Chinese Remdesivir study

The Chinese study involved 237 COVID-19 patients of which 158 were administered Remdesivir and 79 were given a placebo. The study found that the placebo group actually had better survival rates than the group who received Remdesivir. 13.9% if the group who were treated with Remdesivir sadly died where as just 12.8% of those in the placebo group died. However, the study has been met with much scepticism due to the nature it was released and the fact the study was carried out in China with a small sample size. The results of the study had been published by mistake by the WHO before it was quickly removed. Gilead Sciences, the company who owns Remdesivir, hit back at the findings saying the study had been completed early and pointed to the progress of on-going studies.Merdad Parsey, Chief Medical Officer at Gilead Sciences commented on the Chinese study: “Today, information from the first clinical study evaluating the investigational antiviral remdesivir in patients with severe COVID-19 disease in China was prematurely posted on the World Health Organization website. This information has since been removed, as the study investigators did not provide permission for the publication of the results. Furthermore, we believe the post included inappropriate characterizations of the study. The study was terminated early due to low enrollment and, as a result, it was underpowered to enable statistically meaningful conclusions. As such, the study results are inconclusive, though trends in the data suggest a potential benefit for remdesivir, particularly among patients treated early in disease. We understand the available data have been submitted for peer-reviewed publication, which will provide more detailed information from this study in the near future.” “The results of this trial in China, along with those of the compassionate use cohort of more critically ill patients published on April 10, add to a growing but still inconclusive body of evidence for remdesivir. Remdesivir is an unapproved investigational product, and the safety and efficacy of remdesivir for the treatment of COVID-19 are not yet known. There are multiple ongoing Phase 3 studies that are designed to provide the additional data needed to determine the potential for remdesivir as a treatment for COVID-19. These studies will help inform whom to treat, when to treat and how long to treat with remdesivir. The studies are either fully enrolled for the primary analysis or on track to fully enroll in the near future.”Gilead statement on data from study in patients with severe COVID-19 in China: https://t.co/pDsnSmVijG. pic.twitter.com/UpqR5EJqvQ

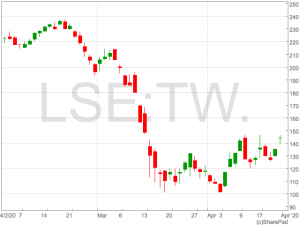

— Gilead Sciences (@GileadSciences) April 23, 2020