Worry about market volatility due to the Brexit process was the reason 29% of people chose not to put money into their stocks and shares ISA this year. This was the second most common reason after not having the money to spare.

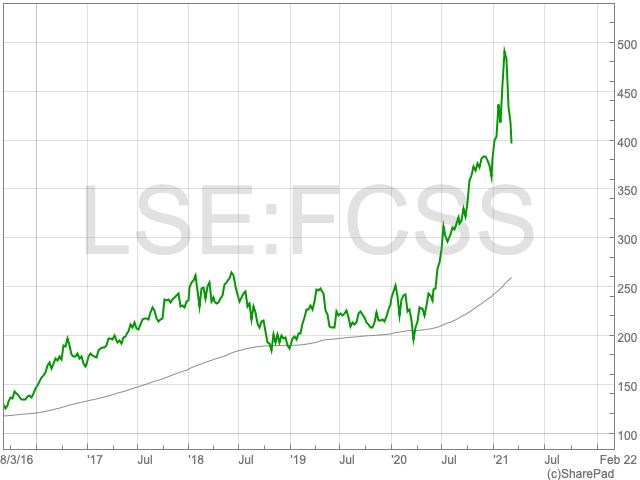

The FTSE All Share index has dropped by 9% from pre-pandemic February last year. However, in the meantime, it has dropped 31%, before climbing 27%, dropping and then rising again.

Sarah Coles, personal finance analyst at Hargreaves and Lansdown, outlined the behaviour of investors during the pandemic. “When markets plummeted at the outset of the pandemic, some investors were worried into selling up and retreating into cash. Others held back from investing this year’s ISA allowance. However, being put off by volatility means missing out on potential long-term growth. The FTSE 100 is down less than 10% from the pre-pandemic levels, plenty of funds and markets are up over this period, and we’re only a year down the line.”

Below, Coles outlines six strategies for investors during volatile times.

Diversification

Diversification allows an investor to manage risk and reduce the overall volatility of an asset’s price movement. Coles advises to “ensure you have a diverse portfolio that matches your objectives, and then hold on through the volatility for the long-term growth.”

“However, don’t assume your portfolio is diverse: revisit it. Over time, growth in some areas and falls in others can unbalance it, so check you’re comfortable with your holdings,” Coles adds.

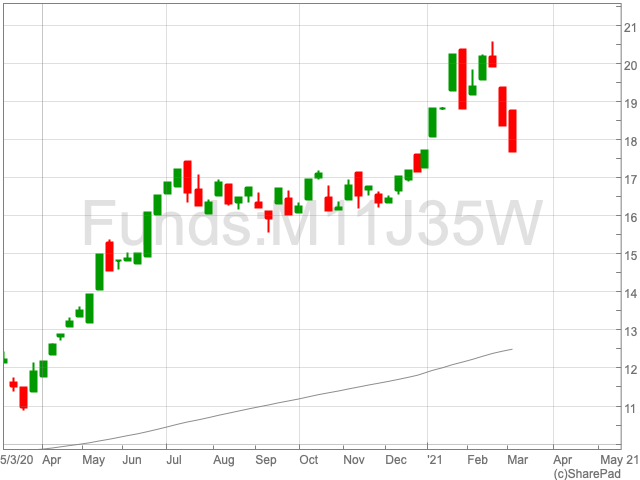

Buy Into Long-term Growth at a Good Price

When there is a market-wide dip, even high quality businesses are likely to experience a drag. This can be a good opportunity to purchase undervalued stocks.

“Some will have had their prospects fundamentally altered by the course of the pandemic, but those with sound fundamentals offer a potential buying opportunity,” Coles argues.

Protect Your Allowance

Even if you don’t want to invest any or all of your money right away, you can secure your ISA immediately. Coles adds: “You can open a stocks and shares ISA and park the money in cash, then gradually drip feed it into stockmarket investments when it suits you best.”

Drip Feed

If you are only able to contribute a certain amount per month, Hargreaves and Lansdown offers a regular savings plan. “You can make payments from £25 a month, and then top up with lump sums throughout the tax year when it makes most sense for your finances,” says Coles.

Open a Lifetime ISA to Bag the Bonus

Even if you invest a minimum amount, opening a LISA (Lifetime ISA) can help you to keep your options open, according to Sarah Coles. “If you’re 39, open a LISA and put a small sum of cash in it. You may not have plans to buy a first property, you may own a home, you may already be saving in a pension, and you may be worried by market movements – and all of those things may have put you off. However, taking out a LISA now protects your right to have one, and pay into it any time before the age of 50. It keeps your options open in case your plans change and you want to take advantage of the government bonus. Failing to take one out before the age of 40 means you have lost the opportunity altogether.”

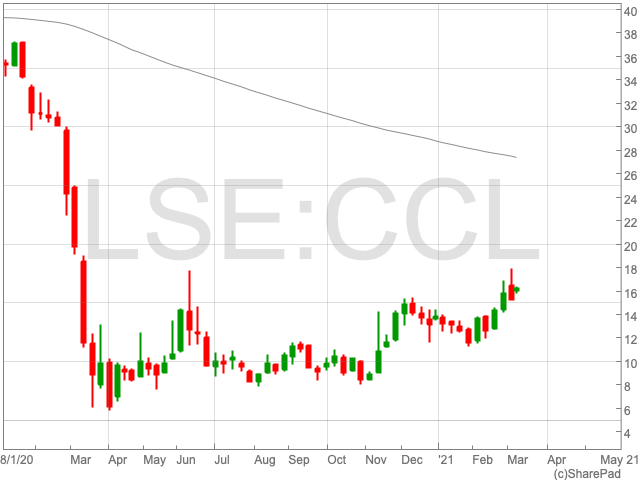

Consider ISA Income Alternatives to Pension

Dividends from pension funds have dropped over the past year, therefore it could be wise to look for an alternative source of income. Drawing money from one’s pension every month could be risky, says Cole: “You’re eating into a larger percentage of your pot when prices fall, and this will continue to have an impact even when it recovers. If you have ISAs alongside your pension, it gives you far more flexibility. You can draw the income tax free from stocks and shares ISAs to boost your income, or you could dip into cash ISAs to make up the shortfall, and refill the coffers when better times return.”