French Connection posts 53% fall in revenue, shares fall

Marshall Motor Holdings gains traction with vehicle sales up 34%

Meanwhile, the company’s fleet sales were also up by 17.1% on a like-for-like basis, with total new fleet sales up 23.9%, compared with the SMMT’s reported fleet registrations decline of 7.4%. Similarly, used vehicle sales rose by 15.7% on a like-for-like basis in September, and 29.4% in total.

Overall, total revenue was up by 28.0%, and by 16.3% on a like-for-like basis. This progress saw the company change its full-year guidance, from break-even, to an anticipated profit-before-tax of £15 million.

Marshall Motor Holdings responds

Commenting on the optimistic update, company Chief Executive, Daksh Gupta, said:“Our strong culture, brand partnerships with scale, in-house technology platform and online presence, coupled with our exceptional colleagues have enabled the Group to significantly outperform the wider automotive retail market through this important post-lockdown trading period. Our operational performance in August and September, in particular, was strong across all key like-for-like new vehicle sales metrics and we have also delivered significant like-for-like growth in both used car sales and aftersales. On behalf of the Board, I would like to thank all of our colleagues who have worked tirelessly through these unprecedented times and contributed so magnificently in delivering this performance.”

“Whilst this period of positive trading has been welcomed following the significant impact of COVID-19 in the first half of the Year, there remain a number of uncertainties regarding the trading environment for the remainder of the Year and beyond. We are also mindful that the market in Q3 was positively impacted by pent-up demand for new and especially used vehicles, which, allied to restricted supply, created favourable conditions from which the Group was very well positioned to benefit. It is for these reasons that we have taken appropriate actions in terms of limited business closures and restructuring measures to ensure the Group is well placed to meet these potential future challenges”.

Investor notes

Following the update, the company’s shares rallied by 10.83% or 13.00p, to 133.00p apiece 13/10/20 11:00 BST. Today’s price represents the stock’s highest price since the start of lockdown, with the price last hitting this level at the start of March. At present, the company has a p/e ratio of 5.24, and was given a 61.29% ‘Underperform’ rating by the Marketbeat community.SSE shares rally after selling energy-from-waste business for £1bn

At present, the MEL1 and MEL2 ventures are joint-owned by SSE and Wheelabrator Technologies Inc, and consist of the operational Ferrybridge Multifuel 1 and Ferrybridge Multifuel 2 facilities (MEL1), and the Skelton Grange Multifuel development project (MEL2) – all of which are located in West Yorkshire.

The two MEL1 components have a capacity of 75MW apiece and are capable of processing around 725,000 tonnes and 675,000 tonnes of waste every year respectively. The MEL2 component is set to reach financial close around April 2021, and commence commercial operations in 2025. It is expected to have a capacity of 45MW and will be able to process 400,000 tonnes of waster per year.

The decision to sell followed SSE identifying the two ventures as an early priority for sale, in an effort to free up £2 billion from disposal of non-core assets by autumn of next year.

Today’s announcement follows the sale of the company’s 25.1% non-operating stake in Walney Offshore Wind Farm to Greencoat UK Wind for £350m and the agreement to sell its 33% equity interest in meter asset provider MapleCo to Equitix, under which SSE will receive net proceeds of around £90m on closing.With these three disposals, SSE is more than 70% of the way to completing its disposals goal. With the proceeds of the sales, the company plans to invest £7.5 billion in low-carbon energy infrastructure over the next five years, which it says will both lower UK emissions and reduce its own net debt.

SSE sale to spur on future investment in low-carbon energy

Speaking on the announcement, company Finance Director, Gregor Alexander, commented:“This sale marks a major step in our plans to secure at least £2bn from disposals by autumn 2021, with just over £1.4bn now delivered. While these multifuel assets have been successful ventures for SSE, they are non-core investments and we are pleased to have agreed a sale that delivers significant value for shareholders while sharpening our strategic focus on our core low-carbon businesses.”

“Our disposal programme demonstrates how the company can create value from our assets and supports our plans to invest £7.5bn over the next five years in the low-carbon infrastructure needed to stimulate a green economic recovery and help the UK transition to a net-zero future.”

Investor notes

Following the news, SSE shares rallied by 3.85% or 51.00p, to 1,377.00p a share 13/10/20 11:15 BST. At present, this is around 4% behind analysts’ target price of 1,418.30p a share, and short of its half-year high, in July, of 1,436.00p. Analysts currently have a consensus ‘Hold’ rating on the Group’s stock, a p/e ratio of 15.86, and was allocated a 61.74% ‘Underperform’ rating by the Marketbeat community.Sareum Holdings shares plunge 10%

B.P Marsh & Partners shares surge 12% despite market uncertainty

Europa Oil & Gas shares plummet as loss widens

Unemployment reaches 4.5% amid Covid crisis

UK tourism fell by 96% during lockdown and remains sluggish

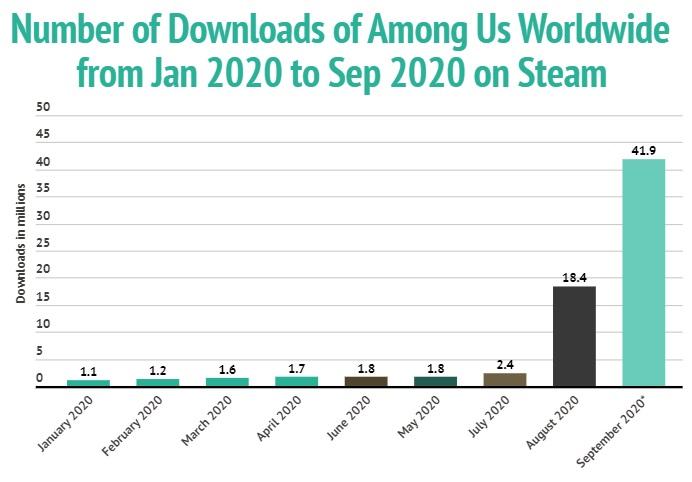

Among Us downloads surge, up 3700% versus the start of the year