Computacenter see strong 2019 as revenues and profits grow

Computacenter PLC (LON:CCC) have dipped following a trading update published today.

Shares in Computacenter trade at 1,388p (-5.06%). 12/3/20 16:44BST.

Mike Norris, Chief Executive of Computacenter plc, commented: ‘As we stated back in January, the results for 2019 set a high bar for the business in 2020. It is too early to predict the outcome for the year as a whole and there is still much work to be done, particularly as we have not yet completed our first quarter. Our Services pipeline is the strongest we have seen for some time in both Professional and Managed Services. While we still believe customers will continue to invest in product, particularly in the areas of Security, Networking and Cloud, it may well be difficult to achieve the same growth rates we have seen in recent years.

Our current focus is on maintaining continuity for our customers for the services and products we supply as well as doing whatever we can to protect the health of our employees, customers and the wider community.’

Across 2019, the firm reported that revenue had risen by 16% to £5.05 billion – which the firm said was largely down to new acquisitions and merger deals.

Notably, Computacenter also noted that pretax profit surged 30% to £141 million – while the adjusted pretax profit figure was 24% higher at £146.3 million.

The firm added that its’ performance in France was particularly strong. In this sector, revenue growth of 16% was recorded totaling €644.9 million. Germany also performed strongly – seeing revenue growth of 5.2% to €2.23 billion.

Looking at UK performance – this market saw revenue fall 1.8% to £1.58 billion, whilst revenue in America surged to $986.6 million due to an acquisition at the end of 2018.

The firm also said that trading going forward will be more tough, with the recent outbreak of the coronavirus.

Computacenter commented: ‘The current COVID-19 outbreak makes forecasting the future even more challenging. In the short term, we are urgently supporting our customers focused on their business continuity plans which involves the need for a greater degree of remote working. We have seen a surge in demand for laptop computers for this purpose. To-date, supply constraints from our Technology Providers have been minimal, although there are some concerns going forward. We do however have some concerns that in the medium-term, customers may postpone significant IT infrastructure projects while the current uncertainty remains’.

Tullow Oil swing to $1.7 billion loss in 2019

Shares in Tullow Oil plc (LON:TLW) have nosedived on Thursday afternoon as the firm revealed that it had swung to a loss across 2019.

Tullow Oil have seen a tough few weeks of trading, and the share price has seen a downward trend.

The firm revealed today that following the publishing of their annual results – it will cut the size of its’ workforce by over a third.

The oil and gas exploration firm reported a $1.7 billion pretax loss in 2019 – which showed a massive slump from the $85 million profit figure recorded in 2018.

Notably, turbulence in the macroeconomic environment and volatile oil prices saw their free cash flow fall 13% to $355 million in 2019 from $411 in 2018.

Notably, Tullow added that their cash flow may only reach between $50m to $75m this year based on an oil price of $50 per barrel.

Total revenue figures also took a bruising, as this fell from $1.8 billion to $1.6 billion over the same period – representing a fall of almost 10%.

Net debt did reduce on a better note from $3 billion to $2.8 billion – however the firm have suspended their $100m dividend.

Production figures also fell by 3.6% – with the 2019 average totaling 86,800 barrels of oil per day equivalent.

Notably, Tullow were also relegated from the FTSE 250 following a tough few months for the firm.

Dorothy Thompson, Executive Chair, Tullow Oil plc, commented today:

“This has been an intense period for Tullow as we have worked hard on a thorough review of the business which has led to clear conclusions and decisive actions. We are focused on delivering reliable production, lowering our cost base and managing our portfolio to reduce our debt and strengthen our balance sheet. Even with recent events in oil markets, Tullow’s assets remain robust: we are a low-cost African oil producer, with a strong hedging position, substantial reserves that underpin our business and a high potential exploration portfolio.”

