Deutsche Bank oust CEO John Cryan amid continued losses

Deutsche Bank (ETR:DBK) has ousted its chief executive John Cryan amid continued losses in the last few years.

Germany’s biggest lender announced the decision after an emergency meeting was held late into Sunday evening.

The move comes amid three years of reported losses and a series of scandals damaging the reputation of the bank.

Back in February, the bank reported pre-tax profits of 1.3 billion euros, and a net loss of 0.5 million euros for the year.

John Cryan had been at the helm of the bank since 2015, with his contract was due to expire in 2020.

However, with little signs of improvement, pressure had been mounting on Yorkshire-born Cryan, who had originally been tasked with overhauling the bank.

The bank’s troubles follow a series of legal difficulties and heavy penalties relating to mortgage backed securities dating back to before the financial crisis.

Specifically, the bank had been hit with a $7.2 billion (£5.9 billion) fine by US authorities back in 2016.

The series of challenges led the IMF to label Deutsche Bank as the riskiest bank that year, alongside failing US-based stress tests.

Deutsche chairman Paul Achleitner commented that Mr Cryan had “laid the groundwork for a successful future of the bank” despite a “relatively short tenure” in the role of chief executive.

“However, following a comprehensive analysis we came to the conclusion that we need a new execution dynamic in the leadership of our bank.” He added.

Co-deputy chief executive Christian Sewing is set to take over the position, effect immediately.

Cryan’s successor has been at Deutsche Bank for the majority of his career, specifically overseeing the bank’s private and commercial operations.

In a letter published on Deutsche Bank’s website, Mr Sewing stated:

“The priority is to leverage our strengths and to allocate our investments accordingly. And at the same time we will look to free up capacity for growth by pulling back from those areas where we are not sufficiently profitable”.

Shares in the bank are currently trading +4.33 percent as of 10.29 AM (GMT).

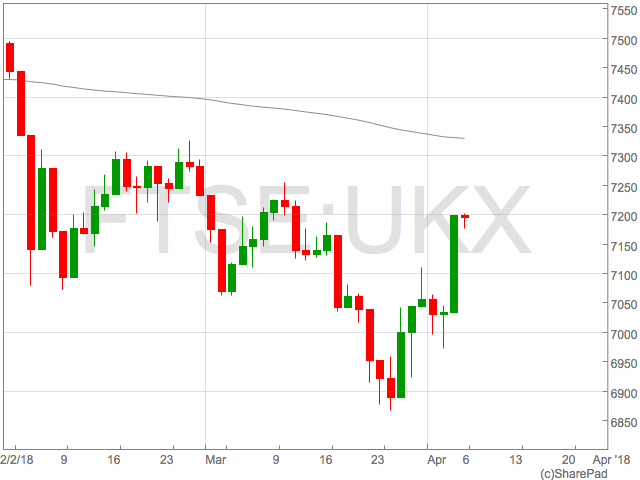

FTSE 100 flat after Non-Farm Payrolls as dollar adds to gains

The United States added 103,000 jobs in March, falling well short of the 193,000 expected.

Despite the big miss on the headline figure the US jobs picture remains relatively robust with unemployment steady at 4.1%.

Analysts at Faraday Research noted downward revisions to previous months releases but the market took the disappointment in it’s stride with US equity futures little changed.

Today’s move sustains a week of gains for the FTSE 100 which managed to shrug of the fears of a trade war and continue its rebound from sharp declines through February and March.

FX markets remained subdued with GBP/USD showing no signs of breaking the tight range 1.4000-1.4100 in has traded in for most of the week.

“Currency markets have taken on the role of a casual observer, with the initial trade war firing shots taking place on the equity market battlefield,” said Viraj Patel, strategist, ING Bank NV.

Today’s move sustains a week of gains for the FTSE 100 which managed to shrug of the fears of a trade war and continue its rebound from sharp declines through February and March.

FX markets remained subdued with GBP/USD showing no signs of breaking the tight range 1.4000-1.4100 in has traded in for most of the week.

“Currency markets have taken on the role of a casual observer, with the initial trade war firing shots taking place on the equity market battlefield,” said Viraj Patel, strategist, ING Bank NV.

In the immediate aftermath the FTSE 100 rallied back to flat for the day while the dollar index added to gains.Adding to the NFP disappointment, there were -50k negative revisions to the last two months’ reports.

— Faraday Research (@FaradayResearch) 6 April 2018

Today’s move sustains a week of gains for the FTSE 100 which managed to shrug of the fears of a trade war and continue its rebound from sharp declines through February and March.

FX markets remained subdued with GBP/USD showing no signs of breaking the tight range 1.4000-1.4100 in has traded in for most of the week.

“Currency markets have taken on the role of a casual observer, with the initial trade war firing shots taking place on the equity market battlefield,” said Viraj Patel, strategist, ING Bank NV.

Today’s move sustains a week of gains for the FTSE 100 which managed to shrug of the fears of a trade war and continue its rebound from sharp declines through February and March.

