Car production falls for fifth consecutive month

A new report from the Society of Motor Manufacturers and Traders (SMMT) revealed UK car production to plummet in November.

The industry’s trade body showed output to tumble by 20% amid Brexit concerns, falling to the lowest point since the 2009 recession.

November is the fifth consecutive month for production to fall.

Mike Hawes, the chief executive of the SMMT, said: “It’s very concerning to see demand for UK built cars decline in November, with output seriously impacted by falling business and consumer confidence in the UK allied to weakening export markets.”

As well as concerns in the car industry, Brexit has also impacted car manufacturers who have issued many warnings on the impacts that a no-deal Brexit could have on production.

“Thousands of jobs in British car factories and supply chains depend on free and frictionless trade with the EU. If the country falls off a cliff-edge next March the consequences would be devastating,” said Hawes.

The SMMT chief executive has called for a no-deal Brexit to be ruled out. He said that thousands of car manufacturer jobs and their suppliers depend on frictionless trade with the EU.

Jaguar Land Rover has announced plans to cut as many as 5,000 job next year amid falling sales in China.

“Jaguar Land Rover notes media speculation about the potential impact of its ongoing charge and accelerate transformation programmes.” said the carmaker.

“As announced when we published our second-quarter results, these programmes aim to deliver £2.5 billion of cost, cash and profit improvements over the next two years. Jaguar Land Rover does not comment on rumours concerning any part of these plans.”

Elon Musk undercuts LA traffic with new tunnel

Pioneer and tycoon Elon Musk has unveiled a new tunnel designed and built by The Boring Company, to tackle the landmark Los Angeles trope – the traffic.

Elon’s new(ish) company

Founded in 2016, The Boring Company was created with the sole purpose of revolutionising the way we do road transport, with Elon’s vision being to implement this system of underground road arteries in cities around the world. Mr Musk has stated, “I am actually going to do this. Defeating traffic is the ultimate boss battle.” “It’s not like you’re going through a whole series of stops. Nope, the main arteries will be going super fast, and it’s only when you want to get off the loop system that you slow down.” Elon has said that after considering a skate-style format, he settled on the concept of fitting the cars with specially designed wheels that would pop out perpendicular to a car’s regular tyres and mount the track. The price is expected to stand at $200-300 per car.From concept to reality

After securing permission to build the tunnels in June, the Tesla (NASDAQ:TSLA) founder has gone on to build a trial ‘loop’ system underneath Los Angeles, which he said would – with time – act more as an underground highway network than a subway, with exit points being distributed throughout the network of tunnels. Since June, the O’Leary Station has been built and within the last day, the first public tests were carried out. A wall-less lowered the electric vehicle thirty feet below surface level, with a Tesla Model S being driven at 40mph through the tunnels, though Elon later said that the vehicle would be capable of travelling at 150mph through the subterranean road. Mr Musk described the first trial as,“Epic” “For me it was a eureka moment. I was like, ‘This thing is going to damn well work’.”Musk later noted that there were a few rough edges, with the speed of his paving machine not keeping pace with the ambitious man’s best-laid plans. However, he vowed that going forward, the future systems would be “smooth as glass” and that, “This is just a prototype, that’s why it’s a little rough around the edges”.

Standard Elon Musk patter

To bolster the merits of his next big project, Mr Musk then pointed out that the tunnels would be the ‘safest’ place to be during earthquakes. He then went on to refute claims that the construction of the tunnels would be at all disruptive, “The footsteps of someone walking past your house will be more noticeable than a tunnel being dug under your house.” Whether just another quaint idea or a vision for the future, history will remember Elon Musk as either an egotist or a genius.The Environment Agency introduces fishing restrictions to target salmon shortages

The Environment Agency announced the implementation of a series of new fishing restrictions to combat declines in salmon and sea trout stocks.

The new regulation is set to come into effect from the January 1st, in a bid to encourage greater prioritisation of sustainability within the UK’s fishing industry.

According to 2017 government figures, the UK’s waters have witnessed a marked decline in returning salmon across the last decade.

In fact, as many as 27 of the total rivers in the UK had been categorised by the findings as ‘probably at risk’, with an additional 9 already considered to be at ‘at risk’.

Kevin Austin, Environment Agency’s Deputy Director for Agriculture, Fisheries and the Natural Environment said of the newly implemented restrictions:

“It is only through continuing to take concerted action, and through the co-operation of others, that we will successfully protect this iconic fish for future generations.