Tullow’s shares crash in November

In November, the firm saw their shares crash following a warning on their 2019 production figures. During 2019, London-based oil producer Tullow sees production averaging 87,000 barrels of oil per day, but 2019 guidance was in November. In July, Tullow had warned production was likely to be between 89,000 barrels and 93,000 barrels, lower than the 90,000 barrels to 98,000 barrels initially guided, which caused shares to dive.Chief Executive departs

A few weeks on, the Chief Executive of the firm announced that he would be departing. Pat McDade, along with exploration director Angus McCoss, said they had quit the firm. The board said it was “disappointed by the performance of Tullow’s business”. Tullow Oil saw more than £1.05 billion wiped off their market value at 9am this morning, which left the company only valued at £801.7 million. The firm has suspended its dividend to shareholders, and “now needs time to complete its thorough review of operations”. The company said it expects full-year net production to average around 87,000 barrels of oil per day, reiterating its guidance from Novembers’ trading statement. However, Tullow said that after a review of “production performance issues” this year, and the impact this could have on its fields’ performance in the coming years, it had changed its guidance. Next year’s production is predicted to average between 70,000 and 80,000 barrels of oil per day (bopd), while over the next three years it expects an average of 70,000 bopd, which may leave a bitter sweet taste in the mouths of shareholders. Tullow said it had picked out “a number of factors” that have caused the reduction in guidance. Shares in Tullow Oil trade at 12p (-30.22%). 12/3/20 16:39BST.Intu struggle across 2019, as annual revenues slip by £38 million

Intu Properties (LON:INTU) have seen their shares slump on Thursday afternoon on the back of the releasing of their annual results.

“Our results are evidence of the challenges in our market, in particular structural changes ongoing in the retail sector, with some weaker retailers struggling to remain relevant in a multichannel environment. This has led to a higher level of administrations and CVAs and has been exacerbated by the continued weak consumer confidence from the political and economic uncertainty in the UK.

The impact of this can be seen in the reduction in revenue. Like-for-like net rental income reduced by 9.1 per cent in 2019, with over half the change coming from CVA and administration processes which were predominantly agreed in the first half of the year.

This has also impacted the investment market where 2019 saw the lowest level of shopping centre transactions since 1993. This weak sentiment has weighed heavily on valuations. We have seen reductions in the year of 23 per cent and around 33 per cent from the peak in December 2017. This property valuation deficit was the main contributor to the £2.0 billion loss for 2019”.

Looking at the figures, Intu reported 2019 revenue to be £542.3 million, which sees a £38 million decline on the 2018 figure of £581.1 million.

On a worrying note for shareholders, the firm reported that their loss had massively widened from £1.173 billion to £2.021 billion – and the firm alluded this to further property revolution deficit and a change in the value of financial instruments.

Net rental income also fell by £48.9 million from £450.5 million to £401.6 million – and a like for like reduction of 9.1% which was driven by impact of administrations and CVAs.

Intu also told the market that they had seen an impact disposals of £10.5 million, with the main contributor being Intu Derby.

Underlying earnings fell by £65.9 million from £193.1 million to £127.2 million.

The Chief Executive commented: “In addition to having been a challenging year, 2019 has been a year of change for intu. I took over as Chief Executive in April and in the summer I introduced our five-year strategy. With the pace of change accelerating in our sector, radical transformation was required, so we carried out a comprehensive review of the business and tested our findings to develop the strategy.

Our review of the business looked at the risks and opportunities of the evolving retail market, and along with an assessment of our underlying strengths, helped formulate our strategy for the next five years. This will reshape the business by way of four strategic objectives, detailed below. I am pleased to say we have already taken steps to deliver this strategy.

However, there are challenges. In the year, we made a loss of £2.0 billion, predominantly due to a property value deficit of 23 per cent, which is now 33 per cent down from the peak in December 2017. This results in our debt to assets ratio increasing to 65 per cent (adjusted for the Spanish disposals), highlighting the importance of fixing the balance sheet in our strategy. Although we were unable to proceed with an equity raise, we have a range of options including alternative capital structures and asset disposals”.

Going forward the firm note the they expect like for like net rental income to be down, and the current coronavirus situation is rapidly evolving.

