UK Household Finance Index up in January

Coca-Cola set to transition to a circular economy and invest heavily into France

Coca-Cola HBC AG (LON:CCH) have announced that they will be heavily investing into France to support sustainable development.

The firm said that alongside Coca-Cola European Partners PLC (LON:CCEP) they will invest as much as €1 billion over the next five years.

At the Choose France Summit, Coca-Cola’s chair and chief executive in James Quincey announced a new “major investment plan” which expanded on the next five years.

Quincey and the French authors are set to discuss the deal on Monday, which will be pleasing for the French president.

Quincey said that the investment will be primarily used to add new products within the French market and support innovation.

The money will also go towards the expansion of Coca-Cola European Partners’ manufacturing plants, as the firm makes an active effort to promote environmentally friendly investing and sustainability.

Coca-Cola European Partners intends to “transition to a circular economy”, altering its packaging as part of this effort.

Having added a bottling line for glass bottles only in 2019, it will invest in its Socx, Dunkerque plant to add a “state-of-the-art aseptic bottling line in mid-2020” to meet higher demand for its ready-to-drink tea brand Fuze Tea and for Tropico juice.

“Additional investments across all five CCEP plants in France will enable the introduction of a higher quantity of recycled material in bottles and cans and the replacement of plastic by cardboard for secondary packaging,” said Coca-Cola.

Quincey concluded: “Coca-Cola has been part of France for a century, and our presence today includes more than 2,800 people who work for Coca-Cola in France, plus many more across our entire value chain.

“Today’s announcement shows continued commitment to France, helping to build the French economy and contributing to sustainable French communities for years to come.”

Coca-Cola steps up efforts to promote sustainability

In November, the multinational said that they will be stepping up to ensure that their practices are in line with sustainability measures.

The move comes as part of Coca-Cola’s European strategy to expand environmental friendly policies and increased use of recycled plastic.

The drinks producer announced that the switch at the Jordbro factory near Stockholm would allow the reduction of 3,500 tonnes of newly produced plastic.

“That means a 25% reduction of CO2 emissions annually compared with before the transition, when the portfolio consisted of around 40% recycled plastic,” it said, referring to its Swedish operations.

Along with Coca-Cola, rivals such as PepsiCO (NASDAQ:PEP) are attempting to promote the use of recycled plastic as firms respond to plastic waste pollution worries.

The move as the first step in ensuring that all PET bottles are produced from 100% recycled plastic by the end of 2023.

At group level, Coca-Cola’s recycled plastic ratio is 11% currently, and in western Europe, 27%, Keane said.

Last year, Coca-Cola pledged to collect and recycle a bottle or can for every one it sells globally by 2030.

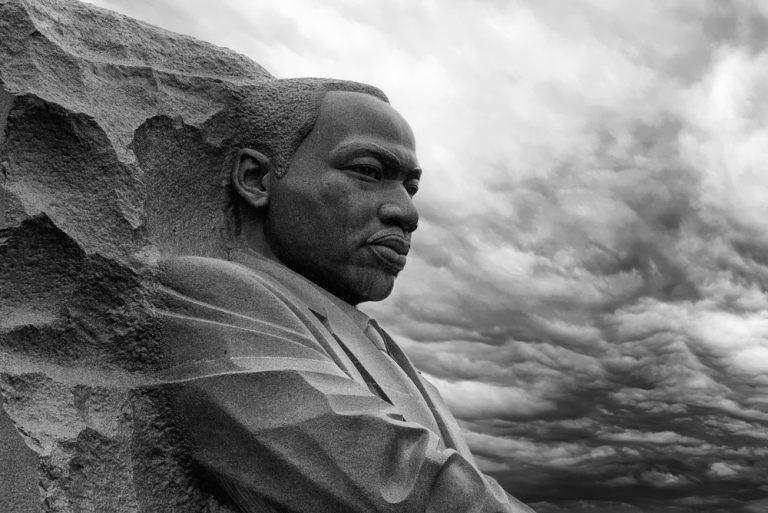

Markets flat as Martin Luther King Day removes Dow Jones from play

“With the US off for Martin Luther King Day, it could be a quiet session, the European indices losing their de facto leader in the Dow Jones.”

“It doesn’t help that on top of its absence, the Dow ended last week by pulling back slightly from its all-time highs, the index seeming to settle at 29300. That means the momentum that seemed to be building has, for now, fizzled out, leading to a rather drab open.”

“The FTSE, which hit a 6-month peak on Friday, dipped 10 points after the bell, drifting from that high without going into a full reversal. The DAX was flat at 13500, a level it has hit its head on a few times in the last week or so. The CAC, meanwhile, slipped 0.2%, unable to keep up its assault on 6100.”

“As January 31st grows ever closer, the pound may see more and more mornings like this. Cable fell 0.3%, once again falling under $1.2985, while against the euro sterling shed the same amount, dipping below €1.1705.”

“It is probably going to take something unexpected – a rogue comment from a Davos attendee, perhaps – to prevent the session from being one to forget.”

Fever-Tree shares plunge after “challenging” Christmas

Rent in London soars

Dow Jones beats expectations and leaves European indices in the dust

The real challenge now will be seeing whether either the US or China will have the appetite for further negotiations, and the potential for more substantive – rather than superficial – terms. For now, though, President Trump will enjoy his victory lap, and milk phase one for all it’s worth.One of the greatest trade deals ever made! Also good for China and our long term relationship. 250 Billion Dollars will be coming back to our Country, and we are now in a great position for a Phase Two start. There has never been anything like this in U.S. history! USMCA NEXT!