We are not implementing these changes lightly and have consulted widely with those affected. There is no single solution to protecting salmon stocks; reducing the catch of salmon can only partly contribute to the recovery of salmon stocks.”

However, the shortages are not limited to the UK’s waters, with global salmon levels continuing to deplete alongside other marine life. In fact, according to statistics, 90% of world marine fisheries are overfished or fully fished, with numbers only set to decline further, as high levels of plastic continue to pollute the world’s oceans at a remarkably rapid rate. It’s not just government agencies that are ramping up efforts to improve the sustainability of the fishing industry. Recently launched businesses, such as Pure Salmon, are championing a more socially conscious brand of fishing. Specifically, Pure Salmon, a business developed by 8F Asset Management, is set to employ a technology called ‘Recirculating Aquaculture System (RAS)’ across its farms. The business has said that the land-based alternative to fishing is a ‘proven and scalable method of aquaculture’. Alongside promoting a more sustainable approach to fishing, the new technology is also set to ensure that its salmon produce is free of any chemicals, antibiotics, hormones, mercury and microplastic. Moreover, because the fish will be produced closer to consumers, it hopes to achieve lower levels of harmful carbon emissions due to reduced transportation costs. Stephane Farouze, Chairman and Founder of 8F, commented on the launch of the business: “We’re delighted to be launching what is the most exciting global development in land-based Atlantic salmon farming. We believe that RAS technology will be the leading driving force for growing salmon in a resource strained world, where producing sustainable food without further damaging our oceans is paramount.” Whilst businesses such as Pure Salmon are leading the way in revolutionising fishing for the better, there is still some way to go to truly preserve the world’s oceans, amid staggering levels of plastic pollution. Nevertheless, public awareness of the issue is on the rise. In fact, ‘single-use’ was recently named the word of Collins’ Dictionary’s word of the year for 2018. What’s more, government’s too are increasingly beginning to prioritise the issue. Back in October, the European Parliament voted for a complete ban on various single-use plastic goods. The Environment Agency’s latest legislation decision is only a further indication of the strength of the growing momentum behind the cause.GDP 2019 – Britain falls in rankings

PricewaterhouseCoopers (NYSEARCA:PWC) have released their latest projected GDP rankings for 2019, with these latest rankings dropping the UK from fifth to seventh place.

This follows the announcement that the World Bank dropped the UK to ninth in their business rankings, with most bearish outlooks being attributed – unsurprisingly – to Brexit uncertainty.

While currency concerns continue for developing economies, PwC remain confident in India’s ascendancy to fifth place in GDP rankings, and added that India’s projected growth of at least 7.6% p/a over the next five years would allow them to bolster their position.

Other developing players include Brazil, who are set to retain their ninth place spot behind Italy in eighth, while the euro’s strong performance against the pound looks set to push France ahead of Britain and into sixth place in 2019.

Mike Jakeman, a senior economist at PwC, said, “India is the fastest growing large economy in the world, with an enormous population, favourable demographics and high catch-up potential due to low initial GDP per head. It is all but certain to continue to rise in the global GDP league table in the coming decades.

“The UK and France have regularly alternated in having the larger economy, but subdued growth in the UK in 2018 and again in 2019 is likely to tip the balance in France’s favour. The relative strength of the euro against the pound is an important factor here.”

PwC have forecast the British GDP to grow by 1.6% next year and 1.7% in 2020, then 1.8% each year to 2025 as Brexit tensions and uncertainty wain. The UK’s GDP is then expected to once again surpass France into the sixth spot as the pound rallies against the euro.

The world’s largest economies are all set to suffer from the effects of ageing populations, with the Federal Reserve’s higher interest rates likely to hamper consumer spending in the US, and China struggling to reign in corporate and consumer borrowing.

The report’s co-author, Barret Kupelian, added,

“Last year, the big economic news was centred around advanced economies creating around 4.5m jobs.

“We expect this trend to gradually moderate in 2019, with some economies such as the US, Canada and Germany hitting structural floors in their unemployment rates, and wage growth starting to gradually pick up.

“Assuming an orderly Brexit, we expect the UK to also see unemployment flattening off, though a disorderly Brexit could lead to a marked rise of unemployment.”

EU reveals no-deal Brexit plans

The European Commission has said that it is preparing contingency plans for a no-deal Brexit.

Given the continued uncertainty surrounding the UK government’s Brexit deal, the Commission revealed the “essential and urgent” measures.

