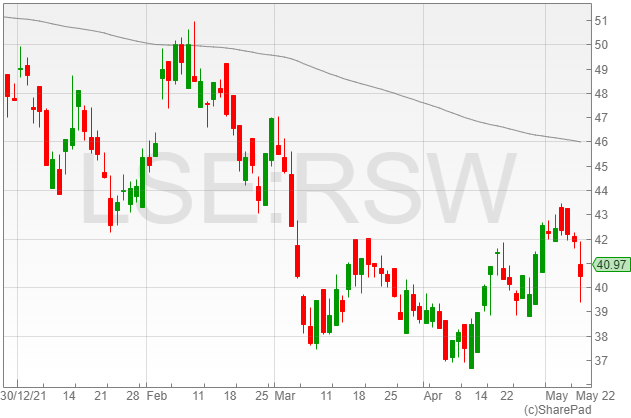

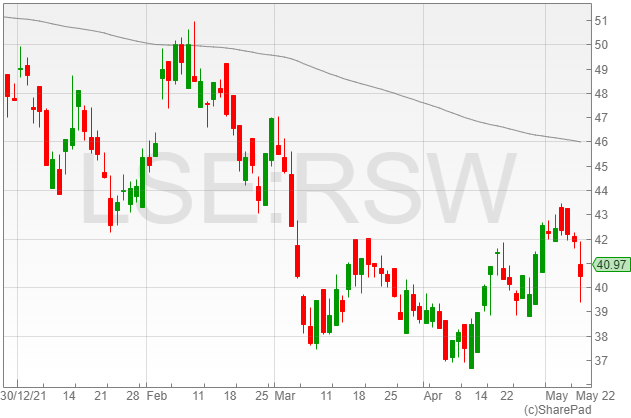

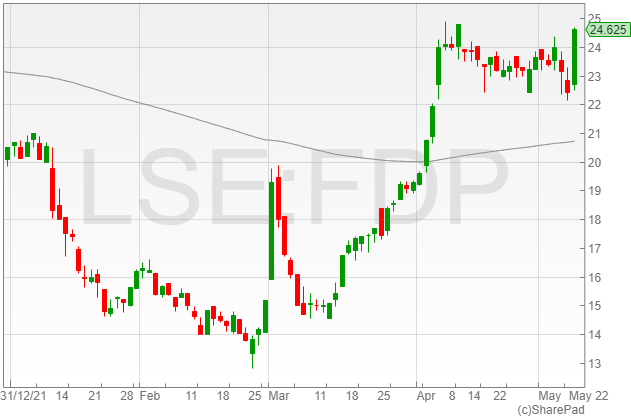

FD Technologies shares increased 9.6% to 2,462p on the back of increased revenue of 11% to £263.5 million compared to £237.9 million, ahead of management expectations.

