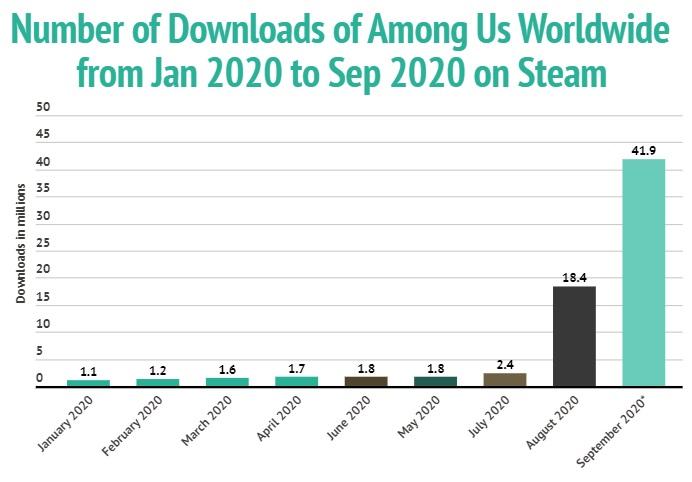

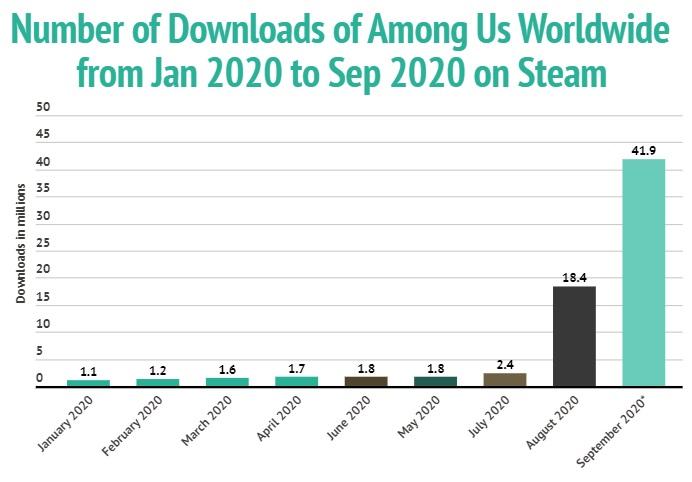

Among Us downloads surge, up 3700% versus the start of the year

Biden lead and stimulus hopes keep the ball rolling for global equities

“Far from Trump benefiting from a sympathy vote, his antics have increased Biden’s lead in the polls to close to 10%. The betting markets now give a two in three chance of Biden winning the Presidency.”

“If there is a clear victory for Biden, this reduces the chances of possibly the worst outcome for the markets – a result which would remain in dispute for a number of weeks after the election. A decisive victory, particularly if it includes the Democrats gaining control of the Senate, would also mean it would be easier for Biden to implement his plans for a sizeable fiscal stimulus package early next year.”

“The concern recently has been that Congress and the President have failed to agree a package to replace the stimulus measures which expired in July. The position here changed almost daily last week but on balance an agreement still looks unlikely this side of the election. If so, the prospect of a new Democratic Government able to enact an increasingly badly needed fiscal stimulus clearly has its attractions.”

The most impressive shifts, however, came from Asian equities, with the SSE Composite soaring 2.64%, to 3,358 points, while the Hang Seng jumped 2.20%, to 24,650. Slightly further East, the Nikkei slumped, down 0.29% to 23,559 points.

Is a second lockdown the correct approach?

So who says a second lockdown is the wrong course?

