Two Investment Trusts for the UK’s economic recovery

The attraction to the JPMorgan Smaller Companies Investment Trust stems largely from the trusts focus on the UK consumer. However, with a backdrop of COVID-19 causing concerns about consumer confidence in the short-term, we see strength in the trusts exposure to specialist consumables. The trust again holds Games Workshop whose inelastic demand from enthusiasts is unlikely to see any major problems in the near term. It also holds Future plc, the specialist media company who commands loyal communities of users and readers with titles such as FourFourTwo, Horse & Hound and the official magazines for Xbox and Playstation. Specialist titles such as these provide contextual opportunities for advertisers meaning Future can see step much of the reduction in advertising spend associated with newspapers and more general publications. Other consumer companies such as Dunelm and Pets at Home also fall into the specialist sector but retail exposure may mean the market asks questions of the shares going forward. With a 14% discount to NAV, JPMorgan Smaller Companies Investment Trust provides an attractive exposure to growing UK companies that have taken COVID-19 in their stride.

Ferguson shares up 7% as it reinstates dividend

Ferguson response

Speaking on the update, company Chief Executive, Kevin Murphy, commented: “We have delivered a strong performance in 2020, which given the global pandemic has highlighted the resilience of our business model. Early in the crisis we moved decisively to protect the health and wellbeing of our associates while continuing to serve our customers supporting critical infrastructure. We have rapidly adjusted our ways of working to adapt to this new operating reality while taking action to lower the cost base. We have also managed working capital and capital expenditure which alongside the strong profit delivery has led to an excellent cash performance.” And looking towards the future, he added: “[…] It is impossible to predict the future progress of the virus, or its economic impact and we expect the current levels of uncertainty to continue for the foreseeable future. However, the fundamental aspects of our business model remain attractive and since the start of the new financial year Ferguson has generated low single digit revenue growth in the US in flat markets overall. While we remain cautious on the outlook for the year as a whole, the business is in good shape and well prepared to address any further market related disruption.”Investor notes

Following the update, Ferguson shares rallied 6.85% or 508.00p, to 7,924.00p apiece 29/09/20 12:00 GMT. Analysts have a majority ‘Hold’ stance on the company, alongside a 6,541.00p consensus target price, and the Marketbeat community offering a 52.97% ‘Outperform’ rating on the stock. The company has a p/e ratio of 18.45, ahead of the industrials sector average of 11.35.B&M European shares rally 5% as shopper spending sees revenues up 25%

The company added that it expects first half EBITDA to be above the guidance range of £250 million to £270 million, at £285 million.

Other positive news included the opening of nine new B&M UK stores, which after closures brings the number up by one. Similarly, the company said it expects to open 40 to 45 new stores in the UK, most of which will be in the fourth quarter.

B&M European continued, stating that its Heron Foods convenience store chain, had enjoyed like-for-like sales growth, alongside six net new store openings.It added that its Babou stores in France reopened on 11 May 2020, with H1 revenue standing at €156.8 million and a ‘small positive’ EBITDA outturn. Overall, it said 37 stores were trading under the B&M brand at the end of H1.

B&M response

Speaking on the results, Chief Executive, Simon Arora, comments:“Our Group has performed well in the first half. Our business model is proving well-attuned to the evolving needs of customers, given our combination of everyday value across a broad range of product categories being sold at convenient out-of-town locations.

Our people have risen to the many challenges posed by the COVID-19 crisis, not least in serving our customers through a period of high demand, keeping our shelves filled, providing a clean and safe shopping environment, as well as sourcing higher volumes than we had planned. I thank them all for their commitment, hard work and resilience.”

Investor notes

Following the update, the company’s shares rallied 4.76% or 23.32p, to 513.72p apiece 29/09/20 11:30 BST. Analysts also have a majority ‘Buy’ rating on B&M European stock, a consensus target price of 452.62p, and with Marketbeat‘s community offering a majority ‘Outperform’ stance on the company. The Group also has a p/e ratio of 25.15.BoE: Mortgage approvals hit 13-year high

