FTSE 100 jumps on economic recovery hopes

UK and Coronavirus – reviewing a difficult week for Boris’s government

Any hope of enforcement?

On Friday, Home Secretary Priti Patel did offer some semblance of tangible policy, with the implementation of self-quarantine for arrivals into the UK. The new measure will mean those coming into the country will have to self-quarantine for 14 days, effective from the 8th of June, with failure to comply resulting in a £1,000 fine. The quarantine policy will not apply to those travelling from the Republic of Ireland, the Channel Islands and the Isle of Man and will exempt lorry drivers, seasonal farm workers and Coronavirus medics. Unfortunately, the system will be enforced by way of ‘random spot checks’, and will likely end up being as strictly implemented as the government’s consistently vague advice on going outdoors. Also, after a challenging week of backtracking on fees for overseas NHS workers, any hope of continued clarity in Ms Patel’s announcement was dashed as the Home Secretary was flustered by a question from The Independent, who asked whether the visa extensions offered to overseas doctors and nurses would also be afforded to hospital porters and cleaners.Flouting his own guidelines

The government’s bumpy end to the week was made worse, as allegations of Dominic Cummings flouting isolation rules were made public. A spokesman for Durham Constabulary said, “On Tuesday, March 31, our officers were made aware of reports that an individual had travelled from London to Durham and was present at an address in the city.” “Officers made contact with the owners of that address who confirmed that the individual in question was present and was self-isolating in part of the house.” “In line with national policing guidance, officers explained to the family the guidelines around self-isolation and reiterated the appropriate advice around essential travel.” At the time, Cummings had been reported as self-isolating with symptoms of Coronavirus, having made recent contact with both Matt Hancock and Boris Johnson, both of whom had tested positive for the virus. The allegations follow sightings of the Number 10 advisor outside of his parents’ house. They not only represent a contradiction of the advice issued by the government, but a replication of behaviour which has seen other high profile officials being forced to resign.Back to school, or not?

The party’s rocky end of the week was exacerbated again by continued resistance to primary school children returning to school. Despite popular desire for life as normal to resume, the Teachers’ Union disputed reports by the Sun newspaper, which framed findings from the SAGE scientific advisory group as clearly indicating the reduced risk factors of young children being exposed to Coronavirus. “It will quickly become clear to anybody reading the papers that the science is not definitive,” said Geoff Barton, leader of the ASCL heads teachers’ union. “The papers highlight the significant gaps in evidence, knowledge and understanding,” said Patrick Roach, leader of the Nasuwt teachers’ union. The mood of the general public seems to be equally ambiguous, with some saying it should be the parents’ prerogative to allow their children to return to school if they see fit, while others have argued that the benchmark for returning to normality should be set by MPs returning to Commons.Holyrood-Westminster divergence

Much like Wales, the Scottish government’s approach to the virus is becoming more diametrically opposed to that of Westminster as the days pass. After announcing an additional £50 million in social care support funding last Tuesday, on Thursday Nicola Sturgeon published plans to start relaxing the country’s quarantine from next week, having maintained its restrictions on outdoor activities and travel more than a week beyond their English counterparts. On Wednesday, the Scottish government also followed the example of Wales, Denmark and France, and said they too would not be offering financial support to companies based in tax havens. The proposals were initially tabled and then amended by the Scottish Green Party, before being backed by both the SNP and Scottish Conservatives. Speaking on the news, SGP co-leader Patrick Harvie commented, “Any company which avoids its responsibility to contribute to society should not be getting handouts when things go wrong. That’s why many European nations and Wales have already made this commitment.” “I’m delighted that ministers finally saw sense on this basic issue of fairness. This move isn’t the final word, but it marks the beginning of a new approach to tackling the companies which shamelessly avoid paying tax, and we will continue to build on what’s been achieved today.”Final thought

It has proven to be a difficult week for the Conservative party. On Friday we saw the likes of Ian Hislop take the PM to task on Have I Got News for You, as the Boris administration’s hesitance and negligence becomes accepted public discourse. As the founder of ‘Clap for Carers’ calls for the ritual to be ended – before it becomes an exclusively cynical, political device – Jacob Rees-Mogg encouraged MPs to return to Commons, and gee up the prime minister for next week’s PMQs. Unfortunately for the prime minister, the ‘turbo-charging’ and ‘ramping-up’ rhetoric appears increasingly hollow; his party lauds ‘NHS heroes’ one day and votes down NHS pay-rises the next. As we should see through his babbling veneer more and more with each passing day, Boris’s handling of Coronavirus should also see his hopes of a Churchill-esque legacy become a more and more distant dream.Investment grade artist – Richard Hambleton, proving real value to investor’s portfolios during turbulent times.

