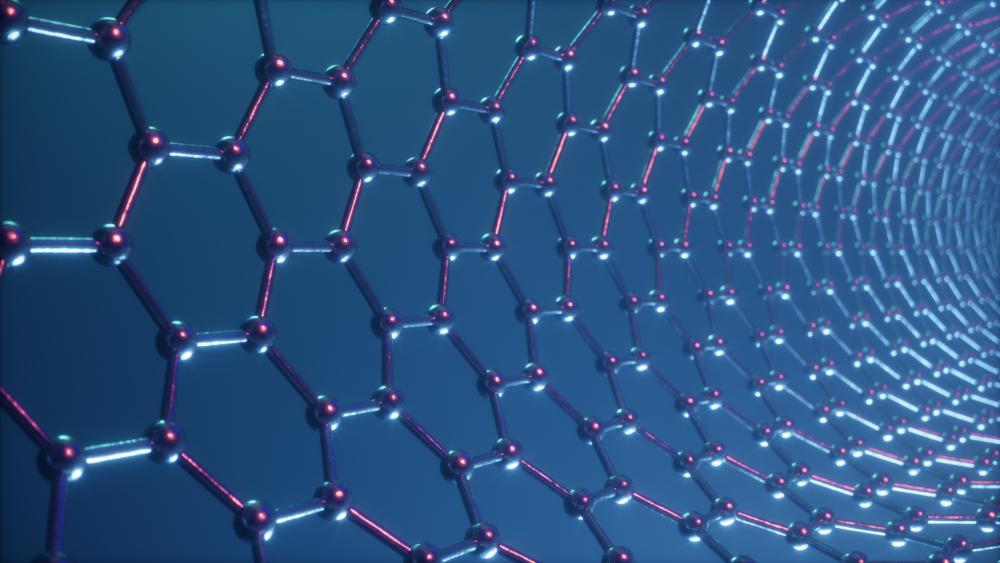

Advanced materials group Versarien PLC (LON: VRS) followed up its graphene order update at the end of June with exciting operational developments and mixed financial results for the year ended 31 March 2019.

@versarien is pleased to announce its unaudited results for the year ended 31 March 2019. Click for more information…https://t.co/05IbfHmDQr

— Versarien® plc (@versarien) July 17, 2019

https://platform.twitter.com/widgets.js

In its operational update, the Company acquired energy storage tech company Gnanomat S.L. and commenced thirteen new graphene application collaborations and MOU agreements in the UK and overseas.

The Group also announced that the UK government continued to support the Company’s international expansion plans, including the recent establishment of its US subsidiary, Versarien Graphene Inc.

Versarien continued by noting that it had joined the Graphene Engineering Innovation Centre as a tier one member, giving it access to development and scale-up facilities worth c.£60 million.

Regarding financials, the Group’s revenues rose modestly during the full year, up to £9.14 million from £9.02 million for the FY18. Adjusted LBITDA was also up from £0.8 million to £1.1 million, net assets jumped 66% from £8.0 million to £13.3 million and the Company collected £5.2 million during its fundraising in September 2018.

Despite some positive results, the Group noted that loss before tax widened from £1.6 million to £2.8 million on-year, and share based payments charges grew from £0.1 million to £0.7 million.

Versarien comments

Commenting on the results, Company Chief Executive Officer, Neill Ricketts said,

“The year to 31 March 2019 has, again, been one of great progress for Versarien particularly in our emerging technologies businesses, globally and in the UK. The graphene businesses have delivered on our strategy of expansion into global markets and progress is being seen in our existing collaborations, as well as new collaborations being entered into. We look forward to showcasing our new technologies at future investor events.”

“Having spent some time examining opportunities for expansion into China, the Board concluded that the best one lies with BIGT and consequently signed a term sheet with them in April 2019. A wholly owned foreign enterprise is being established and will be managed by BIGT on behalf of Versarien, with planned investment from a BIGT managed fund. BIGT will focus on both the manufacture and sale of our graphene in China using our patented technology. “

“Opportunities in South Korea, Japan and India are emerging as a result of the support given to us by the UK Government seconded staff and we have established operations in North America, albeit they are at an early stage.”

“New graphene production equipment has been installed in the UK and is now up and running at our Cheltenham manufacturing site which will enable us to meet the initial expected demands of our graphene based products. Testing of new equipment is underway which, if successful, would expand our production capacity to up to 30 tonnes per annum of high quality graphene. Manufacture and sale of graphene at these levels requires certain permissions under EU regulations and I am pleased to report that we have been successful in our registration and are now accredited to produce significant volumes of graphene under the EU rules for chemical production.”

“Our mature businesses have focussed on efficiency gains and overall have returned acceptable results whilst also looking at opportunities for inclusion of graphene in their future products. This includes using graphene in headphones and mobile phone cases, through to producing Hexotene enhanced ceramics for use in satellite engines.

Investor notes

The Company’s shares rallied 3.26% or 3.8p to 120.3p a share 17/07/19 14:08 BST.

Elsewhere in the mining and minerals sector, recent updates have come from; Rio Tinto plc (LON: RIO), Bushveld Minerals Limited (LON: BMN), Kavango Resources PLC (LON: KAV), Anglo Asian Mining plc (LON: AAZ), Anglo Asian Mining plc (LON: AAZ) Pan African Resources (LON: PAF), Keras Resources PLC (LON: KRS) and Jubilee Metals Group PLC (LON: JLP).