If you weren’t around to watch last night’s romp, you missed such

Trump classics as: a declaration that windmills are carcinogenic bird-killers; that the US has some very nice ‘crystal clear’ water; and then responding to 500 children being separated from their parents by simply saying: “good”. On the other podium,

Biden wasn’t exactly on fire. A weaker performance than the first debate, the ex-VP’s most repeated soundbites were pained chuckles and “give me a break”. So, where do last night’s antics leave public mood as we close in on election day?

Well, according to a lot of the polls posted so far,

Biden won the debate last night:

Being honest: having watched the previous exchanges, I could only bring myself to watch the second half of last night’s debate, and even then I was tempted to flick back onto a re-run of ‘Merlin’.

From what we saw,

Trump was as bombastic as ever, though a lot more managed in terms of delivery. Unfortunately for Biden, this meant that the incumbent POTUS looked in charge when he was speaking, and more respectful when he wasn’t.

The same could not be said for

Biden. with the exception of a strong closing statement, Biden seemed to have all the opportunities and facts to land decisive blows on Trump, but lacked the conviction – or the calm – to do so. Coming unstuck at some points due to Trump’s repetitive and combative style, the only thing keeping the Democrat candidate afloat last night was simply the fact that he was arguing for generically agreeable policies, and making statements that were patently true (the president, of course, never burdens himself with these kinds of constraints).

Overall, it was another cringeworthy watch, with the difference from earlier bouts being that Trump looked slightly more level-headed, and at points, Biden looked lost for words. With a considerable rift opening up in polling between candidates after the first debate, the incumbent president just had to appear semi-palatable for voter sentiment to swing even slightly in his favour. And indeed, it appears to have done just that.

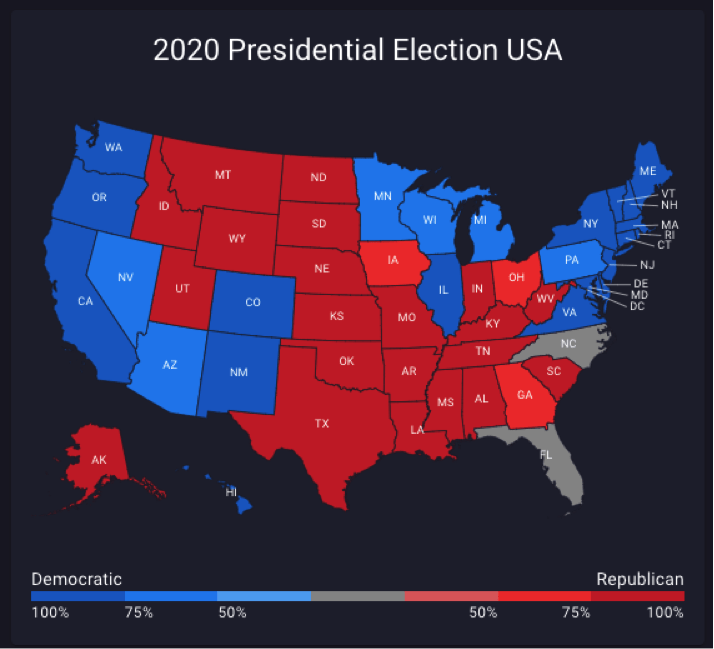

Now, while Biden appears to still have a considerable lead – around 9-10% in most polls – this has narrowed from polling the previous week, with most giving him a 10-12% advantage. The latter poll, giving him just a 6% lead, might be a tad drastic (and from a Trump-leaning pollster), but it does also signify the smallest advantage awarded to Biden since the 30-day election countdown began.

Significantly, the 6% figure covers voter intentions, rather than electoral college votes. This matters because in terms of ECs, Trump’s voter spread gives him an advantage. Indeed, Clinton had a 5% poll lead going into the 2016 election, and 3 million (4-5%) more votes than her rival, but ended up losing by 77 college votes. With this in mind, Biden supporters mustn’t fall at the final hurdle, as any vote lead below 10% will likely be too close for comfort.

As we approach election day, the narrowing margins are also reflected in swing states, even though Biden still retains a lead in most:

Though winning in most swing states, sentiment projections in Florida seem to change depending on which poll you’re looking at. Florida and Pennsylvania are especially significant, though, with 49 ECs between them being more than enough to decide the outcome of the 2020 election.

Worth noting, also, that Biden is far and away viewed as the more ‘decent’ candidate – 64% saying yes to Biden, versus 37% agreeing that Trump has decency. Also, following last night’s debate, Biden’s approval rating rose from 55% to 56%, while Trump’s fell from 42% to 41%. If none of these factors offer Biden supporters consolation about the narrowing margins, then hopefully they take some heart from The Economist’s bold predictions:

Overall, though, an election is not won by polls, and as we saw in 2016, the polls can get it badly, badly wrong. The only way to see your candidate in the White House, is to go out and vote for them. An improvement on last time’s 55% voter turnout, would be a victory for US politics as a whole.