— Donald J. Trump (@realDonaldTrump) 16 January 2020

Unfortunately, European equities couldn’t match the excitedness of their peers over the pond. One of the sad cases was the FTSE, doubling back on its modest early gains on account of poor company news, a stronger Pound and corporate updates. Speaking on the Dow Jones and other movements on Thursday, Spreadex Financial Analyst Connor Campbell stated,The farmers are really happy with the new China Trade Deal and the soon to be signed deal with Mexico and Canada, but I hope the thing they will most remember is the fact that I was able to take massive incoming Tariff money and use it to help them get through the tough times!

— Donald J. Trump (@realDonaldTrump) 16 January 2020

“Flaws be damned! The Dow Jones decided to keep celebrating the signing of the US-China ‘phase one’ trade deal, with momentum firmly on the index’s side. The same couldn’t be said for its European peers, however.”

“Additionally bolstered by a strong core retail sales figure – jumping from 0.0% to 0.7% month-on-month as the regular reading remained unchanged at 0.3% – the Dow added 165 points after the bell. That allowed it to strike 29200 for the first time in its history, sparking ripples of excitement that it could well reach 30000 before the month is out (Trump permitting, perhaps).”

“Normally Europe takes its cue from the US. However, investors across the pond just couldn’t muster the same level of enthusiasm. The DAX nudged 0.1% higher, continuing to lurk between 13400 and 13450, while the CAC added a handful of points.”

“The FTSE actually went into reverse, dropping half but just about clinging onto 7600. Part of the problem was that the pound’s rebound gathered strength as the session went on. A 0.2% against the dollar put cable at $1.305, while a 0.4% increase against the euro left sterling above €1.172. This as Swedish foreign minister Ann Linde claimed Britain and the EU could reach some kind of trade deal before the end of 2020.”

“Adding to the FTSE’s misery was a raft of weak corporate update. Chief among the losers was Pearson (LON:PSON), which plunged nearly 9% after it warned operating profits would fall once again in 2020. Whitbread (LON:WTB) was also on the losers pile, dropping 5% thanks to regional weakness at Premier Inn. At least Associated British Foods softened the blow to the UK index, climbing 5% thanks to a decent showing at Primark (LON:ABF) and a sweet performance from its Sugar division.”

Atalaya Mining strikes record quarterly copper production

This allowed the full year to end on a high. Full-year copper production bounced 6.7% on-year, from 42,114 tonnes to 44,950 – which was at the upper end of the company’s guidance.

The Group did note, however, that its annual copper recovery rate dropped from 88.30% to 87.09%, which was driven by lower recovery rates during Q4, which it attributed to the ramp-up of the SAG mill.

Atalaya Mining comments

CEO of the company, Alberto Lavandeira, stated,

“We are pleased to have completed the expansion at Proyecto Riotinto which is now successfully operating at the increased annualised capacity of 15Mtpa since January 2020. We are also pleased to have delivered production rates at the higher end of our expectations in the final quarter of the year. This track record gives us confidence in our ability to achieve our increased 2020 production forecasts.”

Investor notes

Elsewhere in mining; Serabi Gold (LON: SRB) finished with its highest quarterly production, AMG Advanced Metallurgical Group N.V. (AMS: AMG) announced a new appointment, ARC Minerals Ltd (LON: ARCM) uncovered high-grade copper assays and Lucara Diamond Corp (TSE: LUC) was pessimistic in its revenue guidance. Following the update, Atalaya Mining shares rallied 1.15% or 2.24p to 196.24p 16/01/19 14:41 GMT. Peel Hunt reiterated its ‘Buy’ stance on the stock, the Company’s p/e ratio is 8.93.Cloudcall report revenue growth of 30% within impressive financial year

Cloudcall Group PLC (LON: CALL) have told shareholders that they have had a brilliant year where the Chief departed but business has grown.

The firm said that it has seen double digit growth in revenue and user numbers, which contributed to a year of growth and progress for the firm.

CloudCall is a software and unified communications business that has developed and provides a suite of cloud-based software and communications products and services.

The firm added that revenue, cash and losses before tax adjustments are expected to be in line with market expectations.

Cloudcall said its revenue for 2019 grew by 30% to £11.4 million, with the US continuing to perform particularly strong, helped by a larger customer.

Total users also surged by 35% to over 42,300 year on year, which showed a net monthly user growth of 917 which was a 41% rise from 2018.

The average recurring revenue per user remained constant during the year, Cloudcall said, at £28 per user per month.

Simon Cleaver, Chief Executive Officer of CloudCall, commented:

“2019 has been another outstanding year for CloudCall. Not only has the Company once again delivered organic revenue growth of 30%, it also successfully raised new capital to fund future growth and strengthen the balance sheet.

The two standouts for the year are the quantum increase in interest from enterprise companies and the over-50% growth we delivered in the US.

It is worth noting that the US is now responsible for approximately 40% of our total revenue and with nearly half of the total funds raised in the recent placing coming from US investors, I have little doubt there is a huge, largely untapped, opportunity for CloudCall in the US and this is a key focus of our sales and marketing expansion.

CloudCall has a clear strategy to become the leading provider of ‘integrated communications’. We will continue to build out our product, integrate with more CRMs, expand our geographic reach and engage with ever larger customers – our 4 pillars of growth.

We are entering 2020 with significant opportunities and a well-funded balance sheet that is strong enough to capitalise on those opportunities. The Board continues to be confident in the future outlook for the Company.”