Poor sales progress and the need for more funding has hit the Shield Therapeutics (LON: STX) share price, which had already been plummeting. It fell a further 38.5% to 7.375p. Shield Therapeutics launched its Accrufer iron deficiency treatment in the US last

July and sales are taking longer than initially indicated to build up. Having failed to raise money via a share issue, management has obtained a $10m loan from a major shareholder lasting until the end of 2023. This is secured on the US IP for Accrufer, which are the main attraction of the business. finnCap forecasts net debt of £20.9m by the end of 2023 and continuing cash outflows.

Cornerstone FS (LON: CSFS) is making progress with its strategy to consolidate and grow international payment businesses by using its own cloud technology. Gross margin has improved but the group is still loss-making. In fact, the interim underlying operating loss increased from £1m to £1.44m. The increase was greater if transaction costs and

share-based payment charges are included. There was cash of £348,000 at the end of 2021. Cash outflows, including capitalised software development, should reduce with further growth but financing growth will be difficult with the share price slumping 46.8% to 10.25p.

Kefi Gold and Copper (LON: KEFI)

says that the project finance syndicate for the Tulu Kapi gold mine has signed a funding umbrella agreement. The Ethiopian authorities have confirmed that the Tulu Kapi mining licence has not been cancelled. The plan is to launch the project at the start of the dry season in October. Kefi says that the intrinsic value of its assets, based on the net present values of the company’s three projects, is 9p a share. This does not appear to take account of any liabilities for the holding company. The share price jumped 43.2% to 0.7305p.

Oil and gas explorer Tower Resources (LON: TRP) shares have had a chance to react to last night’s news has secured a bank loan covering 40% of the $18m cost of the NJOM-3 well on the Thali block in Cameroon. The share price rose 17.7% to 0.3p. Estimates for the

NJOM-1 well are slightly higher than previously announced. The NPV10 of the mean recoverable case for the whole structure is $305m.

Ex-dividends

Anglo Asian Mining (LON: AAZ) is paying a 3.5 cents a share final dividend and the share price was unchanged at 97.5p.

Insurance businesses investor BP Marsh (LON: BPM) is paying a 2.78p a share final dividend and the share price fell 6p to 301p.

Duke Royalty (LON: DUKE) is paying a 0.7p quarterly dividend and the share price was unchanged at 35p.

Fluid power products distributor Flowtech Fluidpower (LON: FLO) is paying a 2p a share final dividend and the share price fell 0.25p to 117.75p.

Ideagen (LON: IDEA) shareholders are receiving a 0.29p a share dividend before the completion of the takeover of the software company. The share price fell 0.5p to 349.5p. The bid is 350p a share.

iEnergizer Ltd (LON: IBPO) is paying a 13.8p a share final dividend and the share price fell 21.5p to 455p.

Medical technology company Inspiration Healthcare (LON: IHC) is paying a 0.41p a share final dividend and the share price fell 9p to 88.5p. At the AGM, it was warned that ordering patterns could be second half weighted.

Learning Technologies Group (LON: LTG) is paying a 0.7p a share final dividend and the share price fell 4.55p to 111.05p.

Property investor Panther Securities (LON: PNS) is paying a 6p a share final dividend and the share price is unchanged at 295p.

Leather processor Pittards (LON: PTD) is paying a 0.5p a share final dividend and the share price fell 2.5p to 54p.

Real Estate Investors (LON: RLE) is paying a 0.81p a share quarterly dividend and the share price fell 0.25p to 34.5p.

Packaging manufacturer Robinson (LON: RBN) is paying a 3p a share final dividend and the share price is unchanged at 87.5p.

Oil and gas producer Serica Energy (LON: SQZ) is paying a 9p a share final dividend and the share price fell 8p to 286p.

Skillcast (LON: SKL) is paying a maiden dividend of 0.28p a share and the share price is unchanged at 24p.

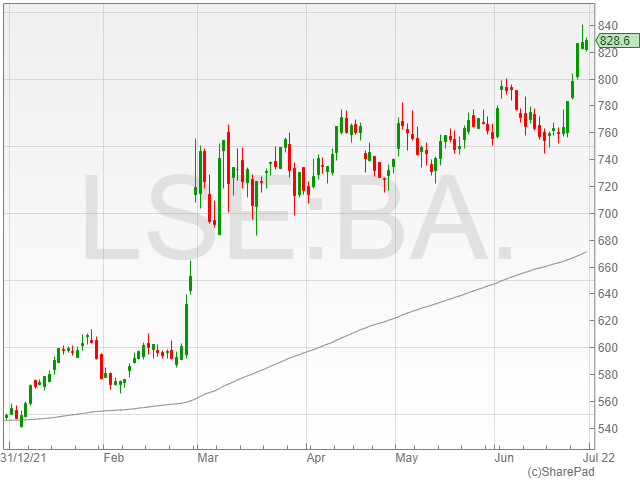

Smart Metering Systems (LON: SMS) is paying a 6.88p a share final dividend and the share price fell 21.5p to 826.5p.

Financial services business STM (LON: STM) is paying a 0.9p a share final dividend and the share price is unchanged at 24p.

Think Smart Ltd (LON: TSL) is paying a A$0.0414 a share dividend and the share price is unchanged at 24.5p.

Vertu Motors (LON: VTU) is paying a 1.05p a share final dividend and the share price fell 1.45p to 55.05p.

Oil and gas company Wentworth Resources (LON: WEN) is paying a 1.16p a share final dividend and the share price fell 1p to 23.5p.

Wynnstay Properties (LON: WSP) is paying a 14p a share final dividend and the share price fell 5p to 690p.