HSBC exposed in $80m Hong Kong Ponzi scandal

What did the FinCEN Files find?

The 2,657 leaked documents, containing more than 2,000 ‘suspicious activity reports’ or SARs, revealed how some of the world’s biggest banks have been knowingly involved in money laundering affairs despite legal obligations to interfere with criminal activity. SARs do not necessarily count as explicit evidence of financial crime, but banks are supposed to send them on to authorities when they suspect clients may be breaking the law. If evidence is found that the activity is indeed illegal, banks are meant to halt the transfer of money while a criminal investigation is launched. The SARs identified in the FinCEN Files were instead leaked to Buzzfeed and subsequently shared with the International Consortium of Investigative Journalists (ICIJ). BBC’s Panorama led the research for the BBC as part of a “global probe” into money laundering in the world’s top financial institutions, while the ICIJ had already fronted the reporting of the Panama Papers and Paradise Papers leaks, which had exposed the offshore tax evasion of scores of celebrities and wealthy individuals worldwide. The files have since been submitted to the US Financial Crimes Investigation Network, with documents spanning from 2000 to 2017 detailing transactions worth a cumulative $2 trillion. Speaking on behalf of the ICIJ, Fergus Shiel told the BBC that the FinCEN Files are “insight into what banks know about the vast flows of dirty money across the globe… [The] system that is meant to regulate the flows of tainted money is broken”.What did HSBC do?

The issue is more in what HSBC did not do. The investment scam that the bank had been made aware of was called WCM777, launched by Chinese national Ming Xu with the promise of a global investment bank that could guarantee 100% profit in just 100 days. Xu fashioned an alternative identity as an Evangelical preacher based in Los Angeles, using Christian iconography to recruit believers and poor from the Latino and Asian communities in the region. His seminars, webinars and social media campaigns managed to drum up more than $80 million in what Xu claimed was an investment opportunity in cloud computing software. Thousands of people became victims to the fraud, from American citizens to residents in Colombia, Peru, and even the UK. Regulators from California told the BBC that HSBC had been alerted to Xu’s potential illegal activity as early as September 2013, when the state first reported that WCM777 was fraudulent. The bank filed its first SAR related to the scheme when it was alerted to a potential scam involving $6 million being transferred to accounts based in Hong Kong. Bank officials stated at the time that there was “no apparent economic, business, or lawful purpose” for the transactions, and noted suspicions of “Ponzi scheme activities”. A second SAR was reported in February 2014, concerning more than $15 million of suspicious money transfers, and an additional report was filed in March 2014. Despite being aware of the allegations, HSBC did not formally shut any of Xu’s accounts until April 2014, after a US financial regulator, the Securities and Exchange Commission, filed charges against the bank. By then, the vast majority of the funds linked to the accounts had already been withdrawn. Xu was later arrested by Chinese authorities in 2017 and served a 3 year jail sentence for his involvement in the scam. He alleges that the bank “had not contacted him about his business” to date, and maintains that WCM777 was not a Ponzi scheme. Instead, Mr Xu claims that “his aim had been to build a religious community in California on more than 400 acres of land”.What else did HSBC do wrong?

Analysis from the ICIJ has also revealed that between 2000 and 2017, HSBC had identified “suspicious transactions” involving accounts based in Hong Kong which had a cumulative value of about $1.5 billion – with some $900 million linked to explicit criminal activity. According to the BBC, the bank’s reports failed, however, to identify “key facts about customers, including the ultimate beneficial owners of accounts and where the money came from”. This is all in spite of the Mexican drug-trafficking scandal back in 2012, which had seen the bank receive a slap on the wrist from US prosecutors for turning a blind eye to illegal activity in HSBC-registered accounts. A spokesperson for HSBC commented: “Starting in 2012, HSBC embarked on a multi-year journey to overhaul its ability to combat financial crime across more than 60 jurisdictions… HSBC is a much safer institution than it was in 2012”. HSBC stated that it had “met all of its obligations under the [agreement struck with US prosecutors]”, according to US authorities residing over the case.What does this mean for HSBC?

On the face of it, the FinCEN Files indicate that Britain’s largest bank allowed for millions of dollars to be transferred as part of a money-laundering scheme despite repeatedly being warned of a potential scam. This inevitably detracts from HSBC’s legitimacy and trustworthiness as a front-running financial institution. The scandal has shown that HSBC has – on more than one occasion – facilitated, and thus contributed, to the concerning culture of “dirty money” transfers around the world, of which regulators have no doubt only seen the tip of the iceberg. What’s more, the leaked files show that the system designed to flag up suspicious activity is, in effect, defunct. Repeated alerts about WCM777’s potentially criminal nature failed to spur HSBC to shut the accounts, even as the amount of cash involved continued to rapidly increase. Perhaps the most alarming lesson to be learned from the FinCEN Files is that HSBC is not alone in its negligence towards money laundering. A number of other big banks, including Barclays and JP Morgan, have also been incriminated. The documents have unveiled a culture among big banks, of essentially turning a blind eye to illegal activity, which has allowed for criminal groups to transfer and stockpile funds which help make their cause even stronger, and thus more difficult for authorities to dismantle further down the line. Even once they do, in many cases, the damage has already been done.FinCEN Reactions on Twitter