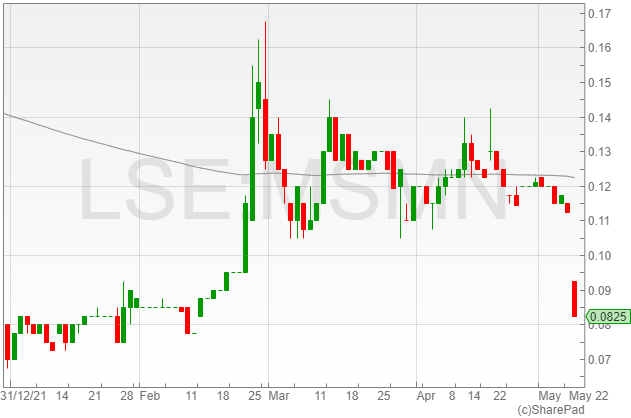

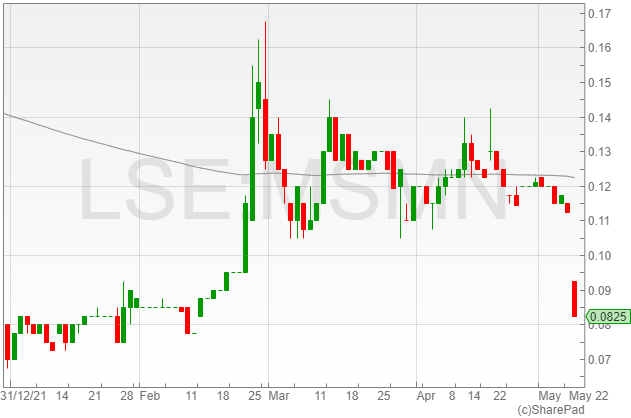

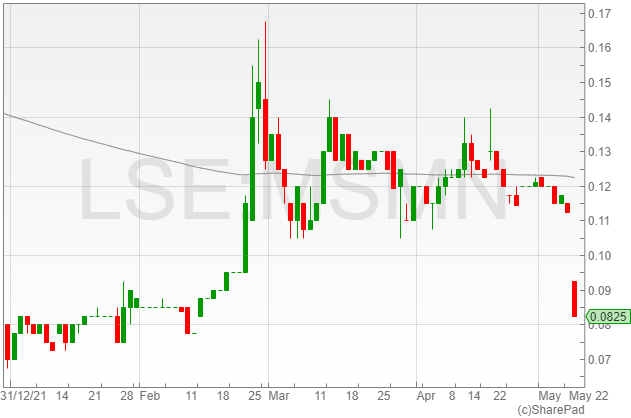

Mosman Oil & Gas shares fell 26.6% to 0.08p following its discounted fundraise of 1.38 billion shares at 0.08p per share to raise £1.1 million in funds for the drilling of its first re-development well at the Challenger project in Texas.

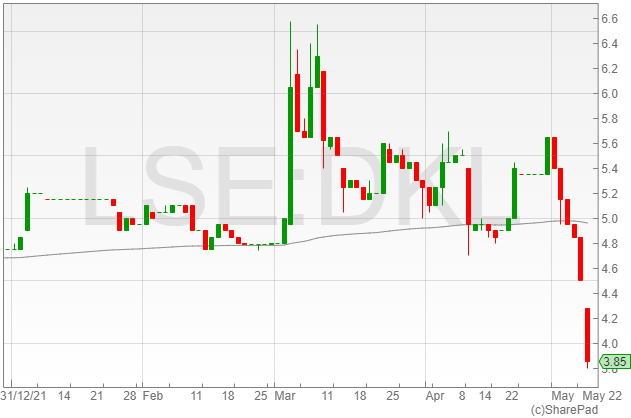

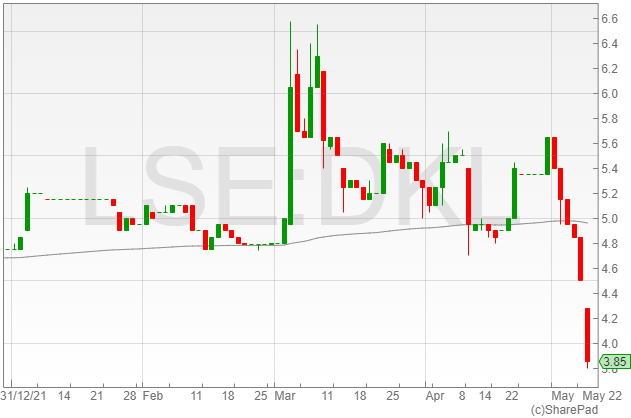

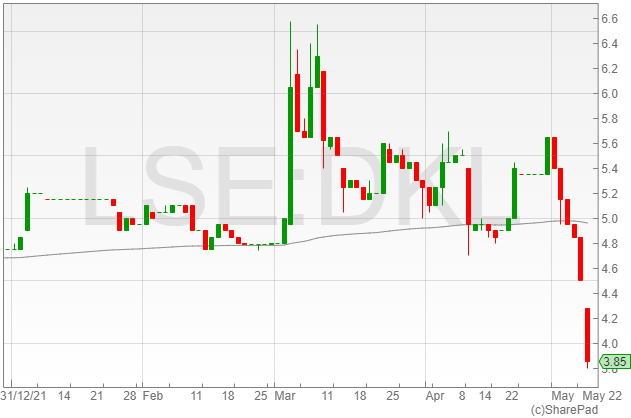

Dekel Agri-Vision shares dropped 14.4% to 3.8p on the back of the group’s weak palm oil output, due to low recent rainfall delaying the ripening on fresh fruit bunches.

