As Beckham’s Guild Esports goes public: Is it time to invest in E-Sports?

Advanced Oncotherapy progresses towards ‘democratising proton therapy’

In service of this end, the company’s second update was also promising. It announced that it had successfully delivered all of the high-precision accelerating structures for the LIGHT system to its Daresbury assembly site; that it had manufactured the hardware necessary for the patient positioning system; and had delivered all of the technical files for the certification process.

Further, it announced that at its Daresbury site, it had been developing the infrastructure necessary to support the assembly of future machines. In short, it is another step closer to bringing its technology to the public.

Then, to help with the costs of research and production, Advanced Oncotherapy celebrated several new sources of funding. These included a successful equity fundraise of £14.9 million pre-expenses; the option of accessing £42 million courtesy of VDL and Nerano Pharma; and a drawdown of $10 million from an ‘interest-bearing secured convertible facility’ with Nerano Pharma. Finally, to assist in rolling out its treatment to patients, the company announced that it had signed ‘multiple’ commercial partnership agreements with stakeholders, including The London Clinic, The Mediterranean Hospital of Limassol and University Hospital Birmingham NHS Foundation TrustCommenting on these areas of progress made over the last six months, Advanced Oncotherapy CEO, Nicolas Serandour, said:

“We are delighted with the progress achieved over the past six months despite the impact that COVID-19 has had on our business. As previously announced, we have added more focus on and made excellent progress with the documentation and software development. During the half year under review, we also signed a number of significant collaborations with partners for further LIGHT systems to be constructed at world leading hospitals, and we look forward to updating the market in due course on the progress of these agreements.”

“We are pleased to have recently resumed activities at the Daresbury site, and are expecting to be in line with our operational plan for completion of the first LIGHT system in 2021. We will be holding a virtual Investor Day in October when we will update the market on our patient-centric business model, the broader strategy and operational deliverables for the next year, including our LIGHT system being fully conditioned and generating a full-energy beam that is necessary to treat patients with our clinical partner, the University Hospital Birmingham NHS Foundation Trust.”

