Latin America: is an economic recovery viable?

Dow Jones briefly breaks 28k mark on positive PMI data

New investment helps convert electric vehicle batteries into grid storage systems

Renewi shares surge on first-half “resilience”

Fastest-growing Asian economies saw mixed success in manufacturing PMI data

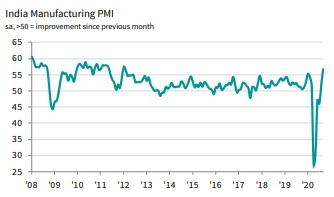

India manufacturing moves up a gear

Continuing the boom it began in August, India’s manufacturing sector enjoyed an orders and production renaissance, pushing its PMI to its highest mark since January 2012. With renewed expansions in export sales and input stocks, and improved business confidence, output rose for the first time in six months, reflecting an uptick in input costs. IHS Markit (NYSE:INFO) stated that India’s PMI increased from an already-positive levl of 52.0 in August, to 56.8 in September, signalling not just back-to-back growth but its highest reading for more than eight-and-a-half years.

Speaking on the data, IHS Markit Economics Associate Director, Pollyanna De Lima, added:

“Exports also bounced back, following six successive months of contraction, while inputs were purchased at a sharper rate and business confidence strengthened.”

“One area that lagged behind, however, was employment. Some companies reported difficulties in hiring workers, while others suggested that staff numbers had been kept to a minimum amid efforts to observe social distancing guidelines.”

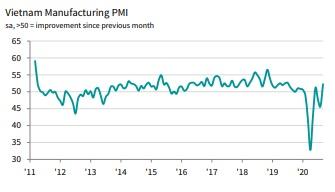

Vietnam PMI bounces back to green

On a more modest but similar trajectory is Vietnam, whose manufacturing PMI returned to growth in September as Covid concerns somewhat eased. With this, output and new orders regained their footing, while business confidence grew and the rate of job cuts slowed down. This saw the manufacturing PMI of Asia’s fifth-fastest-growing economy recover from the negative level (sub-50) of 45.7 points in August, and back into the green, at 52.2 points for September.

Philippines regains stability

On a more tentative note, Filipino data indicated that operating conditions for manufacturers had returned to something broadly resembling stability. While at a marginal pace, new orders rose for the first time since February – led by improving customer demand as more part s of the country’s economy reopened due to the easing of Covid restrictions. Similarly, business sentiment improved to its highest point since February, with upbeat forecasts attributed to hopes of rising demand and Covid becoming a thing of the past in the not-too-distant future. Meanwhile, output fell to its weakest level in three months, though this, also, was only a marginal change. However, unemployment continues to expand at a notable rate, which manufacturers often link to non-replacement of voluntary leavers and sufficient capacity. Further, cost burdens rose as shortages led to higher prices, and respondents only partially passing on higher costs to clients, due to market pressures forcing them to keep prices competitive. Following a downturn, with 47.3 points in August, September saw a very slight return to positivity, with Philippines manufacturing PMI rising to 50.1. This latest reading represents extremely modest expansion, and its the highest since conditions were last stable in the goods producing sector, back in February.

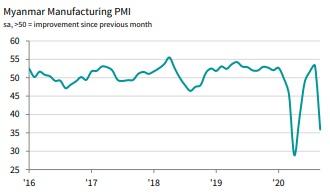

Myanmar hampered by a surge in Covid cases

Unfortunately unable to gain traction away from Covid was Asia’s sixth-fastest-growing economy, Myanmar, whose manufacturing PMI suffered as performance indicators were scuppered by a resurgence in new cases. With factories temporarily closing to combat the spread of the virus in September, both output and new orders ‘declined rapidly’ according to IHS Markit. Alongside these considerations, a deterioration in business conditions, and contraction in workforce numbers, both saw the July-August recovery stopped in its tracks. As stated by IHS, Myanmar manufacturing PMI fell from a 15-month-high in August, at 53.2 points, to 35.9 in September – representing a notable contraction.

How has Ocado overtaken Tesco on the stock market?

Britvic shares drop 6% as it sells three bottling facilities in France

Britvic stated that it has retained the ownership of the Pressade and Fruit Shoot brands, which it said would be manufactured by Refresco as part of a long-term partnership.

It continued by saying that this transaction will not impact its Teisseire and Moulin De Valdonne brands, or the private label syrups business, all of which are made at its production site in Crolles. The company’s statement continued by saying that:“This transaction supports our stated strategic priority to improve operating margins in our Western European markets, while also enables our teams to focus on growing our soft drinks portfolio of local favourite and global premium brands.”

Following the update, the company’s shares dipped by 6.27% or 51.50p, to 769.50p a share 01/10/20 13:00 GMT. This is shy of analysts’ consensus target price of 880.91p a share, which would represent a 14% upside on its current level. At present, the Marketbeat community has a 54.23% ‘Underperform’ stance on the stock, with the company’s p/e ratio standing at 13.73, just above the consumer defensive sector average of 13.64.