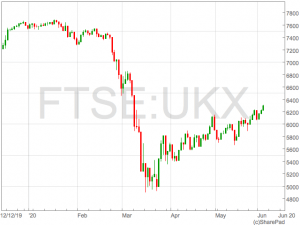

FTSE 100 falls with global equities

The FTSE 100 fell on Thursday, halting a three-day rally which saw London’s leading index breach the highest levels since the selloff in March.

The FTSE 100 inline with global stocks with weakness in US and mainland Europe indices. However, the tech-focused US NASDAQ bucked the trend and continued to tip toe higher towards all-time record highs.

The culmination of US riots and concerns over China gave markets reason to pause, although the declines were slight and it appears the market has stopped for breath, as opposed to displaying any signs of volatility.

The market also digested the latest ECB meeting and the announcement of a fresh wave of stimulus in the form of €600 billion in asset purchases. The latest measures adds to previous stimulus measures and with rates already negative, bond purchases are the most powerful tool at the ECB’s disposal.

“Today’s easing measures were another illustration that the ECB means business and stands ready to do whatever is necessary to help the euro area survive the corona crisis in one piece. The ECB will do its part, and it hopes the governments will do their part,” said Nordea analysts in a note.

Such a large injection of liquidity would usually be cheered by markets but it failed to turn the equity markets positive on the day.

The selling of stocks in the FTSE 100 was broad with most industry sectors falling, particularly cyclical sectors that have enjoyed gains over the past month.

Lookers and Aston Martin announce UK job cuts

Car dealerships Lookers and Aston Martin have both announced plans to cut hundreds of UK jobs in response to the Coronavirus.

As the government is lifting lockdown restrictions and car rooms are set to reopen, Lookers it will cut its workforce by almost 20%.

Mark Raban, Looker’s chief executive, said: “We have taken the decision to restructure the size of the group’s dealership estate to position the business for a sustainable future, which regrettably means redundancy consultation with a number of our colleagues.”

“This has been a very difficult decision and we will be supporting our people as much as possible throughout the process,” he added.

The car dealership will cut 1,500 jobs and close 12 dealerships. The group has 164 dealerships and hopes to save £50m annually from the redundancies.

Aston Martin has also announced to cut 500 jobs in an attempt to restore profits amid falling sales.

“As communicated previously, the plan requires a fundamental reset which includes a planned reduction in front-engined sports car production to rebalance supply to demand,” said the group.

“The company’s first SUV, DBX, remains on track for deliveries in the summer and has a strong order book. The measures announced today will right-size the organisational structure and bring the cost base into line with reduced sports car production levels, consistent with restoring profitability.”

Aston Martin said last week that the current Chief Executive, Andy Palmer, is to step down and will be replaced by Tobias Moers, who currently runs Mercedes-AMG.

The sector is under increasing pressure under Coronavirus. The number of new cars registered last month was down 89% compared to May 2019.

Shares in Lookers (LON: LOOK) are trading up over 5% at 24.50 (1204GMT).

Frankie & Benny’s: 120 restaurants to permanently close

The Restaurant Group, owner of Frankie & Benny’s, will permanently close 120 of the restaurant sites in response to Coronavirus.

The decision to close the sites will lead to almost 3,000 job losses across the 22,000 employees who are currently on furlough. The Restaurant Group was set to tell the staff on Wednesday.

In an email sent to site managers this week, the company said:

“Many sites are no longer viable to trade and will remain closed permanently. The Covid-19 crisis has significantly impacted our ability to trade profitably, so we have taken the tough decision to close these restaurants now.”

The Restaurant Group, which also owns Wagamama and pubs across the UK, issued a profit warning in March and revealed plans to permanently close 61 branches of its Mexican chain, Chiquito.

The group is speeding up previous plans announced in September when the company said it hoped to restructure and close 88 Frankie & Benny’s, Garfunkel’s and Chiquito outlets over the next six years.

