Dyson to axe 900 jobs in new cost-cutting plan

88 Energy Prepare for a Farm out on Billion Barrel Plus Alaskan Project

Project Peregrine

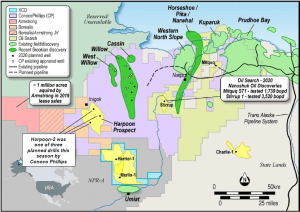

Project Peregrine comes with three onshore prospects already identified at the project — Merlin (Nanushuk), Harrier (Nanushuk), Harrier Deep (Torok). Combined, these prospects have a mean unrisked recoverable prospective resource of 1.6 billion barrels of oil, as per an independent report generated by ERC Equipoise. To the north and south of Project Peregrine sit major oil discoveries. Willow, located to the north of Peregrine, is a 0.75 billion barrel discovery made by oil major ConocoPhillips (NYSE: COP). A recent well drilled by ConocoPhillips, just 15 kilometres from Project Peregrine, encountered hydrocarbons at its Harpoon prospect which is interpreted to be directly on trend and analogous to the Harrier prospect at Peregrine. The Peregrine Project also lies directly to the north of the Umiat oil accumulation that’s estimated to have greater than 1.0 billion barrels of oil in place.

2021 Drilling Planned

88 Energy intends to drill two, low cost wells to explore Project Peregrine in early 2021. These wells will be testing the resource potential of Peregrine, with the aim of unlocking the next major oil discovery on the North Slope. As 88 Energy currently holds 100% of the project, it intends to do a farm out deal with other partners that want exposure to near term upside. The company will be undertaking low cost options for well drilling, estimating that the two wells will to cost ~US$15 million. 88 Energy has identified two primary prospects — Merlin and Harrier that total over 1 billion barrels, that it is intent on drilling in early 2021. Both prospects are located on trend to existing recent discoveries, with Harrier recently being de-risked by evidence of hydrocarbons at Conoco’s Harpoon-2 well.Project Icewine

In addition to the newly acquired Project Peregrine, there remains significant opportunity and value at the company’s Project Icewine. Despite a negative market overreaction to early results from the Charlie-1 well at Project Icewine earlier this year further investigations have been promising. These results were released amid ‘peak fear’ from the COVID-19 pandemic and faced a record low oil price environment. However, 88 Energy views that sell off as an overreaction. The company has just released sidewall core analysis using two different techniques. Both demonstrate that the primary targets — the Seabee and Torok Formations — are in fact, full of oil. Reservoir modelling of stimulation of the formations is now underway to understand flow potential. More lab data and news is to come from Charlie-1 and 88 Energy has identified a new preferred well location to test the conventional targets at Project Icewine — a location with better reservoir quality. A farm-in partner is also being sought to further investigate Project Icewine in the search for flowing hydrocarbons. All up, major upcoming activity includes the farm-out of Project Peregrine in the lead up to the drilling of two wells in early 2021, plus the integration of new results from the Charlie-1 well, and reinvigoration of the farm out process for Project Icewine. Sponsored by 88 EnergyViva Vietnam with Vietnam Holding

Viva Vietnam

Vietnam is a high growth market situated in the heart of Asia. Its cohesive population of 100m people is young, hard-working and increasingly digitally connected. Over the last 30 years, Vietnam has experienced high levels of GDP growth, averaging about 6 to 7% and attracting record levels of Foreign Direct Investment (FDI) with almost USD 20 bn in 2019. It also is an increasingly open economy, with trade equivalent to 200% of GDP, and the government has negotiated a number of free trade agreements. Vietnam is one of the original countries in what was formerly known as the Trans-Pacific Partnership TPP and is now the somewhat unpronounceable alphabet soup of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CTCPP). In addition, Vietnam recently approved a bilateral EU free trade agreement, which could serve as a model for a new free trade agreement with the UK. Perhaps more important than a static GDP number is the per capita GDP which has just recently passed USD 3,000, which is considered an inflection point in an emerging consumer society. For example, Thailand doubled its GDP from this point in seven years and China doubled its within five years.V for Victory – against the coronavirus