Interestingly, however, the ‘herd immunity’ narrative appears to be moving into more creditable channels of public opinion. Granted, most don’t apply the exact verbiage of Dominic Cummings’ sinister-sounding master plan, but outlets such as the Telegraph, pundits such as Andrew Neil, and even the World Health Organisation Director General’s Special Envoy, Dr David Navarro, are now speaking out about the risks of a second lockdown.One of the driving forces behind the challenge to lockdown is infectious disease epidemiologist and Oxford Professor of theoretical epidemiology, Sunetra Gupta, who believes that the economic and social harms experienced by the worst off – in the UK and in poorer countries – outweigh the potential harms the virus might cause. She adds that areas which have already been hit hardest by the virus, are less likely to see the same degree of reuptake. Speaking to the Biomedical Scientist magazine about the suspected second wave, Professor Gupta stated that: “It’s not really a resurgence. It’s just where it didn’t increase in the first place. Now all the barriers have been removed, it is increasing. I don’t see any surprises in that pattern. What I do think is interesting is that it’s not resurgent in many areas that did suffer the full brunt of the pandemic, so in London, New York, northern Italy, Sweden.” Her view is that herd immunity has not yet been reached, but that early signs of resistance appear in certain geographies. She states that the next step is to use serological testing, and try to determine not just who has COVID, and what proportion of the population has been exposed to it. On the prospect of a second lockdown, she says that: “I don’t see any clear and rational thought behind it. More importantly, my primary reason for being vocal has all along been my deep concern about the economically vulnerable, in this country and globally. I am terrified when I read reports of 260 million people going under the poverty line as a result of these measures. We also have to think of the young and what they have been denied.” The alternative to lockdown, however, still appears somewhat fudged, and awkwardly apologetic about what it would mean for the safety of vulnerable people. She adds: “I think the best strategy for protecting the vulnerable is to shield. Obviously mistakes were made in terms of sending infected people back to care homes. I think we should be very careful, especially when we move back into winter. But in many parts of the UK, the infection rates are down to a point where people can make a sensible decision about what level of risk to take.” Professor Gupta adds that the initial Oxford study of the virus’ spread also noted that the disease may have appeared in the UK a month before it was officially declared. This loss of time likely limited the effective roll-out of key preventative and research procedures, which could have been used to identify key characteristics about how the virus transmits, and where. “We’ve been looking at blood banks in Scotland and can see infections going up in mid March, which suggest the virus was there in February. Then there’s the work in the sewers where they’re looking for the virus. I think it’s important to have these sentinels in place to try and see when the virus arrived and where it spread.” Overall, though, she believes the political outlook is skewed, and that the UK’s efforts to cocoon, are plunging tens of millions around the world into destitution: “I think it’s important not to look at the situation along the one dimension of ‘how are we going to get this under control?’ We must consider all the consequences. I think we also need to take a more holistic view and not just this individual, nationalistic view. Think globally, think internationally.”WATCH: Dr David Nabarro, the WHO’s Special Envoy on Covid-19, tells Andrew Neil: ‘We really do appeal to all world leaders: stop using lockdown as your primary control method’. Watch the full interview here: https://t.co/XLdaedsKVS #SpectatorTV @afneil | @davidnabarro pic.twitter.com/1M4xf3VnXQ

— The Spectator (@spectator) October 9, 2020

COVID teaming, looks to blight Christmas

Not quite as cheery as Bing Crosby’s holiday classic, but it appears that despite the threat of business closures, isolation, life being put on hold, and now the very credible counter-narrative of millions being pushed back into poverty, the UK might observe a second lockdown over the festive period. Hopefully the government has learned lessons from round one – including not turning care homes into incubation chambers, and not handing billions in taxpayer funds to companies who don’t pay UK corporation tax. For now, Boris has given himself the traffic light system, which will probably afford the PM a couple of weeks to decide whether the public are calling for escalation or de-escalation of lockdown measures. He still remains in an unenviable position, stuck between the centre-ground who are likely, onerously in favour of a second lockdown, and his more ardent right-wing, who are thoroughly fed up of restrictions. Though only representative of my small following of Twitterati, here is the response to my question, ‘Would you agree with existing/new Covid lockdown measures over the Christmas period?’:Would you agree with existing/new Covid lockdown measures over the Christmas period? #COVID19 #lockdownUK #covidchristmas

— Jamie Gordon (@JamieJourno) October 4, 2020

Aminex shares soar 200% gas project gains approval

Aveva shares down by 5% as revenues fall by an eighth

One of these contracts was the renewal of a ‘significant’ global account. With revenues from this contract being pulled forwards into September 2019, unadjusted revenues declined by 12% in H1 2020. Accounting for the contract renewal, revenues declined year-on-year by 7% during the first half.

Speaking on the confidence it has in its offering, and future prospects, the Aveva statement read: “Notwithstanding Covid-19 related disruption, there has been solid demand for AVEVA’s software due to its ability to drive efficiency, flexibility and sustainability for customers across a wide range of industries. AVEVA has performed creditably in the first half against this backdrop and its outlook for the full year remains unchanged.”

“The order pipeline for the remainder of the financial year is strong, underpinned by a higher volume of contract renewals, including major Global Account contracts, as well as the contracts that slipped from the second quarter. As such, the Board expects to see solid revenue growth in the second half and remains confident in the full year outlook.”

Following the update, Aveva shares slid by 4.79% or 227.00p, to 4,499.00p 21/10/20 11:45 GMT. This more than 6% above its consensus target price of 4,209p, but far below its year-to-date high of 5,290p. The company currently has a consensus ‘Hold’ rating, and a 63.49% ‘Underperform’ stance from the Marketbeat community. Its p/e ratio is 43.57, below the IT and tech average of 65.37.