The Restaurant Group acquired Wagamama in 2018, as part of a £559m deal. Sites are expected to reopen next month under the social distancing government guidelines.

The casual-dining sector has faced pressure in recent years amid rising costs and competition. Last month, Casual Dining Group said they were on the brink of calling in administrators.

The company, which owns Bella Italia, Café Rouge, and Las Iguanas, said: “As is widely acknowledged, this is an unprecedented situation for our industry and, like many other companies across the UK, the directors of Casual Dining Group are working closely with our advisers as we consider our next steps.

“These notifications are a prudent measure in light of the company’s position and the wider situation. These notifications will also protect the company from any threatened potential legal action from landlords while we review the detail of the government advice and formulate a plan for the company in these difficult times.”

Shares in The Restaurant Group (LON: RTN) are trading down 2.64% at 72.00 (0852GMT).

Ibstock revenue declines 75% during lockdown

Brickmaker and concrete producer, Ibstock (LON:IBST) provided insight into the UK construction industry during the coronavirus lockdown in a trading update released on Wednesday.

Revenue in the first quarter was down just 10%, however, the company revealed a 75% drop in revenue in the two months to 31st May, the period the most strict coronavirus lockdown measures were in place.

The sharp drop in revenue reflects a construction industry that was almost completely shutdown by the government measures.

Many of the larger house builder such as Taylor Wimpey shut sites amid unclear government guidance on who could go to work, and who couldn’t.

However, smaller construction businesses had evidently kept operations open and provided Ibstock with some demand, albeit heavily reduced.

Ibstock said in a statement:

“The Group has taken significant action to address the challenges presented by Covid-19. These measures have included utilising the Government’s Coronavirus Job Retention Scheme for a significant portion of colleagues during the shutdown period, reducing discretionary spend wherever possible and implementing a temporary salary reduction for the Board and the executive leadership team.”

“In addition, in order to ensure that the business remains well-positioned as it emerges from the current crisis, we are conducting a review of all operations. This review is expected to lead to a material reduction in the Group’s fixed cost base, through selective site closures, changes in operating patterns and changes to the size and structure of support functions.”

Highlighting the companies thinking around the market conditions for the rest of the year, Ibstock announced a restructuring programme that would lead to a number of job cuts.

“We have entered into consultations with employees across the Group as part of a series of restructuring proposals, with up to 375 positions, representing around 15 per cent of the Group’s total workforce, potentially impacted as a result of these actions,” Ibstock said.

FTSE 100 continues rally with strength in travel and leisure shares

A rally in the FTSE 100 on Wednesday was triggered by promising Asian economic data overnight and was built on by optimism over the reopening of economies and resumption activity in the travel sector.

The FTSE 100 was up 1.1% to 6,290 just after midday on Wednesday.

easyJet was up over 5% whilst International Consolidated Airlines added 8% and was the FTSE 100’s top riser as it touched 272p, the highest level since the sell off in March.

Cyclical sectors such as financials and commodities were also amongst the top risers.

The strong session in Europe followed a rally in Asia over night which was kicked off by the latest raft of global economic data in the form of services data.

“Ignorant, oblivious or uncaring about the domestic situation in the USA, investors instead focused on a gangbusters Caixin services PMI out of China, extending the month’s early rebound,” said Connor Campbell, analyst at Spreadex.

“Coming in at 55.0, the PMI was way ahead of the 47.4 forecast AND the previous month’s 44.4, showing a sharp return to growth for the sector across May.”

“That was a huge boost to Europe. The FTSE added another 0.9%, pushing the index to a near 3-month peak of 6275. It would have been higher, however, if the pound weren’t continuing to rebound itself.”

A shift in focus towards Brexit talks has started to play out in currency markets recently as the prospect of hard Brexit hit sentiment, however, today the focus was very much on economic data.

“Though the ongoing Brexit talks seem frosty at best, outright hostile at worst, cable rose 0.4% to $1.2588, its best price in close to 7 weeks,” Campbell said.

