Morgan Sindall upgrades profit expectations, shares rise

John Lewis to axe 1,500 head office jobs

Smurfit Kappa shares soar with ‘particularly pleasing’ Q3 earnings of €390m

Smurfit Kappa added that its results reflected the benefits of its capital allocation decisions, cost management, geographic reach and recovery across its US and Americas businesses. It continued, saying the strong data underlines its 65,000 customers’ support for its innovation, supply chain management and sustainability credentials.

The company said that its business is now ‘strongly weighted’ towards FMCG customers, where it feels it is well-positioned to capitalise on e-commerce and innovative packaging demand. It added that it had implemented new ways of working during the pandemic, and would carry out a programme to look at ways to further increase its operational efficiency and effectiveness.

Responding to the company’s progress and full-year targets, the company’s CEO, Tony Smurfit, commented:

“I am pleased to report that the quality of our business and the strength of our people has produced an excellent performance in both the third quarter and the year-to-date. While some uncertainty still exists around the evolution of the effects of COVID-19 in the weeks ahead, absent a dramatic change to working practices, the Group expects to deliver EBITDA in the range of €1,460 million to €1,480 million for the full year 2020.”

“We are increasingly excited by our future prospects and the structural growth drivers of our business including e‑commerce and sustainable packaging as well as our innovative ability to capitalise on these opportunities. Reflecting the Board’s confidence in SKG’s performance and prospects, it is recommending a second interim dividend of 27.9 cent per share. This second interim dividend, following the payment of an interim dividend in September, ensures the Group is aligned with the dividend payment cycles of previous years. It is proposed to pay this dividend on 11 December 2020 to all ordinary shareholders on the share register at the close of business on 20 November 2020.”

Following the update, Smurfit Kappa shares bounced around 5% at lunchtime on Wednesday, up to 3,258.00p a share 04/11/20. This price is ahead of any other price posted during the year-to-date, and ahead of analysts’ target price for the stock, of 3,150p. The company has a ‘Buy’ rating from analysts, a p/e ratio of 17.13 – behind the consumer cyclical average of 31.19 – and a 56.53% “outperform” rating from the Marketbeat community.Kerry Group posts strong recovery in Q3

Is Hovis on the brink of a takeover deal?

M&S shares rise despite first-ever loss

LIVE: Trump vs Biden 2020 Presidential Election

15:17 – Georgia to initiate recount

With Biden pulling out a lead over Trump in Pennsylvania, a recount has been confirmed in the state of Georgia, with just 1,000 votes separating the two candidates. While expected to occur, the Georgia recount marks the first in a possible sequence of many hold-ups which could see the election prolonged to an even more nail-biting conclusion.While this likely won’t change the final result, what it will do is give pundits and onlookers pause for thought – and for Democrats, a pause on early celebrations. The race might be all but won, but team Trump will drag the process out until the bitter end.As I was saying. Recount now official. Georgia. https://t.co/3MfzPaIIYw

— Andrew Neil (@afneil) November 6, 2020

14:15 – DecisionDeskHQ calls the election and declares Joe Biden the next US President

With a handful of votes left to count and Biden extending his lead in Pennsylvania, DecisionDeskHQ called the state in the Democrat candidate’s favour – making him the next President of the United States.Legal challenges and recounts notwithstanding, the news sees Biden pull ahead to 273 electoral college votes. Which, crucially, means he has surpassed the 270 EC vote benchmark needed in order to secure a majority. We will deliver further updates as they emerge.BREAKING: Joe Biden has won Pennsylvania and its 20 electoral college votes for a total of 273.

