Baron Oil strikes work-sharing agreement, shares jump 40%

Baron Oil (LON:BOIL) was one of AIM’s top risers on Wednesday after the oil explorer revealed a work-sharing agreement alongside the release of their final results.

Baron Oil announced a work-sharing agreement “with a large European Exploration and Production Company” for in the Inner Moray Firth area. The news is a milestone in the prospect which could lead to significant value creation for Baron Oil’s shareholders.

Baron Oil has a 15% interest in the prospect and the work sharing agreement could lead to a more formal farm-in agreement.

The explorer, who has prospects in South East Asia, Latin America and the UK, also posted a significant reduction in pre-tax losses to £1.7m in their final results.

Commenting on the results, Malcolm Butler, Executive Chairman, said:

“The final award of the Chuditch PSC was a great result for your Company and marks a step-change in Baron’s asset base. However, our industry is currently faced with the dual global impact of significantly lower oil prices and the rapid spread of the COVID-19 virus. While Baron is not insulated from the oil price shock, it should be noted that the Company’s assets are all in the pre-cashflow exploration phase and, following the award of the Chuditch PSC, are now heavily weighted towards gas where regional markets play a much greater role in pricing.”

“In Timor-Leste, there is no obligation to drill before 2022 and any commercial production is unlikely to be achieved before 2025. There are no plans to fund drilling in the UK for the foreseeable future. In both cases, work on these projects over the next 12 months is desk and computer-based and should not be affected by current movement restrictions, although gaining access to the necessary data is being delayed.”

“As regards the El Barco-3X well in Peru, it is unclear how much local oil companies’ appetite for drilling will be affected by oil price movements and although it is unlikely that local gas prices in this part of Peru will be affected by the drop in oil prices, it is impossible to predict the effects on short term gas demand of a COVID-19 related recession.

“Critically for shareholders, following our £2.5m (gross) fund raise in Q1 2020, our proposed work programme for 2020 and into 2021 is funded.”

Analysts were also positive on the results and pointed towards potential uplift for Baron Oil.

“Exclusivity may be extended until 31 December 2020 in the event that the interested party wishes to negotiate a formal farm-in agreement. In the event that the third parties’ technical work suggests significant potential resources to be present on the licence and a farm-in is agreed, we believe that the value of Baron’s interest could increase significantly,” Barry Gibb, Research Analyst at Turner Pope, wrote in a note.

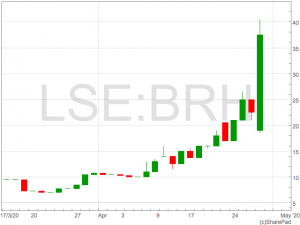

Braveheart Investments shares rocket 71% on plans to grow portfolio

Shares in AIM-listed Braveheart Investments (LON:BRH) rocketed on Wednesday after the investment company announced the results of a placing to help grow their portfolio.

The Braveheart Investments share price was up 71% to 38p on Wednesday.

The jump followed a successful £275,000 placing at 17p. Th proceeds will be used to expand the company’s portfolio with investments already earmarked for the cash.

The cash will be invested in Braveheart’s strategic investments including Paraytec, Pharm2Farm, Kirkstall Limited, Gyrometric Systems , Phasefocus Holdings and Sentinel Medical.

Braveheart Investment’s portfolio is focused on technology companies with high levels of intellectual property.

Trevor Brown, Braveheart CEO, commented: “We are delighted to have been able to raise this extra funding and to have also increased our shareholder base. The balance sheet of Braveheart remains strong and so we will be able to provide financial support to our Strategic Investments if it is required to keep up their momentum in development.”

The cash will be invested in Braveheart’s strategic investments including Paraytec, Pharm2Farm, Kirkstall Limited, Gyrometric Systems , Phasefocus Holdings and Sentinel Medical.

Braveheart Investment’s portfolio is focused on technology companies with high levels of intellectual property.

Trevor Brown, Braveheart CEO, commented: “We are delighted to have been able to raise this extra funding and to have also increased our shareholder base. The balance sheet of Braveheart remains strong and so we will be able to provide financial support to our Strategic Investments if it is required to keep up their momentum in development.”

The cash will be invested in Braveheart’s strategic investments including Paraytec, Pharm2Farm, Kirkstall Limited, Gyrometric Systems , Phasefocus Holdings and Sentinel Medical.

Braveheart Investment’s portfolio is focused on technology companies with high levels of intellectual property.

Trevor Brown, Braveheart CEO, commented: “We are delighted to have been able to raise this extra funding and to have also increased our shareholder base. The balance sheet of Braveheart remains strong and so we will be able to provide financial support to our Strategic Investments if it is required to keep up their momentum in development.”