In a statement, the European Commission said that the measures will be designed to limit disruption in areas including finance and transport if the UK crashes out of the EU without a deal.

Commissioner Valdis Dombrovskis said on Wednesday: “These measures will not – and cannot – mitigate the overall impact of a ‘no-deal’ scenario.”

“This is an exercise in damage limitation given the continued uncertainty in the UK.”

Some of the contingency plans included will be British airlines to operate flights into and out of the EU and the UK financial services regulations to be recognised as equivalent to the EU’s.

“This decision provides vital clarity to UK clearing houses and their customers in the EU,” said City of London Corporation policy chair Catherine McGuinness.

“I am glad the Commission has started to address the serious cliff edge risks of a no deal scenario.”

“The Commission now needs to take steps to address the significant risks to data transfers and contract continuity for insurance and uncleared derivatives at an EU level,” she added.

Chief executive of the Association for Financial Markets in Europe (AFME) also welcomed the news, calling it an important step.

“This is a very important step to enable continued access for EEA firms to clearing and settlement services in a no deal Brexit scenario,” said Simon Lewis.

“While this addresses a significant risk, it is important for further action at EU and national level to mitigate against other risks and put in place cooperation arrangements between the EU and UK regulators.”

RBS names new finance chief

Royal Bank of Scotland Group Plc (LON:RBS) have named Katie Murray as their new Chief Financial Officer, with Ms Murray having carried out the role on an interim basis following the departure of Ewen Stevenson, to HSBC (LON:HSBA).

Ms Murray’s appointment lays the groundwork for RBS to become the first major bank to have women in its two executive roles – with Deputy Chief Alison Rose lined up to replace the incumbent Chief Executive after 2019.

An RBS spokesperson has said,

“it’s a very different job to four years ago”

Ms Murray is a former Finance Director for Old Mutual Emerging Markets, and KPMG auditor for thirteen years, and thus her background differs greatly from her predecessor Mr Stevenson, who is a former Credit Suisse banker (SWX:CSGN).

Ms Murray has said she will work with RBS colleagues to, “continue to build a bank that is simple and safe for customers, produces positive returns for shareholders and makes a major contribution to the UK economy.”

Last year RBS logged their first profit since their 2008 bail-out to the tune of £45.5 billion of taxpayers’ money, and the company look set to continue the trope of generous bonuses – despite public opposition. Ms Murray is set to receive £750,000 a year – less than the £800,000 per annum received by Mr Stevenson – as well as a £750,000 a year fixed stock allowance and a bonus quota of up to 200% of her salary.

Incumbent RBS Chairman Howard Davies, said, “I am pleased to welcome Katie to the RBS board following a successful period as interim CFO. Katie brings nearly 30 years of finance and accounting experience in capital management, investor relations and financial planning to the role. She has already contributed significantly to RBS over the past three years as the bank has resolved its last major legacy issues, returned to profit and restarted paying dividends.”

The other front-running candidate for the position was William Chalmers, who jointly leads Morgan Stanley’s global financial institutions group.

The company’s shares are currently trading up 1.2p or 0.57% at 210.5p.

888 remains confident for full-year results, shares rise

Shares in the online gambling firm, 888, rose on Wednesday after the group revealed that full-year earnings are on track.

The group said that it had seen progress over the year, and is confident over plans to expand in the US.

“The Group has continued to focus on driving growth in regulated markets, enhancing compliance, and delivering exciting product innovation,” said the 888 chief executive, Itai Frieberger.

“888 has maintained its strong momentum in Casino and Sport, particularly in continental European markets. In the UK, we are pleased to update that the initial positive trends in revenue reported at the time of the Group’s half-year results have continued.”

“888 remains very excited by the significant long-term growth opportunities in the US market and, throughout the year, we have made significant operational progress in the region.”

“The recently announced acquisition of the remaining stake in AAPN places 888 in an even better position to take advantage of the significant growth opportunities in the US and create additional value for our shareholders,” he added in a statement.

Last week, the gambling firm bought a remaining 53% stake in All American Poker Network (AAPN) in a $28 million deal (£22.3 million).

Earlier in December, the UK’s biggest gambling firms agreed to stop advertising during live sports broadcasts.

“There was clear public support for these restrictions and I’m glad that the Remote Gambling Association has taken its responsibilities seriously and listened,” said Labour’s Shadow Secretary of State for Digital, Culture, Media and Sport, Tom Watson.

