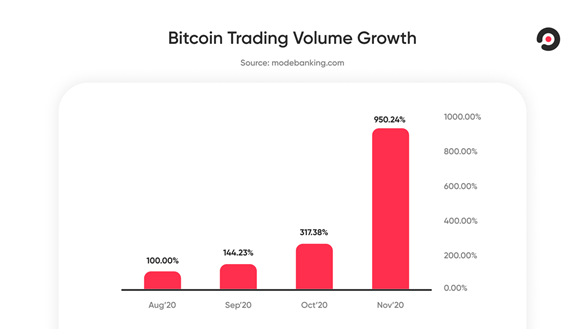

LSE-listed fintech, Mode Global Holdings (LON:MODE), has been on the right side of the recent Bitcoin surge, with the company reporting that in-platform trading volumes spiked by 950% between August and November.

The company said that customers have been using their app to buy and hold Bitcoin as the cryptocurrency hit its highest price since 2017. Mode Global added that some 80% of trades occurring during the three-month period were purchases, with the app’s total assets under custody increasing by 210%, and app usership increasing by almost 500%.

Jonathan Rowland, Executive Chairman of Mode, commented on the recent trends: “We’ve seen unprecedented interest in buying and holding Bitcoin just as the market rally really took off. That coincided with the chaotic US elections that brought with it market volatility, as well as a second UK lockdown with all the economic uncertainty this entails. Longer term, economists anticipate that the unprecedented fiscal support we’re seeing launched to tackle the pandemic crisis will boost inflation. We believe that this will only increase demand for inflation hedges and diversification strategies such as investing in Bitcoin.”

Mode Group added that the increase in trading volumes and assets under custody it has witnessed, reflect the strong performance of Bitcoin over the last few months, which has gained as much as 75% in USD terms since August, and almost 300% since its March nadir around eight months ago.

The company itself are also capitalising on the recent popularity of alternative currencies, with up to 10% of its own treasury holdings now allocated to Bitcoin. These recent shifts follow the news that Mode Global became one of the first consumer-focused, digital banking apps to list on the London’s main market. The company added that some 80% of Bitcoin held on the app has now switched from user accounts to the app’s Bitcoin Jars, which offers savers 5% interest APY.