Ryanair to continue flights despite new quarantine rules

The Ryanair boss has insisted the airline will continue all flights throughout summer, despite new quarantine rules for travelers.

From Monday all passengers arriving in the UK must self-isolate for 14 days. However, for airline boss, Michael O’Leary, these rules are “rubbish”.

Speaking to the BBC on Monday, he said “British people are ignoring this quarantine. They know it’s rubbish”.

His comments come after Ryanair, easyJet (LON: EZJ) and British Airways owner, IAG, (LON: IAG) started legal action against the government to try and overturn the new rules that require travelers to self-isolate for two weeks.

Following a letter from the three airlines, a Ryanair spokesperson said: “These measures are disproportionate and unfair on British citizens as well as international visitors arriving in the UK. We urge the government to remove this ineffective visitor quarantine which will have a devastating effect on UK’s tourism industry and will destroy even more thousands of jobs in this unprecedented crisis.”

The new rules are designed to prevent a second wave of the Coronavirus and will be reviewed every three weeks.

The chief executive of Heathrow Airport has also criticized the government measures, saying that up to 25,000 jobs could be lost if these restrictions weren’t relaxed soon.

“We cannot go on like this as a country,” said John Holland-Kaye.

“We need to start planning to reopen our borders. If we don’t get aviation moving again quickly, in a very safe way, then we are going to lose hundreds of thousands if not millions of jobs in the UK just at the time when we need to be rebuilding our economy, he added.

“76,000 people are employed at Heathrow. That represents one in four households in the local community, so if we start cutting jobs en masse it will have a devastating impact on local communities.”

Shares in Ryanair (LON: RYA) are trading at 12.98 (1126GMT).

AstraZeneca pledges to mass produce potential Coronavirus vaccine

British pharmaceutical company AstraZeneca (LON:AZN) has stated that it will begin producing doses of its potential Coronavirus vaccine, while awaiting the results from its new treatment’s trials.

Astrazeneca Chief Executive Pascal Soriot, told BBC Radio 4’s Today programme, “We are starting to manufacture this vaccine right now.

“And we have to have it ready to be used by the time we have the results.

“Of course, with this decision comes a risk but it is a financial risk and that financial risk is that if the vaccine doesn’t work.”

“We will find this out at the end of August, then all the materials, all the vaccines we have manufactured will be wasted.

“We felt that there are times in life that corporations need to step up and contribute to resolving a big problem like this one, so decided to do it at no profit.” he finished.

Initial testing was carried out on 160 healthy volunteers between the ages of 18 and 55, with the next phase of testing due to be carried out on an additional 10,260 subjects, including elderly and child participants.

Should the trials yield positive results, the company will continue to produce the vaccine to a capacity of two billion planned doses, following the signing of two new contracts on Thursday.

Last week, the company announced a manufacturing deal with Oxford BioMedica (LON:OXB), before signing the first of its new contracts with the Serum Institute of India, to provide low and middle income countries with one billion doses of the vaccine by 2021.

The second partnership is a £595 million deal with two charities – the Coalition for Epidemic Preparedness Innovations and Gavi vaccines alliance – backed by Bill and Melinda Gates, who will provide 300 million units with delivery starting by the end of 2020.

AstraZeneca’s Mr Sorios said he expects to know the effectiveness of the AZD1222 vaccine by August, while CEPI Chief Executive Richard Hatchett noted that there was a real chance the vaccine would prove ineffective.

AstraZeneca began the testing process for the vaccine back in January, in partnership with Oxford Vaccine Group.

Speaking to The Daily Telegraph, team member Prof. Adrian Hill commented,

“We said earlier in the year that there was an 80 per cent chance of developing an effective vaccine by September.”

“But at the moment, there’s a 50 per cent chance that we get no result at all.”

“We’re in the bizarre position of wanting COVID-19 to stay, at least for a little while. But cases are declining.”

