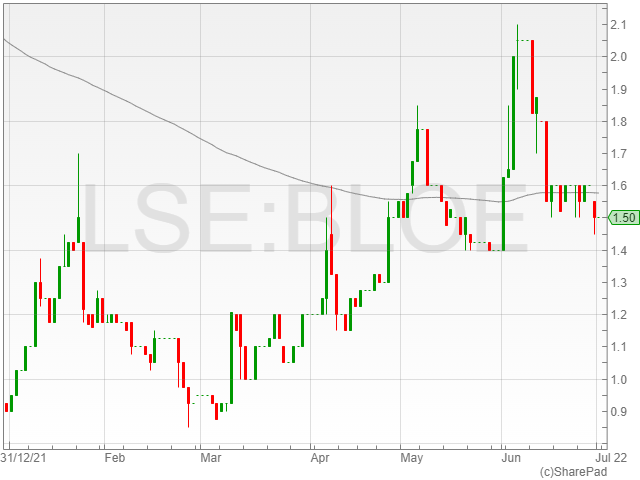

The share price of health products and diagnostic services supplier Goodbody Health Inc (LON: GDBY) has recovered by 11.1% to 1.5p during the week. The share price is still 58.3% below the level at the beginning of 2022.

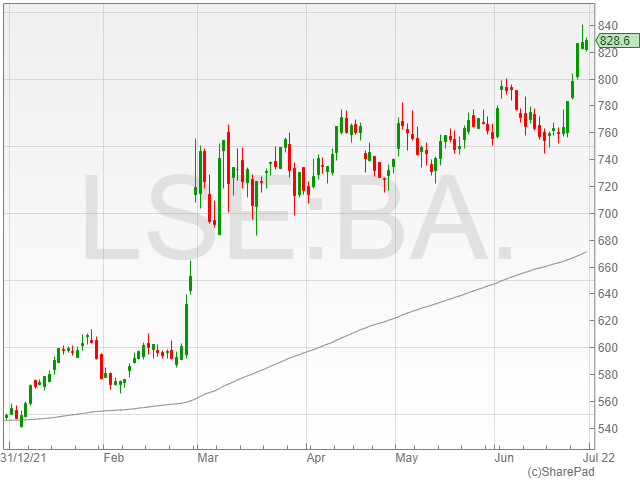

Shepherd Neame (LON: SHEP) issued a full year trading statement and the share price edged up 0.9% to 812.5p. The Kent-based brewer and pubs operator says revenues are recovering and Peel Hunt forecasts a return to profit in 2021-22. Net debt was reduced from £93.2m to £75.3m by the end of June 2022. The estimated 2021-22 pre-tax profit of £7.2m is expected to improve to £9.6m in 2022-23, but that is a £900,000 reduction on the previous forecast prior to the trading statement.

==========

Fallers

Asimilar (LON: ASLR) is the largest faller on the week with a 20.8% decline to 10.5p. The technology investment company reported its interim figures, which show a £10.6m loss due to a sharp decline in the Dev Clever Holdings share price, which is currently suspended. Net assets were 25.3p a share at the end of March 2022. A relisting of All Active Asset Capital could boost the NAV.

The departure of chief marketing officer Mark Harvey from Chapel Down Group (LON: CDGP) knocked 17.6% off the share price, leaving it at 21.5p. He has been with the wine maker for six years. The share price is well below last July’s fundraising price of 59.5p. There was £9.2m in the bank at the end of 2021, so Chapel Down should not require any more cash to finance further vineyard planting.

Blockchain and digital assets investor KR1 (LON: KR1) has fallen by three-quarters so far this year, including a 16.9% decline to 24.5p this week. Net assets were 423% higher at 122.68p a share at the end of 2021, but that figure is likely to be lower now given the weak cryptocurrency market this year. There was £3.49m in cash on the balance sheet.

There was profit taking in Valereum (LON: VLRM) and the shares fell 15.8% to 24p.

Energy storage technology developer Invinity Energy Systems (LON: IES) generated revenues of £3.2m in 2021. VSA has cut its forecast for 2022 revenues from £26.5m to £14.1m. There are already contracts won valued at £13.8m. The loss is expected to reduce from £21.3m to £17.9m. There should still be net cash of £10m by the end of 2022. The share price fell 15.1% to 45p

S-Ventures (LON: SVEN) shares also fell by 15.1% to 31p. The organic snacks supplier generated interim revenues of £4.1m, while the loss was £815,000. S-Ventures has subsequently acquired Market Rocket Ltd.