Driver Group shares surge 11%

Aircraft orders plummet 91% in Q3

United Carpets shares rally on sales increase

Oil prices & European stock markets slide amid Corona restrictions

Yourgene Health shares plunge as lockdown impacts H1 results

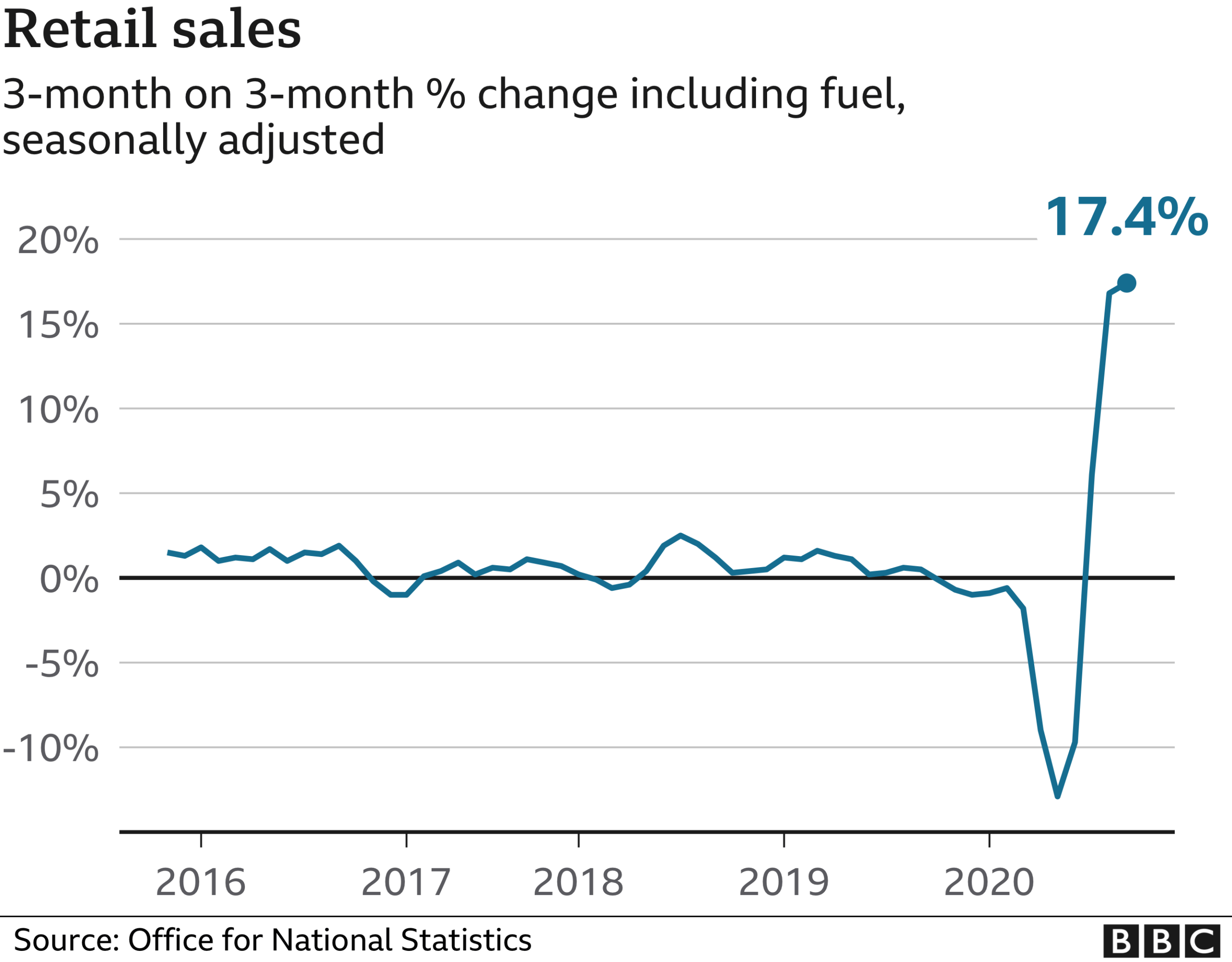

Did retail sales really bounce back in September?

The problem with this positive way of thinking is that retail sales aren’t actually experiencing exponential growth, Instead, September’s growth was lower than the previous month, there appear to be challenges ahead, and the growth is not being experienced by retailers across the board.

Indeed, new lockdown restrictions will have the double-edged-sword effect. The first half of this will be a reduction in customers and potential closure of some shops. As stated by Kingswood CIO, Rupert Thompson:

“Retail sales posted an unexpectedly strong gain in September, rising 1.5% m/m to be up 4.7% from a year earlier. However, this is only encouraging up to a point as this strength was prior to the introduction of the new lockdown/social distancing measures. Business confidence fell back in October with the decline led by the services sector, the area the most vulnerable to the latest restrictions. This fall highlights the need for the new package of support measures announced by the Chancellor yesterday.”

