Capping off an altogether mixed week, FTSE indexes finished Friday with a slump, having decided to go into the weekend with the prospect of a No-Deal Brexit as the main takeaway.

Down by 0.80%, the FTSE 100 reversed its mid-week gains and finished at 6,546 points, just shy of where it began on Monday. Meanwhile, the FTSE 250 dropped by 0.68%, to 19,622 points – more than 500 points below its Monday open, following a rough week for the index.

The story on Friday was disappointingly glum, what with the first COVID vaccines being rolled out just a couple of days prior, and a low pound and new trade deals with Singapore and Vietnam, all looking to jack up the sentiment towards UK equities.

Alas, it was the continuing Brexit impasse, and increasing likelihood of a No-Deal scenario that ruled traders’ thoughts at the end of the week. Speaking on the FTSE’s underwhelming performance, and the likelihood of No-Deal, IG Senior market Analyst, Joshua Mahony, said:

“Wednesday’s Brexit dinner appeared to provide little more than clarity that both sides remain as far apart as ever, with a growing consensus that a no-deal Brexit now appears to be the most likely eventuality.”

“Sceptics will see the current impasse as a way to fame any eventual deal as a success on both sides, yet we have just three weeks to both finalise and sign off a deal that needs to pass through all 27 EU nations.”

“From a market standpoint, the value-led recovery seen over the past month is coming into question, with the FTSE 250 outperformance likely to reverse if a no-deal Brexit comes back to hurt domestically-focused firms.”

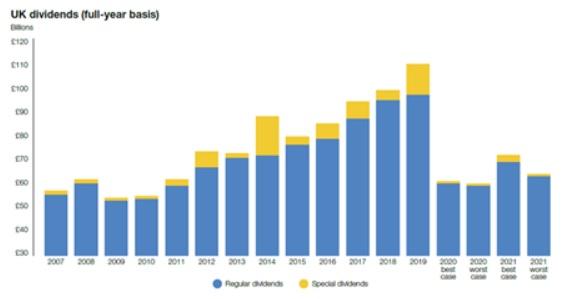

The situation was hardly peachy for the UK’s largest international financiers, either. Despite the Bank of England lifting the ban on bank dividend payments on Thursday, Lloyds shares fell almost 4.5%, while NatWest shares shed more than 6.60%.

“The prospect of a no-deal Brexit is doing little to bolster optimism for the UK banks, with the likes of Lloyds, NatWest, and Barclays leading the FTSE losses in early trade”, Mr Mahony added.

“The latest BoE financial stability report highlighted that banks are in a very healthy position as they head into what could be a very turbulent few months.”

“However, with the government having staved off a wave of insolvencies and administrations through the pandemic, the next question is just how they can avoid any short-term economic suffering that could come with a disorderly exit from the EU.”

Finishing on a smaller and brighter note – should a No-Deal Brexit materialise, some investors are heartened by the opportunities this could offer UK-focused SMEs and micro-caps, especially given that the potential for tariffs may give them a price advantage in the domestic market.