Joe Biden has been elected the 46th President of the United States of America.@DecisionDeskHQ Projects — Political Polls (@Politics_Polls) November 6, 2020

14:10 – Biden takes lead in Pennsylvania and pulls out 7k lead

Having been on the back foot in the state since polls closed, Democrat candidate Biden came back from a 600,000 vote deficit on Wednesday, and has now pulled ahead with a 7,000 vote lead on Friday.Biden takes the lead in Pennsylvania

— Lucy Prebble (@lucyprebblish) November 6, 2020

With 98% of votes counted, Trump trails with 2,389,725, versus Biden’s 3,295,319 votes. It looks likely the Democrat candidate will take the win, and could even win fairly decisively if he takes the majority of the remaining states. Of course, proceedings may continue for some time to come, become recounting, legal challenges et al. The real race, now, will be for the Senate, with the Republicans winning 48 to the Democrat’s 46 seats.President Biden

— ALASTAIR CAMPBELL (@campbellclaret) November 6, 2020

22:20 – Trump election lead in Georgia now under 10k votes

Having been all but written off by many pundits, Georgia now looks to be back on the table for Joe Biden, as Trump lead narrows from 110,000 votes to less than 10,000 votes, within just 7 hours. Less than 1% of the vote remains to be counted according to Decision Desk HQ. And, while many viewers wait at home for the Pennsylvania count, the Georgia race has livened up during the final knockings.Trump’s lead in Georgia now under 10,000 votes https://t.co/ESJhuhkkLZ

— Political Polls (@Politics_Polls) November 5, 2020

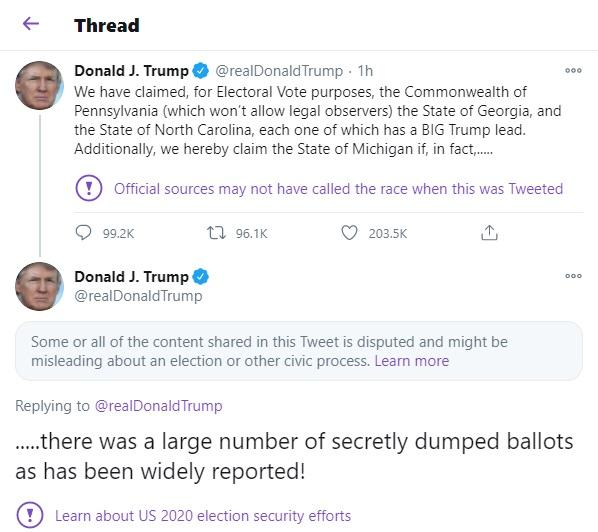

23:50 – Trump misinformation on ballot dumping flagged twice by Twitter within the same thread

There’s another one for the President’s bucket list. Not quite the mass incarceration of the ‘bloodsucking paedophile ring’ he was hoping for, but at least he’s peaked in what he would describe as ‘Leftist elite’ censorship. The incumbent POTUS seems to be taking the apparent Biden lead quite badly, and within the scope of one thread, he not only repeated the baseless claim of there being ‘dumped ballots’, but also wrongly claimed he had won Georgia, Michigan, North Carolina and Pennsylvania. In response, Twitter flagged both Tweets with misinformation warnings. And, while this kind of messaging might seem fairly on-brand for Trump, it also reeks of desperation, from a man who realises he’s losing.

The disregard for due process is also dangerous for the fabric of US civil society. And while it taps into some very real anger that continues to exist in the working class, it has been evident over the past four years that Trump does less to salve these wounds, and more to take advantage of them, and misdirect genuine feelings if miscontent.

In response, Twitter flagged both Tweets with misinformation warnings. And, while this kind of messaging might seem fairly on-brand for Trump, it also reeks of desperation, from a man who realises he’s losing.

The disregard for due process is also dangerous for the fabric of US civil society. And while it taps into some very real anger that continues to exist in the working class, it has been evident over the past four years that Trump does less to salve these wounds, and more to take advantage of them, and misdirect genuine feelings if miscontent.

23:15 – Pennsylvania voters gives first-hand accounts of voting in decisive swing state