April CPO production fell 42% year-on-year to 2,965 tonnes compared to 5,147 tonnes, with processed fresh fruit bunches down 45% to 13,168 tonnes from 24,010 tonnes.

CPO sales across April declines 64% to 1,788 tonnes compared to 4,971 since April 2021.

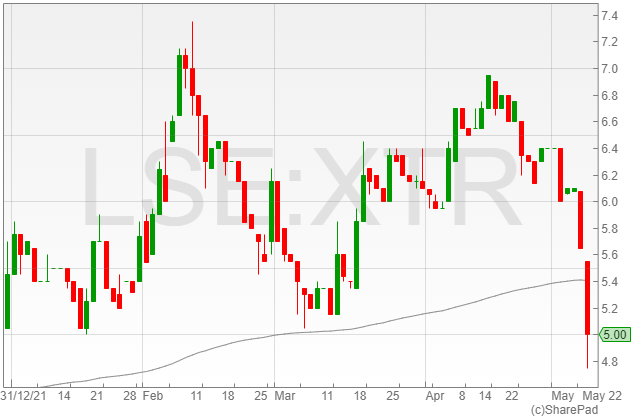

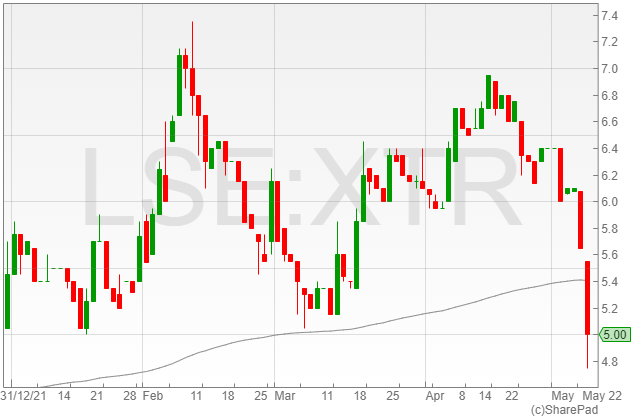

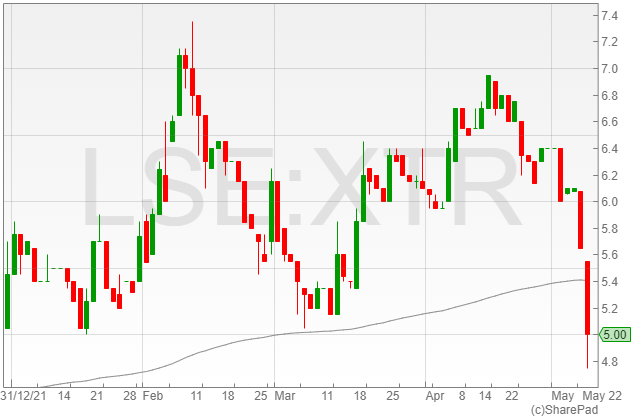

Xtract Resources shares dropped 11.5% to 5p after the firm noted an “eclectic” set of drill results from its Bushranger copper-gold exploration project in Australia.

The company said the results required follow-up drilling, with several holes revealing “some degree of mineralisation and some meaningful gold values.”

“Whilst these outlying holes do not in themselves indicate significant extensions, we continue to drill and model to better understand both Ascot and the area between Ascot and Racecourse. The modelling for the primary Racecourse open pit is advancing satisfactorily,” said Xtract Resources executive chair Colin Bird.