The FTSE 100 is up by 0.49% during the morning session on Friday to 7,046.11 as concerns over inflation are spreading across the world.

“It feels like fears over inflation have returned with a vengeance this week as central bankers increasingly struggle to mask their own nervousness about rising prices,” says Danni Hewson, financial analyst at AJ Bell.

Nonetheless stocks appear to be in a good mood this morning.

“Travel and hotel stocks trading firmly higher as traditional holiday destinations Ibiza, Majorca, Menorca and Formentera are added to the UK’s amber list and demand for staycations continues to surge,” said Hewson.

“Investors may be hoping for a number which is neither too hot nor too cold when the US reports retail sales figures later. If the reading is a lot higher than expected then there will be concern that the world’s largest economy is overheating but if the data is much weaker then there will be fears the recovery from the pandemic is being knocked off course amid mounting infection rates linked to the Delta variant.”

US reporting season is underway and the UK is soon to follow. This will help to give the markets some sense of direction as they continues to navigate the threats of inflation and Covid-19.

FTSE 100 Top Movers

Whitbread (3.9%), Intercontinental Hotels Group (3.53%) and DCC (3.23%) are leading the way with strong gains on the FTSE 100 as the weekend draws to a close.

Burberry (-4.12%), Just Eat (-3.43%) and Rio Tinto (-1.43%) have seen the biggest fall in the value of their shares this morning.

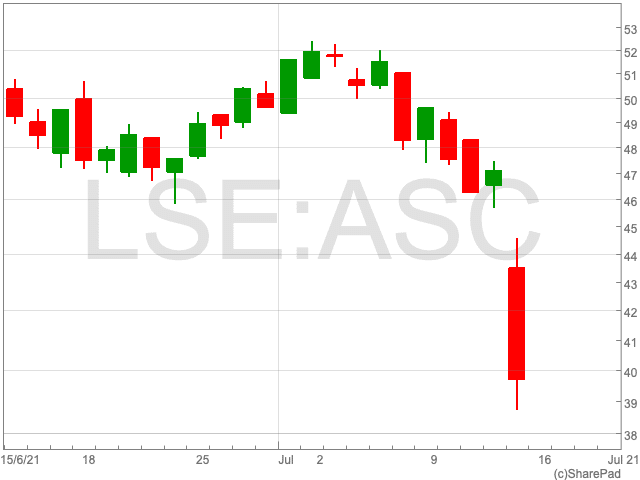

Rio Tinto

Rio Tinto is struggling to reach its full-year guidance for its iron ore operations as a weather conditions, a shortage of labour and ongoing cultural heritage management issues dragged on the miner’s performance.

The FTSE 100 miner confirmed in its quarterly update on Friday that it exported 76.3m tonnes of iron ore, a fall of 12% compared to the same quarter twelve months ago.

Burberry

Burberry sales surged back during Q1 of its financial year as its locations opened back up on the easing of restrictions.

The luxury fashion brand also noted that it is attracting younger customers, thanks in part to its collaboration with model Kendall Jenner.

GSK

GSK has set out plans to construct a new life sciences campus in the UK, one of the largest in Europe, as the pharmaceutical company attracted £400m of private investment.

The FTSE 100 company will raise the money by selling land in Hertfordshire and then turning it into a biotechnology campus.