In one of the most decisive swing states, one Pennsylvania resident told us about contrasting experiences of voting by different methods, during the tumultuous 2020 Presidential Election. Pennsylvania resident, Caitlyn Rau, and her family, voted via drive-thru and mail-in ballot, and said: “It was super easy and quick just dropping mine off with my mail in ballot, my mom and sister mailed theirs and and we got the confirmation within about a week. I kept my friend company in line and brought dinner. I live in hicktown so many people weren’t wearing masks and blaming government officials for long lines (which is understandable).” “In the city they set up a drive through drop off lane which makes that process easy, that’s how I dropped mine off for the primary.” In contrast, Ms Rau accompanied her friend to the polls to vote in person, and described waiting in line up to three hours, to vote in a politically tense setting: “[…] There were several poll workers at that location wearing blue lives matter propaganda and trump apparel, which shouldn’t be allowed. Really no safety measures put in place other than plexiglass in front of the registration people. Not enforcing social distancing, no hand sanitizer, and like I said – many people not wearing masks which is quite irritating.” Echoing these sentiments, Ms Rau’s friend described feeling “anxious, frustrated and uncomfortable” at the polling station, and “[at] the end satisfied but still super worried and anxious”. So, despite Trump’s efforts to lament the advance-voting process, residents in this high-profile state provide testament to just how easy it is to submit mail-in ballots, versus orthodox methods. Perhaps if the President hadn’t spent so long lambasting mail-in and absentee ballots, we might be in a different situation as the first day of full vote-counting ends.19:15 – Biden set to win most votes out of any candidate in US history

This election has truly been one to remember – between the surprise show-up by Trump voters, the questioning of democratic norms, and, overall, the biggest turnout in recent history. In terms of raw numbers, the majority of media outlets have now confirmed that Joe Biden has secured the highest number of ballots out of any US presidential candidate in history. And really, this should make us challenge those questioning both the performance of the Democratic party, and the predictions of pollsters.Certainly, pollsters were wrong about the resurgence of team Trump, with the ‘silent majority’ making themselves even more known than they had done in 2016. However, in a vote which has ultimately become a referendum on the US civic culture and tone of civil society, it was hard to picture that such a turn-out would be achieved. What neither the Democrats nor the pollsters got wrong, is that Biden would receive record-breaking numbers of votes, and for that, both ought to be given some credit.Not sure I agree with the poll-bashing and Democrat-denigrating. Biden has secured the most votes out of any candidate in US history. He’s done well and polls were right to predict a huge turnout for the blues – even if they underestimated team Trump #USElection #Trump #Biden

— Jamie Gordon (@JamieJourno) November 4, 2020

16:55 – Biden steps closer to election victory with leads extended in Michigan and Wisconsin

With the majority of the vote counted in Wisconsin, and having swung Michigan from a Republican lead, team Biden will be heartened to see their lead extend in two key battleground states.Having led on a knife-edge for much of the afternoon, Biden then drew out a more notable lead in the last hour or so.WISCONSIN

Biden 1,630,279 49.6% Trump 1,609,641 48.9% Jorgensen 38,385 1.2% 3,288,771 votes counted. Estimated >99% in Via @DecisionDeskHQhttps://t.co/Cn1bRjmra2 — Political Polls (@Politics_Polls) November 4, 2020

In Michigan, Biden extended his lead, having seen voter intentions swing 1.6% in the Democrats’ favour by 15:00 GMT. While tens of thousands of votes are yet to be counted in the state, the majority of those remaining are absentee and mail-in ballots, which, as we’ve said, tend to lean in favour of the Democrats. While too early to celebrate, many blues will be thinking that the election is heading in the right direction – and will continue to do so as mail-in votes continue to be counted.MICHIGAN Biden 2,578,854 49.6% Trump 2,545,142 48.9%

5,204,982 votes counted. Estimated >95% in Via @DecisionDeskHQhttps://t.co/8y7XDPVZ0I — Political Polls (@Politics_Polls) November 4, 2020

15:10 – Democrats see voter support swing their way in 3 Rust Belt States

It’s been noted since Florida went red again, that the glory or failure of Trump and Biden will be decided in the ‘Rust Belt’ swing states, with particular emphasis being put on the contests Pennsylvania, Michigan and Wisconsin. While vote-counting continued in Wisconsin, the Democrats have already declared victory in the state. And, this was likely not hurt by the BBC report stating that voting swung 0.9% in Democrats’ favour since 2016. Similarly, in the highly contested state of Pennsylvania, the BBC noted that voting has swung 1.3% in the favour of the blues. At present, Trump remains almost 600,000 votes ahead, though remaining votes are made up quite heavily of postal and absentee ballots. Finally, in Michigan, a Trump lead took a hit as team Biden saw voter intentions swing 1.6% in their favour. Now, the Democrat candidate stands 0.2% in the influential state, with almost half a million votes still to be counted.14:40 – Biden takes the lead in Michigan