The firm concluded by saying: “We are focusing all our energies on moving the business forward. We own many of the best shopping centre locations in the UK, with dedicated staff looking after our visitors who are coming to our centres in the same numbers and like intu more than ever. In a world where it is harder for retailers to increase profits, our centres offer them the best opportunity and many, such as Next, Primark and JD Sports, are thriving. But we cannot stand still, and as we have always done, we will focus on placemaking, curating our space to ensure it remains the place visitors love to be”.

Intu shares trade at 5p (-9.65%). 12/3/20 12:49BST.

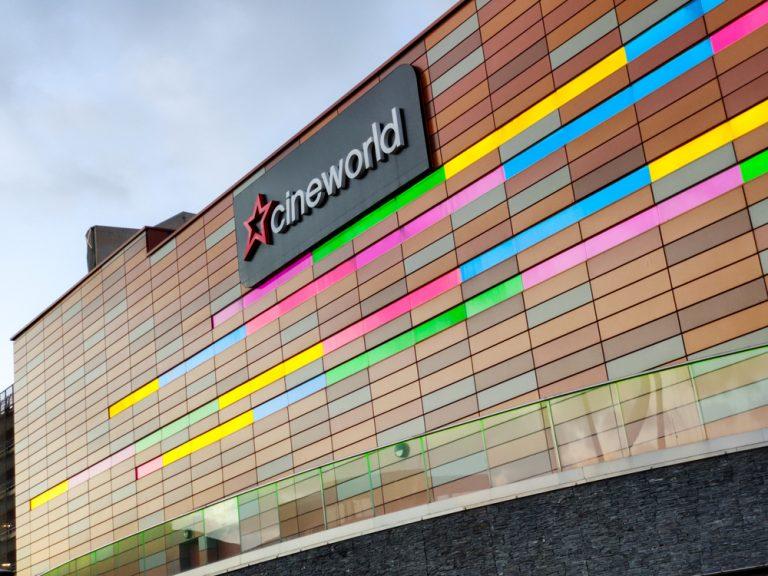

Cineworld shares crash 44% as 2019 profits suffer

Cineworld Group plc (LON:CINE) shares have descended into free fall on Thursday, as the firm gave shareholders a disappointing update.

Shares in Cineworld trade at 49p (-44.13%). 12/3/20 11:41BST.

The firm noted that it had successfully launched its’ Unlimited Program in the US – which had generated positive impact on cash flow, market share and box office performance.

On a better note, Cineworld said that they managed to reduce their net debt to $3.5 billion from $3.7 billion at 31 December 2018.

The firm also reported that group revenue had reached $4.3 billion, which was softer as expected compared to 2018.

Admissions slipped from 275 million to 308.4 million – which will worry shareholders. Adjusted EBITDA also fell to $1.03 billion from, $1.07 billion – representing a 3.7% drop.

Profit before tax was recorded at $432.6 million, whilst adjusted profit before tax was $474.5 million.

Cineworld noted that revenue decreased by 6.2% on a pro-forma basis from 2018 – the firm alluded this to ‘strong comparative film slate and closure of loss making sites in the US’.

On a better note, Rest of the World constant currency revenue rose 10% whilst UK & Ireland constant currency revenue decreased 2.7%.

Anthony Bloom, Chairman of Cineworld Group plc, said:

“2019 was a solid year for Cineworld, a year in which over 275 million customers watched movies on our screens, adjusted EBITDA exceeded a billion dollars, the synergy expectations in the Regal acquisition were virtually doubled in a well handled integration exercise, net debt was reduced and the dividend increased. I consider that to be a successful year. In the future, the Group will be well positioned to capitalise on our scale as the second largest cinema chain in the world, our deep experience and wide geographic diversification.

It is thus ironic that these achievements should be overshadowed by the negative impact of the global COVID-19 crisis, even though that at the time of writing the Group’s operations have not been affected to a material degree. I am of course conscious of the possibility that events could develop adversely very quickly and change this position in the short term, but I remain confident that the crisis will ultimately pass and that the cinema exhibition industry will continue to play a major role in providing fun, laughter, happiness and joy to millions of dedicated movie fans, just as it has for over a century”.