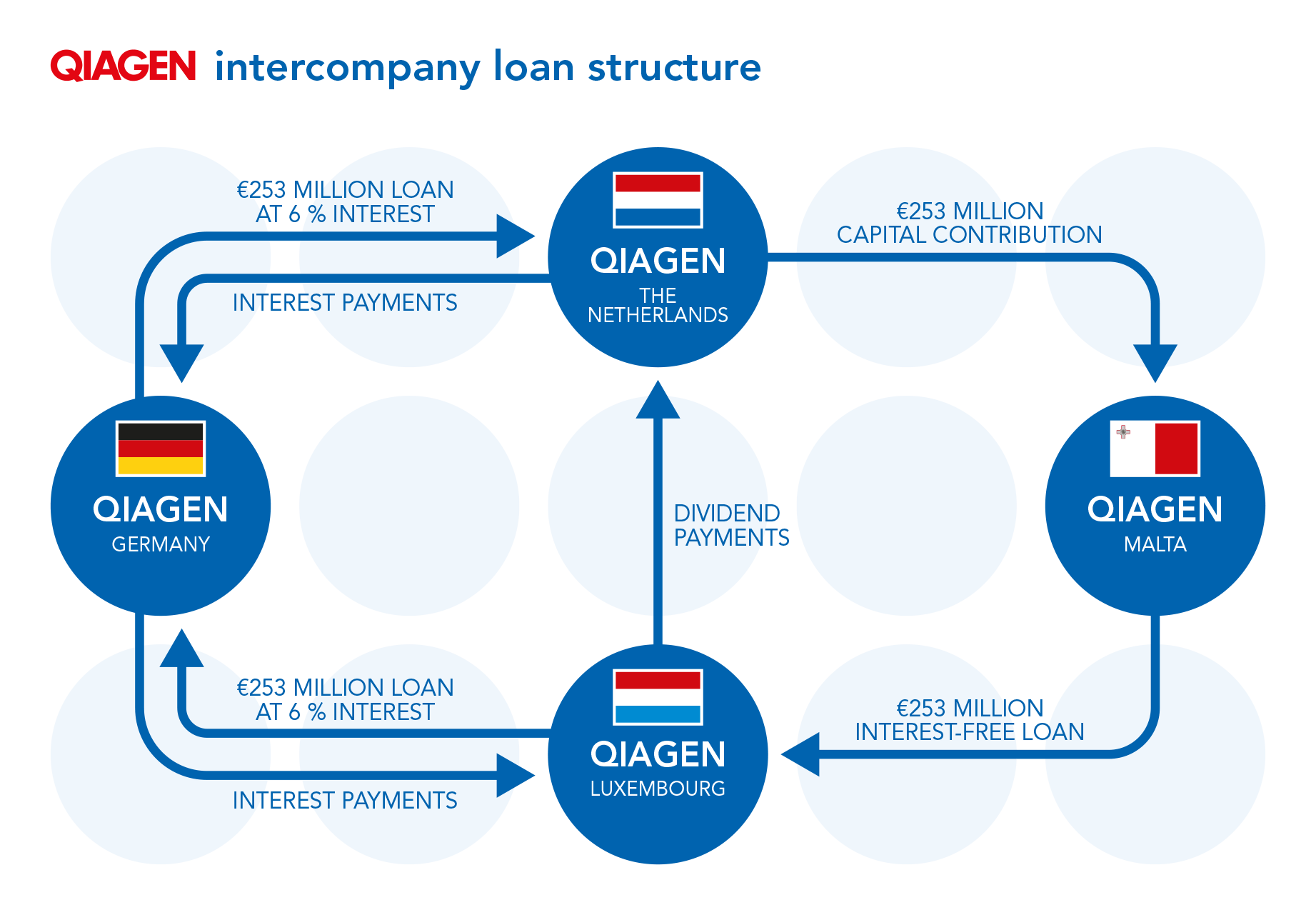

How Covid test manufacturer Qiagen dodged €93mn in tax since 2010

How have Qiagen gotten away with it?

The company itself has an operational HQ in Germany, but is officially headquartered in Venlo, the Netherlands. Having boasted second quarter profits of €77 billion – double the level of the same period the previous year – SOMO revealed that the company had not paid proportionate tax on these gains. Instead, SOMO described Qiagen’s tax structure as a ‘network of letterbox companies’ in European tax havens (listed above), which it uses to avoid tax via internal loan-giving between subsidiaries. In essence, it downplays the true nature of its taxable profits – which might differ from the profit figure it uses as a public performance indicator – by transferring its earnings to lower-tax jurisdictions such as Luxembourg. These transfers occur via loans, with the main company paying letterbox or subsidiary companies disproportionate interest payments. Much like ‘facilitation payments’ replacing bribery in the past, bogus ‘interest rates’ are just a form of euphemism to mask an unsavoury, but financially prudent, transaction.

Taking from the public and not giving back their fair share

Alongside not paying an equitable tax on their profits, Qiagen has received large sums of public funds from both the US and Netherlands governments, among others. For instance, it received €511,000 from the US Department of Health, to help accelerate the development of a new Covid test. The subsequent test is now being produced and procured on a massive scale, again using public money, by the Netherlands, US and other countries around the world SOMO’s view is that government’s must intervene, with this just the latest in a catalogue of brazen tax avoidance schemes by large companies, who are happy to benefit from the countries they operate in, without feeling any duty of reciprocity towards the people who have facilitated their success. It says that organisations such as the EU and the Netherlands government must now implement rules that are more exacting with the allocation of public funds, and tighter on tax avoidance infrastructure, such as subsidiaries being used to offshore profits made in a company’s places of operation. Wemos, a Dutch non-profit, global health lobbyist group, published its own study on public funding of medicines in 2019, underlines the recommendations of the SOMOS report. Ella Weggen, global health advocate for Wemos, said: “Transparency about public investments is desperately needed. Conditions must be attached to this public funding in terms of affordability and accessibility, so that people actually benefit from medicines and medical devices developed with their taxpayers’ money.”UK announces £200m post-Brexit port infrastructure fund

