Griffin Mining shares surge 9% on positive Q3 performance

Stock selections for 2020 year end from Zak Mir & Alan Green

US Presidential Election – where do polls stand after the final debate?

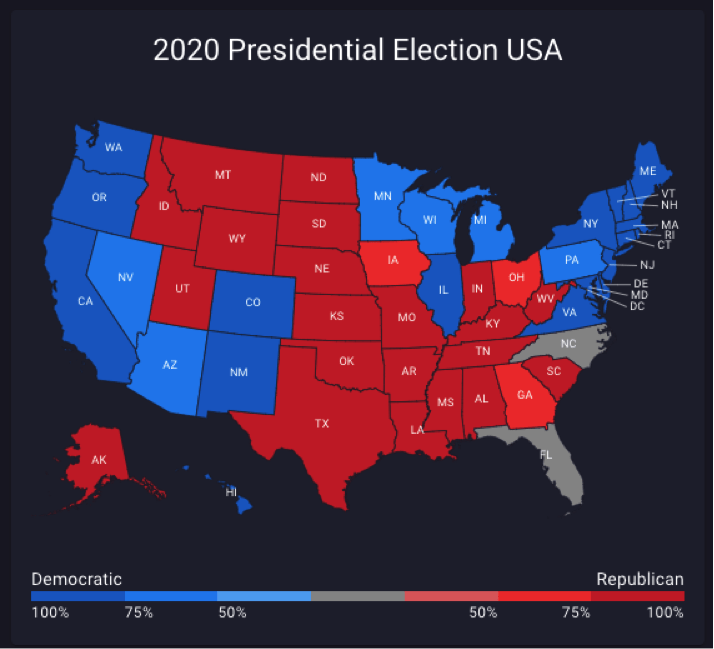

Being honest: having watched the previous exchanges, I could only bring myself to watch the second half of last night’s debate, and even then I was tempted to flick back onto a re-run of ‘Merlin’. From what we saw, Trump was as bombastic as ever, though a lot more managed in terms of delivery. Unfortunately for Biden, this meant that the incumbent POTUS looked in charge when he was speaking, and more respectful when he wasn’t. The same could not be said for Biden. with the exception of a strong closing statement, Biden seemed to have all the opportunities and facts to land decisive blows on Trump, but lacked the conviction – or the calm – to do so. Coming unstuck at some points due to Trump’s repetitive and combative style, the only thing keeping the Democrat candidate afloat last night was simply the fact that he was arguing for generically agreeable policies, and making statements that were patently true (the president, of course, never burdens himself with these kinds of constraints). Overall, it was another cringeworthy watch, with the difference from earlier bouts being that Trump looked slightly more level-headed, and at points, Biden looked lost for words. With a considerable rift opening up in polling between candidates after the first debate, the incumbent president just had to appear semi-palatable for voter sentiment to swing even slightly in his favour. And indeed, it appears to have done just that.Who won tonight’s debate?@YouGovAmerica: Biden 54% (+19) Trump 35% .@CNN: Biden 53% (+14) Trump 39%@DataProgress: Biden 52% (+11) Trump 41%

— Political Polls (@Politics_Polls) October 23, 2020

National GE: Biden 53% (+10) Trump 43% . Generic Congressional Ballot: Democrats 51% (+8) Republicans 43%@GSG/@GBAOStrategies, RV, 10/15-19https://t.co/i9Zu5wO4Jz

— Political Polls (@Politics_Polls) October 23, 2020

Now, while Biden appears to still have a considerable lead – around 9-10% in most polls – this has narrowed from polling the previous week, with most giving him a 10-12% advantage. The latter poll, giving him just a 6% lead, might be a tad drastic (and from a Trump-leaning pollster), but it does also signify the smallest advantage awarded to Biden since the 30-day election countdown began. Significantly, the 6% figure covers voter intentions, rather than electoral college votes. This matters because in terms of ECs, Trump’s voter spread gives him an advantage. Indeed, Clinton had a 5% poll lead going into the 2016 election, and 3 million (4-5%) more votes than her rival, but ended up losing by 77 college votes. With this in mind, Biden supporters mustn’t fall at the final hurdle, as any vote lead below 10% will likely be too close for comfort. As we approach election day, the narrowing margins are also reflected in swing states, even though Biden still retains a lead in most:National GE: Biden 52% (+6) Trump 46%@SurveyMonkey/@tableau/@axios, LV, 10/19-21https://t.co/XyP5kztmIf

— Political Polls (@Politics_Polls) October 23, 2020

PENNSYLVANIA Biden 51% (+7) Trump 44%@Muhlenberg/@mcall, LV, 10/13-20https://t.co/IPQTBKbwHR