Going forward the firm said that it is expecting solid box office performance year to date with compelling film slate scheduled for 2020.

CIneworld have not fully assessed the impact of the coronavirus, however the firm have said that they are taking measure to ensure they prepare business for all possibilities.

Mooky Greidinger, Chief Executive Officer of Cineworld Group plc, said:

“Cineworld has delivered a solid set of full year 2019 results despite 2018 being a very strong comparative period. In particular, I am proud of our integration with Regal which continues to progress well. The refurbishment plan is on track, our “Unlimited” subscription plan was successfully launched in July 2019, we’ve upgraded our synergy target to $190 million from $100 million and Union Square in New York is due to open in the coming weeks. This gives us confidence in our ability to achieve our synergy target for the proposed transaction with Cineplex Inc, which we expect to complete in the first half of this year having received overwhelming universal support from shareholders.

We remain committed to our long-term strategy and vision to be “The Best Place to Watch a Movie”. Throughout our global estate, our cinemas offer cutting edge formats and technologies, such as ScreenX and 4DX; products from the likes of Starbucks and PepsiCo that are favoured by consumers; and staff that are amongst the most experienced and loyal in the industry. Our strong cash generation also allows us to focus on deleveraging whilst delivering returns to shareholders.

We are closely monitoring the evolution of COVID-19 and so far, we have seen minimal impact on our business. However, there can be no certainty on its future impact on our activities, hence we are taking measures to ensure that we are prepared for all possible eventualities”.

Cineworld announce Canadian acquisition

Just before Christmas, Cineworld announced that they had made a new acquisition. The firm said that it had agreed to buy Cineplex Inc (TSE: CGX), the largest cinema operator in Canada, for CAD2.8 billion. The FTSE 250 said that the deal was supported unanimously by its board, but remains subject to Cineworld and Cineplex shareholder approvals and various regulatory consents. Cineworld believes the deal represents an “exciting” opportunity to enter the “stable and attractive” Canadian market. The transaction will add 165 cinemas and 1,695 screens to Cineworld, it said.Galliford Try successfully dispose of Linden Homes but H1 revenues fall

Galliford Try plc (LON:GFRD) have seen their shares in red as the firm published its’ half year results this morning.

The firm said that it had successfully disposed of its’ Linden Homes and Partnerships division – which was completed on January 3.

Looking at the figures for Galliford Try – the firm said that its’ revenues had fallen across the first half of 2020 from £728 million to £636 million.

Additionally, the firm noted that it had swung to a loss of £6.7 million in the half period from a profit of £2.9 million in 2019.

The firms’ order book remained flat – totaling £3.2 billion across both periods.

Bill Hocking, Chief Executive, commented: “This has been a period of significant change with the successful strategic disposal of the Group’s housebuilding divisions transforming Galliford Try into a well-capitalised, UK construction-focused business.

The restructured Group is performing well with a number of recent significant project wins, and I’m pleased to report the results for the first half of the year.

Galliford Try has continued to maintain a strong pipeline of work in its chosen sectors, with excellent positions on several key frameworks in the public and regulated sectors. We are encouraged by the demand in our sectors and look to further enhance this position through the continued disciplined approach to project selection and rigorous risk management.

The Group’s focus remains on safe and efficient project delivery and disciplined bottom line growth. We have a strong executive board and management team who are focused on a values-driven, people-orientated, progressive company, working together to deliver for our clients and stakeholders. I am confident that our clear strategy will deliver sustainable results.”

Going forward, Galliford Try have said that they intend to maintain a high quality order book. In their current financial year, 96% of projected revenue is secured and 72% secured for the next financial year.

The firm also noted that it is wary and assessing the current situation with the coronavirus outbreak, and is taking measures to mitigate harm.

Galliford Try declared an interim dividend of 1.0p per share which will be paid on 17 April 2020.