Compounding the shaky prognosis, a member of Oxford University’s Jenner Institute – who has begun trialling the vaccine – was said to be sceptical about its potential success rate.

Despite news that it would be producing a potential COVID vaccine, AstraZeneca shares dipped 1.21% or 103.00p to 8,427.00p per share 05/06/20 16:35 BST. The company’s p/e ratio stands at 104.41, while its dividend yield sits at a modest 2.59%.

Start of June defined by triple-point Dow Jones rally & non-farm payroll rise

The Dow Jones ended the week with another giddy rally, following another set of more-positive-than-expected data on employment. The index bounced 700 points after the bell, briefly touching the 27,000 point mark last seen at the end of February – a far-cry from the sub-18,200 point nadir suffered at the end of the March.

“In a baffling turn-up for the books, America actually CREATED jobs last month, sending the already giddy markets into a state of triple-digit ecstasy.” said Spreadex Financial Analyst, Connor Campbell.

He added, “Earlier in the week analysts were forecasting that more than 9 million jobs had been lost in May. Then, after a far stronger than expected ADP reading on Wednesday, that was revised down to 7.75 million.”

“Well, in actuality, the US added 2.5 million jobs last month.”

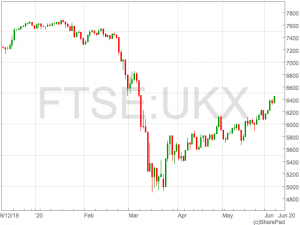

We should certainly temper our excitement, with the seeming inevitability of mass unemployment and April’s job loss figure being revised from 20.54 million to 20.69 million. However, with unemployment previously forecast to hit 19.4%, a drop from 14.7% to 13.3% between April and May is something the markets are perhaps justified in celebrating (even if they ignore the 1% drop in wages in the process). The Dow Jones is now far closer to its Valentine’s Day record high of 29,500 point high, than its record low some two months ago, and this optimism was reflected elsewhere with the FTSE rising 1.8% to 6,450, while the DAX booked a 350 point increase to 12,800 and the CAC climbed an impressive 3.1% to over 5,160 points during the afternoon. These kind of rallies may tempt us to think of greener pastures, but we should also be wary not only of the possibility of a second wave of the Coronavirus later in the year – and the inevitable disruption this would cause – but also the harsh reality that this employment-related rebound may be an outlier. While it may be possible for the situation to improve as non-essential services re-open, it is equally possible that grey skies will be here for the long-haul – at the very least we should not get ahead of ourselves following this week’s good news. Enjoy it for what it is.UK house prices fall for third consecutive month

New figures from Halifax have shown UK house prices have fallen for the third consecutive month.

The mortgage lender found the average UK house price to fall 0.2% in May to £237,808.

As the UK went into lockdown, buyers and sellers were told to delay their moves and suspend new viewings. Since the relaxation of lockdown measures in mid-May, however, there has been an increase of interest from buyers.

The property website, Zoopla, reported a 88% rise in online demand after following the ease in restrictions. Taylor Wimpey said on Friday there was strong interest from buyers since reopening its sales centers.

The managing director of Halifax, Russell Galley, has said that calculating house prices during the pandemic are “challenging”.

“Looking ahead, we expect market activity to increase progressively as restrictions are eased further across the whole of the UK and we continue to have confidence in the underlying health of the housing market over the long term.”

“However, the extent of downward pressure on market confidence and prices over the coming months will depend on how quickly the economy is able to recover from the effects of the pandemic and the available government policy support for jobs and households,” he added.

The Office for National Statistics has suspended its official house price index due to insufficient data.

The EY Item Club economic forecasting group has said that house prices will fall by about 5% over the next few months.

Howard Archer, the chief economic advisor, said: “Housing market activity is likely to be limited in the near term … Many people have already lost their jobs, despite the supportive government measures, while others will be worried that they may still end up losing theirs once the furlough scheme ends. ”

FTSE 100 lifted by surging travel and leisure shares

The FTSE 100 rose on Friday rebounding from a weakness in the following session as investors cheered the reopening of global economies and strong jobs data from the US.