“One of the only downsides to this brilliant World Cup has been the bombardment of gambling advertising on TV and social media that thousands of children will have been exposed to,” he added.

After the update, shares rose over 7%. Shares in the group (LON: 888) are currently trading +7.88% at 182,70 (1314GMT).

Fall in oil prices sends UK inflation to 20-month low

According to a new report from the Office for National Statistics, UK inflation fell to a 20-month low in November.

The fall was achieved by a sharp fall in oil prices, as well as a growth in consumer prices by 2.3% – down from 2.4% in October.

Prices for food, computer games and concert tickets also dipped in November.

Analysts have predicted that prices in oil could continue to fall, forcing inflation even lower.

Howard Archer, an analyst at EY Item Club, said: “Inflation should trend down over the first half of 2019. The recent falling back in oil prices should increasingly impact, while Ofgem’s price cap will put some downward pressure on domestic energy prices in January.”

Prices in petrol fell by 2.6 pence per litre between October and November.

PwC economist Mike Jakeman said: “Inflation returning towards the Bank of England’s 2% target is good news for workers, who are receiving the dual benefit of accelerating wages and slowing inflation, pushing up their income growth in real terms.”

Upward pressures also came from the rise in tobacco prices, which increased following the Budget. Other upward pressures included clothing prices, hotels and restaurants.

Mike Hardie, the ONS head of inflation, said: “Inflation was little changed as falling petrol prices, thanks to a substantial drop in the cost of crude oil, were offset by rises in tobacco prices following the duty changes announced in the Budget.”

“House price growth continued to slow with the smallest annual rise seen in over five years, led by price falls across London.”

The Bank Of England had forecast a CPI rate of 2.5% for October and November. Analysts are betting a rise next year amid Brexit uncertainty.

This week, the British Chambers of Commerce forecast that economic growth in 2018 and 2019 would be the slowest since the 2009 recession.

Barclays fined $15m over whistleblower controversy

Barclays (LON:BARC) has been hit by a $15 million penalty by a New York regulator over attempts by its chief executive to unmask a whistleblower.

The New York State Department of financial services investigation concluded that Barclays had violated local and banking law regarding whistleblower procedures.

The fine relates to a scandal back in 2016, when chief executive Jes Staley attempted to name a whistleblower, prompting the launch of a series of investigations against the bank.

“Whistleblowers are vital to uncovering and addressing intentional wrongdoing,” commented Maria Vullo, New York department of financial services superintendent.

She added: “DFS’s thorough investigation uncovered actions at the top that exposed the bank to risk and created an atmosphere in which employees might doubt that it was safe to escalate issues of concern to the bank.”

The fine follows a £642,430 penalty dealt by the UK’s financial watchdog, the Financial Conduct Authority (FCA) to the bank.

Back in August, Barclays reported a fall in its half-year profits as legal and litigation costs relating various controversies dragged down revenue.

Pre-tax profits fell from £2.3 billion to £1.6 billion after the bank were forced to payout £2 billion, including costs relating to a £1.4 billion settlement.

This latest penalty marks one of many fines in recent years, including compensation relating to PPI and investigation by the Serious Fraud Office (SFO) into a loan given to Qatar back in 2008.

Shares in Barclays are currently +0.45% as of 12:26PM (GMT).

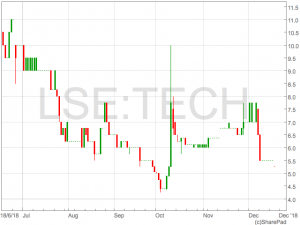

TechFinancials harnesses Blockchain to enter the Diamond trading and ticketing market

TechFinancials (LON:TECH) are propelling their transformation with the launch of two Blockchain based ventures in CEDEX, a diamond trading platform, and NewCo, a sports venue ticketing solution.

TechFinancials are a Fintech software provider and the recent developments bolster their portfolio of global trading solutions and signals growth into new markets.

The announcements came after the company released interim results that highlighted the transformational nature of 2018 for TechFinancials.

The group posted revenues fo $3.78m for the first half, down 46% for the same period a year prior.

Despite a disappointing first half, the group is well positioned for further investment with a cash position at the end of the first half of US$2.86m.

New blockchain trading technology business produced revenues of US$1.3m (H1 2017: $0).

TechFinancials (LON:TECH) has recently received a $1.7m dividend pay-out by DragonFinancials, their 51% owned subsidiary operating a trading platform targeting the Asia Pacific Region.