Vietnam declared war on the coronavirus in late January and emerged victorious in containing it within about 90 days by the end of April. The government was very quick to react when the first cases were confirmed during the Lunar New Year (‘Tet’) holiday in January by imposing a large-scale quarantine, stopping flights to China, and implementing control and trace to identify outbreaks. It also employed all the tools in the ‘media’ armory to keep its citizens informed via social media, traditional media, as well as propaganda art. Vietnam is in many ways a Confucian ‘East-Asian’ society, with strong community values, and an adherence to authority. Its social cohesion and the government’s effective response meant that Vietnam was one of the first countries to come out of lockdown at the end of April after a relatively short three-week lockdown. Since mid-April there have been no community spread cases, and remarkably, in a population of close to 100m people, there have been less than 400 infected cases in total and zero deaths. The closest someone came to death was a British pilot with Vietnam Airlines, the National Carrier, an unfortunate super-spreader which created a cluster of infections around a popular expat-bar in Ho Chi Minh City’s District Two. He was in a coma and at death’s door for almost 100 days in an Intensive Care Unit in Vietnam. The Vietnamese people rallied around him, even offering him their own lungs, and he went on to make a complete and full recovery. He has now returned to his home city of Motherwell in the UK, saying that ‘I would have died’ if it were not for Vietnam. V – Shaped recovery

V – Shaped recovery

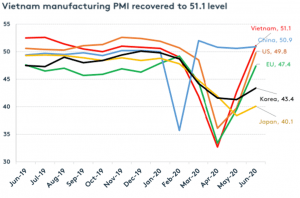

Vietnam has the potential to make a V-shape road to recovery post-pandemic. The Purchasing Managers Index (PMI) rose sharply from the depths of the pandemic, as the country gradually went back to work. Retail sales have also been rising, though some discretionary spending has been unsurprisingly delayed.

The GDP growth for the first six months of 2020 was 1.8%, and the full year is expected to be somewhere between 3% and 4%. This is lower than the 6-7% trend but is a rare positive number in a world of fearful negative growth forecasts.

Prospects for Vietnam will be strengthened as more manufacturers look to its proximity to key markets and abundant, well-educated and young workforce as a powerful source of production. Last year’s trade spat between the US and China accelerated a ‘China-plus-one’ strategy as supply chains are increasingly being broadened in an attempt to diversify risk and bend costs down. Vietnam has seen decades of strong FDI into the manufacturing sector and has enhanced its logistics and business-to-business (B2B) services to facilitate this growth.

Although Vietnam has many of the characteristics of a more recognized ‘emerging market’ in part due to the size of the equity market already being above USD 160 bn, and with more than 1,500 companies to invest in, it is still classified by MSCI as a frontier market. In fact, this year Vietnam is likely to be the largest component of the Frontier Market Index. As a frontier market, it is estimated that only one in five emerging market investors are present: it will be a game changer in a few years if and when Vietnam is classified as an MSCI Emerging Market.

Vietnam has emerged from the covid-19 crisis as a winner. Its capital markets are set for expansion, the infrastructure is improving, and it will continue to attract interest from manufacturers and other types of companies looking to diversify away from China. Its macro-economic position is the envy of much of the world, and this could improve in a scenario where the US dollar weakens. Clearly the world as a whole is facing uncertainties, and there will be winners and losers ahead. Vietnam has signaled the ‘V’ for Victory sign against the devastating coronavirus, and this fast-growing country of 100m people is one to keep an eye out for in the months and years ahead.

Vietnam Holding Limited (LSE: VNH) can be purchased through your stockbroker, or wealth manager, and should be considered as a part of a diversified portolio for investors with a mid-to long-term investment horizon.

Author’s Note: the title ‘Viva Vietnam’ was first used by Standard Chartered Bank in 2003, when they correctly called the first growth cycle in Vietnam’s capital markets. I was working at Standard Chartered at the time and had successfully co-led an investment in a company that manufactured branded toiletries for the emerging consumer classes in south-east-Asia. They had a dominant position in the Malaysian market, a population of about 30m people, and a small but fast-growing business in Vietnam. During the due-diligence on the investment (which was a ‘home-run’ generating substantial gains), I was so taken by the incredible prospects that I moved my family to Vietnam for five years and helped Prudential invest across a wide-range of asset classes on behalf of its domestic customers.

The author of this article is Craig Martin, Chairman of Dynam capital (www.dynamcapital.com), a Guernsey regulated fund manager focused exclusively on the exciting opportunities in Vietnam. Dynam has a team of 12 Vietnamese professionals on the ground in Ho Chi Minh City.

Dynam is the Investment Manager for Vietnam Holding Limited (LON:VNH) an Investment Trust listed on the premium segment of the Main market of the London Stock Exchange.