The cash will be invested in Braveheart’s strategic investments including Paraytec, Pharm2Farm, Kirkstall Limited, Gyrometric Systems , Phasefocus Holdings and Sentinel Medical.

Braveheart Investment’s portfolio is focused on technology companies with high levels of intellectual property.

Trevor Brown, Braveheart CEO, commented: “We are delighted to have been able to raise this extra funding and to have also increased our shareholder base. The balance sheet of Braveheart remains strong and so we will be able to provide financial support to our Strategic Investments if it is required to keep up their momentum in development.” Next shares sink as the retailer scraps dividend

Shares in Next plc (LON:NXT) fell on Wednesday as the company scrapped their dividend amid disastrous sales performance due to the coronavirus pandemic.

The British retailer released full price sales figures that revealed an obliteration of sales during the lockdown with total sales for the year to April 25th down 38%.

Next faced pressure to close their warehouses after failing to implement social distancing measures meaning their website was forced to close.

With stores already closed, Next’s revenue generation was severely limited to the extent the company made no sales in the week commencing 29th March.

Online sales have since resumed but a well below the comparative period last year.

The company has scrapped the dividend to be paid in August and said it is unlikely the January dividend will be paid either. This is estimated to save £220m in an effort to conserve cash.

Next summuarised the results of stress tests and potential scenarios that showed even in the case of a 40% reduction in full year sales, the company would still be EBITDA positive.

“It is hard to think of a time when the outlook for sales and profit has been more difficult to predict. A pandemic of this scale has simply not been experienced by a modern global economy. No amount of information about the past can accurately guide us in our deliberations on the future. Our job is not to guess exactly how things will pan out but to prepare the Company for all outcomes that seem reasonably possible,” Next said in a statement.

“So, the scenarios we set out are just that, scenarios, not guidance, not a forecast. Their purpose is to demonstrate how the business is likely to perform under different levels of stress, without seeking to predict which outcome is most likely.”

“But these stress tests are more than an academic exercise. They serve to inform the decisions we take about the costs we should save, the cash we need to generate and investments we can afford to make.”

“The stress test also serves to demonstrate the financial stability of the Group. NEXT’s historic maintenance of healthy margins and high returns on capital have built a strong base from which to weather the storm: even in our worst case scenario of sales down -40% the Group still is likely to deliver positive EBITDA and reduce year end financial net debt.”

Barclays shares rally as the bank prepares for COVID-19 fallout

Barclays shares (LON:BARC) rallied on Wednesday after the UK bank posted a reduction in profit for the first quarter as it set aside $2.1bn for bad debt dues to COVID-19.

Shares in Barclays rose significantly above 100p for the first time since late March as Barclays share price rallied over 5% to 103p in early trade on Wednesday.

The UK bank reported statutory profit before tax of £0.9bn, down from £1.5bn in the same period a year ago. Profit before tax would have been £3bn should the bank not have had to set aside £2.1bn in provisions for bad loans.

Before the impact of the £2.1bn provision, Barclays £3bn profit represents a strong increase on last year and will stoke investor optimism Barclays were in good shape going into the crisis.

“An event like the COVID-19 pandemic makes everyone focus on what’s really important right now. For us, that means running the bank safely and soundly, helping our customers and clients through the difficulties they face, supporting the UK economy and the communities where we live and work, and taking care of our colleagues around the world,” said Jess Staley in a statement included in the update.

Jess Staley continued to outline the impact government schemes such as CBILs had on Barclay’s ability to make loans to UK businesses.

“We welcome the government and Bank of England’s business support programmes and have introduced additional measures to back UK companies ourselves. They are now having a real impact. As at 24 April 2020 we have facilitated significant commercial paper issuance though the Covid Corporate Financing Facility, lent £737m in Coronavirus Business Interruption Loans, approved over 238,000 mortgage and loan payment holidays, and over 6 million customers and clients are currently paying no personal overdraft or business banking charges. We have launched a community aid package; through which we are donating £100m to support those who are being hardest hit by COVID-19. We expect that all of these measures will help to limit the economic and social impact of the pandemic.”

The Barclays CEO highlighted the impact of COVID-19 on the bank’s earning which would have been £3bn if they were not to set aside £2.1bn in provisions for bad loans due to the COVID-19 crisis.

“The impact of COVID-19 came late in what was until that point a good quarter. Statutory profit before tax was £0.9bn and profit before tax excluding credit impairment charges was £3.0bn. We have taken a £2.1bn credit impairment charge which reflects our initial estimates of the impact of the COVID-19 pandemic.”

