Morning Round-Up: EU markets up, Opec deal uncertain

Next Fifteen shares up on big account wins

Playtech shares edge up on Italian deal green light

Airbus may move operations out of the UK on hard Brexit fears

FTSE 100 falls following Bank of England minutes

FTSE 100 sinks

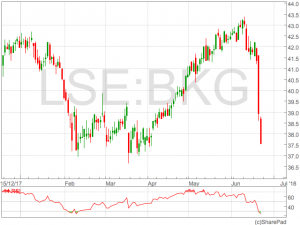

The announcement drove a sharp decline in the FTSE 100 as sterling rallied strongly against the dollar. Some of the biggest fallers in the FTSE 100 were again the house builders who were still reeling from a trading update from Berkeley Group suggesting the housing market was set for a lull which could see thier profits fall – something unlikely to be helped by rising rates.

Taylor Wimpey (LON:TW), Persimmon (LON:PSN), Barratt Developments (LON:BDEV) and Berkeley Group (LON:BKG) were down between 2.9% and 3.7% on Thursday.

Some of the biggest fallers in the FTSE 100 were again the house builders who were still reeling from a trading update from Berkeley Group suggesting the housing market was set for a lull which could see thier profits fall – something unlikely to be helped by rising rates.

Taylor Wimpey (LON:TW), Persimmon (LON:PSN), Barratt Developments (LON:BDEV) and Berkeley Group (LON:BKG) were down between 2.9% and 3.7% on Thursday.

The BoE also commented on asset purchase balance sheet saying rates were likely to be increased significantly before there was any consideration of reducing the balance sheet.

Some analysts questioned the substance of the today’s balance sheet comments from the Bank of England suggesting any meaningful action was still some way.

The BoE also commented on asset purchase balance sheet saying rates were likely to be increased significantly before there was any consideration of reducing the balance sheet.

Some analysts questioned the substance of the today’s balance sheet comments from the Bank of England suggesting any meaningful action was still some way.

Today’s plans to bring in an unwind of QE from years and years away to merely years away could be seen as bid to remind investors that sterling can rise as well as fall.

— WorldFirst (@World_First) 21 June 2018

Chinese central bank ends slump with market liquidity

The Chinese central bank took steps to increase market liquidity on Tuesday and Wednesday, in the wake of the five-day stock market slump.

Following the three-week low reached by stock markets earlier this week, policy-makers in Beijing concluded that a full-scale Sino-US trade war could not be ruled out, but a pragmatic step in the short-term would be to try and increase market liquidity.

As such – having stopped short of quantitative easing – the Chinese central bank opted to lend financial institutions 200 billion yuan (31 billion USD) and fix the yuan rate higher against the dollar. In the aftermath of posting the currency’s biggest daily fall for a year-and-a-half, such steps were deemed necessary to decrease volatility and increase confidence.

Thus far the policies appear to have had the desired effect; gains in China have encouraged the pan-European STOXX 600 to rally 0.6 percent and European auto shares to rise by 0.2 percent. This is promising, considering European auto shares is a sector that is particularly vulnerable to US tariffs.

However, such rallies are only a step in the right direction. European auto shares have declined 2 percent in the last five days alone, and such scenarios could be repeated in the coming weeks.

According to Francois Savary, chief investment officer at Prime Partners, “The framework is set: there is monetary policy tightening, less liquidity, more geopolitical uncertainty and an economic situation which in Europe at least we need to be more cautious about.”