See www.vietnamholding.com for more information.

Although Vietnam has many of the characteristics of a more recognized ‘emerging market’ in part due to the size of the equity market already being above USD 160 bn, and with more than 1,500 companies to invest in, it is still classified by MSCI as a frontier market. In fact, this year Vietnam is likely to be the largest component of the Frontier Market Index. As a frontier market, it is estimated that only one in five emerging market investors are present: it will be a game changer in a few years if and when Vietnam is classified as an MSCI Emerging Market.

Vietnam has emerged from the covid-19 crisis as a winner. Its capital markets are set for expansion, the infrastructure is improving, and it will continue to attract interest from manufacturers and other types of companies looking to diversify away from China. Its macro-economic position is the envy of much of the world, and this could improve in a scenario where the US dollar weakens. Clearly the world as a whole is facing uncertainties, and there will be winners and losers ahead. Vietnam has signaled the ‘V’ for Victory sign against the devastating coronavirus, and this fast-growing country of 100m people is one to keep an eye out for in the months and years ahead.

Vietnam Holding Limited (LSE: VNH) can be purchased through your stockbroker, or wealth manager, and should be considered as a part of a diversified portolio for investors with a mid-to long-term investment horizon.

Author’s Note: the title ‘Viva Vietnam’ was first used by Standard Chartered Bank in 2003, when they correctly called the first growth cycle in Vietnam’s capital markets. I was working at Standard Chartered at the time and had successfully co-led an investment in a company that manufactured branded toiletries for the emerging consumer classes in south-east-Asia. They had a dominant position in the Malaysian market, a population of about 30m people, and a small but fast-growing business in Vietnam. During the due-diligence on the investment (which was a ‘home-run’ generating substantial gains), I was so taken by the incredible prospects that I moved my family to Vietnam for five years and helped Prudential invest across a wide-range of asset classes on behalf of its domestic customers.

The author of this article is Craig Martin, Chairman of Dynam capital (www.dynamcapital.com), a Guernsey regulated fund manager focused exclusively on the exciting opportunities in Vietnam. Dynam has a team of 12 Vietnamese professionals on the ground in Ho Chi Minh City.

Dynam is the Investment Manager for Vietnam Holding Limited (LON:VNH) an Investment Trust listed on the premium segment of the Main market of the London Stock Exchange.

See www.vietnamholding.com for more information. Tesla reports Q2 profit, shares rise

Brexit and Neorealism: quickly explaining why the UK needs Trump out of office

Why is this relevant for a Trump presidency?

Now it is worth noting that this zero-sum trend does not always play out. Indeed, over the last four decades, the West has typically favoured globalisation and complex supply chains. While these mechanisms have helped our more economically capable states (traditionally Western countries) to become more capable, as their citizens specialised more intensively in high-income sectors such as legal, financial and generally white-collar services, these changes have not negatively impacted the previously less capable states. In fact, relative changes in power dynamics have been in favour of many newly industrialising nations, with the economic and military development of countries such as China, India and Brazil among others far surpassing the relative development of Western nations during the same period. This trend, it seemed, would occur perpetually, with China rising at such a rate that people began questioning the longevity of the US’s hegemony. This was, perhaps, revised over the last four years, with Donald Trump as president. Certainly, any fair analysis of Trump would not credit him with any revolutionary expansions in America’s capabilities. What he has done, however, is wobble the tracks of the Chinese boom train, with a combination of tariffs and rhetoric which have made it harder for the Chinese to supply the US – and its allies – with Chinese goods and services with the ease it became accustomed to. This anti-Sino approach is just a small part of Trump’s pro-American protectionism, which, in fact, isn’t just disruptive for China, but anyone that’s not the US. In this sense, Trump America is the twenty-first century vindication of realism. Realising that power is a matter not just of how much of each capability you have, but how much you have relative to everyone else, we can imagine the Trump approach to be one of maximising domestic benefits while minimising the benefits incurred by others. And, putting yourself in the shoes of a US citizen who enjoys seeing their country as the biggest and baddest player in the game, you can see why the Trump approach might be appealing. Regarding economic capabilities, (for the sake of being simple, we’ll use GDP) US GDP has risen from $10.25 trillion in 2000, to 20.54 trillion in 2018. During the same period, Chinese GDP skyrocketed from $1.21 trillion, to $13.61 trillion. These trajectories, save for US efforts to slam the brakes on everybody’s perpetual growth, would have seen it unseated as the unitary global hegemon. However, we now know that the US is willing to not play nice in order to keep its throne, and this should be concerning for relatively small fry who rely on its mercy, such as the UK.Brexit Britain: small fish in a pond with big fish

