Glint Pay opens gold-based account for ‘largest corporate client to-date’

KisanHub raises over £1m to transform the agri-food supply chain

FTSE stunted as pound gains on Brexit hopes

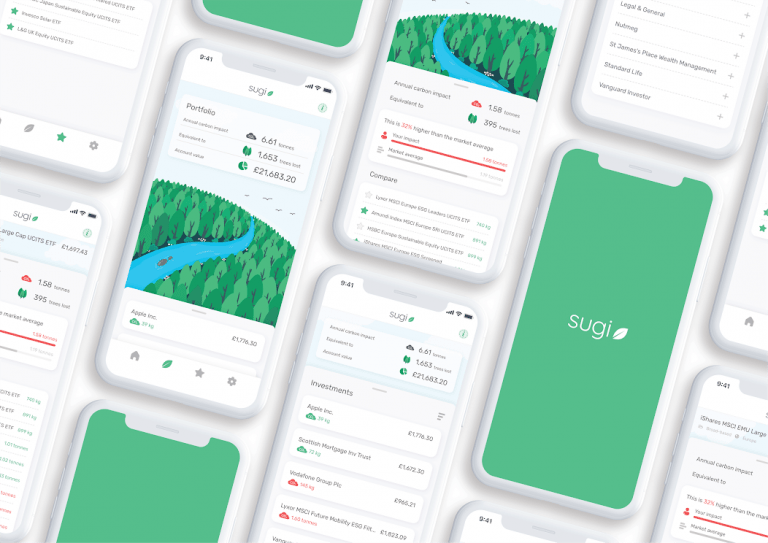

New app launches for investors to track their carbon footprint

PM launches new ‘green revolution’ with 10-step strategy

British Land announces reduced dividend, shares fall

North American funds and the “tectonic shift toward sustainability”

BlackRock North American Income Trust

BlackRock aims to provide “an attractive and growing level of income return with capital appreciation over the long term”, which is predominantly through investment in a diversified portfolio of primarily large-cap US equities. The company has over 27 years of experience running trusts and has holdings in Apple, Microsoft, Amazon, and Facebook. As approaches to investing are rapidly changing, BlackRock believes that how the world is changing amid the Coronavirus is “accelerating transformations in our economies and societies across four dimensions – sustainability, inequality, geopolitics and the policy revolution. “A tectonic shift toward sustainability was already underway, and the pandemic shone a spotlight on some underappreciated environmental, social and governance (ESG) factors such as employee safety and supply chain integrity.” BlackRock is priced at 162.50 and has a premium of -7.3% and a NAV of 175.38.Baillie Gifford US Growth Trust

Baillie Gifford is a North American company that believes that “exceptional growth companies are the major drivers of market wealth creation”. With this in mind, it invests in US companies that have the potential to grow and to hold onto them for long periods of time, for long-term capital growth. Top holdings include Tesla, Shopify, Amazon, Wayfair, and Zoom Video Communications. Companies that have gone from strength to strength amid the pandemic, Amazon’s latest trading statement revealed profits to triple and posted a quarterly sales of almost $100bn (£77.4bn). Writing for Baillie Gifford, James Anderson focuses on how the pandemic has changed our investment habits. “It’s been startling but wonderful to see the progress of so many of our companies in the crisis. But it comes with challenges. It’s still hard to discern how far pandemic-induced changes will persist. “There’s a great deal of work to be done. But we do believe that the pandemic period is accelerating the process of change that we continually focus on in our portfolio. We see little road to recovery for supposed value stocks. If we can remain patient and disciplined the opportunities have only proliferated.” The bulk of the group’s assets are currently in consumer discretionary (33.1%) and information technology (28.4%). Baillie Gifford is priced at 260.00, with a premium of +3.8%, and a NAV of 250.38.Spirax-Sarco shares dip as pandemic continues to hamper industrial production

Spirax-Sarco said that trading has ‘continued to hold up well’ even against the challenging macroeconomic backdrop. All of its facilities remain open, and organic sales decline in the four months to the end of October was less pronounced than during the first half.

Its Steam Specialities business benefitted from the reduced IP contraction and IP growth in China. Its Electric Thermal Solutions business saw similar trends, with a continued decline in its Chromalox product was offset by growth in its Thermocoax offering. Finally, the company said that the Watson-Marlow Fluid Technology Group enjoyed strong sales to the biopharmaceutical sector.

Group operating profit remained ‘slightly below’ the same period the previous year, and the company noted that currency effects continued to have ‘an adverse impact’, as sterling maintained strength versus its basket of trade currencies. Speaking on its outlook, the Spirax-Sarco statement read: “After reaching a low point in the second quarter when global IP contracted 12%, macro-economic conditions improved in the third quarter with a global IP contraction of 4%. IP is now forecast to contract by an overall 5.5% in 2020. ” “However, the sequential month-on-month rate of IP growth slowed markedly in August and September, infection rates remain high in the Americas and increasing levels in Europe are resulting in further lockdowns. Although the impact on IP growth in the fourth quarter resulting from the COVID-19 resurgence remains uncertain, these factors could further slow the rate of IP recovery in the final quarter of 2020, as we anticipated at the Half Year results announcement in August.”Following the news, the Spirax-Sarco shares dipped by around 4.5%, down to 11,370.00p a share 18/11/20. Analysts currently have a consensus ‘Hold’ stance on the stock, and a target price of 8,549.23p, around 25% below its current level.

Market dynamics of UK and US small cap growth shares

Alan Green joins the UK Investor Magazine Podcast to dissect the factors driving the small caps markets in the United States and the UK. We explore factors such as vaccines, Brexit and natural resources.

In keeping with prior Podcasts, we pay attention to three UK equities in Bidstack (BIDS), Destiny Pharma (DEST) and RA International (RAI).