The second consideration will be a change in consumer behaviour, with customers focusing on outlets perceived to be selling essential and cut-price goods, as will as outlets offering online retail opportunities. As said by Mark Lynch, Partner at Oghma Partners:

“While these figures highlight British stoicism in supporting a fragile economy, it is important to note that these retail sales figures might be slightly misleading in terms of giving an impression of the strength of the consumer economy as a whole. UK shoppers have been buying more food and drink at supermarkets because they have been spending less on eating out. The Government’s lockdown restrictions have re-emphasised earlier trends that we saw around Spring which showed positive sales growth for direct to consumer and supermarket companies. We have already seen a significant shift in consumer behaviour which has boosted growth for those companies in Q2 and to a lesser extent in Q3 but which now look to boost growth again in Q4.”

The problem with this positive way of thinking is that retail sales aren’t actually experiencing exponential growth, Instead, September’s growth was lower than the previous month, there appear to be challenges ahead, and the growth is not being experienced by retailers across the board.

Indeed, new lockdown restrictions will have the double-edged-sword effect. The first half of this will be a reduction in customers and potential closure of some shops. As stated by Kingswood CIO, Rupert Thompson:

“Retail sales posted an unexpectedly strong gain in September, rising 1.5% m/m to be up 4.7% from a year earlier. However, this is only encouraging up to a point as this strength was prior to the introduction of the new lockdown/social distancing measures. Business confidence fell back in October with the decline led by the services sector, the area the most vulnerable to the latest restrictions. This fall highlights the need for the new package of support measures announced by the Chancellor yesterday.”

The second consideration will be a change in consumer behaviour, with customers focusing on outlets perceived to be selling essential and cut-price goods, as will as outlets offering online retail opportunities. As said by Mark Lynch, Partner at Oghma Partners:

“While these figures highlight British stoicism in supporting a fragile economy, it is important to note that these retail sales figures might be slightly misleading in terms of giving an impression of the strength of the consumer economy as a whole. UK shoppers have been buying more food and drink at supermarkets because they have been spending less on eating out. The Government’s lockdown restrictions have re-emphasised earlier trends that we saw around Spring which showed positive sales growth for direct to consumer and supermarket companies. We have already seen a significant shift in consumer behaviour which has boosted growth for those companies in Q2 and to a lesser extent in Q3 but which now look to boost growth again in Q4.”

“We are sadly seeing more and more long term problems for Food to Go and food service providers that are unable to service clients as per normal. The fact is that more end user businesses will go bust, including pubs, restaurants and the more food service manufacturing capacity and, to a lesser extent, Food to Go capacity we will see taken out of the market.”

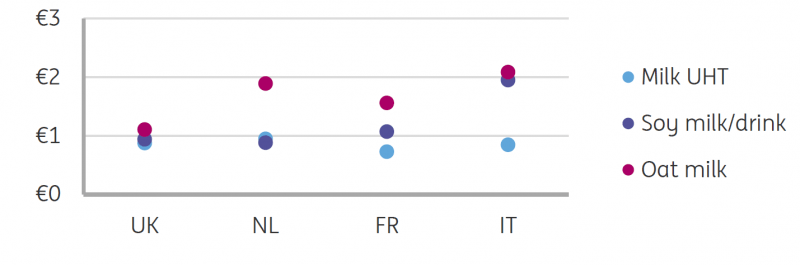

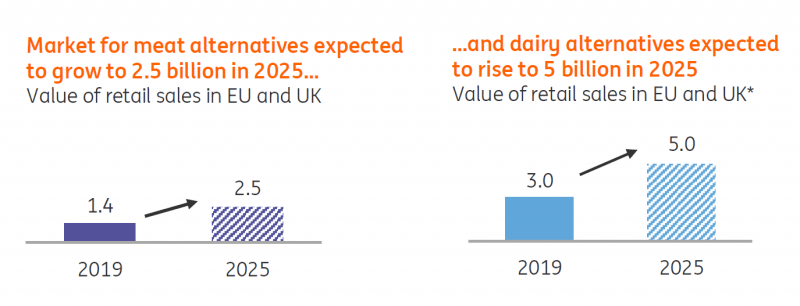

Plant-based meat and dairy alternatives market to hit €7.5bn in Europe by 2025

“Shifting consumer preferences combined with the increasing awareness of the role of a more plant-rich diet in tackling some of the key ecological and health consequences of our current global food system has led to the rise of plant-based alternatives, both as stand-alone businesses as well as existing businesses pivoting into this space. At Tribe, we have found a clear expansion in the number of opportunities to support this transition as an investor over the last couple of years.”

“Plant-based meat and dairy is now disrupting the food production industry in many of the same ways that renewables disrupted the energy market over the last 30 years. The annual growth rate European retail sales of meat and dairy alternatives of 10% between 2010 and 2020 though does compare favourably to the 3.3% growth in renewables in a similar period1, showing the size of the potential opportunity for investors in new food developments.”

“As this shift continues, we also have to commit to managing and reducing the impacts that such a wholesale change in agriculture can create – for example, the issues with soy production leading to deforestation is documented. Investors must be aware of the impact and sustainability issues associated with plant-based food too, if they are to identify those companies who are managing themselves for this transition sustainably. Those companies who have adopted frameworks that help them navigate the complex issues embedded in agriculture, for example the Natural Capital Protocol or the Regenerative Organic certification scheme, are better placed to manage the sustainability issues associated with this transition.”