— Political Polls (@Politics_Polls) October 23, 2020

MICHIGAN Biden 48% (+9) Trump 39% .#MIsen: Peters (D-inc) 45% (+6) James (R) 39%

EPIC-MRA, LV, 10/15-19https://t.co/9ujjpFrWRL — Political Polls (@Politics_Polls) October 23, 2020

Though winning in most swing states, sentiment projections in Florida seem to change depending on which poll you’re looking at. Florida and Pennsylvania are especially significant, though, with 49 ECs between them being more than enough to decide the outcome of the 2020 election. Worth noting, also, that Biden is far and away viewed as the more ‘decent’ candidate – 64% saying yes to Biden, versus 37% agreeing that Trump has decency. Also, following last night’s debate, Biden’s approval rating rose from 55% to 56%, while Trump’s fell from 42% to 41%. If none of these factors offer Biden supporters consolation about the narrowing margins, then hopefully they take some heart from The Economist’s bold predictions:FLORIDA Trump 50% (+2) Biden 48%@SurveyMonkey/@tableau/@axios, LV, 9/24-10/21https://t.co/XyP5kztmIf

— Political Polls (@Politics_Polls) October 23, 2020

Overall, though, an election is not won by polls, and as we saw in 2016, the polls can get it badly, badly wrong. The only way to see your candidate in the White House, is to go out and vote for them. An improvement on last time’s 55% voter turnout, would be a victory for US politics as a whole.#Latest @TheEconomist Forecast:

Chance of winning the electoral college: Biden 92% Trump 7% Chance of winning the most votes: Biden 99% Trump 1% Estimated electoral college votes: Biden 345 Trump 193https://t.co/6Ei5T5ogc2 — Political Polls (@Politics_Polls) October 23, 2020

InterContinental Hotels shares restless as revenues slide 53%

However, there was some room for optimism. During Q3, the company opened 82 new hotels and signed a further 14,000 rooms. This brings its total rooms opened in 2020 up to 23,000, and its total estate up to 890,000 rooms across 5,977 hotels, up 2.9% year-on-year.

Further, the company booked positive cash flow in Q3, with total liquidity at the end of September rising to £2.1 billion. It also added that it was on track to reduce its business costs by £150 million, targeting at least half of that number ‘to be sustainable into 2021’.

InterContinental Hotels dust themselves off

Coming through a tough year, company CEO, Keith Barr, discusses both the challenges and opportunities that lie ahead:Despite the challenges we’ve faced, we have continued to open new hotels and sign more into our pipeline. This is recognition of consumer preference for our brands and strong owner relationships, and also the long-term attractiveness of the markets we operate in and the relative resilience of our business model. We signed 82 hotels in the quarter, taking us to 263 year-to-date, more than a quarter of which are conversions. As we continue to invest in growth initiatives, we do so with a strict focus on cost reduction and an unwavering commitment to act responsibly for our people, guests, owners and local communities.”

“A full industry recovery will take time and uncertainty remains regarding the potential for further improvement in the short term, but we take confidence from the steps taken to protect and support our owners and drive demand back to our hotels as guests feel safe to travel. Our actions have resulted in ongoing industry outperformance in our key markets, and we remain focused on leveraging the strength of our brands, scale and market positioning to recover strongly and drive future growth.”

Investor notes

Following the news, InterContinental Hotels Group shares dipped by 2.39% or 102.00p, down to 4,161.00p a share 23/10/20 12:38 BST. This level is around 5% above analysts’ target price of 3,951.54p a share, but beneath its six-month high of 4,484.00p seen in September. Analysts currently have a ‘Hold’ stance on the company’s stock, it has a p/e ratio of 18.38, and it currently has a 66.92% ‘Underperform’ rating from the MarketBeat communityInfrastructure India shares rise on full-year results

Sunak scheme add-ons see FTSE bounce from five-month low

Between the first bit of vaccine-related optimism in a long time, and Chancellor Rishi Sunak’s new assortment of support scheme patch-ups, the FTSE recovered from its five-month low, when it hit 5,726 points during the morning.

Speaking on the index‘s movements during the day, Spreadex Financial Analyst, Connor Campbell, said: “The midday rebound seemed related to good news out of the Oxford vaccine trials, with reports that it was prompting a ‘strong immune response’ in patients.”

“Then there was Rishi Sunak’s announcement that the government is extending the furlough replacement scheme, by launching a new grant scheme for companies in areas under tier 2 restrictions while making changes to the level of employer contributions and number of hours an employee must work for a firm to be eligible.”