Travle and leisure shares were the again among the top risers as more countries outlined plans to ease travel restrictions.

Turkey said it was working with a number of countries, including the UK, on reciprocal travel arrangements. An agreement with the UK would involve so-called ‘air bridges’ that would allow passengers to travel between countries with low infections rates. Greece is also exploring similar arrangements.

With Turkey and Greece being one of the most popular destinations for Europeans, the adoption of air bridges would signal an opportunity for a recovery in passenger numbers for airlines.

FTSE 100 airlines International Consolidated Airlines and easyJet surged on the prospect of a ramping up in air travel, rising over 11% and 7% respectively.

Shares in cruise operator, Carnival, were up as much as 20% and were the FTSE 100’s top riser on Friday.

Companies thats have been dubbed ‘stay at home shares’ were among the biggest fallers . Ocado has been a major benefactor of the coronavirus restrictions with shares rising 61% in 2020, but shares in the online grocery delivery service fell on Friday as investors shifted their attention to cyclical recovery shares.

Precious metals miner Polymetal was also weaker as the risk-on tone diminished demand for safe havens.

Markets were also buoyed by a fresh round of ECB stimulus and hopes surrounding AstraZeneca’s vaccine development.

Companies thats have been dubbed ‘stay at home shares’ were among the biggest fallers . Ocado has been a major benefactor of the coronavirus restrictions with shares rising 61% in 2020, but shares in the online grocery delivery service fell on Friday as investors shifted their attention to cyclical recovery shares.

Precious metals miner Polymetal was also weaker as the risk-on tone diminished demand for safe havens.

Markets were also buoyed by a fresh round of ECB stimulus and hopes surrounding AstraZeneca’s vaccine development.

Companies thats have been dubbed ‘stay at home shares’ were among the biggest fallers . Ocado has been a major benefactor of the coronavirus restrictions with shares rising 61% in 2020, but shares in the online grocery delivery service fell on Friday as investors shifted their attention to cyclical recovery shares.

Precious metals miner Polymetal was also weaker as the risk-on tone diminished demand for safe havens.

Markets were also buoyed by a fresh round of ECB stimulus and hopes surrounding AstraZeneca’s vaccine development.

Companies thats have been dubbed ‘stay at home shares’ were among the biggest fallers . Ocado has been a major benefactor of the coronavirus restrictions with shares rising 61% in 2020, but shares in the online grocery delivery service fell on Friday as investors shifted their attention to cyclical recovery shares.

Precious metals miner Polymetal was also weaker as the risk-on tone diminished demand for safe havens.

Markets were also buoyed by a fresh round of ECB stimulus and hopes surrounding AstraZeneca’s vaccine development.

US Jobs

Later in the day, equity rallied after investors received the latest instalment of job data from the US in the form of the US Non-Farm Payrolls. The US economy added 2.5 million jobs in May, significantly beating the economist consensus of 8 million jobs lost. In April, the US economy shed 20 million jobs and exceptions were the Non-Farm Payrolls would show further job losses in May. However, the reading showed that hiring picked up in May suggesting the recovery from the coronavirus induced downturn would move quicker than previously thought. The jobs data triggered a wave of optimism through markets and the FTSE 100 built on earlier gains to trade at 6,455, up 1.8% on the day. US equities also rose with the Dow Jones and S&P 500 push towards the highest levels seen since February.

Unemployment levels expected to reach 15pc

The UK’s unemployment rate is predicted to reach 15% following the worst of the Coronavirus pandemic.

James Reed, head of the UK’s largest recruitment firm, Reed, has suggested that up to five million people could be unemployed.

Speaking BBC’s Today programme, Reed said that recent announcements from companies around job cuts were “the tip of the iceberg”.