CIP secures €4bn investment for greenfield renewables fund

Asda sold to Blackburn billionaires in £6.8bn deal

Cenkos Securities shares rise as group swings to profit

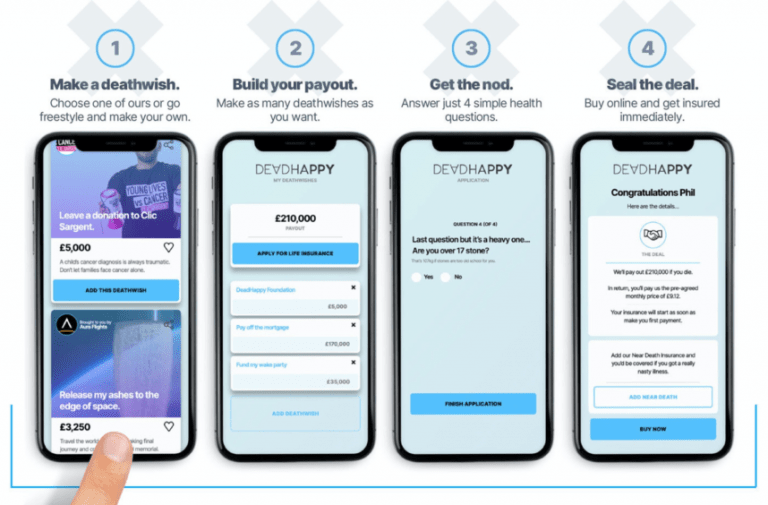

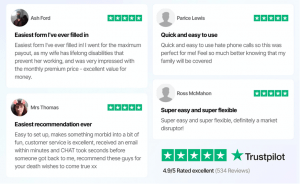

Digital life insurance provider DeadHappy is overfunding on Seedrs

Life insurance to die for

Equipped with the idea of helping people think, talk and plan for what they want to happen when they die, DeadHappy offers a life insurance product based on deathwishes. Deathwishes help customers identify their life insurance needs and gives their life insurance plan some real, tangible meaning.

“Our Deathwish platform helps customers specify how they want their insurance payout to be used, such as pay off your mortgage or send your family on holiday,” says Phil Zeidler, Co-founder of DeadHappy. “Crucially, it acts as a catalyst to thinking about what you’d like to happen when you die and helps to open up those conversations with your loved ones.”

Launched in February 2019, the company’s ‘Deathwish Platform’ has seen over 120k deathwishes created to date.

Life insurance to die for

Equipped with the idea of helping people think, talk and plan for what they want to happen when they die, DeadHappy offers a life insurance product based on deathwishes. Deathwishes help customers identify their life insurance needs and gives their life insurance plan some real, tangible meaning.

“Our Deathwish platform helps customers specify how they want their insurance payout to be used, such as pay off your mortgage or send your family on holiday,” says Phil Zeidler, Co-founder of DeadHappy. “Crucially, it acts as a catalyst to thinking about what you’d like to happen when you die and helps to open up those conversations with your loved ones.”

Launched in February 2019, the company’s ‘Deathwish Platform’ has seen over 120k deathwishes created to date.

The crowdfunding round

DeadHappy’s current crowdfund follows £5.5m investment to date from notable VCs Octopus and eVentures, both of whom are reinvesting in this round.

“As we look forward to the next stage of development for this company, we’re really excited to support them on their mission to change people’s attitudes to death,” said Malcom Ferguson, partner in Octopus Ventures.“And hopefully go some way to fixing the chronic underinsurance that exists in this sector.”

Why we invested in DeadHappy – Octopus Ventures from DeadHappy on Vimeo.

DeadHappy plans to use the funds raised to continue its rapid growth through marketing investment, launch new products, and accelerate the on-boarding of partners and sponsors.

The company’s round on Seedrs is set to close on the 9thof October 2020.

Click here to invest!

The crowdfunding round

DeadHappy’s current crowdfund follows £5.5m investment to date from notable VCs Octopus and eVentures, both of whom are reinvesting in this round.

“As we look forward to the next stage of development for this company, we’re really excited to support them on their mission to change people’s attitudes to death,” said Malcom Ferguson, partner in Octopus Ventures.“And hopefully go some way to fixing the chronic underinsurance that exists in this sector.”

Why we invested in DeadHappy – Octopus Ventures from DeadHappy on Vimeo.

DeadHappy plans to use the funds raised to continue its rapid growth through marketing investment, launch new products, and accelerate the on-boarding of partners and sponsors.

The company’s round on Seedrs is set to close on the 9thof October 2020.

Click here to invest!