This news saw the FTSE 100 bounce from its initial 50 point drop, up to an end of day rally of around 10 points, or 0.16%, to 5,785. More bullish was the FTSE 250. Having dropped by over 100 points to begin with, the index then mustered a 0.60% rally, up to 17,894 points. However, the broader outlook is less positive than today’s developments might suggest. With no clear news on when a vaccine can be expected, and changes in political policy making another potential lockdown difficult to price in, there is certainly room for further downward pressure between now and Christmas. Campbell adds on the day’s developments:“Yet this had only a limited impact on investors’ disposition. The markets remain deeply worried by the scope and scale of rising covid-19 cases and subsequent restriction measures around the world, but especially in Europe.”

This worry was reflected in Eurozone equities, with the DAX dropping 0.12%, to 12,543 points, and the CAC trying its best to recover, but ultimately finishing with a marginal dip of 0.053%, down to 4,851 points.Bitcoin bets 85% in favour of Trump victory says Cloudbet

At one point, the Economist said there was a 90% probability that Biden would win more electoral colleges than his rival, as well as a 99% chance the Democrat candidate would win more votes.

In stark contrast, Cloudbet said that 85% of its users have their money on Trump retaining the presidency. Speaking on why this irregular pattern has emerged, the company’s statement read:“There are a few theories about why this dichotomy exists. The betting public is possibly more right-leaning, and libertarian, and therefore more likely to be in Trump’s base. Or that people still remember 2016 and don’t believe the polls. At the time, the odds reached 1.14 for Hillary v +6.00 against Trump. He defied the odds then and could do it again?”

Using their own data on polling and betting odds, Cloudbet’s political page still favours a Biden victory. Though, while some predict a Democrat clean-up with more than 300 electoral colleges, Cloudbet currently sees team Biden claiming 287 college votes, versus 204 for the Trump GOP.

Cloudbet adds that other changes include shifts in sentiment in swing states such as Florida, where odds have swung back towards the direction of the GOP. The company says that:

“The state was looking decidedly blue from a market standpoint last week, with prices firming towards Biden and the Dems. That was fuelled in part by The Donald’s stance on Covid and his comments during his recovery from the disease, which may have alienated the state’s older residents.”

Since then, though, Trump has campaigned twice in Florida, and this appears to have brought the state back to swing status. In fact, Cloudbet now says that two-thirds of the Bitcoin bet on the Florida state outcome is in favour of the state remaining red.Banks could net £26bn from businesses relying on bounce back loan scheme

Speaking on the issue, Positive Money’s executive director, Fran Boait, said:

“Burdening businesses with unsustainable levels of debt isn’t the right way to support them at this time. Many of these businesses will struggle to repay, and a growing private debt pile risks dragging down any economic recovery and even a financial crisis.”

“The government’s backing of bank loans has socialised the risks of lending, whilst privatising the rewards. Banks will be netting more than £1bn a year from interest payments on loans that are fully guaranteed by the state.”

“In this next phase of lockdowns, support to small businesses should be provided more in the form of grants and other instruments, rather than more piles of debt. The government must also follow Switzerland in ensuring that banks aren’t able to profit from interest payments on state guaranteed loans.”

In Switzerland, where the ‘Bounce Back Loan Scheme’ was pioneered, banks are not allowed to charge interest on fully guaranteed loans. In the UK, however, lenders are able to charge interest rates of 2.5% on these types of loans, which could see banks receiving over £1 billion per year in interest from indebted businesses. An investigation by the National Audit Office also added that through the Bounce Back Loan Scheme, the government could be handing lenders a total of up to £26 billion.

The result of this bank payday isn’t just an added burden on businesses trying to regrow, but also the potential for a second banking bailout in little over a decade. Having shouldered the cost of lenders’ mistakes after the 2008 crash, the struggles of UK citizens will now make up a sizeable chunk of lenders’ balance sheets over the coming years. Once again, it looks to many to be a reincarnation of ‘rugged individualism for normal people, socialism for banks’.

In fact, it’s probably worse than that. It’s now more like: ‘abide by government guidance, and pay a large corporation for the privilege of doing so’. Indeed, as stated by Ms Boait:

“The fact these loans are fully backed by the government means that we could be walking into another implicit bailout of the banking sector when they fail, with the public paying billions of pounds to cover banks’ losses and protect their balance sheets.”

“This would represent yet another transfer of wealth from the public to the banks. The government must learn the lessons of 2008 and make sure that any bailout, implicit or otherwise, involves conditions which would restructure Britain’s broken banking system so that it helps serve the public good.”