“My concern is that the data that we’re seeing, which is that the number of jobs advertised is down two-thirds and has been consistently for two months now, suggests that there could be a lot more job losses to come,” he said.

He has suggested unemployment rates will be the highest in October when the government’s furlough scheme is set to end.

“It’s very difficult for those businesses to re-employ all the people they’ve got furloughed. So I’m dreading this day of reckoning where they decide they’re not going to do that and a lot more people will become unemployed” said Reed.

8.7 million employees are currently on the scheme.

Earlier this week, Boris Johnson braced the nation for “many job losses” as the economic impacts of the pandemic are set to emerge.

This week has seen a number of companies axe UK jobs due to Coronavirus impacts. Car manufacturers Lookers (LON: LOOK) and Aston Martin are planning to cut hundreds of jobs and offer voluntary redundancies to hundreds of UK staff.

The Restaurant Group (LON: RTN) has said it plans to close 120 of its Frankie & Benny’s restaurants.

Avacta fundraising signals progress towards transformational COVID-19 testing

Avacta (LON:AVCT) has taken another significant step forward in their fight against COVID-19 with a capital raising thats proceeds will fund development of their diagnostics products.

In addition to COVID-19 antigen testing, Avacta’s technology is being used in a pipeline of cancer therapies.

Avacta raised £48 million at 120p, representing a 4.4% discount to 125.3p, the 30 day volume weighted average price (VWAP) to 3rd June.

Avacta shares were trading at 162.55p, up 7%, in mid morning trade on Friday.

“By taking this initiative, Avacta’s Board has recognised the demand from institutional and private investors to fully capitalise the business,” said Barry Gibb, Research Analyst at Turner Pope.

“It unlocks the Group’s pipeline of differentiated cancer therapies centred on its pre|CISION™ and Affimer® platforms, expands its diagnostic products pipeline and provides the working capital required to grasp the potentially huge short and longer-term commercial opportunities now being presented by the COVID-19 antigen tests in development with partners.”

“TPI considers the successful completion of this Fundraising will enable the Avacta to reach a number of the major inflection points it is currently presented with,” Barry Gibb concluded.

Of the £48 million raised, £10 million will be designated to COVID-19 testing and £38 million will be used in the expansion of cancer therapies.

The fundraising was significantly oversubscribed highlighting the demand for Avacta shares. Exceptional demand was noted from retail investors who invested through PrimaryBid.

“I am delighted to report that the placing has received overwhelming support from both institutional and retail investors leading to a bookbuild that was multiple times oversubscribed,” Avacta CEO Dr Alastair Smith.

“I would like to thank our existing investors and welcome new shareholders to Avacta. We are very pleased to have added a significant strategic US investor to our register,” Smith said.

“This substantial fundraising allows us to rapidly expand the in-house Affimer® and pre|CISION cancer therapy pipelines and scale-up the diagnostics business to expand the Affimer® diagnostic products pipeline. In the short term the funds will provide the Company with the working capital to support the development and manufacture of the COVID-19 antigen tests in development which, given the potential demand, could be transformational for Avacta.”

“It unlocks the Group’s pipeline of differentiated cancer therapies centred on its pre|CISION™ and Affimer® platforms, expands its diagnostic products pipeline and provides the working capital required to grasp the potentially huge short and longer-term commercial opportunities now being presented by the COVID-19 antigen tests in development with partners.”

“TPI considers the successful completion of this Fundraising will enable the Avacta to reach a number of the major inflection points it is currently presented with,” Barry Gibb concluded.

Of the £48 million raised, £10 million will be designated to COVID-19 testing and £38 million will be used in the expansion of cancer therapies.

The fundraising was significantly oversubscribed highlighting the demand for Avacta shares. Exceptional demand was noted from retail investors who invested through PrimaryBid.