With the state having backed Trump since polls closed, this commanding battleground region has since swung in Biden’s favour. And, should the vote share remain the same, this state could prove influential an influential stepping stone for a potential Biden election win.BREAKING Biden takes the lead in Michigan:

Biden 2,511,077 49.4% Trump 2,497,873 49.1% 5,088,195 votes counted. Estimated >95% in Via @DecisionDeskHQhttps://t.co/8y7XDPVZ0I — Political Polls (@Politics_Polls) November 4, 2020

12:50 – Who will win Key Battleground States according to our flash polling?

By no means all-encompassing, our polling on Twitter asked users to vote between Trump and Biden, and asked: Who will win the Battleground States: North Carolina, Pennsylvania, Michigan, Nevada and Georgia? With Biden looking likely to win Arizona and perhaps Wisconsin, we gave members of the public just a few minutes to decide who will win the crucial swing and rust belt states. With the first 300 votes rushing in, the momentum appears to be swinging back towards Biden. Having surpassed bookies’ expectations, the incumbent, Trump, now appears to be fearful, with wild claims of theft and polling fraud.This momentum shift is mirrored in our data, with 56.7% of voters favouring Biden to snatch up most of the crucial remaining states, versus 42.3% in favour of President Trump. Click here to vote in the poll before it closes.What a terrible election. As far as I can tell from the vote analysts, Biden is highly likely to pull this out — the outstanding votes in WI/MI/PA and, for different reasons, GA are likely to be very Democratic, he’s probably won AZ and NV. But then what? 1/

— Paul Krugman (@paulkrugman) November 4, 2020

12:25 – Nevada decides it wants to have the final say

With the gap currently standing at 238 ECs for Biden and 213 for Trump, the Democrat challenger needs to maintain his lead in Arizona and Wisconsin, and perhaps swing Michigan. At this point, he’d just need to win Nevada as well, and then the rest of the college cotes become inconsequential, as the Democrat candidate would hit 270 ECs. For now, though, Nevada has chosen to leave onlookers wanting, with its announcement that it would be pausing vote counting until Thursday morning.11:55 – UK Investor Magazine election polling update

Having stood divided at a flash reading last night, our two Twitter polls remain at odds, with one in favour of Trump and the other favouring Biden. The first poll, posted at 8:30PM GMT (3:30PM EST) currently has Trump leading Biden, with 53% versus 47%. Our second poll, posted 15 minutes later by a different journalist, is 55% pro-Democrat and 45% in favour of the GOP candidate. It’s worth noting that in both polls, support has swung towards Trump, with the earlier flash reading showing Trump ahead with 51.8% in the first poll, and Biden leading with 56.8% in the second. To vote, our Twitter poll links are: Poll 1 Poll 210:50 – Despite close election and choppy week ahead, rush to safe haven assets looks unlikely

With the election hinging on four or so key Rust Belt states, and with the House of Representatives and Senate likely to remain with the Dems and GOP respectively, voters’ indecision in choosing between team Biden or team Trump will likely give the markets a few things to think about in the week ahead. With Biden currently up by just 0.3% in Wisconsin, and with postal and absentee votes likely to have an influential role, there is the real possibility that the result may be contested and recounts ordered. With this in mind, risks would certainly be towards the downside – though the reaction so far assumes that any decline won’t be as monumental as previously feared. Speaking on the election and the state of play in equities and commodities, Kingswood CIO, Rupert Thompson, commented:“The market reaction, however, so far has been limited. European and UK equities are currently now up a little, as are US futures. There has also been no rush into safe haven assets with gold, the dollar and US Treasury yields volatile but overall little changed from earlier in the week.”

10:00 – Biden likely to win Wisconsin

Wisconsin was listed by CNN and others as one of the 13 Biden vs Trump key battlegrounds. And now, the Democrat candidate looks to have taken the state, with over 95% of the vote now counted.BREAKING Biden takes the lead in Wisconsin:

Biden 1,551,268 49.29% Trump 1,549,127 49.22% 3,147,142 votes counted. Estimated >95% in Via @DecisionDeskHQhttps://t.co/Cn1bRjmra2 — Political Polls (@Politics_Polls) November 4, 2020

09:50 – With Trump wanting the vote count to be stopped, can the democratic process be protected?