“The strength of Barclays lies in our diversification by business, geography and currency, which allows us to remain resilient through the developing economic downturn.”

Touching on the letter from the Bank of England which instructed banks to cut their dividends, Staley provided a rough timeline on when the Barclay’s board would start to consider paying dividends.

“In response to a request from the Prudential Regulation Authority (PRA), we cancelled the full year 2019 dividend payment of 6 pence per ordinary share, and the Board will decide on future dividends and its capital returns policy at year-end 2020.”

“Despite all the challenges we face as a consequence of COVID-19, I am confident Barclays will emerge from this pandemic, well placed to continue to serve our customers and clients, the communities and economies in which we operate, and our shareholders.”

The Barclays share price was up 5.68% at 103.3p in the first hour of trading on Wednesday.

Before the impact of the £2.1bn provision, Barclays £3bn profit represents a strong increase on last year and will stoke investor optimism Barclays were in good shape going into the crisis.

“An event like the COVID-19 pandemic makes everyone focus on what’s really important right now. For us, that means running the bank safely and soundly, helping our customers and clients through the difficulties they face, supporting the UK economy and the communities where we live and work, and taking care of our colleagues around the world,” said Jess Staley in a statement included in the update.

Jess Staley continued to outline the impact government schemes such as CBILs had on Barclay’s ability to make loans to UK businesses.

“We welcome the government and Bank of England’s business support programmes and have introduced additional measures to back UK companies ourselves. They are now having a real impact. As at 24 April 2020 we have facilitated significant commercial paper issuance though the Covid Corporate Financing Facility, lent £737m in Coronavirus Business Interruption Loans, approved over 238,000 mortgage and loan payment holidays, and over 6 million customers and clients are currently paying no personal overdraft or business banking charges. We have launched a community aid package; through which we are donating £100m to support those who are being hardest hit by COVID-19. We expect that all of these measures will help to limit the economic and social impact of the pandemic.”

The Barclays CEO highlighted the impact of COVID-19 on the bank’s earning which would have been £3bn if they were not to set aside £2.1bn in provisions for bad loans due to the COVID-19 crisis.

“The impact of COVID-19 came late in what was until that point a good quarter. Statutory profit before tax was £0.9bn and profit before tax excluding credit impairment charges was £3.0bn. We have taken a £2.1bn credit impairment charge which reflects our initial estimates of the impact of the COVID-19 pandemic.”

“The strength of Barclays lies in our diversification by business, geography and currency, which allows us to remain resilient through the developing economic downturn.”

Touching on the letter from the Bank of England which instructed banks to cut their dividends, Staley provided a rough timeline on when the Barclay’s board would start to consider paying dividends.

“In response to a request from the Prudential Regulation Authority (PRA), we cancelled the full year 2019 dividend payment of 6 pence per ordinary share, and the Board will decide on future dividends and its capital returns policy at year-end 2020.”

“Despite all the challenges we face as a consequence of COVID-19, I am confident Barclays will emerge from this pandemic, well placed to continue to serve our customers and clients, the communities and economies in which we operate, and our shareholders.”

The Barclays share price was up 5.68% at 103.3p in the first hour of trading on Wednesday.

Before the impact of the £2.1bn provision, Barclays £3bn profit represents a strong increase on last year and will stoke investor optimism Barclays were in good shape going into the crisis.

“An event like the COVID-19 pandemic makes everyone focus on what’s really important right now. For us, that means running the bank safely and soundly, helping our customers and clients through the difficulties they face, supporting the UK economy and the communities where we live and work, and taking care of our colleagues around the world,” said Jess Staley in a statement included in the update.

Jess Staley continued to outline the impact government schemes such as CBILs had on Barclay’s ability to make loans to UK businesses.

“We welcome the government and Bank of England’s business support programmes and have introduced additional measures to back UK companies ourselves. They are now having a real impact. As at 24 April 2020 we have facilitated significant commercial paper issuance though the Covid Corporate Financing Facility, lent £737m in Coronavirus Business Interruption Loans, approved over 238,000 mortgage and loan payment holidays, and over 6 million customers and clients are currently paying no personal overdraft or business banking charges. We have launched a community aid package; through which we are donating £100m to support those who are being hardest hit by COVID-19. We expect that all of these measures will help to limit the economic and social impact of the pandemic.”

The Barclays CEO highlighted the impact of COVID-19 on the bank’s earning which would have been £3bn if they were not to set aside £2.1bn in provisions for bad loans due to the COVID-19 crisis.