“I am delighted to report that the placing has received overwhelming support from both institutional and retail investors leading to a bookbuild that was multiple times oversubscribed,” Avacta CEO Dr Alastair Smith.

“I would like to thank our existing investors and welcome new shareholders to Avacta. We are very pleased to have added a significant strategic US investor to our register,” Smith said.

“This substantial fundraising allows us to rapidly expand the in-house Affimer® and pre|CISION cancer therapy pipelines and scale-up the diagnostics business to expand the Affimer® diagnostic products pipeline. In the short term the funds will provide the Company with the working capital to support the development and manufacture of the COVID-19 antigen tests in development which, given the potential demand, could be transformational for Avacta.”

“It unlocks the Group’s pipeline of differentiated cancer therapies centred on its pre|CISION™ and Affimer® platforms, expands its diagnostic products pipeline and provides the working capital required to grasp the potentially huge short and longer-term commercial opportunities now being presented by the COVID-19 antigen tests in development with partners.”

“TPI considers the successful completion of this Fundraising will enable the Avacta to reach a number of the major inflection points it is currently presented with,” Barry Gibb concluded.

Of the £48 million raised, £10 million will be designated to COVID-19 testing and £38 million will be used in the expansion of cancer therapies.

The fundraising was significantly oversubscribed highlighting the demand for Avacta shares. Exceptional demand was noted from retail investors who invested through PrimaryBid.

“I am delighted to report that the placing has received overwhelming support from both institutional and retail investors leading to a bookbuild that was multiple times oversubscribed,” Avacta CEO Dr Alastair Smith.

“I would like to thank our existing investors and welcome new shareholders to Avacta. We are very pleased to have added a significant strategic US investor to our register,” Smith said.

“This substantial fundraising allows us to rapidly expand the in-house Affimer® and pre|CISION cancer therapy pipelines and scale-up the diagnostics business to expand the Affimer® diagnostic products pipeline. In the short term the funds will provide the Company with the working capital to support the development and manufacture of the COVID-19 antigen tests in development which, given the potential demand, could be transformational for Avacta.”

“It unlocks the Group’s pipeline of differentiated cancer therapies centred on its pre|CISION™ and Affimer® platforms, expands its diagnostic products pipeline and provides the working capital required to grasp the potentially huge short and longer-term commercial opportunities now being presented by the COVID-19 antigen tests in development with partners.”

“TPI considers the successful completion of this Fundraising will enable the Avacta to reach a number of the major inflection points it is currently presented with,” Barry Gibb concluded.

Of the £48 million raised, £10 million will be designated to COVID-19 testing and £38 million will be used in the expansion of cancer therapies.

The fundraising was significantly oversubscribed highlighting the demand for Avacta shares. Exceptional demand was noted from retail investors who invested through PrimaryBid.

“I am delighted to report that the placing has received overwhelming support from both institutional and retail investors leading to a bookbuild that was multiple times oversubscribed,” Avacta CEO Dr Alastair Smith.

“I would like to thank our existing investors and welcome new shareholders to Avacta. We are very pleased to have added a significant strategic US investor to our register,” Smith said.

“This substantial fundraising allows us to rapidly expand the in-house Affimer® and pre|CISION cancer therapy pipelines and scale-up the diagnostics business to expand the Affimer® diagnostic products pipeline. In the short term the funds will provide the Company with the working capital to support the development and manufacture of the COVID-19 antigen tests in development which, given the potential demand, could be transformational for Avacta.” Gap posts $932m loss, shares fall 8pc

Gap (NYSE: GPS) has posted a $932m (£740m) loss in the three months to May.

The clothing retailer reported a 43% fall in sales during the period, as 90% of the group’s stores were closed amid the Coronavirus pandemic.

Although sales were hit hard in the last quarter, online sales are improving. For the month of May, online sales at the retailer had doubled compared to the same month last year.

The retailer has up to 2,800 stores in North America, the vast majority of which are set to open in June.