Likely not much surprise to anyone, but when compared to the US, the UK is a bit of a tiddler. Militarily, we are comparatively miniscule; technologically, we produce a fraction of the patents and are home to far fewer tech giants; we rely on US strength for our resource security; and economically, we are little over a tenth of the size of the US, with a 2018 GDP of $2.8 trillion. Now, in a situation where the US has a relatively benign leader, keen on preserving the ‘special relationship’, a lonely Britain knocking on the door and asking for fair treatment would be less of a problem. Sadly, that is not the case. Trump, as we have discussed, is unreserved in putting US interests first, and he makes no exception when dealing with the UK. He knows that we need a trade deal with the US more than they need one with us, and he knows this makes the UK extremely susceptible to the US’s will. Firstly, because, under an ideal free trade agreement, a greater proportion of our exports will be US-bound than theirs would be UK-bound. Secondly, they have the clout and resources to start a tariff war with the UK, knowing that it’ll hurt them less than it’ll hurt us. Third, knowing we’re unlikely to negotiate particularly favourable terms with the EU, they’ll know the UK are desperate, and will therefore be more likely to agree to unfair terms with the US. And these dynamics are now our reality. With the US demanding parity of market access, the erosion of UK food standards and removal of protections on NHS services and drug prices, Trump has sent a clear message to the UK. We will give you what you want if you offer us everything you hold dear. Playing the neorealist game of counting capabilities for a moment, if we look at the UK versus the US in terms of economic scale; the global GDP in 2018 was around $142 trillion, with the US and UK representing roughly $20.5 trillion and $2.8 trillion respectively. Alternatively, we might turn the global GDP into a ratio out of 100, with the UK having a rough stake of 2/100, and the US holding a stake of 14.5/100. Now, this comparison may not be all-inclusive, but it indicates the UK’s vulnerability. We are a small fish, pleading for the benevolence of a big fish that has decided that its friendship are secondary to its appetite – but things have not always been so hopeless. Indeed, while the infamous Suez crisis tells us that the US has always been quite particular about when it chooses to be the UK’s friend, the UK has not always been quite so helpless when playing the international field. Pre-empting the expected response, I am not referring to the British Empire – that period of British dominance has well passed, and short of some miracle, (thankfully) shows little sign of occurring in the near future. Instead, what I am referring to is the UK’s time as an EU member. While at best third in command of the EU agenda – behind the Franco-German double entente – the UK was part of a body of unilateral rights and standards that were hard to erode, even by the largest of big powers. Rather than going, hands extended with a $2.85 trillion GDP, to an audacious US president for a trade deal, the UK could have been part of the EU bloc, with a nominal GDP of $18.3 billion in 2019. These numbers might seem over-simplistic or even meaningless to some, but when we have a president who makes neorealist IR theory more accurate than ever, these numbers have more significance than many would care to realise. The simple fact is that it is far easier to dictate terms with Trump as part of the EU than it is outside of it. Once the EU bloc has agreed upon a policy direction, it can defend these decisions with the voices – and power – of over 25 nations against external antagonists. This is not denying, of course, the EU’s current internal turmoil – as evidenced in the recent debate over pandemic recovery spending. However, as a group of small and medium-sized countries acting together, the EU has successfully protected itself against attempts to erode its citizens rights and standards, with all external actors having to adhere if they want to trade goods with the vast single market. This luxury of dictating terms to outsiders is only afforded to these little fish because of their decision to band together, and acting to prevent each individual agent being bullied by bigger fish. Of course, it would be right to argue that EU’s decision to give membership to nations which are economically troubled (take your pick) and ethically questionable (potentially Turkey) might have put an expiry date on the organisation in its current form. With that being said, Britain’s choice to exit the bloc when it did puts us at the mercy of an unmerciful president, and we should pray that he doesn’t secure another term in November. If he does, we may find that the standards and services which preserve our way of life, will be at an acute risk. Further, and I fear, concurrently, our opportunities to trade with the EU – now from outside of it – will be limited if we align ourselves with the US script. The narrative of pro-US trade deal Conservatives has so far been one of welcoming cheaper, lower-quality goods, as this will improve the range of goods available to UK consumers. In fact, it is unlikely that any move towards lower standards will be in any way partial. Trump will likely demand that UK supermarkets accept US goods on their shelves, and once this starts, I fear it will mark the decline of existing UK standards. Under the pretence of ‘choice’, cheaper goods will likely gain market share as initial consumer resistance to the new products gradually dissipates. Over time, UK farmers will have a very real dilemma on their hands: supply the lower quality goods that UK consumers are buying, or maintain standards to trade with the EU. Ultimately, all we need to know is that Trump getting another four years in office will be an entirely bleak deal for the UK. Floating the idea of a triumphant US-UK trade deal may give Britain some leverage in its negotiations with the EU (plainly because we’ll appear less desperate), but doing so while at Trump’s behest, may mean we have to make some very real concessions. We’ll likely be reminded, once again, that Brexit in the time of Trump can only bring us more pain than gain.Over 40% of employees make mistakes leading to cybersecurity breaches