“The impact of COVID-19 came late in what was until that point a good quarter. Statutory profit before tax was £0.9bn and profit before tax excluding credit impairment charges was £3.0bn. We have taken a £2.1bn credit impairment charge which reflects our initial estimates of the impact of the COVID-19 pandemic.”

“The strength of Barclays lies in our diversification by business, geography and currency, which allows us to remain resilient through the developing economic downturn.”

Touching on the letter from the Bank of England which instructed banks to cut their dividends, Staley provided a rough timeline on when the Barclay’s board would start to consider paying dividends.

“In response to a request from the Prudential Regulation Authority (PRA), we cancelled the full year 2019 dividend payment of 6 pence per ordinary share, and the Board will decide on future dividends and its capital returns policy at year-end 2020.”

“Despite all the challenges we face as a consequence of COVID-19, I am confident Barclays will emerge from this pandemic, well placed to continue to serve our customers and clients, the communities and economies in which we operate, and our shareholders.”

The Barclays share price was up 5.68% at 103.3p in the first hour of trading on Wednesday.

Before the impact of the £2.1bn provision, Barclays £3bn profit represents a strong increase on last year and will stoke investor optimism Barclays were in good shape going into the crisis.

“An event like the COVID-19 pandemic makes everyone focus on what’s really important right now. For us, that means running the bank safely and soundly, helping our customers and clients through the difficulties they face, supporting the UK economy and the communities where we live and work, and taking care of our colleagues around the world,” said Jess Staley in a statement included in the update.

Jess Staley continued to outline the impact government schemes such as CBILs had on Barclay’s ability to make loans to UK businesses.

“We welcome the government and Bank of England’s business support programmes and have introduced additional measures to back UK companies ourselves. They are now having a real impact. As at 24 April 2020 we have facilitated significant commercial paper issuance though the Covid Corporate Financing Facility, lent £737m in Coronavirus Business Interruption Loans, approved over 238,000 mortgage and loan payment holidays, and over 6 million customers and clients are currently paying no personal overdraft or business banking charges. We have launched a community aid package; through which we are donating £100m to support those who are being hardest hit by COVID-19. We expect that all of these measures will help to limit the economic and social impact of the pandemic.”

The Barclays CEO highlighted the impact of COVID-19 on the bank’s earning which would have been £3bn if they were not to set aside £2.1bn in provisions for bad loans due to the COVID-19 crisis.

“The impact of COVID-19 came late in what was until that point a good quarter. Statutory profit before tax was £0.9bn and profit before tax excluding credit impairment charges was £3.0bn. We have taken a £2.1bn credit impairment charge which reflects our initial estimates of the impact of the COVID-19 pandemic.”

“The strength of Barclays lies in our diversification by business, geography and currency, which allows us to remain resilient through the developing economic downturn.”

Touching on the letter from the Bank of England which instructed banks to cut their dividends, Staley provided a rough timeline on when the Barclay’s board would start to consider paying dividends.

“In response to a request from the Prudential Regulation Authority (PRA), we cancelled the full year 2019 dividend payment of 6 pence per ordinary share, and the Board will decide on future dividends and its capital returns policy at year-end 2020.”

“Despite all the challenges we face as a consequence of COVID-19, I am confident Barclays will emerge from this pandemic, well placed to continue to serve our customers and clients, the communities and economies in which we operate, and our shareholders.”

The Barclays share price was up 5.68% at 103.3p in the first hour of trading on Wednesday. ESG, Fintech, eCommerce and Medical Solution online get togethers

Sponsored by Earth Investments

Earth- investments ltd reports here on how It’s not all bad news, it’s just about businesses being flexible, and pulling together more in these uncertain times. Collaboration is key.

Earth Investments online Soirees, are a great example of business that are doing well and making the most of the lock down. They report massive interest in fintec, and ecommerce, and their alternative medical solutions are also booming. Many of their showcased businesses are enjoying huge interest from the current situation.

Their key to success is offering a unique approach to investments, the company focuses on collaborations based on positive impact before profit, as there has never been a better time to invest in certain businesses, for both those elements.

Ideas were brought together, when a group of friends brainstormed how to combine real impact, socially and environmentally with profitability, they then use their profits to do further good.

The Partners have a combination of 300 years of relevant experience, but have Stepped out of their corporate worlds to following their passion, and make a difference,

Vast Experience from the financial industry and real entrepreneurship, coupled with a passion to make a difference is at the heart of what creates this winning team, that energy has brought great results so far.

One partner was the head of loans and investments at Santander, other partners had worked 30 years for HMRC, and The CEO is a well known Relationship Therapist, Meditation teacher and human behaviour specialist, she has headed up raises of over $130 million to date.