Galliford Try agree deal with Bovis Homes

In November, the firm told the market that it had agreed a substantial home building deal, for Bovis Homes (LON:BVS) to takeover two Galliford housebuilding business units. The deal was valued at £1.4 billion, and the firm said that this deal was close to being completed today. The agreement comes after Galliford rejected a £1.05 billion bid from rival Bovis for its Linden Homes and Partnerships & Regeneration businesses back in May. In September the two confirmed they had resumed talks. Bovis was to issue shares worth £675 million and pay £300 million in cash, combined with £100 million of Galliford debt. The two firms announced that the terms from the September agreement were unchanged, and will see will see Bovis issue 63.8 million new shares to Galliford, valued at £675 million, pay £300 million in cash, and take over Galliford’s £100 million debt. The transaction values the two Galliford businesses at a combined £1.14 billion, and gives Galliford a 29% stake in the expanded Bovis group. It leaves Galliford with its’ construction business intact. Shares in Galliford Try trade at 123p (-12.66%). 12/3/20 11:22BST.Go-Ahead shares dive 20% as first half challenges take a toll

Go-Ahead Group plc (LON:GOG) shares have dived on Thursday, as the firm updated the market with its’ interim results.

David Brown, Group Chief Executive, commented: “Our London & International bus business is performing well and in line with expectations for the full year, while our expectations for our regional bus business have slightly reduced, reflecting cost pressures and adverse weather on passenger travel.

“In rail, while we await the outcome of the Williams review, our current UK operations are performing well and we are in the final stages of discussions with the Department for Transport regarding a potential direct award contract for Southeastern.

The stronger than expected UK rail performance has offset the impact of operational challenges in the first six months of running our German rail contracts. We began running rail services in Norway in December and are delivering high levels of operational performance.

“In the second half of the year our focus will be on continued management of our regional bus cost base, integrating new contracts and recent acquisitions, and improving our German rail operations.”

The travel operating firm noted that group operating profit within the first half was £60 million, this sees a slight fall from the same figure one year ago of £54.5 million.

As a results, Go-Ahead have added that their full year expectations have reduced, which reflects cost pressures and adverser weather in regional bus travel routes.

The firm added that bus operating profit fell 3.4% to £45.3 million, again this saw a fall from £46.9 million in the first half of financial 19.

On a better note, Go-Ahead said that strong performance in London and International Divisions mitigated the weaker regional performance.

Looking at rail operating profit, this figure totaled at £14.7 million – seeing another drop from £17.6 million on a like for like basis.

The firm maintained its’ interim dividend at 30.17p which should give some consistency for shareholders – despite the disappointing update.

The firm also noted that the impact of the coronavirus is yet to be fully assessed, however ‘travel patterns are likely to be impacted in the second half of the year’.

Brown concluded by adding: “While it is unclear how the coronavirus situation will evolve in the coming weeks, travel patterns are likely to be impacted in the second half of the year.

“I’m pleased with the progress we’re making towards our vision of a world where every journey is taken care of, with industry leading customer satisfaction scores in regional bus of 92% and our improving scores of 82% and 81% in GTR and Southeastern respectively. We’re also helping drive up customer satisfaction and performance in bus markets in Singapore and Ireland where tendering authorities have opened up to commercial operators.

“We have long been campaigning for a national bus strategy to maximise the benefits that buses bring to local communities and society as a whole. I’m pleased with the Government’s decision to move forward with such a strategy and its commitment to invest £5bn in bus and cycle networks in the coming years. This commitment recognises the part public transport can play in protecting our environment, supporting our communities, improving our health and wellbeing, and growing our economy.”

Shares in Go-Ahead trade at 1,313p (-21.94%). 12/3/20 10:53BST.

Novacyt shares bounce as coronavirus test kit develops

Novacyt SA (LON:NCYT) have seen their shares bounce, as the firm gave an update on its’ coronavirus testing kit.

The firm said that its coronavirus test kit, which has been developed by Primerdesign, its molecular diagnostics division, have invested a significant increase in manufacturing capacity following strong demand.

Novacyt noted that as of March 11, the firm has sold and received order for over £2.3 million of their coronavirus testing costs.

