Landsec posts £835m loss – CEO remains confident

Interview with Mode Banking Executive Chairman, Jonathan Rowland

Mode Banking Executive Chairman Jonathan Rowland joins the UK Investor Magazine Podcast to discuss recent progress at Mode and their plans for the future.

Mode Group Holdings (LON:MODE) has recently listed on the LSE Standard List raising £7.5m to fund the growth of their Digital Asset Banking App that harnesses Open Banking systems.

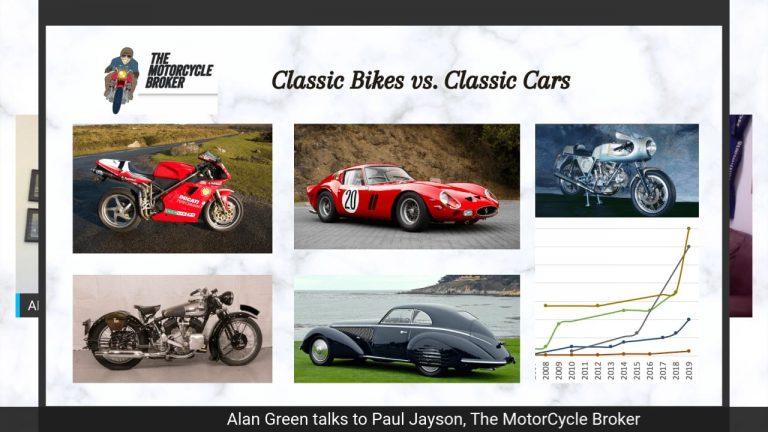

Classic Motorcycles or Classic Cars? Which offers better returns?

In a recently recorded interview, Brand Communications CEO Alan Green and The Motorcycle Broker Paul Jayson look at the investment returns from some of the great classic motorcycles and cars over recent years.

Average investment returns for classic cars over 15 years from the Coutts Passion Index are discussed, before Alan and Paul look at some examples of investment returns from rarer machines, including the Ferrari 250 GTO, Alfa Romeo 8C and 6C, Aston Martin DB4, Ducati 916 Carl Fogarty race bike, Ducati 750SS Green Frame, Brough Superior, Vincent Black Lightning and Honda CBX 1000. Paul looks at some of the pitfalls for prospective classic motorcycle purchasers, and emphasises the importance of machine provenance and originality before the purchase.

Ahead of the next episode covering potential dark horse classic motorcycle investments for the coming decade, Paul talks about the amazing Allen Millyard Kawasaki 1000 four cylinder two stroke.

Arena Events remains in strong financial position, despite Corona impact

Persimmon reveals plans to pay extra dividend

ONS: Unemployment reaches four-year high

Premier Foods raises profit outlook on strong demand

UK house sales enquiries dropped by 32% in 2020

Sunak announces ‘green gilts’ to bolster government’s low-carbon investment

“Markets are currently rife with ‘greenwashing’, and we’ve seen the farce of high-carbon corporations such as oil companies and airports issuing supposedly ‘green’ bonds. We need to make sure that these green government bonds are actually used for ambitious investment in a just green transition.”

“The Bank of England could also help support a fair green recovery by buying up green gilts through its quantitative easing programme, which is currently skewed towards high-carbon companies, including the likes of Shell and BP. Although there is high demand from private investors for sovereign green bonds, the Bank could divest from polluting companies and reinvest funds in these new green government bonds.”