All the partners came together with a united mission to help and support impact businesses, and have merged their extensive networks to focus on doing good in the world, offering a real heart felt way of doing business.

Before the lock down the group were running events at the Mayfair Hotel in London.

The Mayfair Hotel Soirees have now gone online!

They now have a strong international group of investors as members.

In keeping with the motto of ” Business should be sophisticated and fun”

The weekly zoom calls are said to be like a night out vibe, friends and fun brought to your home, to enjoy world class entertainers, renowned Ted talk speakers and the wonderful showcasing of a few selected businesses,

Every one who attends raves about these get togethers.

Business is best done when people like, know and trust each other and this creates such a great group, “we have over 50 billion in cumulative wealth on the calls, and business is getting done” the attitude of support and community is growing fast.

Tax advisors are helping people with much needed support too.

Heres a few comments from last week.

“It was a fantastic event, wonderfully hosted”

“Thank you for arranging all the follow up calls, with investors, what a great way to do business”

“The speaker gave me a much needed boost and it was the best piece of wisdom I’ve heard in a long time”

“I think that this is the way forward, I thoroughly enjoyed the entertainment and showcases thank you”

To apply to attend and become part of this wonderfully supportive group of movers and shakers, private investors, venture capitalists, and family offices apply on the link and we will discuss how we can help you, and offer you a free invite.

Click on the link below to vistit our website for more in formation

www.earth-investments.com/index.php/events/mayfair-soiree

Article Sponsored and Issued by Earth Investments

FTSE 100 surges as Trump outlines plan to reopen US economy

The FTSE 100 rallied inline with global equities on Tuesday as the market cheered plans from the US President to increase testing to help reopen the US economy.

The FTSE 100 was 2.1% higher at 5,970 in mid afternoon trading on Tuesday.

Donald Trump said he wanted to ramp up the testing of individuals across America in order allow broader reopening of the economy.

“We are continuing to rapidly expand our capacity and confident that we have enough testing to begin reopening and the reopening process,” said Trump in an address at the White House.

Some states had begun opening businesses last week after the US President passed responsibility to individual states to manage their own economies.

Today’s announcement brings back control of the reopening process to the White House as the administration will be driving forward the push to increase testing.

The White House also touched on plans for contact tracing in individuals who test positive for COVID-19.

Counties such as South Korea who implemented a high level of contact tracing have managed to keep deaths from coronavirus much lower than other major economies.

Broad FTSE 100 rally

The FTSE 100 built on gains through Tuesday’s session as investors prepared for the economic recovery associated with the reduction in lockdown measures in the world’s largest economy. UK banks were significant gainers with Lloyds, Barclays and RBS all rising in excess of 7%. The move higher in banks also comes a day after the UK government announced ‘Bounce Back Loans’ for small business which will be 100% backed by the government, completely de-risking the banks making the loans. Oil companies BP and Shell were stronger as BP released a trading update and maintained their dividend for the first quarter. The price of oil, on the other hand, had another day of severe volatility as concerns resurfaced over storage capacity.Travis Perkins sees cash outflow slowing as stores reopen

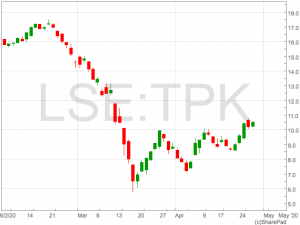

Building material company, Travis Perkins (LON:TPK), has shed light on the impact of COVID-19 in a trading update that highlighted strong sales until lockdown measures were in place.

However, the pandemic shut large parts of Travis Perkins’ business, leading to a 4.8% reduction in sales across the group in the first quarter.

The company, which also owns Wickes and Toolstation, said it saw a £50m cash outflow during the first month of the coronavirus lockdown and has started to reduce cash commitments. Furloughing staff and deferring VAT payments will assist in TPK’s cash conservation. Travis Perkins have furloughed roughly half of their 30,000 staff for three weeks on full pay.

Providing some optimism on the reopening of the UK economy, Travis Perkins said it expected sales resumption to stem the flow in the coming weeks as its outlets begun to reopen.

The company also said it expected to benefit to the tune of £90m from business rates holidays.

House builders such as Taylor Wimpey have recently announced they will reopen sites again in early May, signalling a trend across the industry that will lead to increased demand for Travis Perkins goods.

Nick Roberts, Chief Executive, commented on the update:

“In light of the COVID-19 emergency, we have established a new operating model that has kept colleagues and customers safe, operating within Government guidelines, and enabling branches across all of the Group’s businesses to remain open. Moreover, we have provided essential services and support to keep the nation’s critical infrastructure maintained and operational and the UK’s homes warm, dry and safe during this time of need.