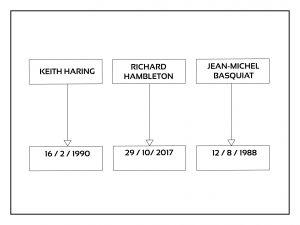

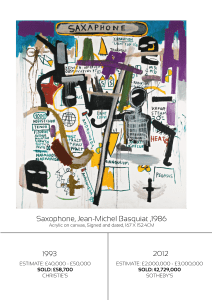

Jean-Michel Basquiat

Price increase of £2,670,300 in 19 years

Jean-Michel Basquiat

Price increase of £2,670,300 in 19 years

\

Richard Hambleton

Price increase of $312,600 in 12 years.

\

Richard Hambleton

Price increase of $312,600 in 12 years.

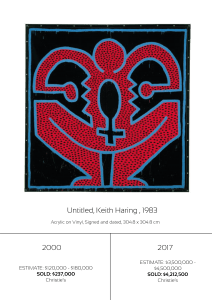

Keith Haring

Price increase of $3,975,500 in 17 years.

Keith Haring

Price increase of $3,975,500 in 17 years.

Once an artist passes their artwork becomes limited to an archive of artwork they created whilst they were alive. In this case, Hambleton’s artwork from the start of his career i.e. the 1980s is becoming much harder to source as investors are seeking these works to build up their collections.

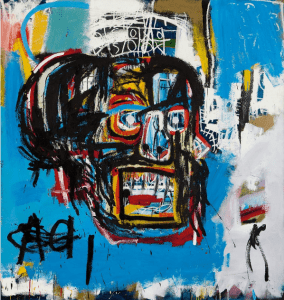

Below is Basquiat’s most memorable artwork originally sold for $19,000 in 1984 and progressed to sell for $110.5 million in the Sotheby’s auction in 2017.

Once an artist passes their artwork becomes limited to an archive of artwork they created whilst they were alive. In this case, Hambleton’s artwork from the start of his career i.e. the 1980s is becoming much harder to source as investors are seeking these works to build up their collections.

Below is Basquiat’s most memorable artwork originally sold for $19,000 in 1984 and progressed to sell for $110.5 million in the Sotheby’s auction in 2017.

To conclude, logic suggests that the Hambleton market will follow in the same footsteps as his predecessors Jean-Michel Basquiat and Keith Haring. Hambleton’s works have already seen some good capital growth since his death in 2017, the above artwork we showed is not a standalone example either. Investors and collectors worldwide are now stockpiling his work with a common-sense approach that it will rise in value in the coming years.

To conclude, logic suggests that the Hambleton market will follow in the same footsteps as his predecessors Jean-Michel Basquiat and Keith Haring. Hambleton’s works have already seen some good capital growth since his death in 2017, the above artwork we showed is not a standalone example either. Investors and collectors worldwide are now stockpiling his work with a common-sense approach that it will rise in value in the coming years. FTSE 100 led lower by financials with Hong Kong exposure

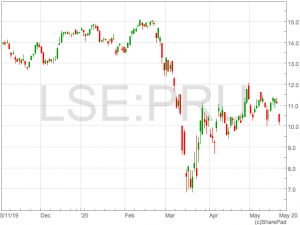

Following the demerger of M&G Investments, Prudential is highly reliant on Asian earnings and disruption in Hong Kong could be highly damaging to 2020 earnings.

Burberry was one of the top risers after the luxury brand said it had seen a strong rebound in Asian sales as demand returns after lockdown measures are lifted. Whitbread was also stronger as the Premier Inn owner rebounded following the announcement of a rights issue.

Following the demerger of M&G Investments, Prudential is highly reliant on Asian earnings and disruption in Hong Kong could be highly damaging to 2020 earnings.

Burberry was one of the top risers after the luxury brand said it had seen a strong rebound in Asian sales as demand returns after lockdown measures are lifted. Whitbread was also stronger as the Premier Inn owner rebounded following the announcement of a rights issue.

Despite falling on Friday, the FTSE 100 is now down just 20% in 2020 having rallied 20% from the 23rd March low. However, there are concerns that the market hasn’t fully priced in the risk of coronavirus on the economy.