“It remains to be seen whether the pound can keep hold of that growth in the face of another weak UK services PMI, one that is expected to see the final reading for May revised marginally higher, from 27.8 to 27.9.”

The Eurozone services sector was also still stuck in contraction, but the Services PMI had nonetheless rebounded strongly to 31.9 from 13 the month before.

“The scale and breadth of the euro zone downturn was highlighted by the PMI data showing all countries enduring another month of sharply falling business activity,” said Chris Williamson, chief business economist at IHS Markit.

The strong session in Europe followed a rally in Asia over night which was kicked off by the latest raft of global economic data in the form of services data.

“Ignorant, oblivious or uncaring about the domestic situation in the USA, investors instead focused on a gangbusters Caixin services PMI out of China, extending the month’s early rebound,” said Connor Campbell, analyst at Spreadex.

“Coming in at 55.0, the PMI was way ahead of the 47.4 forecast AND the previous month’s 44.4, showing a sharp return to growth for the sector across May.”

“That was a huge boost to Europe. The FTSE added another 0.9%, pushing the index to a near 3-month peak of 6275. It would have been higher, however, if the pound weren’t continuing to rebound itself.”

A shift in focus towards Brexit talks has started to play out in currency markets recently as the prospect of hard Brexit hit sentiment, however, today the focus was very much on economic data.

“Though the ongoing Brexit talks seem frosty at best, outright hostile at worst, cable rose 0.4% to $1.2588, its best price in close to 7 weeks,” Campbell said.

“It remains to be seen whether the pound can keep hold of that growth in the face of another weak UK services PMI, one that is expected to see the final reading for May revised marginally higher, from 27.8 to 27.9.”

The Eurozone services sector was also still stuck in contraction, but the Services PMI had nonetheless rebounded strongly to 31.9 from 13 the month before.

“The scale and breadth of the euro zone downturn was highlighted by the PMI data showing all countries enduring another month of sharply falling business activity,” said Chris Williamson, chief business economist at IHS Markit.

The strong session in Europe followed a rally in Asia over night which was kicked off by the latest raft of global economic data in the form of services data.

“Ignorant, oblivious or uncaring about the domestic situation in the USA, investors instead focused on a gangbusters Caixin services PMI out of China, extending the month’s early rebound,” said Connor Campbell, analyst at Spreadex.

“Coming in at 55.0, the PMI was way ahead of the 47.4 forecast AND the previous month’s 44.4, showing a sharp return to growth for the sector across May.”

“That was a huge boost to Europe. The FTSE added another 0.9%, pushing the index to a near 3-month peak of 6275. It would have been higher, however, if the pound weren’t continuing to rebound itself.”

A shift in focus towards Brexit talks has started to play out in currency markets recently as the prospect of hard Brexit hit sentiment, however, today the focus was very much on economic data.

“Though the ongoing Brexit talks seem frosty at best, outright hostile at worst, cable rose 0.4% to $1.2588, its best price in close to 7 weeks,” Campbell said.

“It remains to be seen whether the pound can keep hold of that growth in the face of another weak UK services PMI, one that is expected to see the final reading for May revised marginally higher, from 27.8 to 27.9.”

The Eurozone services sector was also still stuck in contraction, but the Services PMI had nonetheless rebounded strongly to 31.9 from 13 the month before.

“The scale and breadth of the euro zone downturn was highlighted by the PMI data showing all countries enduring another month of sharply falling business activity,” said Chris Williamson, chief business economist at IHS Markit.

The strong session in Europe followed a rally in Asia over night which was kicked off by the latest raft of global economic data in the form of services data.

“Ignorant, oblivious or uncaring about the domestic situation in the USA, investors instead focused on a gangbusters Caixin services PMI out of China, extending the month’s early rebound,” said Connor Campbell, analyst at Spreadex.

“Coming in at 55.0, the PMI was way ahead of the 47.4 forecast AND the previous month’s 44.4, showing a sharp return to growth for the sector across May.”