“We continue to adapt our operations, applying stringent social distancing and using technology to enable contactless operations, and we are therefore able to respond to the Government’s call to ensure that the construction industry can continue to deliver on crucial programmes and projects and be an engine for future economic recovery.

“As we move forward we will continue to adjust our operations, with our foremost priority to keep colleagues and customers safe and the industry supplied with the materials it needs.”

Shares in Travis Perkins were 3.2% higher on the day at 1,052p and are down 34% year-to-date.

House builders such as Taylor Wimpey have recently announced they will reopen sites again in early May, signalling a trend across the industry that will lead to increased demand for Travis Perkins goods.

Nick Roberts, Chief Executive, commented on the update:

“In light of the COVID-19 emergency, we have established a new operating model that has kept colleagues and customers safe, operating within Government guidelines, and enabling branches across all of the Group’s businesses to remain open. Moreover, we have provided essential services and support to keep the nation’s critical infrastructure maintained and operational and the UK’s homes warm, dry and safe during this time of need.

“We continue to adapt our operations, applying stringent social distancing and using technology to enable contactless operations, and we are therefore able to respond to the Government’s call to ensure that the construction industry can continue to deliver on crucial programmes and projects and be an engine for future economic recovery.

“As we move forward we will continue to adjust our operations, with our foremost priority to keep colleagues and customers safe and the industry supplied with the materials it needs.”

Shares in Travis Perkins were 3.2% higher on the day at 1,052p and are down 34% year-to-date.

House builders such as Taylor Wimpey have recently announced they will reopen sites again in early May, signalling a trend across the industry that will lead to increased demand for Travis Perkins goods.

Nick Roberts, Chief Executive, commented on the update:

“In light of the COVID-19 emergency, we have established a new operating model that has kept colleagues and customers safe, operating within Government guidelines, and enabling branches across all of the Group’s businesses to remain open. Moreover, we have provided essential services and support to keep the nation’s critical infrastructure maintained and operational and the UK’s homes warm, dry and safe during this time of need.

“We continue to adapt our operations, applying stringent social distancing and using technology to enable contactless operations, and we are therefore able to respond to the Government’s call to ensure that the construction industry can continue to deliver on crucial programmes and projects and be an engine for future economic recovery.

“As we move forward we will continue to adjust our operations, with our foremost priority to keep colleagues and customers safe and the industry supplied with the materials it needs.”

Shares in Travis Perkins were 3.2% higher on the day at 1,052p and are down 34% year-to-date.

House builders such as Taylor Wimpey have recently announced they will reopen sites again in early May, signalling a trend across the industry that will lead to increased demand for Travis Perkins goods.

Nick Roberts, Chief Executive, commented on the update:

“In light of the COVID-19 emergency, we have established a new operating model that has kept colleagues and customers safe, operating within Government guidelines, and enabling branches across all of the Group’s businesses to remain open. Moreover, we have provided essential services and support to keep the nation’s critical infrastructure maintained and operational and the UK’s homes warm, dry and safe during this time of need.

“We continue to adapt our operations, applying stringent social distancing and using technology to enable contactless operations, and we are therefore able to respond to the Government’s call to ensure that the construction industry can continue to deliver on crucial programmes and projects and be an engine for future economic recovery.

“As we move forward we will continue to adjust our operations, with our foremost priority to keep colleagues and customers safe and the industry supplied with the materials it needs.”

Shares in Travis Perkins were 3.2% higher on the day at 1,052p and are down 34% year-to-date. BP’s first quarter profit hit by lower oil price and demand destruction

FTSE 100 oil major BP (LON:BP) has reported a drop in profits in the first quarter as the lower oil price and a sharp reduction in demand due to coronavirus takes it’s toll.

BP’s Q1 underlying replacement cost profit fell to $0.8bn, down from $2.4bn in the same period a year ago.

The confirmation of such a large drop in profit barely moved the share price as the market has seemingly priced in the recent negative impact of the COVID-19 crisis to BP shares.

BP shares were softer by 1.59% to 309p in mid morning trade on Tuesday and are down 34% year-to-date.

Looking forward to the second quarter, investors should be prepared for a significant impact due to the lower price of oil. In the first quarter, BP recorded an averaage oil price of $47.47 per barrel, down from $55.90 in the fourth quarter of 2019.

With oil trading around $20 for much of the second quarter, which started 1st April, BP are likely to record a much lower oil price in the next trading update.