FX markets remained subdued with GBP/USD showing no signs of breaking the tight range 1.4000-1.4100 in has traded in for most of the week.

“Currency markets have taken on the role of a casual observer, with the initial trade war firing shots taking place on the equity market battlefield,” said Viraj Patel, strategist, ING Bank NV. UK car sales plunge 15pc

Sales of new cars in the UK plummeted in March, down by 15.7 percent compared with March last year.

Figures from the Society of Motor Manufacturers and Traders (SMMT) showed the biggest drop in demand since April 2017 and point toward the broader trend seen over the past year.

Mike Hawes, chief executive of SMMT, said: “Consumer and business confidence has taken a knock in recent months and a thriving new car market is essential to the overall health of our economy.”

“This means creating the right economic conditions for all types of consumers to have the confidence to buy new vehicles,” he added.

The knock on sales has taken a particular dent from the fall in demand for diesel cars. Sales in diesel cars dropped 37.2 percent in March.

March regularly sees positive results, driven by the higher demand for the new number plates. However, Hawes said it would have been difficult to beat last year.

“March’s decline is not unexpected, given the huge surge in registrations in the same month last year,” he said.

“Despite this, the market itself is relatively high with the underlying factors in terms of consumer choice, finance availability and cost of ownership all highly competitive. Consumer and business confidence, however, has taken a knock in recent months and a thriving new car market is essential to the overall health of our economy.”

Despite the fall in diesel car sales, the sale of petrol and plug-in and hybrid sales increased in March by 0.5 percent and 5.7 percent respectively.

“All technologies, regardless of fuel type, have a role to play in helping improve air quality while meeting our climate change targets, so government must do more to encourage consumers to buy new vehicles rather than hang on to their older, more polluting vehicles,” said Hawes.

Rank group shares fall 15pc amid profit warning

Shares in Rank group (LON: RNK) tumbled 15 percent to a three-year low following a profit warning on Thursday.

The leisure group announced profits of £77 million, as opposed to the analyst expectations of £83 million.

“The board is cautious about the UK consumer outlook and as a result expects venues to continue to be impacted for the remainder of the 2017-18 financial year and into 2018-19,” said the Rank.

The group have blamed poor weather for the falling number of visitors in Mecca bingo halls, which declined by two percent in the 13 weeks to 1 April. Visiting numbers have fallen by nine percent at Grosvenor Casinos.

Revenues at the group’s digital business did better and the group saw a 17 percent rise over the period.

“Both UK venues businesses have been impacted by weaker than expected visits which have been compounded by two periods of cold weather. Grosvenor Casinos’ underperformance has also been exacerbated by a negative contribution from its VIP players,” said Rank.

Rank group are hoping to counter the recent decline in consumer spending and launched a high street bingo chain called Luda. Luda, which is also a coffee shop and bar, is aimed at a younger audience and has three branches with mixed results.

The poor results for the group come at a difficult time. The chief executive, Henry Birch, announced last month he was leaving Rank to run the online retailer Shop Direct.

The decline in consumer spending has hit the high street this year, also affecting the restaurant sector. Restaurant chains including Jamie’s Italian and Prezzo have axed a large number of stores.

Shares in Rank closed at 180 pence on Thursday – the lowest since February 2015.

Pamm Beverages has launched Ginger & Citrus as well as Ginger & Pineapple non-alcoholic juice drinks

Pamm Beverages is medium -scale juice drink limited company that is located in London and an online independent beverage wholesaler distributor.

The brand launch is focused to meet the demand of the market for unique flavours and healthy juice drinks.

A new range of two deliciously exotic juice drinks comes with distant peppery sweet taste, to revitalize yourself inside with a rich source of antioxidants vitamins c and low sugar. This excellent mix juice drink creates a great taste for making various new wine cocktail and cocktail mixer for a long drink.

The beverage comes as a non-alcoholic juice drink, it will be made from Australian ginger roots pairing with citrus and pineapple concentrate juice drinks, product are available in 275ml glass bottles with plastic screw cap.

All ingredients are natural ingredients. Both juice drinks are going to give consumers another option of luscious and unique in taste as well as health benefits.

Our juice drink is a good source of health diet with hectic and busy lifestyle, people are now more interested to be physically fit and healthy.

The overall goal of this brand is to develop juice drink that will be accepted by individuals of all ages in the following segments based on teens, younger working individuals, adults, elderly.

Most importantly, Pamm beverages is designed to be able to meet the needs of simple dinners, parties, events, and every kind of occasions, just as they are going to every available hotels, pubs, airport, restaurants, supermarket stores and international.

Pamm beverages create a pleasant, enjoyable and refreshing quality juice drinks sourced by SALSA production company UK. we are sensitive to the taste, look and feel of good healthy juice drink, we provide healthier taste, mellow and refreshing juice drink flavours with great nutritional energy.

Hence our value proposition is to sell the benefit of enjoyment to our various consumers at reasonable prices.

Pamm beverages is planning a crowdfunding raise to fund further production expansion.

Please visit Pamm Beverages here.

