01/03/2016

Honeywell drops $90bn offer to buy United Tech

Honeywell International Inc (HON.N), the aircraft parts maker has ended its previous offer to buy rival company United Technologies Corp (UTX.N), due to their “unwillingness to engage in negotiations.”

United Technologies have said in response to Honeywell’s decision that it was an “appropriate outcome given the strong regulatory obstacles, negative customer reaction and the potential for a protracted review process that would have destroyed shareholder value.”

Honeywell Chairman and CEO Dave Cote has said in a statement:

“From both an industrial logic and shareholder value perspective, Honeywell and United Technologies are a great match and that is why the two companies have been talking about a combination for more than 15 years. We made a full and fair offer that would have greatly benefited both sets of share owners.”

If the deal had gone ahead, it would have created a company responsible for a huge amount of equipment on commercial airliners including landing gear and cockpits.

Shares of United Tech were down 3.5% in early trading on Tuesday, while Honeywell was up 2.7%

Popularity of Mondo crashes Crowdcube in crowdfunding campaign

On Monday, crowdfunding website Crowdcube experienced a number of technical issues following the launch of the campaign for the app-only bank, Mondo.

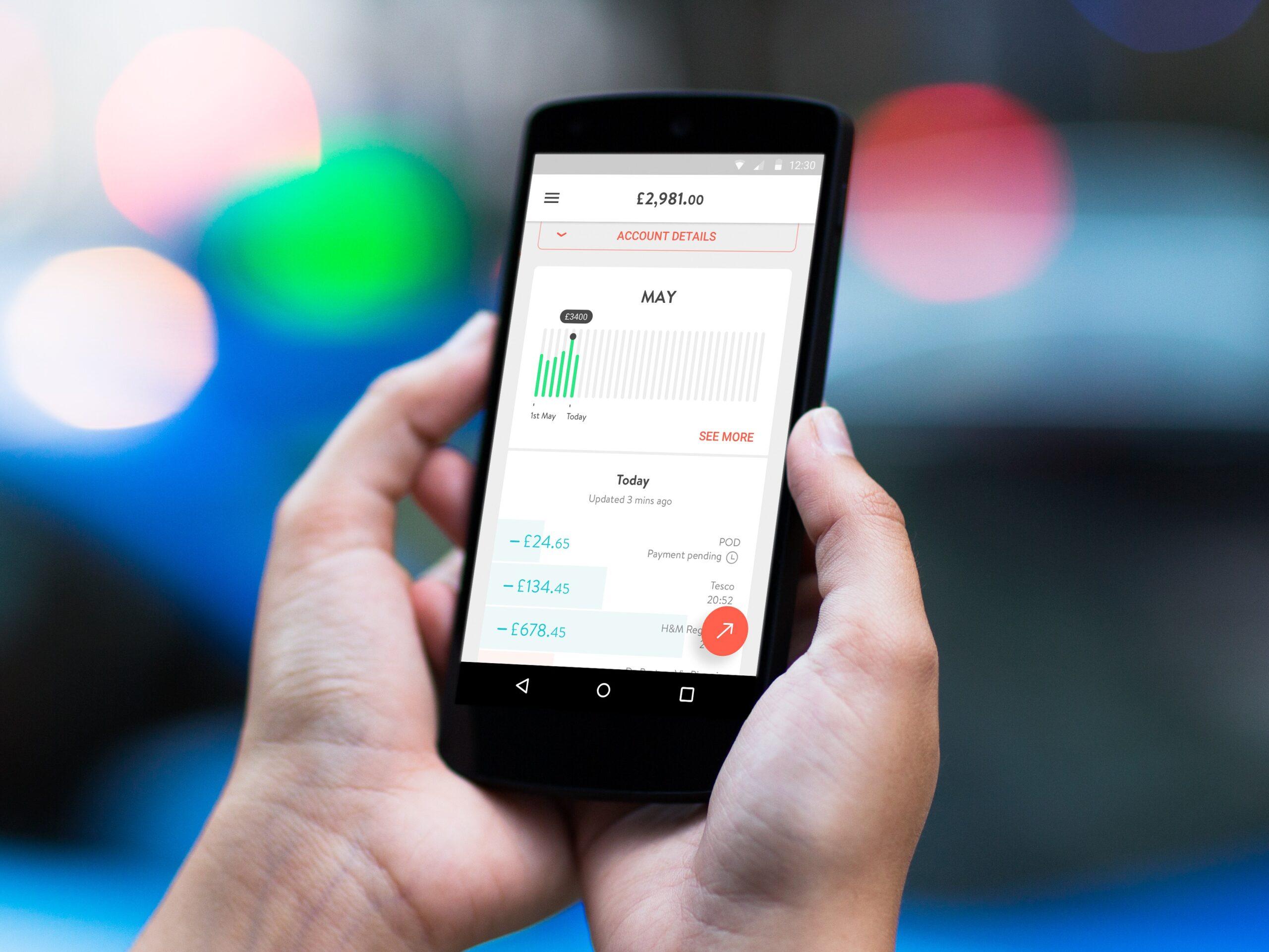

Mondo is a UK based challenger bank, hoping to create an app for “banking like never before” with instant balance updates and intelligent notifications.