Despite the sharp reduction in profitability, BP have maintained their dividend of 10.5 cent which is due to be paid 19th June.

The maintenance of the dividend was helped in large part by BP’s strong cash position. BP had $32bn in liquid assets at the end if the quarter.

BP CEO, Bernard Looney commented on the results:

“This extraordinary time for the world demands extraordinary responses. And thankfully we are seeing that just about everywhere we look around the world. Our industry has been hit by supply and demand shocks on a scale never seen before, but that is no excuse to turn inward. BP, like many other companies, is stepping up and extending a helping hand to those in need. We do it not because it is expected of us – but because we want to. That is consistent with our purpose.”

“We are focusing our efforts on protecting our people, supporting our communities and strengthening our finances. I am incredibly proud of the work that our people are doing in all three areas, particularly our colleagues in operations – from rigs to

retail and everywhere in between – who are continuing to deliver energy and provide goods in the most difficult of circumstances.”

“At the same time, we are taking decisive actions to strengthen our finances reinforcing liquidity, rapidly reducing spending and costs, driving our cash balance point lower.”

“We are determined to perform with purpose and remain committed to delivering our net zero ambition.”

Looking forward to the second quarter, investors should be prepared for a significant impact due to the lower price of oil. In the first quarter, BP recorded an averaage oil price of $47.47 per barrel, down from $55.90 in the fourth quarter of 2019.

With oil trading around $20 for much of the second quarter, which started 1st April, BP are likely to record a much lower oil price in the next trading update.

Despite the sharp reduction in profitability, BP have maintained their dividend of 10.5 cent which is due to be paid 19th June.

The maintenance of the dividend was helped in large part by BP’s strong cash position. BP had $32bn in liquid assets at the end if the quarter.

BP CEO, Bernard Looney commented on the results:

“This extraordinary time for the world demands extraordinary responses. And thankfully we are seeing that just about everywhere we look around the world. Our industry has been hit by supply and demand shocks on a scale never seen before, but that is no excuse to turn inward. BP, like many other companies, is stepping up and extending a helping hand to those in need. We do it not because it is expected of us – but because we want to. That is consistent with our purpose.”

“We are focusing our efforts on protecting our people, supporting our communities and strengthening our finances. I am incredibly proud of the work that our people are doing in all three areas, particularly our colleagues in operations – from rigs to

retail and everywhere in between – who are continuing to deliver energy and provide goods in the most difficult of circumstances.”

“At the same time, we are taking decisive actions to strengthen our finances reinforcing liquidity, rapidly reducing spending and costs, driving our cash balance point lower.”

“We are determined to perform with purpose and remain committed to delivering our net zero ambition.”

Looking forward to the second quarter, investors should be prepared for a significant impact due to the lower price of oil. In the first quarter, BP recorded an averaage oil price of $47.47 per barrel, down from $55.90 in the fourth quarter of 2019.

With oil trading around $20 for much of the second quarter, which started 1st April, BP are likely to record a much lower oil price in the next trading update.

Despite the sharp reduction in profitability, BP have maintained their dividend of 10.5 cent which is due to be paid 19th June.

The maintenance of the dividend was helped in large part by BP’s strong cash position. BP had $32bn in liquid assets at the end if the quarter.

BP CEO, Bernard Looney commented on the results:

“This extraordinary time for the world demands extraordinary responses. And thankfully we are seeing that just about everywhere we look around the world. Our industry has been hit by supply and demand shocks on a scale never seen before, but that is no excuse to turn inward. BP, like many other companies, is stepping up and extending a helping hand to those in need. We do it not because it is expected of us – but because we want to. That is consistent with our purpose.”

“We are focusing our efforts on protecting our people, supporting our communities and strengthening our finances. I am incredibly proud of the work that our people are doing in all three areas, particularly our colleagues in operations – from rigs to

retail and everywhere in between – who are continuing to deliver energy and provide goods in the most difficult of circumstances.”

“At the same time, we are taking decisive actions to strengthen our finances reinforcing liquidity, rapidly reducing spending and costs, driving our cash balance point lower.”

“We are determined to perform with purpose and remain committed to delivering our net zero ambition.”

Looking forward to the second quarter, investors should be prepared for a significant impact due to the lower price of oil. In the first quarter, BP recorded an averaage oil price of $47.47 per barrel, down from $55.90 in the fourth quarter of 2019.

With oil trading around $20 for much of the second quarter, which started 1st April, BP are likely to record a much lower oil price in the next trading update.

Despite the sharp reduction in profitability, BP have maintained their dividend of 10.5 cent which is due to be paid 19th June.