“After the shock of the COVID-19 lockdown, we have to go through a regular recession with high unemployment, low capex, low demand and that’s not what’s priced in at the moment,” said Andrea Cicione, head of strategy at TS Lombard.

Despite falling on Friday, the FTSE 100 is now down just 20% in 2020 having rallied 20% from the 23rd March low. However, there are concerns that the market hasn’t fully priced in the risk of coronavirus on the economy.

“After the shock of the COVID-19 lockdown, we have to go through a regular recession with high unemployment, low capex, low demand and that’s not what’s priced in at the moment,” said Andrea Cicione, head of strategy at TS Lombard. Burberry sees ‘strong rebound’ in Asia

FTSE 100 retreats on China concerns and poor UK data

easyJet shares fly as flights set to resume in June

Johan Lundgren, easyJet CEO commented on the resumption of flights:

“I am really pleased that we will be returning to flying in the middle of June. These are small and carefully planned steps that we are taking to gradually resume operations. We will continue to closely monitor the situation across Europe so that when more restrictions are lifted the schedule will continue to build over time to match demand, while also ensuring we are operating efficiently and on routes that our customers want.

“The safety and wellbeing of our customers remains our highest priority, which is why we are implementing a number of measures to enhance safety at each part of the journey, from disinfecting the aircraft to requiring customers and crew to wear masks. These measures will remain in place for as long as is needed to ensure customers and crew are able to fly safely as the world continues to recover from the impact of the coronavirus pandemic.”

Johan Lundgren, easyJet CEO commented on the resumption of flights:

“I am really pleased that we will be returning to flying in the middle of June. These are small and carefully planned steps that we are taking to gradually resume operations. We will continue to closely monitor the situation across Europe so that when more restrictions are lifted the schedule will continue to build over time to match demand, while also ensuring we are operating efficiently and on routes that our customers want.

“The safety and wellbeing of our customers remains our highest priority, which is why we are implementing a number of measures to enhance safety at each part of the journey, from disinfecting the aircraft to requiring customers and crew to wear masks. These measures will remain in place for as long as is needed to ensure customers and crew are able to fly safely as the world continues to recover from the impact of the coronavirus pandemic.” Whitbread announces rights issue to navigate COVID-19

Dow Jones keen to rebound after Moderna vaccine doubts

The buoyant start for the US gave a boost to European equities, which had initially suffered a sluggish opening. The DAX rose 0.7% to 11,170, while the CAC followed with a 0.2% increase, pushing it past 4,450 points.

Speaking on the UK, Spreadex Financial Analyst Connor Campbell stated,

The FTSE was up 0.6%, pushing the UK index back towards 6050. This as the pound fell 0.2% against the dollar and 0.6% against the euro. The fact Bank of England chair Andrew Baily refused to rule out negative interest rates – like Fed head Jerome Powell appeared to do last week – likely aided the FTSE and hurt the pound. Meanwhile against the euro specifically a better than forecast consumer confidence reading from the across the Eurozone gave the single currency a boost – it was also up half a percent against the greenback.

Marks and Spencer profit drops as strategy shifts towards food

The acquisition of a stake in Ocado Retail was probably the highlight of this strategy shift and is already providing M&S with a return. M&S acquired a 50% stake in Ocado Retail in 2019 for £750m to help boost their food offering as clothing sales continued to disappoint.

Marks and Spencer recognised a £2.6m profit from it’s investment in Ocado Retail in the 7 months to 1st March.

Shareholders will be pleased with the early news from the Ocado acquisition as sales at Ocado Retail jumped 40.4% in the 9 week period to 6th May, due to lockdown restrictions causing rocketing demand for home deliveries.

The market took the results well and shares rose over 2% on Wednesday morning. However, Marks and Spencer shares are down 63% over the last year, seeing them lose their position in the FTSE 100.

The acquisition of a stake in Ocado Retail was probably the highlight of this strategy shift and is already providing M&S with a return. M&S acquired a 50% stake in Ocado Retail in 2019 for £750m to help boost their food offering as clothing sales continued to disappoint.

Marks and Spencer recognised a £2.6m profit from it’s investment in Ocado Retail in the 7 months to 1st March.

Shareholders will be pleased with the early news from the Ocado acquisition as sales at Ocado Retail jumped 40.4% in the 9 week period to 6th May, due to lockdown restrictions causing rocketing demand for home deliveries.

The market took the results well and shares rose over 2% on Wednesday morning. However, Marks and Spencer shares are down 63% over the last year, seeing them lose their position in the FTSE 100.