Speaking on Pennsylvania mail-in ballots, right-wing political consultant, Seth Weathers, said that Trump is leading by 700,000 votes, and that Biden couldn’t win there even if the remaining votes were counted. In response, the BBC presenter pointed out that a million votes are yet to be counted, and that the Democrat candidate was still in with a chance. Certainly, keeping Ohio and Florida were big votes in the GOP, but Democrats are now speaking out against the president’s attempts to undermine the democratic process:Providing some no-doubt comforting contrast, UK Foreign Secretary, Dominic Raab, refuted Donald Trump’s victory claim, but added that: “Whatever the election night comments from either side of the campaigns, I am confident and have full faith in the US institution,” He added that he was sure the “checks and balances” in place for US election races would “produce a definitive result”.Donald Trump’s premature claims of victory are illegitimate, dangerous, and authoritarian.

Count the votes. Respect the results. — Alexandria Ocasio-Cortez (@AOC) November 4, 2020

09:30 – Markets learn their lesson for jumping the gun on election result

Having heavily priced in a Biden win and spent the start of the week proverbially cracking open the champagne, equities took a nasty Trump shaped slap to the face on Wednesday morning, before recovering ground as Biden took Maine and Arizona. Now all on an upward trajectory but in a different mood to the previous two days, the CAC and FTSE initially shed between 50 and 100 points, while the DAX dropped over 200 points as trading began. With many bookies flipping their odds for favourite candidate from where they were 24 hours prior, Spreadex Financial Analyst, Connor Campbell, said: “What is going to be interesting is how markets react if Biden does win, but without a blue Senate, hampering his ability to deliver the kind of stimulus investors were banking on. Similarly, what will a Trump victory mean for traders? It would potentially see a relief bill passed a lot quicker, but likely in a smaller form than the kind of deal the Democrats would’ve produced.” In a similar vein, BlackRock’s press release stated: “A conclusive result could take a few days or more, potentially spurring market volatility and leaving open the possibility of a contested result. We prefer to look through any volatility and stay with high-conviction positions amid any sell-offs in risk assets. Likely low trading volumes in this period could magnify market moves.” In the likely event that Trump pulls another stunt, investors could well see some opportunities for cut-price equities, as uncertainty and political upset could make Wednesday a long day for equities.09:20 – With election clean sweep unlikely for either side, BlackRock contemplates the outlook for the coming years

Having priced in a Joe Biden win with about two-to-one favourability, investment giants BlackRock (NYSE:BLK)are now taking a more contemplative approach, as Trump still appears to be in with a real chance of maintaining office. In its press release titled ‘too early to call’, the company’s statement read:“A win by former Vice President Joe Biden could bring a heightened focus on sustainability through regulatory actions and would likely signify a return to more predictable foreign policy. A re-elected Trump would likely double down on the “America First” approach to immigration and trade, and usher in more deregulation. A Democratic sweep could bring large-scale fiscal spending and higher taxes for companies and the wealthy.”

“We see fiscal policy as a critical area, as it is needed to prevent permanent economic damage from the virus shock. A Biden win with a divided Congress would constrain Democrats’ ability to implement key policy priorities and launch large-scale fiscal stimulus. Stimulus in a second Trump term could be bit larger, in our view, with negotiations on a fiscal package to cushion the virus shock restarting. We expect little public investment in either case.”

“We see the election outcome’s implications playing out in fixed income and leadership in equity markets. We expect long-term yields to be capped under a Biden divided government or Trump re-election – and could see U.S. Treasury yields falling further after a pre-election run-up in yields on expectations of a Democratic sweep. Longer term, however, we see government bonds challenged amid a higher inflation regime. We expect tech companies the quality factor and large caps to perform strongly under a divided government – as they have done in the past. We believe emerging market (EM) assets would likely outperform on improved trade sentiment in case of a Biden win, especially Asia ex-Japan assets. Many countries in that region have managed to contain the virus and are further ahead in the economic restart. We see challenges for EM assets and global cyclicals in a second Trump term due to a possible resurgence in trade tensions.”