Whilst many of the stores have been closed, Gap was sued by the Simon Property Group for refusing to pay rent for stores during the pandemic. Gap is said to owe the shopping mall operator a total of $65.9m for three months of rent.

In a statement on Thursday, the retailer said they are trying to reach an agreement with landlords.

“It’s important to note the profound effect that Covid has had on shopping centers as well, leaving them closed to us and our customers for months,” said the group.

“We remain committed to working directly with our landlords on mutually agreeable solutions and fair rent terms. We are pleased with the progress we’ve made with many landlords as we’re reopening stores across the country, moving forward together towards growth.”

Following the company’s results, shares fell more than 8% in after-hours trading.

Shares in the group are currently trading +1.59% at 12.14 (0948GMT).

FTSE 100 falls with global equities

The FTSE 100 fell on Thursday, halting a three-day rally which saw London’s leading index breach the highest levels since the selloff in March.

The FTSE 100 inline with global stocks with weakness in US and mainland Europe indices. However, the tech-focused US NASDAQ bucked the trend and continued to tip toe higher towards all-time record highs.

The culmination of US riots and concerns over China gave markets reason to pause, although the declines were slight and it appears the market has stopped for breath, as opposed to displaying any signs of volatility.

The market also digested the latest ECB meeting and the announcement of a fresh wave of stimulus in the form of €600 billion in asset purchases. The latest measures adds to previous stimulus measures and with rates already negative, bond purchases are the most powerful tool at the ECB’s disposal.

“Today’s easing measures were another illustration that the ECB means business and stands ready to do whatever is necessary to help the euro area survive the corona crisis in one piece. The ECB will do its part, and it hopes the governments will do their part,” said Nordea analysts in a note.

Such a large injection of liquidity would usually be cheered by markets but it failed to turn the equity markets positive on the day.

The selling of stocks in the FTSE 100 was broad with most industry sectors falling, particularly cyclical sectors that have enjoyed gains over the past month.

Economic fallout

Equity markets have recorded some of the sharpest gains in history since the March selloff with the valuations of stocks decoupling form the underling economic environment highlighted by further job losses in the United States. In the UK, investors received news of jobs cuts in the car industry with Aston Martin and Lookers both cutting jobs after a destruction in car purchases. In the hospitality industry the owner of Wagamamas and Franky and Benny’s, Restaurant Group, outlined outlet closures.Lookers and Aston Martin announce UK job cuts

Car dealerships Lookers and Aston Martin have both announced plans to cut hundreds of UK jobs in response to the Coronavirus.

As the government is lifting lockdown restrictions and car rooms are set to reopen, Lookers it will cut its workforce by almost 20%.

Mark Raban, Looker’s chief executive, said: “We have taken the decision to restructure the size of the group’s dealership estate to position the business for a sustainable future, which regrettably means redundancy consultation with a number of our colleagues.”

“This has been a very difficult decision and we will be supporting our people as much as possible throughout the process,” he added.

The car dealership will cut 1,500 jobs and close 12 dealerships. The group has 164 dealerships and hopes to save £50m annually from the redundancies.

Aston Martin has also announced to cut 500 jobs in an attempt to restore profits amid falling sales.

“As communicated previously, the plan requires a fundamental reset which includes a planned reduction in front-engined sports car production to rebalance supply to demand,” said the group.

“The company’s first SUV, DBX, remains on track for deliveries in the summer and has a strong order book. The measures announced today will right-size the organisational structure and bring the cost base into line with reduced sports car production levels, consistent with restoring profitability.”

Aston Martin said last week that the current Chief Executive, Andy Palmer, is to step down and will be replaced by Tobias Moers, who currently runs Mercedes-AMG.

The sector is under increasing pressure under Coronavirus. The number of new cars registered last month was down 89% compared to May 2019.

Shares in Lookers (LON: LOOK) are trading up over 5% at 24.50 (1204GMT).