Earlier this month, Mondo announced hopes to raise £6 million through crowdfunding website Crowdcube, where in return the company offered to sell £1 million worth of equity.

Launched at 12 pm GMT and was met by so much interest, it shortly led to the overload and crashing of the site.

This overwhelming response was partly expected. Mondo founder, Blomfield, confirmed that that 6,000 people had pre-registered to be involved with the campaign.

In a blog post posted shortly after the campaign went live, Blomfield wrote:

“I’d like to personally apologise to everyone who has tried to get access to the investment today. I know it’s been a frustrating and confusing experience so far. Unfortunately, the level of demand to participate in Mondo’s crowdfunding has overwhelmed Crowdcube’s servers, and so we’ve taken the decision to temporarily pause the campaign.”

The Mondo campaign on Crowdcube is currently still paused.

01/03/2016

David Cameron and the EU: ‘Project Fact’ or ‘Project Fear’?

During attempts to sway public opinion in the run up to the EU referendum, critics have accused David Cameron of using scare tactics to keep Britain in the EU.

Cameron however recently hit back, talking to students at University Campus Suffolk, claiming he was behind ‘Project Fact’, not ‘Project Fear’:

“If ‘Project Fact’ is about saying ‘stay’, then you know what you get: the (EU single) market open, jobs being created, businesses locating here, financial services being able to trade all over Europe. If you leave, you don’t have those facts, you have a lot of uncertainty.”

Cameron has challenged those within his party who want to leave the EU, commenting they should stop hiding behind arguments offering the “illusion of sovereignty”, whilst critics respond, arguing that Cameron is ‘belittling’ Britain by suggesting it cannot cope outside of the 28-member bloc.

01/03/2016

FTSE hits a two month high

Despite the fall in Barclays shares by nearly 10% following announcement to restructure and remove itself from Africa, the FTSE Index was up at 45.52 points at 6,142.61 at noon on Tuesday – its highest level in two months.

Shares in Just Eat are currently trading up 1.1pc at 390p. This is despite warnings that they will be hit by competitions from rivals such as Deliveroo. These widespread concerns from analysts led to a slide in shares last month from 494.9p to 329.1p last month.

Shares in the London Stock Exchange (LSE) increased 8.3% after the New York Stock Exchange, Intercontinental Exchange announced it was considering making an offer to LSE, which could ruin potential plans of LSE merging with Deutsche Bourse.

In the FTSE 250, shares for Greggs rose 14% following news of their 25% rise in annual profits and their £ 100m restructuring plans.

The FTSE 100 remains down 2% since the start of 2016 and 14 percent below the April 2015 record high.

Could investing in crowdfunding reduce your Income Tax payment?

Interested in investing in crowdfunding but unsure of the impact on your tax payment?CrowdRating, the independent ratings agency for equity crowdfunding, has launched their SEIS & EIS Calculator, a free web-based tool which shows crowdfunding investors exactly how their investment activity could affect – and enhance – their tax position.

Designed to simplify understanding the tax impact of investing in crowdfunding opportunities, the SEIS & EIS Calculator can help investors by not only reducing the amount of Income Tax and Capital Gains Tax they will pay in this tax year, but also how much tax they could reclaim against last year’s tax bill. Furthermore, investors will be able to use the SEIS & EIS Calculator to analyse how different investment scenarios, such as a change in the amount invested, the allocation split between SEIS and EIS, or expected future investment returns or losses, might affect their tax position. With only five weeks to the end of the 2015 tax year, this calculator could well be a useful tool in the investor’s arsenal.

According to Alex Heath, founder and director of CrowdRating, “the growth of the crowdfunding market is opening up the early-stage investment market to a new generation of investors who, for the first time, are benefitting from the tax breaks associated with early-stage investing. Using our simple SEIS & EIS Calculator will, for the first time, make it easy for all investors, regardless of their experience or the size of their investment, to understand the tax impact of their investments.”

The SEIS & EIS Calculator is free and very simple to use. All you need to do is gather the relevant investment and tax information, input this into the calculator and click SUBMIT to reveal your results.

Try CrowdRating’s SEIS & EIS Calculator at www.eiscalculator.com.

01/03/2016

Hedge Funds: volatility faced in 2015 and what the future holds

What are Hedge Funds?