09:10 – Ben Shapiro trends on Twitter as Trump attempts to undermine legitimacy of the election

Having made a speech declaring that he’d be taking his frustrations to the US Supreme Court, POTUS Donald Trump has caused outrage by declaring that votes should stop being counted. Naturally – and predictably – the GOP leader has accused Team Biden of cheating. But, having incited voter intimidation by way of Trump-banner-toting convoys, threatened to discount postal votes, and the NYT reporting that the California Republican Party placed hoax ballot boxes around the state, many are now thinking the Trump campaign has gone too far. Among this group is the conservative personality, Ben Shapiro, who went viral on Twitter for lamenting his candidate’s efforts to undermine the democratic process:No, Trump has not already won the election, and it is deeply irresponsible for him to say he has.

— Ben Shapiro (@benshapiro) November 4, 2020

23:55 – Election turnout expected to be the largest since the Second World War

Having achieved just a 55% turnout at the 2016 election, the University of Virginia’s Center for Politics now expects the Trump versus Biden voter turnout to be the largest since WW2. And, despite instances of voter intimidation and waiting times stretching over two hours at polling stations, turnout is expected to be as high as 90% in some states. Thus far, absentee and mail-in ballots appear to be heavily in favour of the Democrats, and a high voter turnout would tend to indicate good news for team Biden. However, having opened up a large lead in polling, the Democrats may now be looking at a kick-back from GOP supporters, who are turning out in numbers to keep their candidate in office. Indeed, almost half of Biden voters said they were voting Democrat to get Trump out of office. Meanwhile, over 60% of Trump voters said they would vote for the GOP candidate to have him in office – as opposed to keeping Biden out. With this in mind, Trump commands more impassioned support from his followers – though , equally, more ardent resistance from his detractors.23:50 – UK Investor Magazine Readers respond to snap US Election Poll

Hardly a decisive or generalisable result, but our readers came down indecisively on both sides, with one snap poll favouring Donald Trump, while the other favoured challenger Joe Biden. In the first poll, the incumbent leads by 51.8%.On our second poll, posted just 15 minutes later, Biden was in front – ahead with 56.8%.With bookies’ odds tightening, voter intimidation, and long waiting times at polling stations, who will win the US Presidential Election 2020? #USAElections2020 #BidenHarris2020 #Trump2020 #Biden2020 #TrumpCollapse #Vote2020 🇺🇸💙❤️🦅

— Jamie Gordon (@JamieJourno) November 3, 2020

This should let us know that it’s still all to play for as voting closes in less than fifteen minutes. We must now reflect on the old adage: it’s all up to you, Florida (not literally, but close enough).Who is going to win the US Presidential Election? #election2020 #USPresidentialElections2020 #USAElections2020 #TrumpCollapse

— Bronte Carvalho (@BronteCarvalho) November 3, 2020

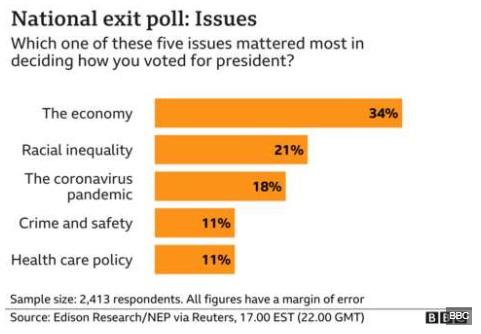

23:45 – Survey finds Economy is top election issue, but who will this favour?

According to data by Edison Research, and presented on Reuters and the BBC, the Economy is the top issue for Trump and Biden voters casting their ballots at the polls.