“That was a huge boost to Europe. The FTSE added another 0.9%, pushing the index to a near 3-month peak of 6275. It would have been higher, however, if the pound weren’t continuing to rebound itself.”

A shift in focus towards Brexit talks has started to play out in currency markets recently as the prospect of hard Brexit hit sentiment, however, today the focus was very much on economic data.

“Though the ongoing Brexit talks seem frosty at best, outright hostile at worst, cable rose 0.4% to $1.2588, its best price in close to 7 weeks,” Campbell said.

“It remains to be seen whether the pound can keep hold of that growth in the face of another weak UK services PMI, one that is expected to see the final reading for May revised marginally higher, from 27.8 to 27.9.”

The Eurozone services sector was also still stuck in contraction, but the Services PMI had nonetheless rebounded strongly to 31.9 from 13 the month before.

“The scale and breadth of the euro zone downturn was highlighted by the PMI data showing all countries enduring another month of sharply falling business activity,” said Chris Williamson, chief business economist at IHS Markit. EasyJet falls off the FTSE 100

EasyJet (LON: EZJ) & cruise operator Carnival (LON:CCL) are set to lose their places on the FTSE 100 due to the COVID-19 impact on the travel industry which saw the companies shed a significant amount of their value.

The budget airline has lost half of its market value since the start of the pandemic as almost all flights have been cancelled.

Despite a recent recovery its market capitalisation was ranked 125th based on Monday’s stock market close in London.

FTSE Russell, requires companies to be ranked at least 110th to be part of the blue-chip index.

EasyJet, which plans to cut up to 4,500 jobs and reduce its fleet, had returned to the FTSE 100 at the end of last year after a fall in its shares had triggered removal from the index.

“EasyJet would need a big rally, but it could come back in September,” said Russ Mould, investment director at AJ Bell.

Carnival, the world’s largest cruise operator, has seen its shares drop by 70% since the start of 2020 as COVID-19 took hold. The cruise industry has been among the most heavily impacted sectors as several ships were hit by outbreaks of infection, and some cruises have been cancelled until at least October.

The travel sector has seen a strong rally over the last week but it’s not been enough to keep the stocks in London’s leading index.

Companies set to be promoted from the FTSE 250 include Avast and Ladbrokes and bwin owner GVC, (LON: GVC) which many investors thought would suffer greatly from the crisis with so many sporting events cancelled.

“Unlike some other operators GVC has multiple strings to its bow, and its online casino business has seen a modest rise in activity”, Nicholas Hyett, an analyst at Hargreaves Lansdown wrote in a note to clients.

Card Factory scraps dividend despite stronger revenue before COVID-19, shares surge

Card Factory shares (LONL:CARD) jumped on Tuesday after the card retailer said revealed a 3.6% increase in revenue in the year to 31st January.

Despite the strong increase in revenue for the period, Card Factory completed scrapped their dividend and said there wouldn’t be any payments for FY2021 due to uncertainty around coronavirus.

However the dividend cut was not enough to offset optimism over sales before the coronavirus pandemic and Card Factory shares jumped over 12% on Tuesday.

“We delivered a reasonable sales performance in a challenging year for the high street, growing both our volume and value card market share in the mature and stable UK greeting card market. Our profitability was, however, impacted by a number of recurring cost pressures and other one off operational costs which we were not able to fully mitigate,” said Karen Hubbard, Chief Executive Officer of Card Factory.

“Across the year we also developed a refreshed long term strategy for future profitable growth. The strategy is focused on strengthening both our market position and the financial performance of the UK business. During the second half of the year we tested our price positioning and elasticity, trailed new customer propositions, and developed partnerships to grow our UK market share through concessions and supply arrangements.”

Hubbard went on to explain the distribution channels that has helped Card Factory achieve the higher level of sales.

“These partnerships have enabled us to serve card shoppers when they are on impulse-driven purchases away from our own retail stores. We have developed further our online infrastructure and capability to ensure that we are set to deliver in what is increasingly becoming a multi-channel environment,” Hubbard said.