Cairn Energy shares dip as it swings into loss

Card Factory shares steady despite loss

Greggs shares fall as group takes August hit

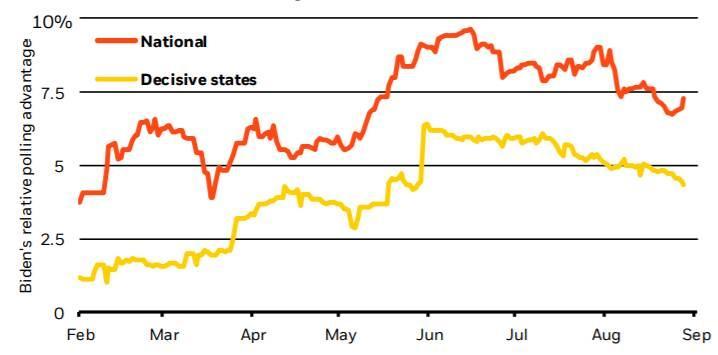

BlackRock says Biden lead stable ahead of ‘consequential election’ debate

Blackrock identifies three policy areas to watch

As far as policy differentiations are concerned, we might see Trump and Biden as diametrically opposed, but BlackRock notes three particular divergences to take note of. First, and crucially: fiscal policy. The company says that under a Democrat clean sweep, the likelihood would be a new round of fiscal stimulus to spend on clean energy, transport and housing, as well as tax increases for companies and the wealthy. A Biden win with a Republican Senate would see less ambitious fiscal stimulus and infrastructure spending, alongside fewer tax changes. BlackRock’s commentary adds that: “The net difference in fiscal spending between the two scenarios could be several percentage points of GDP over each of the next few years, we estimate. Fiscal spending under a second Trump term would be somewhere in the middle between those two scenarios.”On the second policy issue, geopolitics, BlackRock states that under either scenario, a Biden win would likely mark a return back to ‘predictable’ trade and foreign policy, which would support emerging market assets and broader risk sentiment in the short-term. The company also believe that a Biden victory would not greatly impact US-China relations, as there is now bi-partisan support for a competitive stance on China in regard to tech, trade and investment. However, one big change would involve the US spear-heading the green stimulus effort.

BlackRock states that: “The U.S. would likely immediately rejoin the Paris Agreement and increase its emissions reduction goals. Its fiscal plans could help supercharge a globally coordinated green stimulus effort, adding to recent efforts by the European Union. A Trump win, by contrast, would likely lead to a doubling-down of the “America First” stance on trade and immigration.”

Finally, the company disregards the ‘tax-centric’ election logic, which states that a Democratic clean sweep would be seen as a market negative. Instead, in such an instance, BlackRock believes that investors would have to deal with higher taxes and tighter regulation, but that this would be balanced out by predictable foreign policy and greater fiscal support. The main implications, they say, will be in fixed income and leadership in equity markets, with long-term rates being pushed high and leading to a ‘modest steepening’ of the Treasury yield curve.

Also, while additional tax and regulations might pressure high cap companies, domestically-oriented small cap firms might benefit the most. Blackrock finishes by saying that:“This scenario would add to reasons to prepare for a higher inflation regime and reinforces our strategic underweight of developed market nominal government bonds. The tectonic shift to sustainable investing will likely persist regardless of the result, but could be supercharged under a Democratic sweep scenario.”

What BoE negative interest rates would mean for savers and entrepreneurs

Bank of England will have little interest in savers

Aside from being the mainstay of financial prudence, saving will be at the bottom of the agenda for the UK’s central bank. Instead, as is the way with most economic recoveries, the preferred route is to encourage people to spend the economy out of a slump. And, while this may sound like a cheerier alternative to the fiscal retrenchment focus the UK took following the 2008 crash, it certainly isn’t something to celebrate as a saver. In the process of trying to increase liquidity, banks will be told to encourage their customers to go out and use their money, rather than save it. As stated by IW Capital CEO, Luke Davis:“A policy maker at the Bank of England has defended the potential use of negative interest rates, calling results from other countries ‘encouraging’. The move could effectively mean that savers pay to have their money with banks and are incentivised to borrow money and increase their spending.”

And it isn’t just your average saver’s account that will see consumers lose rather than gain money. Indeed, other vehicles which typically offer income for putting your money aside, such as bonds, will likely see participants lose, rather than gain money.

“Many government bonds and investments are already offering investors what are effectively negative returns on their capital once inflation and other factors have been taken into account.” says Mr Davis.

Andrew Bailey’s words in favour of negative interest rates, having previously been opposed to them, has seen ‘record numbers’ of investors turn towards equities and alternative assets such as gold.Negative interest rates positive for new beginnings

While certainly true that negative interest rates are harmful for all those currently trying to save for a house, holiday or other costly venture, they are good news for anyone willing to roll the dice and borrow money to get a new project started. Mr Davis believes that part of the paradigm shift that could be witnesses, will be the move in focus from what were previously thought of as ‘safe’ assets, to illiquid assets. The main thing to note, however, is that negative rates mean that it is the opportune moment to borrow money. One way people could capitalise on this is to take advantage of both the stamp duty holiday and negative rates simultaneously (assuming such a situation comes to pass). On the other hand, banks are being increasingly stingy with mortgage application approvals – in some cases requiring a 20% deposit for properties where they would traditionally only ask for half that level of commitment. Another way to take advantage of cheap borrowing would be to either expand or start up a business. This, Mr Davis states, is the perfect time for start-ups and SMEs to continue adapting, and take advantage of the opportunities offered by an economic rebound:“There are a huge number of SMEs that have adapted quickly to the pandemic and the changes it has ushered in. Many are now primed to grow, create jobs and increase value for investors. There is huge volatility in markets at moment which is putting some investors off – but thinking long-term can offer a refreshing change of perspective.”