Interestingly, this figure represents five months of sales for the division under normal circumstances – and as a results shares have bounced.

Over the past two weeks the number of countries the Company is selling its COVID-19 test into has doubled to over 50, which is expected to increase further as the virus continues to spread.

Currently, the company is seeing significant sales from Europe and from a number of new and existing distribution partners across the Middle East.

Novacyt also added that they had completed a formal evaluation of its COVID-19 test by Public Health England (PHE) and is very satisfied with the performance assessment of its test.

The firm said that they are now expecting more NHS Hospital to purchase the testing kit, which should drive demand and sales.

Graham Mullis, Chief Executive Officer of Novacyt, commented:

“We believe the commercial demand for and interest in our COVID-19 test could continue for several months as the virus continues to spread from country to country. We are therefore ensuring we are fully prepared to meet the increasing demand for the product, as we continue to position Novacyt to support the global response to monitor and contain the COVID-19 outbreak. The sale of our COVID-19 test has already generated significant revenue for the Company, which we expect to continue given the increasing demand for the test.

“In addition, we believe interest in our COVID-19 test will have a positive, long-term impact on Novacyt as new customers look to purchase our broader product range. We are already seeing an increased demand for our B2B capabilities as customers look to utilise our molecular design and development capabilities.

“We will continue to update shareholders regularly with the Company’s progress, but we also ask shareholders to be patient as we try to respond to an ever-changing situation.”

Novacyt thrive on coronavirus scares

A few weeks back, news first broke out that Novacyt had been developing a testing kit for the coronavirus. Novacyt SA have said that it has launched a CE-Mark approved molecular test for the detection of the coronavirus (COVID-19). CE-Mark allows a company to register their product in compliant with the European Unions safety, health and environmental requirements. The firm said that the COVID-19 test is the first CE-Mark test for the 2019 strain of novel coronavirus and follows the company’s rapid launch of its research use only coronavirus test on January 31. Novacyt added – “As a result of the CE-Mark, the Company’s COVID-19 test can be used directly by laboratories and hospitals for the testing of patients without the need for validation by clinicians. The Company anticipates increased demand for its test for COVID-19 due to this extended use for clinical diagnosis.” Shares in Novacyt trade at 121p (+13.41%). 12/3/20 10:42BST.WH Smith shares crash as coronavirus could have significant impact on results

WH Smith Plc (LON:SMWH) have given shareholders an update on its first half trading and the impact of the coronavirus.

The high street retailer said that across the first half of its’ financial year – which ended on February 29, group total revenue had jumped 7%, however on a like for like basis revenue had fallen 1%.

Total revenue across their travel division spiked 19% as like for like revenue also rose 2%. Notably, High Street saw their total revenue fall 5%, as like for like revenue also fell 4%.

The firm remained confident however that despite the current market conditions, that that underlying profit before tax for the first half will be in line with market expectations.

WH Smith also gave an update about the impact of the coronavirus on their operations and trading.

The firm said that across its Asia Pacific operations – which accounts for 5% of Travel revenue, the firm has been significantly affected.

Additionally, over the last two weeks WH Smith has seen a reduction in passenger numbers at airports outside of the Asia Pacific Region.

The firm said: “The Group is managing the business to protect profitability and is taking all necessary action to reduce costs. Based on current trading and modelling, the Group believes that the effects of Covid-19 will result in a reduction in our expectations for revenue and profit across the Travel business for the second half. Today, the Company is therefore providing guidance on the impact on full year results of Covid-19 based on an assumption of a challenging third quarter and a modest normalisation in the fourth quarter.

For UK Travel, we expect revenue for the six months to be down approximately 15% on expectations which includes airports, our most affected channel, down 35% in March and April. On the same basis, including significant reductions in March and April, second half revenue in the US is expected to be approximately 20% lower than our expectations. The rest of our International business is also expected to be approximately 20% lower.”

WH Smith have said that they will give more clarity on April 22, when interim results are set to be published.

The firm have speculated that the coronavirus could have a major impact within their financial year, and could face a hit between £100m and £130m on Group revenue.