The report also found that 20% of companies had lost customers following an instance of emails mistakenly being sent to the wrong recipient, with these details containing either irrelevant information or at worst, potentially sensitive information. Tessian said that as much as 58% of employees surveyed admitted to making this mistake at some point, with 10% saying they had lost their job as a result of making such an error.

Additionally, a quarter of respondents admitted to having clicked on a phishing email at work. These type of mechanisms are commonly used by scammers, seeking to ‘phish’ or steal data from the email recipient, often including financial and personal details. Interestingly, instances of mistakenly opening phishing emails were most common in the tech sector, with 47% of employees in the field admitting to having clicked on a phishing email.

Why are these mistakes so common?

Though the reasons these mistakes happen are likely numerous, Tessian’s report focused on psychological factors which may have contributed to lapses in staff focus. The number one reason cited for potentially cybersecurity jeopardising mistakes was employees being distracted, with 47% of employees stating that distraction was the main reason they’d fallen for a phishing scam, while 41% cited distraction as the reason for emails sent to the wrong recipient. Contrary to many of the more positive cases in favour of flexible work arrangements, some 57% of respondents said they were more distracted when working from home, which would lead us to wonder whether the impact of employee mistakes have been even more acute during lockdown.Other factors which caused staff to click on scam emails include 43% of respondents initially perceiving phishing emails to be legitimate, with 41% saying that scam emails appeared to be sent from senior executives or well-known brands.

The final issue discussed in the report was fatigue. With the stress and hassle of reconfiguring work arrangements and lifestyles to lockdown life, some 44% of respondents stated that fatigue contributed to them sending emails to the wrong person. Speaking on the findings, Standford University Professor and expert in social dynamics, Jeff Hancock, commented:“Understanding how stress impacts behaviour is critical to improving cybersecurity. This year, people have had to deal with incredibly stressful situations and a lot of change. And when people are stressed, they tend to make mistakes or decisions they later regret. Sadly, hackers prey on this vulnerability. Businesses, therefore, need to educate employees on the ways a hacker might take advantage of their stress during these times, as well as the security incidents that can be caused by human error.”

Other factors outside of psychological strains included biological characteristics. The report found that staff aged 18-30 were five times more likely to have made mistakes which may have compromised tehir company’s cybersecurity, than employees over the age of 51. Further, Tessian also found that male employees were twice as likely to fall for a phishing scam than their female counterparts, with 34% of male employees clicking on a data-stealing email versus 17% of female staff.The alarming regularity of poor cybersecurity

Instances of high profile cybersecurity breaches seem to make their way into the news cycle on an uncomfortably regular basis for many consumers. Should the move to a more tech-integrated society continue at its current high pace, companies will need to convince their users that online solutions don’t come with inherent risk attached to them.

Speaking on how online security can be improved on an institutional level, Tessian CEO, Tim Sadler, commented:

“Cybersecurity training needs to reflect the fact that different demographics use technology and respond to threats in different ways and that a one-size-fits-all approach to training won’t work. It is also unrealistic to expect every employee to spot a scam or make the right cybersecurity decision 100 per cent of the time, especially during these uncertain times.”

“To prevent simple mistakes from turning into serious security incidents, businesses must prioritise cybersecurity at the human layer. This requires understanding individual employees’ behaviours and using that insight to tailor training and policies to make safe cybersecurity practices truly resonate for each person.”