Pret A Manger announces plans to axe 400 jobs

Bank of England seeks to incorporate climate risk into bond purchases

In a speech to the Investment Association, Mr Hauser said:

“2% of the Bank’s Asset Purchase Facility consists of sterling corporate bonds, acquired as part of the MPC’s quantitative easing programme. As we stated in our TCFD disclosure, the framework for the MPC’s asset purchases is determined by the Committee’s remit given to it by the Chancellor. But, subject to the Government indicating a willingness to update this remit, we will over the coming year be considering how to incorporate climate factors into decisions on the mix of financial assets, whilst still achieving our policy aims.”

This move follows a similar approach taken by ECB President, Christine Lagarde, just two days earlier, and the Chancellor is now being urged by climate campaigners to align the bank’s Quantitative Easing programme with the government’s own climate commitments, alongside the next budget.

Having been slow off the mark, today’s move represents the first statement of intent since Andrew Bailey pledged to make the decarbonisation of corporate bond purchases ‘a priority’ back in March. Since then, in April, fossil fuel-producing companies featured in the updated list of eligible bonds for further rounds of corporate QE.

In June, the premier Bank of England climate-related financial disclosure showed that if the projected emissions performance of the Bank’s corporate bond portfolio was representative of the emissions performance of corporates globally, the world would experience 3.5 degrees celcius of heating by 2100.

The bad year suffered by fossil fuel giants looks set to get even tougher, between the BoE’s new strategy proposal, and pressure from campaigners for the bank to stop including BP and Shell in its bond-buying programme.

Speaking on the update, Executive Director of Positive Money, Fran Boait, said:

“It’s positive to hear the Bank of England is finally taking forward proposals to ensure its asset purchases aren’t fuelling the climate crisis, though progress seems worryingly slow. The Bank says it will consider incorporating climate over the coming year, more than six months since Andrew Bailey told MPs he would make it a priority in March.”

“Action needs to happen more urgently, especially with the prospect of more corporate quantitative easing as the Bank of England responds to the worsening economic outlook. The Bank’s own disclosure suggests its corporate bond purchases are currently fuelling 3.5C global heating, more than double the 1.5C limit the government is committed to pursuing through the Paris Agreement.”

“The Bank of England and the Treasury should work to ensure the central bank’s remit is updated to allow it to support the government’s net zero strategy by the next Budget.”

Serco Group upgrades profit guidance, shares rise

Loungers PLC shares rise thanks to “excellent trading”

Wetherspoons: shares plunge but can it ride out the storm?

SpaceandPeople shares down 25% after “very challenging year”

Mind Gym shares plummet amid Corona disruption

Boots sales fall as people avoid high streets

Apple’s iPhone 12 – formidable or forgettable?

But do we think the iPhone 12 is worth the hype?

Well, in terms of features, there are a few new things to talk about. For instance, the confirmed iPhone Mini at 5.4 inches and iPhone 12 at 6.1 inches. Unusually, though, there could be up to four sizes launched on within a short range of release dates, with a 6.1 inch iPhone Pro and a sizeable 6.7 inch iPhone Pro Max also being announced.What has really been grabbing headlines, though, are the iPhone’s new tech features and appearance. Boasting 5G capabilities and a 3D depth-sensing camera, Apple have made an some effort to move with the times – and will also be keeping their popular 14 interface for the launch of their new models. In terms of the look of the thing, the iPhone 12 seems to hark back to the reliable and popular iPhone 5, taking a leaf out of the old-school book with sharp, rather than rounded edges. The phone is also being showcased in dark blue, a new colour scheme for Apple’s staple product. The main selling point for many though, will be the price, $699 in the US and £699 in the UK for the Mini, which is far short of the iPhone X’s £999 price tag, and may appear slightly more affordable than the £729 asked for the basic iPhone 11 model.iPhone 12 Size Comparison: All iPhone Models Side by Sidehttps://t.co/pZ2YatGkMx pic.twitter.com/xnXfG8JIff

— MacRumors.com (@MacRumors) October 15, 2020

Or is the iPhone 12 more predictability from Apple?

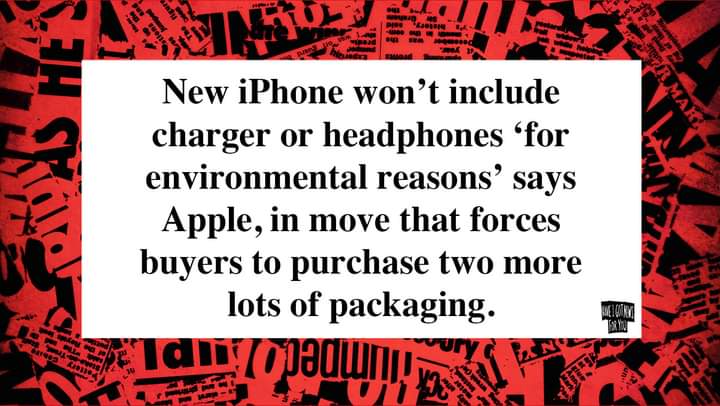

Having completely blown mobile phone technology into a new paradigm with the iPhone 3G and 3GS, it is little secret that ever since, Apple has been trying to find ways to replicate that success. Indeed, as stated by Daniel Morgan, senior portfolio manager Synovus Trust Co.:“Since 2014, the newest iPhone launches have felt more like ripples opposed to a wave,”And, to be honest, it doesn’t look like this model will be the one to do it, at least not on merit. Apple’s last big boom in devices followed the launch of the iPhone 6 and 6 Plus, and while the iPhone X’s top range models saw the company boast record-breaking revenues, its new features seem more in the range of like novelty, than revolutionary. But perhaps that’ll be enough to get fans onboard. Indeed, Apple is seen as the cutting edge of tech fashion, its devices are battery-powered status symbols, and the addition of a swanky display was enough to get some people to pay around £1,400 for the top spec iPhone 11. Also, some analysts (granted, ones who work for companies with large Apple holdings) believe that the iPhone 12 will spur sales that exceed beat 231 million devices sold during the 2015 fiscal year. Dan Ives, analyst for Wedbush Securities, comments: “I believe it translates into a once-in-a-decade-type upgrade opportunity for Apple,” One factor that might drive sales will be the pandemic, with Apple shares rallying more than 50% and its market value climbing above $2 trillion. Similarly, with consumers being more reliant on tech than ever, and looking to enjoy the endorphin hit provided by a sleek new device, the next dose of Apple might prove to be just what the doctor ordered. Equally, though, the pandemic might discourage consumers from lavish new expenditure, or more importantly, home-working might reduce the demand for high-speed, wireless connections, as people rely more heavily on home Wi-Fi. The other factor which could – and should – turn off some potential customers, is the fact that the iPhone 12 doesn’t actually cost £700. If you include essentials, or the items that are normally included when you buy a new handheld device – earphones, the obligatory earphone adaptor, and charger – this will set you back an additional £78. As put by Have I Got News for You:

And that pretty much sums it up for me. Being a past Apple patron myself, these infuriating details seem to mount up to a high-style, low-substance final product; where the suave-woke zeitgeist of the brand doesn’t quite wash against what is quite clearly the company’s priority: it’s balance sheet.

With that being said, I hope the new phone meets everybody’s expectations – it may well end up being a roaring success.

And that pretty much sums it up for me. Being a past Apple patron myself, these infuriating details seem to mount up to a high-style, low-substance final product; where the suave-woke zeitgeist of the brand doesn’t quite wash against what is quite clearly the company’s priority: it’s balance sheet.

With that being said, I hope the new phone meets everybody’s expectations – it may well end up being a roaring success.