The FinCEN Files have already begun to stir up activity on Twitter ahead of the market reaction expected tomorrow morning. Some comments have been listed below:BOOM! Secret govt documents reveal how giant banks move trillions in suspicious transactions, enriching themselves while facilitating the work of terrorists, kleptocrats, and criminals. And the US government fails to stop it. https://t.co/rm9UFZJQg4@BuzzFeedNews #FinCENFiles

— Mark Schoofs (@SchoofsFeed) September 20, 2020

I’m told on very good authority that people within Deutsche Bank are in a panic. https://t.co/beQyCnUq69

— Scott Stedman (@ScottMStedman) September 19, 2020

So today the #FinCENFiles will be released. Hundreds of journalists have worked on exposing how corrupt governments, criminals and banks are around the world. So no surprises there. I doubt it will result on anything changing unfortunately. But be interesting to see

— Rob Nichols (@TheRealRobN) September 20, 2020

The underlying proposition of the initial batch of #FinCENFiles stories, that global financial surveillance (and a distinctly US-centric morality) should be being used to proactively, and globally censor and block transactions without judicial oversight is a deeply disturbing one

— Sarah Jamie Lewis (@SarahJamieLewis) September 20, 2020

Covid and work turmoil – what can bosses do to protect staff well-being?

The consistency-flexibility duality

Mr Dunn talks about the seemingly contradictory give-and-take between the need for bosses to protect consistency while being flexible and understanding. These requirements, while opposing, are an unfortunate but necessary balancing act of setting standards while being compassionate, in the unprecedented territory of returning to work during a global pandemic. On consistency, Mr Dunn stated that this involves, “making suitable and effective provisions agreed at a corporate level for the safety of employees”. He says that there ought to be a standardised approach to hygiene, face coverings, work stations and facilities, which enforces not only reciprocity between staff in carrying out these behaviours, but invokes the sense that leaders are conducting themselves with a strong duty of care towards staff. This duty of care, and exacting standards, need to be understood by all employees. Staff feedback should also be encouraged, to allow for both dialogue with leaders and necessary adaptations to be implemented as and when necessary.Boss & staff well-being and the work from home phenomena

Trainline shares fall as ticket sales sump 81%

Pub industry says latest restrictions in North East are a “significant blow”

Fusion Antibodies shares surge on positive update

Travel stocks plummet as fear of second lockdown grows

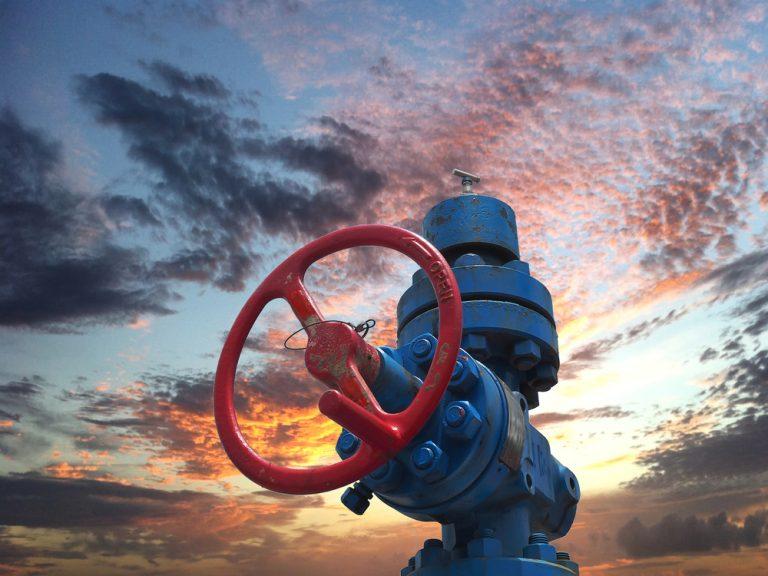

Caspian Sunrise shares plummet 29% amid Corona disruption

“Between 1 January 2020 and 21 April 2020, Brent Crude, on which the price for our export sales are based, fell from $63.65 per barrel to less than $10 per barrel. Domestic prices also fell from approximately $18.75 per barrel to approximately $6.2 per barrel. While international prices have partially recovered and for most of the past 3 months have exceeded $40 per barrel it is disappointing to report domestic prices remain at historic lows,” said the group in a statement.

“The extensive lockdowns in Kazakhstan led to serious disruption to our production and exploration activities. Crew changeovers were limited, vital supplies unable to reach the oilfield and there were long delays getting the required acid and engineers to the field for the long planned acid treatments to our existing deep wells.”

“The shutdown also impacted the renewal of licences and our appeal against what we are firmly advised are excessive state assessed historic costs at BNG. It also delayed the completion of the acquisition of the Caspian Explorer.”

Caspar Sunrise delayed certain projects amid the lockdown as well as cut staff numbers to cut costs. Amid the Coronavirus disruption, the group has said that it plans to focus on preserving the group’s asset base to allow the continued development of potentially extremely valuable assets over the medium and long term. Caspian Sunrise shares (LON: CASP) are currently trading -22.12% at 2,20 (0939GMT).