Profit is also expected to be hit between £30m and £40m – which may worry shareholders.

The firm concluded by saying: “WH Smith is a resilient business with a strong balance sheet, substantial cash liquidity and strong cashflow. The Group has a strong management team in place and has consistently demonstrated that it can adapt and respond quickly to changing market conditions.

Over the longer term, the Board remains confident in the strategy and believes the Group is well positioned to benefit from the normalisation and growth of the global travel market.”

WH Smith see turbulence in 2020

In January, WH Smith gave the market a mixed update. The high street reader said that revenue growth in the 20 weeks period ending January 18 was 7%, however like for like revenue fell by 1%. WH Smith noted that high street business revenue fell by 5% on both a reported and like for like basis, which will worry shareholders. Gross margin was ahead of expectations however, and WH Smith said that they intend to identify further savings of £3 million. The travel business bloomed for the firm, as revenue growth of 19% was reported. This was driven by the acquisitions of Marshall Retail Group and InMotion. MRG was bought in October for £312 million, with InMotion purchased a year earlier for £198 million. Excluding the two deals, WH Smith in their travel sector still achieved revenue growth of 5% across travel overall which was impressive looking at the volatility of the airline and holiday market. Shares in WH Smith trade at 1,390p (-12.41%). 12/3/20 10:25BST.Trainline shares drop 10% however group net ticket sales rise 17% annually

Trainline PLC (LON:TRN) have seen their shares crash on Thursday, as the firm published its’ recent trading update.

The train ticket retailing platform noted that across its recently ended financial year, group net ticket sales increased 17% year on year to £3.7 billion – notably this fell within guidance and expectations.

UK Consumer net tickets also rose 24% – and Trainline added that this “reflected strong mobile demand driven by increasing eticket availability and adoption by customers”.

Trainline praised the strong performance of their new ‘SplitSave’ mobile app feature – which sold more than one million split tickets.

Notably, UK Trainline for Business (UK T4B) net ticket sales declined 1%. The firm said that these ticket sales were impacted by a change in operation and branding for the West Coast mainline franchise in the fourth quarter.

Group Revenue increase 24% year on year, giving a total of £261 million – which was at the top end of improved guidance.

The firm also noted that UK Consumer revenue grew by 30%, which was ‘ driven by strong momentum in net ticket sales and the launch of new revenue services in the last 12 months’.

International Revenue jumped 79%, which was driven by growth in net ticket sales and the launch of a new revenue service in Trainline’s international markets.

Going forward, the firm noted that since the outbreak of the coronavirus – trading had become more challenging.

The firm commented: “The trading environment has become more challenging in recent weeks. Trading softened significantly in February in Italy following an increased number of COVID-19 cases and demand has since weakened across the rest of International. UK demand has remained more resilient, although growth has slowed particularly from inbound travellers. The COVID-19 situation continues to evolve and at this time its ongoing impact is difficult to fully assess. As you would expect, the Group is monitoring the situation closely and will continue to take mitigating actions as appropriate.”

Going forward, Trainline have speculated saying that they expect expect Group adjusted EBITDA to be in the range of £82-86 million.

Clare Gilmartin, CEO of Trainline said:

“We are pleased to announce a strong trading performance for this financial year, with net ticket sales in line with and revenue growth ahead of expectations set out at the IPO. We have continued to focus on our mission to make rail and coach travel easier for customers in all the markets in which we operate, thereby encouraging a much greener way to travel.

“Our UK Consumer segment outperformed expectations, underpinned by ongoing consumer adoption of our mobile app and etickets, as well as the successful launch of our split-ticketing service ‘SplitSave’, which has been very well received by our customers. In International, while French ticket sales were impacted by the nationwide rail strike, I’m pleased we saw a good recovery once the strike ended and a continued strong performance in the rest of our International business.

“We have delivered on our growth plans this year, our first as a public company. While the impact of COVID-19 on near-term trading is unclear at this stage, we are well positioned in all of our markets and remain confident in our long-term growth strategy.”