AdEPT shares up 5pc on strong predicted figures

AdEPT Telecoms (LON:ADT) saw shares rise nearly 5 percent on Thursday morning, after confirming that its underlying earnings are likely to be slightly ahead of market expectations.

Markets had expected a 23 percent rise year-on-year, meaning underlying earnings have risen significantly over the past year to beat targets. Turnover is also expected to be above market consensus expectation of a 29 percent rise year-on-year.

The firm said it recommended an increased final dividend of 4.50p per share, up from 4.00p in 2017, taking total dividends for year to 8.75p per share, up 13% over the prior period.

AdEPT also said that the deferred consideration of Our IT Department Limited of £3.65 million will be paid in early April 2018.

Shares in AdEPT (LON:ADT) are currently up 4.28 percent at 338.90 (1022GMT).

Strong figures in Europe tempered by weakness in Italy

European countries reported strong figures on Thursday, with Spain and Germany both reporting growth, tempered only slightly by a softening in Italy’s manufacturing sector.

Spain

Spanish service providers recorded the fastest rise in employment in 11 years at the end of the first quarter of 2018, according to IHS Markit figures, with business activity also continuing to increase sharply. The headline seasonally-adjusted Business Activity Index fell marginally in March to 56.2 in March, down slightly from 57.3 in February but still signalling a sharp monthly increase in activity across the service sector.Germany

Performance in the German manufacturing sector increased by 0.3 percent in February, according to figures released on Thursday by the Federal Statistical Office (Destatis). Price-adjusted new orders without major orders in manufacturing decreased by 0.7 percent in February 2018, with domestic orders decreasing by 1.4 percent. However, foreign orders increased by 1.4 percent in February on the previous month.Italy

Italy was the weakest link in the European chain, with its service sector suffering a noticeable slowdown in growth during March. Both activity and new work rose at the weakest rates since last October. Employment also rose at a slower pace and cost inflation weakened further, while competitive pressures led to a decline in prices charged.Winners announced in Ofcom’s 5G race

Winners have been announced in Ofcom’s bidding war for the 5G spectrum, with most of the major UK telecoms providers splashing out big bucks for a slice.

BT Group confirmed on Thursday that it had secured 40MHz of the spectrum needed to launch 5G services in the future, at a cost of £302.6 million.

Marc Allera, CEO of BT’s Consumer Division, said:

“The acquisition of 40MHz of 3.4GHz spectrum positions us well for our launch of future 5G services and consolidates our position as one of the world’s leading providers of communications services.

“With this outcome, we’ll continue to roll out the fastest 4G service to consumers and businesses across the UK, and now look ahead to the potential new services that 5G will offer, keeping our nation at the forefront of digital communications.”

Vodafone UK also confirmed that it had acquired 50 MHz of spectrum in the 3400 MHz band, for a total cost of £378.2 million. The spectrum acquired has a 20-year term and is convertible to perpetual licences thereafter.

Three owner Hutchison also picked up 20 MHz of 3.4 GHz spectrum for £151 million, with O2 parent Telefonica winning all 40 MHz of the 2.3 GHz spectrum available at £206 million.

Ofcom’s Philip Marnick commented: “As a nation we’re using ever more mobile data on smartphones and mobile devices. Releasing these airwaves will make it quicker and easier to get online on the move. It will also allow companies to prepare for 5G mobile, paving the way for a range of smart, connected devices.”

Homeserve shares rise as profit comes in ahead of 2017

Emergency repairs business Homeserve said adjusted profit before tax for the year was likely to come in well above last year’s figure, boosted by a customer increase and strong performance in North America.

The emergency home repairs business said customers had increased to 8.4 million from 7.8 million last year, with the group’s retention rate remaining at 82 percent.

Adjusted profit before tax is expected to be in line with market expectations and significantly ahead of the £112.4 million reported in 2017.

Net debt at 31 March 2018 was around 1.3x EBITDA (earnings), in line with expectations and within the group’s target leverage range of 1.0 to 1.5x.

Homeserve benefitted from strong second half performance in North America, as well as the integration of Utility Service Partners and the acquisition of the policy book of Dominion Products and Services.

Shares in Homeserve (LON:HSV) are currently trading up 1.03 percent at 737.50 (0828GMT).

Car registrations sink 15pc in March

The UK car market took a hit in March, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT).

UK car registrations were down 15.6 percent year-on-year in March, with demand for diesel vehicles dropped significantly over the month, down 37 percent. In contrast, demand for petrol cars rose by 1 percent.

These disappointing figures follow on from those at the end of 2017, that showed new car sales falling for the first time in six years. Car sales decreased by 5.7 percent over the year to around 2.5 million vehicles.

However, it must be remembered that March of last year was a record month, as consumers and businesses snapped up new vehicles ahead of a change in Vehicle Excise Duty the next month.

The full data will be published later on Thursday morning by industry body SMMT.

Demand for diesel cars plunged by 17 percent last year, meaning the pace of decline for such vehicles in March has more than doubled.