23:25 – As voting comes to a close, polls favour Biden to win the most votes in the 2020 election

With polling giving Biden advantages ranging from 5% to 16% in the month leading up to the election, here are two polls at different ends of the spectrum, having their final say before votes begin to be counted in earnest. SurveyMonkey, who were credited with accurately predicting the Trump victory in 2016, currently give Biden a 6% vote count advantage:At the other end of the spectrum, and likely leaning more towards the Democrat side, polling by the University of California gives Biden an 11% lead over Trump:National GE: Biden 52% (+6) Trump 46%@SurveyMonkey/@tableau/@axios, LV, 10/31-11/2https://t.co/XyP5kztmIf

— Political Polls (@Politics_Polls) November 3, 2020

Finally – and please note, not a voting intention poll – The Economist predicts the outcome of the Presidential Election, believing there is more than a 99% chance Biden will win more votes than Trump, and a 97% chance he’ll win more electoral colleges. Perhaps a tad over-zealous, but make of it what you will:#Finel National @USCDornsife Poll, (LV, 10/20-11/2):

Biden 54% (+11) Trump 43%https://t.co/klbkg4VNLS — Political Polls (@Politics_Polls) November 3, 2020

#Finel @TheEconomist Forecast:

Chance of winning the electoral college: Biden 97% Trump 3% Chance of winning the most votes: Biden >99% Trump <1% Estimated electoral college votes: Biden 356 Trump 182https://t.co/6Ei5T5ogc2 — Political Polls (@Politics_Polls) November 3, 2020

23:10 – Bookie users favour Trump election win

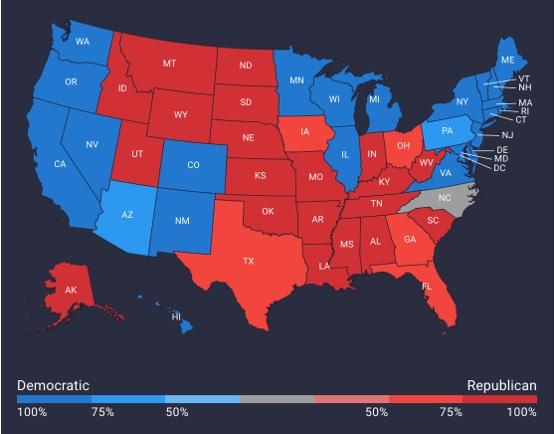

Since one punter placed a £1 million bet on Joe Biden with betfair, the picture has since looked a lot less clear as to who bookies are favouring. While Bet365 narrowed their odds in favour of Trump, William Hill widened their odds – offering users £2.88 in potential winnings for every £1 bet on a Trump victory. Regardless of bookies’ behaviours, and polling data, betting site users appear to be heavily leaning towards Trump-focused bets. For instance, on crypto betting platform, Cloudbet, some 80% of money taken has been on the incumbent president and the GOP. Speaking on betting behaviour and the dilemma faced by betting platforms, the Cloudbet statement read: “[As] anyone who followed betting odds during the 2016 election will tell you. Prices on Trump in the lead up to Election Day had widened as far as 9 (+800) – implying a win probability of 11%. And we know the result…” “So here then is this election’s major challenge for bookmakers: Trump has beaten the odds before. Do you really want to expose your business to massive losses by pricing him too far out of the market, whatever the polls are telling you?” “Bettors are clearly aware of what happened in 2016 – and books are clearly seeing substantial interest on Trump, in spite of what the election polls indicate.” Adding that the nature of crypto bettors normally dictates that they are usually inclined towards the right-wing, Cloudbet said that 90% of the money it has taken from Michigan and 86% of money collected from Florida bets, were in favour of a Republican election victory. Their state-by-state election map is as follows:

22:50 – US equities suggest a Biden election victory is a sure thing

Having dipped during much of last week, the Dow Jones is up 2.06% on Tuesday, hitting a weekly high of 27,480. Similarly, after dipping last Friday, big tech stocks soared on Tuesday, and pushed the Nasdaq up by 1.85%. This bullishness would lead us to believe one thing: markets have already priced in an outcome with some confidence. And, with a Biden victory having appeared the more likely outcome over the past month, it’s more likely that this is the conclusion that equities are expecting. However, we should note that this kind of approach – should this in fact be what markets have done – is a stiff dose of ‘jumping the gun’. As stated by Spreadex Financial Analyst, Connor Campbell:“That [indexes] fell so fast and hard last week is undoubtedly a contributing factor to the size of Tuesday’s gains.”

“The danger for the markets – and it is a very real danger – is that they are going to wake-up with a HELL of a hangover on Wednesday if the result is anything but a decisive, and stimulus-signalling, victory for the Democrats.”