The maintenance of the dividend was helped in large part by BP’s strong cash position. BP had $32bn in liquid assets at the end if the quarter.

BP CEO, Bernard Looney commented on the results:

“This extraordinary time for the world demands extraordinary responses. And thankfully we are seeing that just about everywhere we look around the world. Our industry has been hit by supply and demand shocks on a scale never seen before, but that is no excuse to turn inward. BP, like many other companies, is stepping up and extending a helping hand to those in need. We do it not because it is expected of us – but because we want to. That is consistent with our purpose.”

“We are focusing our efforts on protecting our people, supporting our communities and strengthening our finances. I am incredibly proud of the work that our people are doing in all three areas, particularly our colleagues in operations – from rigs to

retail and everywhere in between – who are continuing to deliver energy and provide goods in the most difficult of circumstances.”

“At the same time, we are taking decisive actions to strengthen our finances reinforcing liquidity, rapidly reducing spending and costs, driving our cash balance point lower.”

“We are determined to perform with purpose and remain committed to delivering our net zero ambition.” Boris Johnson says the UK is now at maximum risk from COVID-19

In his first speech since falling ill, Boris Johnson has said this is the point the UK is at maximum risk from COVID-19, despite being past or nearly past the peak.

Johnson took the opportunity to highlight “there are real signs now we are passing through the peak” of coronavirus following a sustained plateau in the number of death in the UK and a reduction in the number of new cases.

The speech came just as countries such as Spain and Italy begin to reopen their economies after strict lockdowns. Over the weekend Spain allowed children outside for the first time in five weeks and Italy has said certain businesses will reopen 4th May. There is pressure on the UK government to provide guidelines on current lockdown measures given the raft announcements from other countries. The UK government also has another headache in the target it set itself of 100,000 tests per days by the end of April. With it looking highly doubtful the government will hit this self-imposed target, Boris Johnson is likely to receive criticism in his first week back in the job ass the country grows restless under social distances rules. Johnson did make reference to a possible announcement this week on what the lifting of measures could look like but made no comment on timings.UK Prime Minister Boris Johnson says “there are real signs now we are passing through the peak” of the coronavirus outbreak “thanks to our collective national resolve”https://t.co/5bxxzw13mR pic.twitter.com/whkrC5doVO

— BBC News (UK) (@BBCNews) April 27, 2020

Despite any action taken this week, critics will have hard numbers to target the UK government’s handling of the COVID-19. With deaths surpassing 20,000, the UK now has recorded nearly as many deaths as Italy and Spain whilst other European countries such as Germany and Sweden have kept their death rates remarkably low. Germany has managed to keep deaths from coronavirus to just 5,750 despite having a similar sized population as the UK. Sweden forewent strict lockdown measures yet has only recorded 2,200 deaths. In addition to the tragic human cost of coronavirus, the economic cost will likely be higher than it could of been due to the ineffectiveness of business loans made through banks and time it took to roll out the furlough scheme. The government is being blamed for the poor uptake of Coronavirus Business Interruption Loan Scheme. Just 16,000 loans have been made in the UK as France’s equivalent loan scheme has made 250,000.“We cannot spell out now how fast, or slow or even when those changes will be made” says @BorisJohnson. Though in coming days he promises to share emerging thinking on how to modify lockdown

— Robert Peston (@Peston) April 27, 2020

FTSE 100 gains in broad risk-on rally driven by reopening of economies

The FTSE 100 rose on Monday as stocks rallied in a broad risk-on rally sparked by optimism over the reopening of major economies.

Following weeks of strict lockdowns, Italy and Spain had begun lifting a number of measures which signalled a move back to some form of normality.

The United States has already begun an uncoordinated reopening with some states already allowing the resumption of trade for businesses such as hairdressers and bowling alleys.

President Trump has tabled the idea of a phased reopening but individual states have taken this as an opportunity to implement their own interpretation of an economic reopening.

The prospect of increased economic activity has caused a wave of optimism in markets with the FTSE 100 rising by 1.4% to 5,834 shortly before 12pm on Monday.

However, the reopening of economies has not been adopted in a globally coordinated basis and the UK still has no timeline or guidance on when the UK will start reopening it’s economy.

There is a consensus growing that countries must have a comprehensive testing programme in place to reopen businesses in a meaningful way.

The UK is yet to match other counties’ scale of testing so the UK government is likely to behind other governments in reopening the economy.

“We need to put in place a very dense testing regime so you would detect that rebound going back into exponential growth very quickly and not wait for the ICUs to fill up and there to be a lot of deaths. If you see the hot spot, you kind of understand the activities causing that,” said Bill Gates in an interview with CNN.