Hedge funds are alternative investments that are often open to accredited investors requiring a large initial investment, with aims maximize the return of investment. Established in the late 1940s, investments in hedge funds are illiquid as they normally require investors to keep money in the account for at least a year in a ‘lock-up’ period.

Hedge fund Strategies:

- Convertible Arbitrage: type of long-short investing strategy. An equity long-short strategy involves taking long positions in stocks expected to increase in value & short position in stocks that are expected to decrease in value.

- Macro Hedge Funds: Differ from the traditional hedge fund because they focus on major market trends, rather than individual security opportunities. Includes attempts to take advantage of moves in major financial and non-financial markets through trading in bond markets, option contracts and currencies.

- Long/Short Equity: A popular form of hedge fund that aims to minimize market exposure, profiting from stock gains in the long positions and price declines in the short positions.

Safiya Bashir - 01/03/2016

UK mortgage approvals at a two-year high

According to data from the Bank of England, mortgage approvals in the UK have reached a two-year high, with an increase of 3,246 approvals made between December and January 2016.

This increase of consumers taking on credit is causing some concern among debt charities, who believe that it should lead to tighter lending by the central bank.

The Bank of England however have said that it may increase the amount it has set aside for borrowing, in aid to help the economic recovery which is still reliant on spending by households.

This growth in borrowing is seen to have rise, following a growth in consumer credit 9.1%, hitting its fastest pace since January 2006. This is supporting concerns that people are relying too much on overdrafts, credit cards and personal loans to get by, following data that the total amount of consumer credit reached £179.5 billion.

Samuel Tombs from Pantheon Macroeconomics has said;

“British households are back to their old ways and are piling on debt again. With borrowing costs still falling, consumer confidence high and banks willing to lend, indebtedness will only increase unless the Bank of England acts.”

Chief UK and European economist at IHS Global Insight, Howard Archer, acknowledges that the UK’s recovery has been fueled by consumer spending but warns of the possibility that consumers may start relying on excessive debt, whilst also hoping banks do not let their lending standards slip.

01/03/2016

Barclays to leave Africa following fall in profits

Following a 2% fall in full-year profit, Barclays has announced plans to leave Africa in attempts to boost shareholder profits and simplify the the group, cutting down to the two core divisions, Barclays UK and Barclays Corporate International.

This move will occur over the next two to three years, where Barclay has stated that it plans to “sell down” its 62% in the Barclays Africa Group.

Chief executive Jes Stanley, who joined Barclays in December, stated:

“There is of course more we need to do and areas where I believe we can move much faster to deliver the high performing Group that Barclays can and should be,”

The 6.5p dividend for 2015 will be cut to 3p in 2016 and 2017 as the bank hopes to preserve its financial strength.

In early trading, Barclays shares fell 7%

Slow growth in both Britain and China, according to new figures

Growth in Britain’s private sector fell to its slowest rate in three years in January, according to the latest survey by the Confederation of British Industry released on Tuesday.

The CBI’s monthly growth indicator rose a little, to +8 from +6 in January, but still remained slow. Rain Newton-Smith, the CBI’s director of economics, said:

“The British economy has made a slow start to the year, and growth has remained in the doldrums in February.

“With global risks increasing this year following the volatility seen in financial markets, businesses will be keeping a close eye on any possible impact on domestic activity.”

China

Two major surveys gauging China’s manufacturing activity have indicated a further slowdown in growth, becoming the latest in a string of disappointing economic figures for the country.

China’s Purchasing Manager’s Index figure fell to 49.0 in February, down from 49.4 the month before. Any figure below 50 represents contraction. On top of this, the private Caixin PMI survey for smaller businesses came in at a reading of 48.0, its lowest in five months.

These are the latest figure suggesting that the Chinese government’s attempts to control its economic decline with a series of stimuli, such Monday’s lowering of the reserve rate ratio, are not working as well as intended.

01/03/2016

Glencore shares slide further after 32 percent profit drop

Shares in mining giant Glencore (LON:GLEN) fell on Tuesday after announcing its biggest profit drop since floating on the stock market in 2011.

The Swiss-based company saw earnings fall 32 percent to $8.7 billion, after writing down assets by $5.8 billion, and net income plunge 69 percent to $1.34 billion.

The company remained positive, with CEO Ivan Glasenberg saying after the statement was released that they are confident commodity prices have bottomed, and sales into China are looking “pretty good.” However, Glencore have been hit hard over the last year as commodities have collapsed, and are now seeking to reduce debt by selling assets and cutting their dividend.

When Glencore listed on the London market in 2011 it priced its shares at 530p, but has since seen shares slide far below its IPO. On Tuesday its stock fell a further 1.7 percent on the London market, before regaining ground to trade up 1.95 percent at 135.70 (0843GMT).

01/03/2016