“And there is a litany of obstacles standing in the way of that outcome. We could be in for a long and protracted tallying period thanks to the sheer number of mail-in votes, one that may involve recounts.”

At the very least, we may not find out the election result tonight, before European markets open in the morning. At most, Trump may even steal a victory after a late comeback.22:30 – Trump leads in Florida, but swing states remain split overall

As we near the crunch-time of the US 2020 election, the University of Michigan published its latest round of live vote counting in Florida, which showed that the incumbent – president Trump – remained ahead in votes counted thus far.Despite this, BBC US Correspondent Jon Sopel reminded viewers that the president would essentially have to win ‘almost all’ of the swing states, in order to be in with a shot of winning the electoral college overall. At present, pollsters remain divided on the status on these crucial swing states, and their coveted electoral college votes:Florida Update:

GOP: 4,149,144 (+191,876) DEM: 3,957,268 NPA/Other: 2,597,260 Total: 10,703,672 Via @umichvoter99 — Political Polls (@Politics_Polls) November 3, 2020

PENNSYLVANIA Biden 52% (+4) Trump 48% . FLORIDA Biden 51% (+2) Trump 49% . NORTH CAROLINA Biden 51% (+2) Trump 49%

Frederick Polls/@compete_digi, LV, 10/30-31https://t.co/GnCBlys7PQ — Political Polls (@Politics_Polls) November 3, 2020

These close margins are seem to be mirrored in the vast majority of polls, with the election looking as though it’ll be decided by the fine lines in areas such as Iowa, Florida, Pennsylvania, North Carolina and Michigan.FLORIDA Trump 50% (+3) Biden 47% . PENNSYLVANIA Trump 49% (+2) Biden 47% . OHIO Trump 49% (+2) Biden 47% . GEORGIA Trump 49% (+2) Biden 47% . NORTH CAROLINA Trump 49% (+2) Biden 47% . MICHIGAN Trump 48% Biden 48%

Wick, LV, 10/24-25https://t.co/2vrbxZf9wo — Political Polls (@Politics_Polls) November 3, 2020

IOWA Biden 47% Trump 47% Jorgensen 3% Hawkins 0%@ChangePolls, LV, 10/29-11/1https://t.co/vbBaA7TIri

— Political Polls (@Politics_Polls) November 3, 2020

FLORIDA

Trump 48% (+1) Biden 47%@GravisMarketing, LV, 10/24https://t.co/pD9uUjNDA2 — Political Polls (@Politics_Polls) November 3, 2020

PENNSYLVANIA

Biden 50% (+2) Trump 48% Jorgensen 2%@swayable, LV, 10/27-11/2https://t.co/D2fO2bAg8Z — Political Polls (@Politics_Polls) November 3, 2020

Global equities boom seems to indicate US election is a forgone conclusion

“That [indexes] fell so fast and hard last week is undoubtedly a contributing factor to the size of Tuesday’s gains.”

“The danger for the markets – and it is a very real danger – is that they are going to wake-up with a HELL of a hangover on Wednesday if the result is anything but a decisive, and stimulus-signalling, victory for the Democrats.”

“And there is a litany of obstacles standing in the way of that outcome. We could be in for a long and protracted tallying period thanks to the sheer number of mail-in votes, one that may involve recounts.”

The likelihood of a Democrat clean sweep narrows by the minute, with many bookies now saying that the majority of punters are taking advantage of the generous odds for a Trump victory, while Spreadex themselves increased Trump’s projected college votes from 222-230, to 227-235 – roughly where he was before his victory in 2016. With this in mind, global equities may end up taking a hammer blow to the gut if the underdog incumbent takes a second term – or even puts up enough of a fight to see the race drag out over several days. Echoing this sentiment, IG Chief Market Analyst, Chris Beauchamp, commented:“The risk is that investors are getting ahead of themselves, given the potential for a long, drawn-out battle over the result of the US election in coming weeks should no obvious result appear by this time tomorrow morning.”

“In that case risk assets could well struggle to make much headway, even if they do manage to avoid further substantial losses similar to what we saw last week.”

“The focus on the election obscures the really important element, namely a US fiscal stimulus, since whoever emerges as the winner will need to sort out this most pressing item, before the US economy moves into an even deeper slump.”