“We agreed a five year contract with The Reject Shop in Australia following a successful concession trial. This contract represents our first international business and is a potential template for other markets. We believe there is an opportunity to leverage our current infrastructure and supply chain and build market share in other card markets across the world under the Card Factory brand.”

“Since the year end, whilst we have continued to evolve our medium and longer term plans, a key focus has been on appropriately managing our business and protecting our staff through the Covid-19 crisis. We have developed flexible plans which will ensure the safety of our colleagues and customers whilst allowing a phased re-opening of our stores from the 15th June in line with Government guidelines.”

“Our Board and management team have reacted rapidly to the very dynamic situation and I am confident that we will exit this crisis with an operating model and customer proposition that will make Card Factory the customers’ first choice for greeting cards, everywhere and for all occasions, however the customer wishes to shop, although given the uncertainty we are unable to provide guidance on future performance.”

“I look forward to sharing in detail our exciting plans for growth on 28 July 2020.”

AB Foods shares jump on Primark reopenings

Shares in Primark-owner, AB Foods (LON:ABF), jumped on Monday following the announcement of further store reopenings and the impact of on cashflow of the those stores that have already reopened.

The company said closing Primark stores carried cost AB Foods £650m in cash per month but expected most stores to be reopened by the end of June.

The AB Foods share price rose over 7% following the news.

AB Foods outline their plan to continue to reopen stores and the measures they would employ to ensure a strong level of social distancing.

“As European governments have begun to ease restrictions on clothing retailing we have been able to re-open stores. Safety has been our highest priority in our detailed preparations to welcome our customers and employees back to stores. We are following government safety advice in all markets,” AB Foods said in their release.

“Importantly, we will apply the valuable experience gained from more than 100 stores which are already open as we open the remainder of our estate, including stores across the UK. Social distancing protocols, hand sanitiser stations, perspex screens at tills and additional cleaning of high frequency touch points in the store are among the measures we are implementing. Personal protection, including masks and gloves, are being made available to all employees. These measures are designed to safeguard the health and wellbeing of everyone in store and to instil confidence in the store environment. Feedback from customers and employees in those markets where the stores are open has been positive.”

AB Foods was part of a wave of companies unveiling plans to open stores across Europe on Monday making th retail sector one of the best performers in European equities.

AB Foods shares are still down over 25% in 2020 having seen lows beneath 1,600p.

Global stocks rally as Trump leaves trade deal in tact with Hong Kong

World stocks were just shy of three-month highs as optimism on economies opening up boosted risk appetite, shrugging off unease over Washington’s power struggle with Beijing.

Hong Kong stocks are on pace for their best day since March as investors shrug off the Trump administration’s intention to end a special economic and trading relationship with the Asian financial hub.

“Widespread relief in financial markets that President Trump stopped short of announcing damaging sanctions on China buoyed risk assets on the first trading day of June. While the U.S. is still planning on stripping Hong Kong of its special status, Trump’s announcement on Friday was short on details, leading investors to believe that any future action will be measured and proportionate,” said Raffi Boyadjian, senior investment analyst at XM.

European stocks advanced on Monday as many countries are easing lockdown measures and gradually reopen their economies, a key source of upward momentum for markets of late.

London’s FTSE 100 added 1.4% in early trade while France’s CAC 40 climbed 1.5% and Italy’s FTSE MIB gained 1.3%.

Markets are closed in Austria, Denmark, Germany, Norway, Sweden and Switzerland for a public holiday

The dollar has weakened to its lowest level since mid-March as hundreds of people were arrested over the weekend as protesters and police clashed in cities across America after the killing of George Floyd sparked more than 100 protests, rallies and vigils.

“While riots and violent protests may harm economic activity, especially given that many states have just begun unlocking their economies, investors do not seem to be concerned at this stage and believe the impact is insignificant on their portfolios,” said Hussein Sayed, chief market strategist at FXTM.